Together with

Good Morning,

S&P 500 index funds saw the highest inflows ever in April, hedge funds delivered strong returns in last month's market chaos, LPs are increasingly borrowing against their PE holdings, and China is assessing potential trade talks with US.

The Wharton Online-Wall Street Prep Private Equity Certificate Program is back! Level up your PE skillset in the globally acclaimed Private Equity Certificate Program and save with our Litquidity discount! Learn more below.

Let's dive in.

Before The Bell

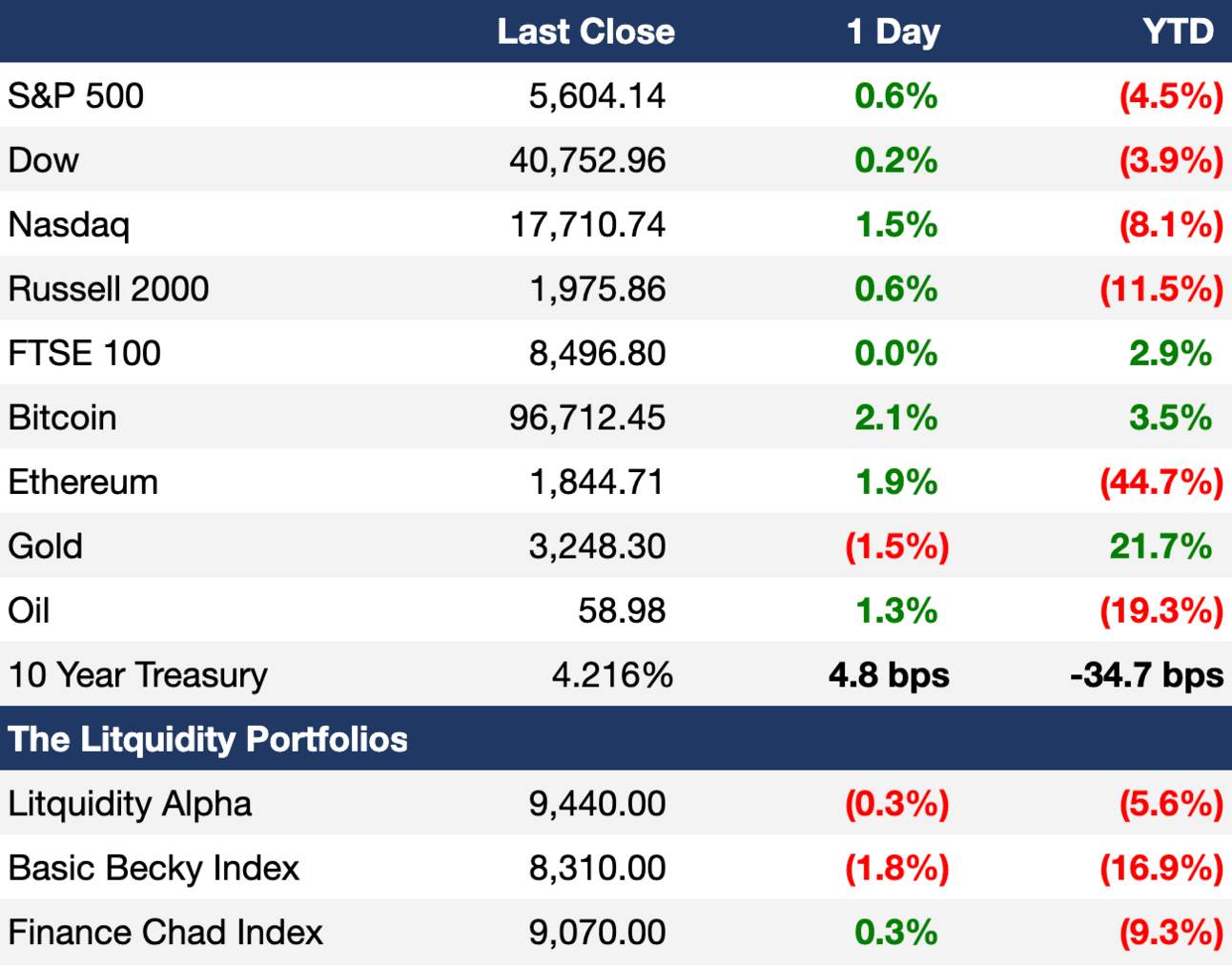

As of 5/1/2025 market close.

