Together with

Good Morning,

Citadel made $16B last year, ETFs turned 30 this weekend, Brazil and Argentina want a common currency, SPAC deal sizes keep shrinking, US home sales hit a 12-year low, Alphabet cut 12k jobs, prosecutors seized SBF's Robinhood stock, and Morgan Stanley lowered its CEO's pay to "only" $31.5M. Should we start a Gofundme?

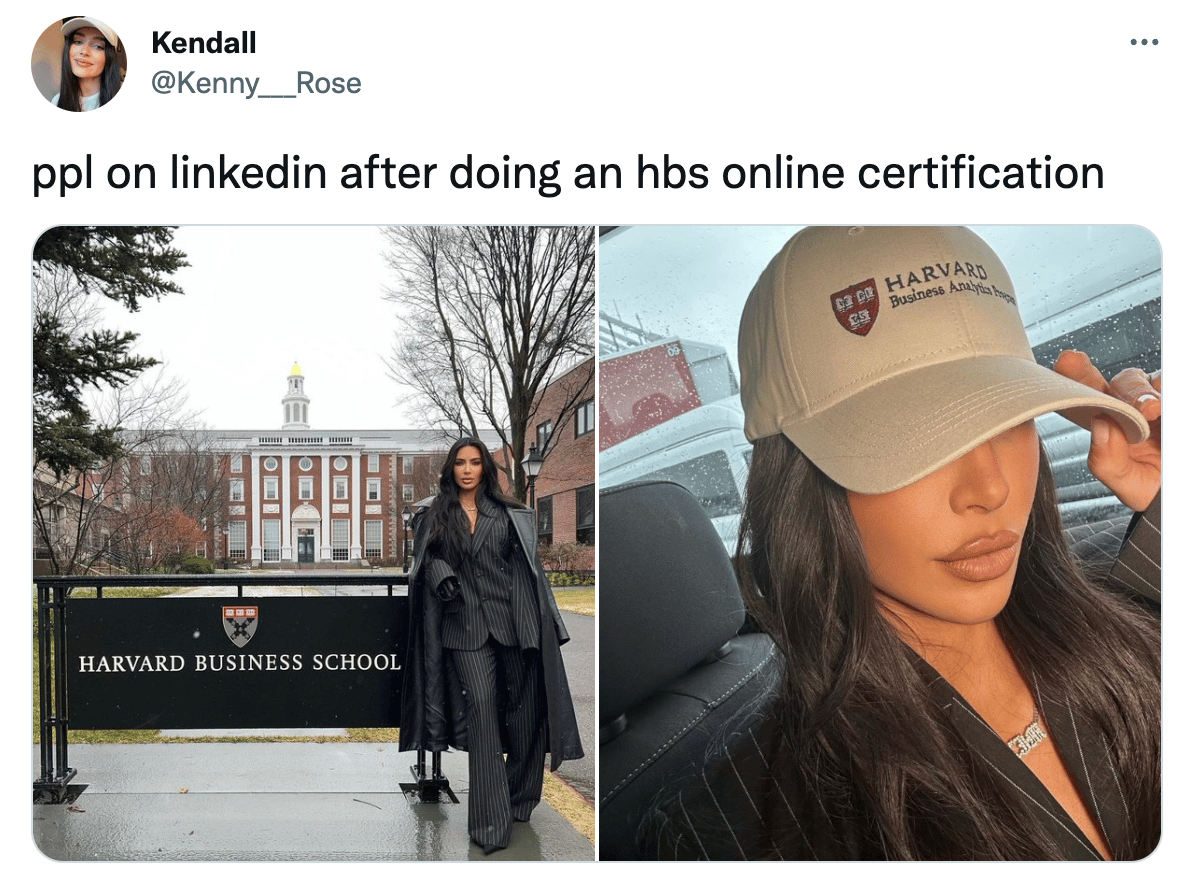

On the sports and pop-culture side of things... we had a crazy weekend of playoff football and the Australian Open! Kim Kardashian dropped a new post meme after posing in front of Harvard Business School's sign following a guest lecture on Skims.

Want to invest in the entity behind The Walking Dead? Skybound Entertainment is raising outside funding from investors, and you can participate by checking out their offering here.

Let's dive in.