Click here to learn more about the Litquidity portfolios and subscribe to the strategies on Autopilot.*

Markets

US stocks rallied yesterday as investors digested major corporate earnings

S&P rose for an eighth-straight day in its best streak since August

S&P fell for a third-straight month despite a late-April recovery

Traders priced in 91 bps of Fed cuts this year

Europe's Stoxx 600 fell for a second-straight month despite a late-April recovery

The index is up 3.3% YTD

UK's FTSE 100 rose for a thirteenth-straight day for its best streak since 2017.

EM stocks recovered virtually all losses since 'Liberation Day'

US yields spiked as factory data spurred a pullback on rate-cut bets

High-yield munis lost 1.8% in their worst month since 2023

Bitcoin broke a 10-week high

Earnings

Apple beat Q2 earnings and revenue estimates on strong iPhone, Mac, and iPad sales and limited impacts to supply chains but said it's 'very difficult' to predict tariff costs beyond June (CNBC)

Amazon beat Q1 earnings and revenue estimates as a 19% YoY increase in ad revenue offset declining growth in its AWS cloud unit, though the firm issued weak Q2 guidance amid tariff and consumer spending uncertainty (CNBC)

McDonald's beat Q1 earnings estimates but missed on revenue as US same-store sales fell 3.6% in the largest drop since Covid; they reiterated its FY outlook (CNBC)

Mastercard beat Q1 earnings and revenue estimates on resilient US consumer spending remained, benefiting from wage growth and a strong labor market and a 15% rise in cross-border volume (RT)

CVS beat Q1 earnings and revenue estimates and hiked FY earnings guidance as its troubled insurance business showed some improvement; the firm did not guide on FY revenue amid higher medical costs and macro headwinds (CNBC)

Airbnb met Q1 earnings expectations but missed revenue and issued a disappointing Q2 revenue forecast amid softness in Canada-US travel and broader economic uncertainties (CNBC)

Reddit beat Q1 earnings and revenue estimates and issues strong guidance on strong user growth as a sluggish economy meant 'business as usual' (CNBC)

KKR beat Q1 earnings estimates on strong fee-related and investing income, with $19B deployed and $13B in deals lined up; total AUM rose 15% to $664B on the heels of credit fundraising (BBG)

Eli Lilly beat Q1 earnings and revenue estimates on strong demand for its blockbuster Zepbound and Mounjaro drugs but cut its FY profit outlook due to rising R&D costs and its acquisition of Scorpion Therapeutics (CNBC)

What we're watching this week:

Today: ExxonMobil, Chevron, Brookfield, Apollo

Full calendar here

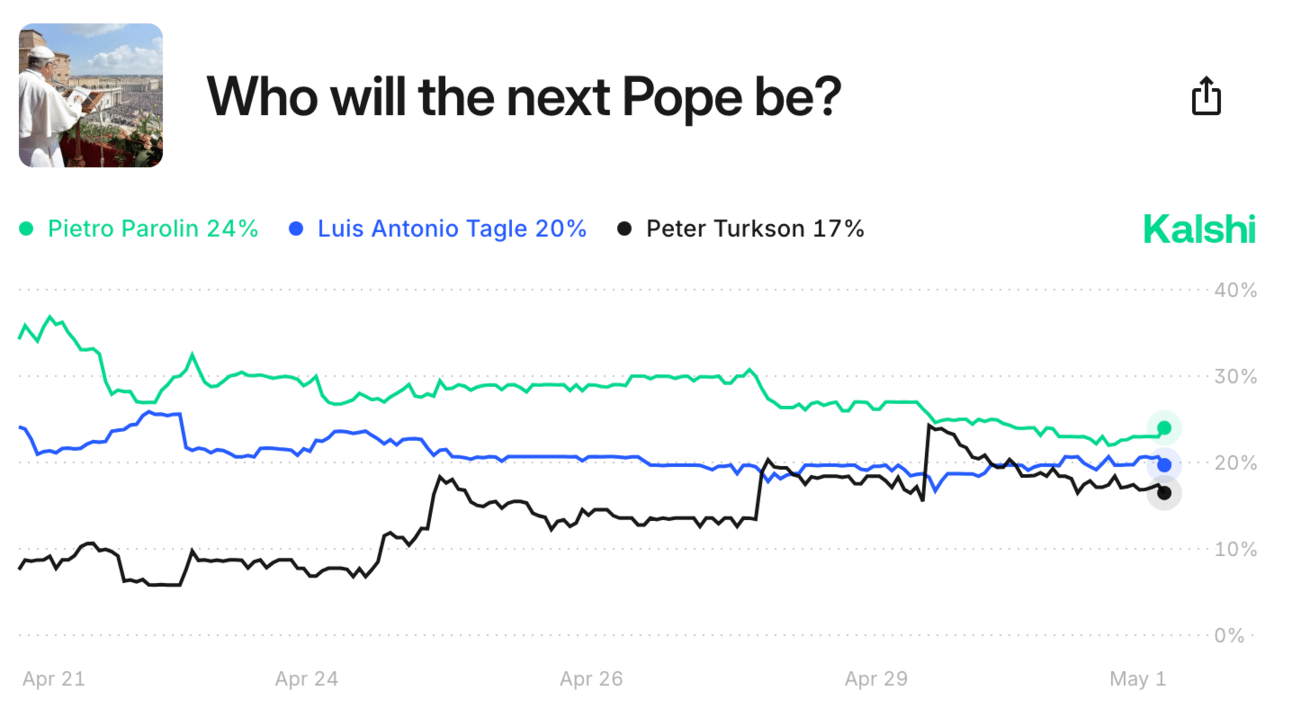

Prediction Markets

Pope succession race is pretty tight.

Headline Roundup

China is assessing US trade talks (BBG)

Bessent says US 2Y yields are signaling Fed to cut (BBG)

DOGE wants to examine Fed's $2.5B renovation costs (BBG)

Fed bank reserves dropped to $3T to YTD low (BBG)