Before The Bell

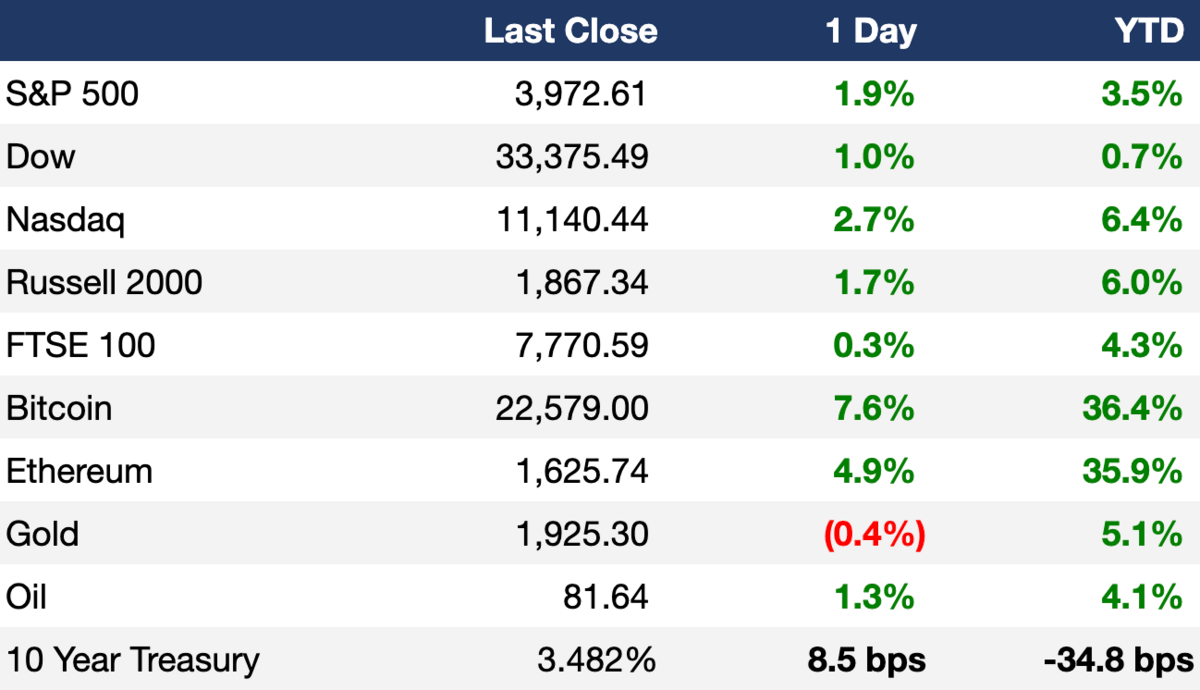

Markets

US stocks rallied on Friday as investors corrected oversold positions and reacted to Netflix's strong earnings report and Alphabet's lay off announcement

The S&P and Dow snapped three-day losing streaks

The Nasdaq was the only weekly winner nonetheless, boosted by sharp gains in Netflix and Alphabet on Friday

Earnings

What we're watching this week:

Tuesday: Capital One, Microsoft, General Electric, 3M

Wednesday: Tesla, Raymond James

Thursday: Blackstone, Intel, Visa, Southwest Airlines

Full calendar here

Headline Roundup

Bipartisan lawmakers are planning to replace the dollar-limit debt ceiling with a ceiling limited to a share of national economic output (RT)

Investors poured a record $12.7B into emerging-market debt and equity funds last week, in response to China's easing of Covid restrictions (RT)

Brazil and Argentina will start preparations for a common currency (FT)

Citadel made a record $16B in profit for clients last year (BBG)

Average SPAC merger valuations have fallen 90% from 2021 peaks to ~$200M (WSJ)

Global VC investment fell for the fourth consecutive quarter to a near two-year low in Q4 '22 (BW)

Women-founded startups received 1.9% of all venture funding in 2022 (TC)

US home sales slumped to a 12-year low (RT)

Hedge fund industry lost $125B worth of assets in 2022 (RT)

The Fed is investigating Goldman Sachs' consumer business over appropriate safeguards (WSJ)