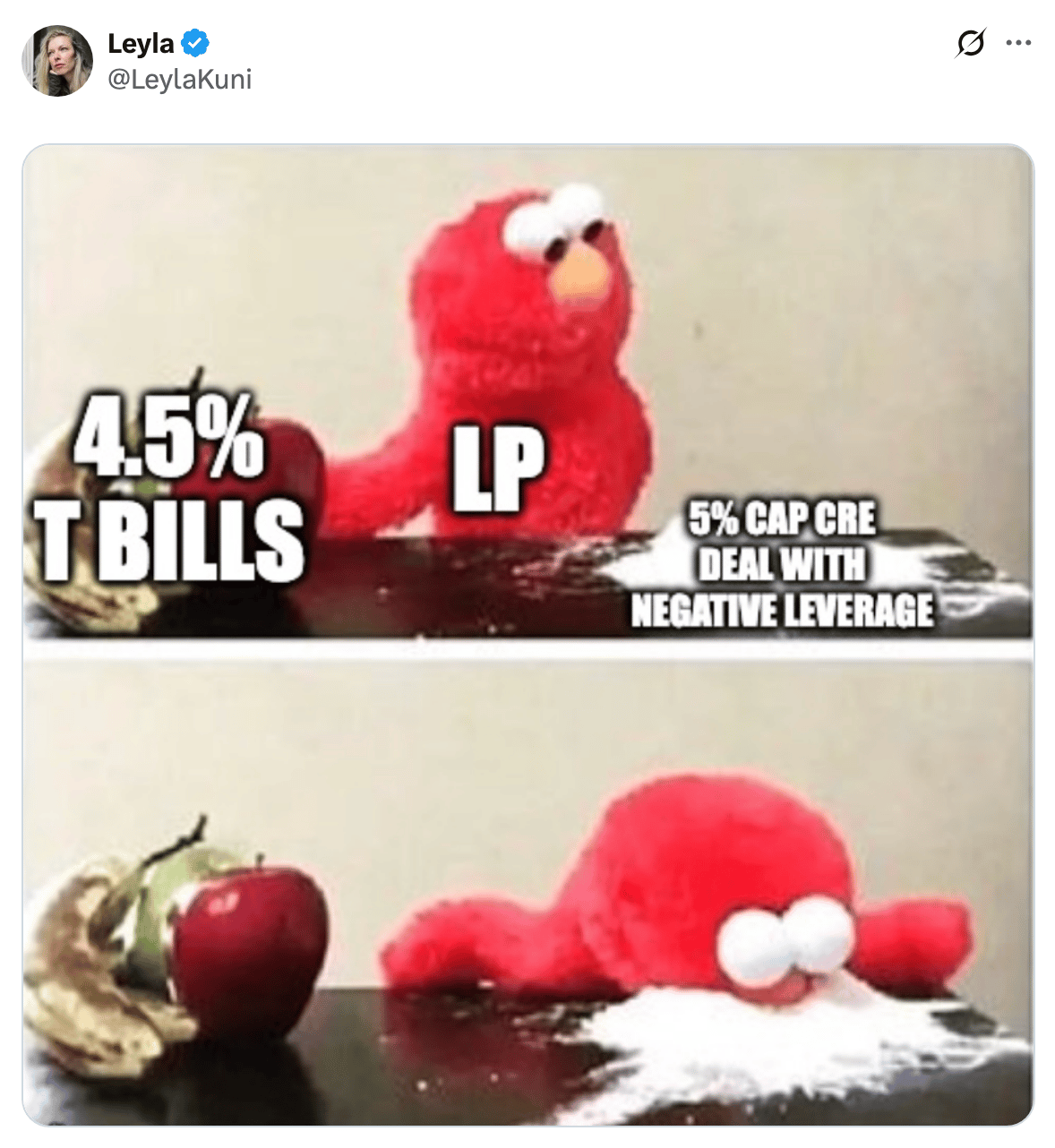

Big LPs are borrowing against PE holdings amid liquidity crunch (FT)

Foreign funds are losing appetite for US corporate bonds (BBG)

PIKs return as Europe junk debt demand soars (BBG)

Berkshire outshines market as Buffett reaches 60 years in charge (RT)

Multi-strat hedge funds turned positive amid April volatility (BBG)

All of Citadel funds gained in April (WSJ)

AQR L/S strategy extended gains to 12.1% YTD (BBG)

Third Point expects to boost credit exposure amid dislocations (BBG)

Norway's $1.8T SWF plans to cut trading costs by 20% with AI (FT)

Nasdaq plan will bring 0DTE option boom closer to single stocks (BBG)

World's biggest S&P 500 ETF drew record inflows in April (BBG)

Charles Schwab warned thousands at risk of margin calls amid volatility (BBG)

Nvidia CEO urged US to change rules for AI chip exports (BBG)

Kohl's fired its CEO after funneling business to a romantic partner (WSJ)

Live Nation expects a record summer concert season (WSJ)

A Message from Wall Street Prep

Eyeing a Move or a Promotion? Here’s How to Stand Out in Private Equity

With deals moving faster and firms tightening their standards, staying competitive means going beyond what you already know.

The Private Equity Certificate Program from Wharton Online and Wall Street Prep teaches the concepts and technical methods used to evaluate investment opportunities.

Beyond learning skills from the top instructors on Wall Street, you’ll hear from leading industry executives like David Rubenstein, Co-founder of The Carlyle Group, and Martin Brand, Sr. Managing Director at Blackstone.

Enroll by May 12 – additional benefits include:

Invite-only networking and recruiting events

Weekly office hours and dedicated support

Certificate issued by Wharton Online and Wall Street Prep

Get $200 off tuition + $300 more with code LITQUIDITY. That's $500 in savings when you enroll by May 12.

Deal Flow

M&A / Investments

Turkish video game developer Dream Games raised $2.5B in equity funding from CVC and debt financing from Blackstone at a $5B valuation

Brazilian O&G firm Prio will acquire a 60% stake in Brazil's Peregrino oil field from Norway's Equinor for $3.5B

Japan's Meiji, France's Lactalis, Canada's Saputo, and PE firm Warburg Pincus are considering bids for peer dairy giant Fonterra's $2.4B global consumer businesses

Consumer-focused PE firm Brynwood Partners will acquire canned pasta-maker Chef Boyardee from foods group Conagra for $600M

Entertainment tycoon Ari Emanuel agreed to acquire influential art organization Frieze Art Group from Endeavor at a potential $200M valuation

PE firm Great Hill Partners agreed to take a minority stake in $10B AUM SoCal-based RIA Mission Wealth

VC

Healthcare technology startup Persivia raised a $107M recapitalization from Aldrich Capital Partners

Astronomer, a unified DataOps platform powered by Apache Airflow, raised a $93M Series D led by Bain Capital Ventures

Rogo, a GenAI for finance, raised a $50M Series B at a $350M valuation led by Thrive Capital

Hilo, a startup developing an ML model for blood pressure, raised a $42M Series B co-led by Earlybird Health and Wellington Partners

Copy trading app dub raised a $30M Series A led by Notable Capital and Neo

Phoenix Tailings, a rare earth metals refining company, raised a $33M Series B led by Envisioning Partners

Zoe, a digital end-to-end wealth platform connecting RIAs and investors, raised a $30M Series B led by Sageview Capital

QbDVision, a digital CMC platform for the life sciences industry, raised a $13M Series A led by Northpond Ventures and S3 Ventures