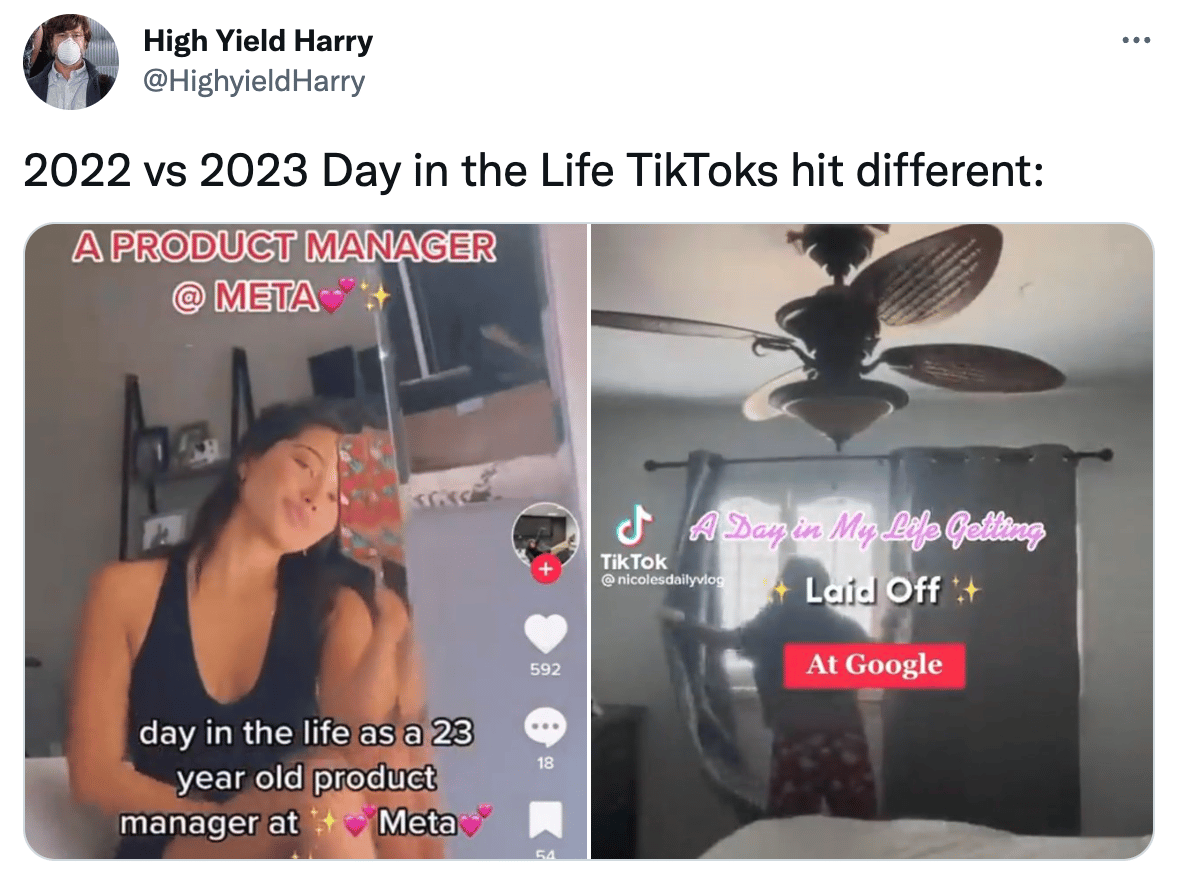

Alphabet slashed 12k jobs or roughly 6% of its workforce (WSJ)

Spotify seen cutting staff as soon as this week to cut costs (BBG)

Point72 gains UK regulatory approval to operate in the country (FT)

Deutsche Bank's 2022 IB bonus pool down less than 10% (RT)

Morgan Stanley lowered its CEO's 2022 compensation to $31.5M (RT)

The first ETF launched 30 years ago, revolutionizing investing (WSJ)

AWS will invest another $35B by 2040 in Virginia (RT)

Air India was fined $37k after a Wells Fargo VP peed on a female co-passenger mid flight (RT)

A Message From Skybound

If you could invest in the company behind one of television’s biggest hits ever, would you? Well here’s your chance.

Skybound Entertainment, the entity behind The Walking Dead, Invincible, Impact Winter, and 150+ other intellectual properties announced its first-ever Regulation A+ campaign through the investment platform Republic, and they are looking for investors like you.