Dinari, a startup allowing users to buy shares in major US companies and funds through dShares, raised a $12.7M Series A led by Hack VC and Blockchange Ventures

EdgeRunner AI, a leader in domain-specific, air-gapped, on-device AI agents for military and enterprise, raised a $12M Series A led by Madrona Ventures

Mivium, a startup building a semiconductor material science platform, raised a $5M round in crowdfunding

Virtual leasing platform Peek raised a $5M Series A led by Moneta Ventures

IPO / Direct Listings / Issuances / Block Trades

Strategy, the biggest corporate holder of Bitcoin, announced a $21B equity offering

Investment firm JAB is seeking to raise $2.5B in a share sale of Keurig Dr Pepper

Franklin Templeton, the asset manager which took over as manager of the Uzbekistan National Investment Fund, is aiming to list $1.7B of Uzbekistan's state assets on international markets

Irish bank AIB shareholders approved a $1.4B buyback from Ireland, moving closer to full private ownership

Activist hedge fund Third Point acquired a meaningful stake in US Steel and expects the $14.1B takeover by Nippon Steel to proceed

Mining giant Rio Tinto fended off activist Palliser's push to review its dual UK and Australia listing structure

Debt

Citigroup sold $5.35B of bonds capping big banks' bond deals

District of Columbia's $1.5B munis sale was 4x oversubscribed, allowing DC to lower yields

Non-profit financial services firm Thrivent sold $1.2B of debt backed by cash flows from its FOF, to free up liquidity for private market funds

Blue Owl-owned data center operator Stack Infrastructure is seeking an $833M loan to fund data center growth in Australia

Bankruptcy / Restructuring / Distressed

Brazil's Gol Airlines raised $125M in financing, aiding its Chapter 11 exit by June, totaling $1.38B in bankruptcy funding

Canadian battery recycling firm Li-Cycle is seeking buyers after a potential sale to mining giant Glencore fell through, raising risks of insolvency

Fundraising

Apollo raised $5.4B for a debut secondaries fund

Ares raised $3B for a secondaries fund from HNWIs which will offer quarterly liquidity

Power Corp. of Canada’s climate-focused alternative asset manager Power Sustainable raised $330M for a new PE fund

VC Uncork Capital raised $300M across two funds focused on seed and growth

Golf pro Rory McIlroy partnered with TPG to launch a new sports investment fund, with a UAE-based investment firm anchoring the fund

Crypto Sum Snapshot

Crypto VC fundraising is springing back to life (TI)

Morgan Stanley plans to offer crypto trading to E*Trade clients

Crypto industry descends on Dubai as Trump euphoria recedes

Strategy doubled Bitcoin buying capital plan to $84M (BBG)

Check out our Crypto Sum newsletter for the full stories on everything crypto!

Exec’s Picks

Did you know that car factories like Ford can output one car per minute? Why hasn't anyone done that in the housing industry? Before BOXABL, the concept of building houses in a factory seemed impractical. With their patented shipping technology, merging housing with assembly line mass production could be a game-changer. Join 40,000 investors, invest in BOXABL today.

*This is a paid advertisement for Boxabl's Regulation A offering. Please read the offering circular here. This is a message from Boxabl.

Despite the recent selloff, US stock valuations are still not 'cheap.'

Financial Services Recruiting 💼

If you're a junior banker looking for your next career move, check out Litney Partners, a recruiting firm established by Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates across private equity, hedge funds, venture capital, growth equity, credit, and investment banking.

We're currently seeking talent for some incredible roles. Head over to Litney Partners to drop your resume / create your profile and we'd love to get in touch!

Meme Cleanser

🛒 Merch Store: Visit our merch store to shop our latest apparel, shoes, bags, accessories and more.

💵 Litquidity Ventures: Accredited investors & qualified purchasers within the Litquidity community can gain access to alternative investments such as venture, late-stage growth, and private equity through Litquidity Ventures. Interested? Fill out this form.

☎️ Book a call with Lit: Want to pick Litquidity's brain on business advice, insights, or just chat to say what's up? Buy his time here.

📧 Launch your own newsletter: Have great content ideas and looking to launch your own publication? We highly recommend Beehiiv to get started.

*DISCLAIMER: Investment advice provided by Autopilot Advisers, LLC ("Autopilot"), an SEC-registered investment adviser. Past performance does not guarantee future results. Investing carries risks, including loss of principal. As always, be smart out there. Litquidity is compensated to promote AutoPilot. Compensation details available upon request.