Unlike most entertainment businesses, Skybound is creator and fan-focused, and this fundraising campaign is a chance for Skybound’s biggest fans to become investors with skin in the game.

Public adoption of the offering has been well received and Republic has described it as one of the most successful launches on its site to date. In a private quiet period, Skybound raised more than $11 million.

Skybound’s offering is now open to the general public, and investments start at $500. If you want to take a stake in Skybound, check out their offering here.

Deal Flow

M&A / Investments

US-based Liberty Media rejected a $20B+ bid by Saudi Arabia's PIF to acquire Formula 1 (BBG)

Thoma Bravo agreed to buy Canadian cybersecurity firm Magnet Forensics for ~$1.3B (BBG)

Activist investor Elliott Management has made a multi-billion dollar investment in Salesforce (WSJ)

PE firms Altor Equity Partners and Marlin Equity Partners agreed to buy online media monitoring company Meltwater for $586M (ML)

Power systems product maker AcBel Polytech agreed to buy Swiss engineering company ABB’s US-based power conversion business for $505M (RT)

A unit of Canadian insurer Sun Life Financial partnered with Hong Kong-based Dah Sing Bank in a $193M deal (RT)

Sports merchandising company Fanatics is in discussions to buy sports betting company BetParx (CNBC)

Memory chip makers Western Digital and Kioxia Holdings are in advanced talks for a possible merger which will involve a dual-listing (RT)

RedBird Capital Partners has built a 5%+ stake in air-transportation provider Blade Air Mobility (WSJ)

VC

Copilot, a platform helping service businesses build digital customer experiences, raised a $10M Series A at a $100M valuation led by YC Continuity and Lachy Groom (TC)

Australian biotech company Ferronova raised ~$7.6M in funding led by Renew Pharmaceuticals (PRN)

Architect Financial Technologies, a startup developing trading infrastructure for global digital asset markets, raised a $5M pre-product financing round from investors including Circle Ventures, Coinbase Ventures and Anthony Scaramucci (PRN)

Restaurant management software Zitti raised a $3.5M seed round co-led by Oceans Ventures and Serena Ventures (TC)

GoodOnes, an app that auto-filters the 'best' photos from Google and iCloud Photos, raised a $3.5M seed round led by TLV Partners (TC)

Crypto payment platform SphereOne raised a $2.5M seed round led by Distributed Global (PRN)

IPO / Direct Listings / Issuances / Block Trades

Oman energy firm OQ SAOC plans to sell up to 49% of its oil drilling unit Abraj Energy Services in an IPO that could raise up to $500M (BBG)

Indonesian lender PT Bank is considering a Jakarta IPO that could raise $150-$200M (BBG)

Saudi Arabia-based management consultancy TAM is planning to IPO in 2023 (BBG)

Debt

Indian conglomerate Adani Group plans to spin off or demerge its metals, mining, data center, airports, roads and logistics businesses by 2028 to dismiss debt concerns (RT)

Fundraising

Eduardo Saverin's VC firm B Capital raised $2.1B for its Growth Fund III and related vehicles to back startups in health care, fintech, software and other sectors globally (BBG)

Big Idea Ventures' raised $38.5M for its $125M Generation Food Rural Partners fund to invest in startups licensing IP related to agriculture and food (AX)

Crypto Corner

Money is moving around at Genesis' trading arm, despite its crypto-lending business filing for bankruptcy (CD)

Genesis claimed $5.1B in liabilities in first-day bankruptcy filing (CD)

US prosecutors seized ~$700M in assets from SBF this month, mostly in Robinhood stock (RT)

FTX won court approval to hire Sullivan & Cromwell lawyers amid conflicts concerns (RT)

Crypto is the second most widely-owned asset class for women, only second to cash (CT)

Crypto sports deals have slowed -- but they aren't dead (BW)

Exec's Picks

Sequoia Capital is one of the world's most successful VC firms, and Michael Houck broke down their pitch deck framework in this Twitter thread.

Forbes published a story covering how TikTok supercharges certain content to ensure that it achieves virality.

Lightspeed Venture Partners' Mercedes Bent covered their fintech trends for 2023 and beyond.

Litney Partners - Financial Recruiting 💼💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

Meme Cleanser

Thinking of starting your own newsletter? Beehiiv is the best platform for creators, period. Click here to get started building your own audience.