Together with

Good Morning,

Diddy was an investor in Musk's Twitter LBO, Chick-fil-A is launching a streaming service, US law firms are offering fat bonuses for talent referrals, and a bank CEO got 24 years after falling for a crypto scam that collapsed his bank.

Automate your complicated business spend and expense allocation process with one of the fastest growing fintech softwares in the alternative asset management space, StavPay.

Let's dive in.

Before The Bell

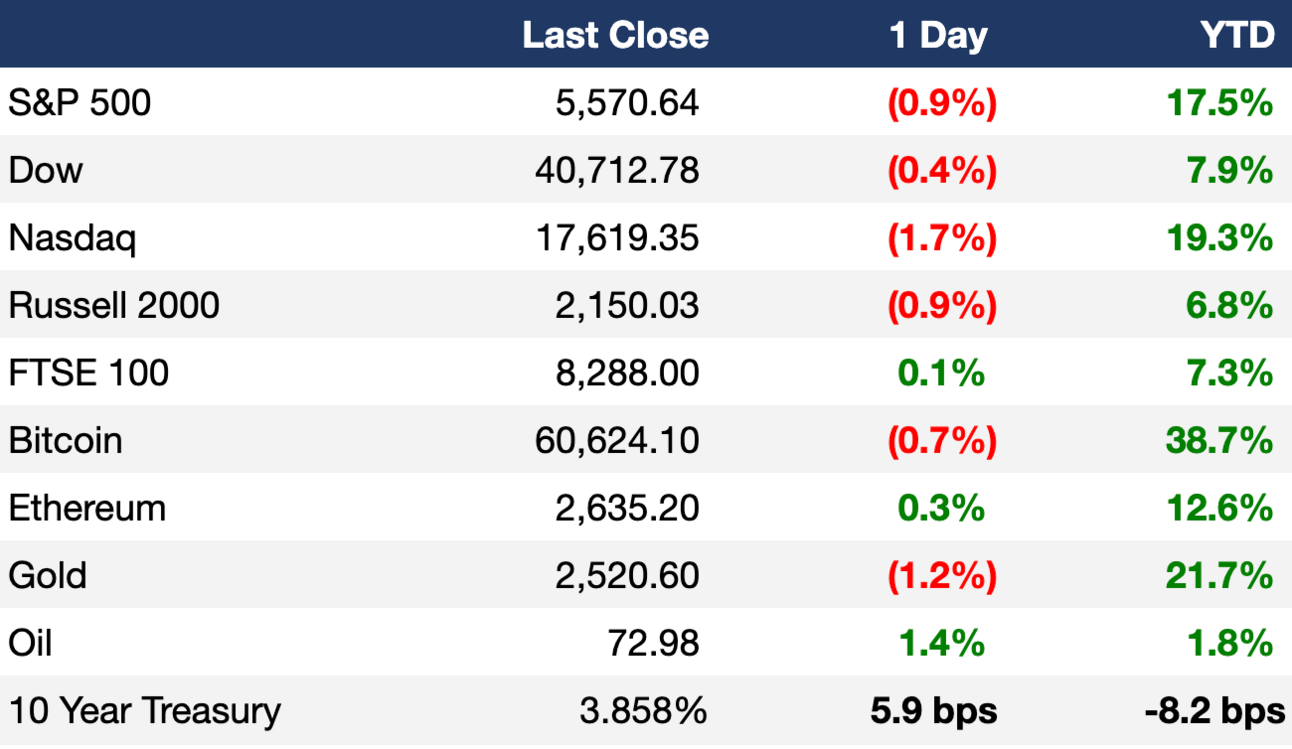

As of 08/22/2024 market close.

Markets

US stocks fell as investors prepared for J Pow's Jackson Hole speech

Canada's TSX index pulled back 0.4% from a record high

US yields recovered from two-week lows

Dollar gained by the most in over a month after hitting a 13-month low vs euro

China 10Y trading volumes dropped 90% in a new headache for PBOC

Earnings

Headline Roundup

X / Twitter revealed list of investors backing Musk's LBO (NBC)

Chick-fil-A is launching a streaming service (TV)

Rise in election talk from US execs highlights policy uncertainty (RT)

New bank capital regulations now hinge on US election (RT)

US law firms offer staff $50k for referrals as talent wars rage (FT)

Jefferies warned of new risks in commodities: ESG regulation (BBG)

New US ETFs are launching at record pace (RT)

Landlords are leaving London in increasing numbers (FT)

Bank of Singapore sees Mideast soon accounting for 20% of assets (RT)

AI coding assistant startups raised ~$1B YoY in threat to SWEs (FT)

Chinese entities turn to AWS to access high-end US AI chips (RT)

Trump anxiety spurs investment in European defense startups (RT)

Nestle fired and replaced its CEO (WSJ)

Apple will let users delete native apps to comply with EU law (WSJ)

US 30Y mortgage slipped to the lowest level since May 2023 (RT)

NFL is cracking down on 'suspicious' gambling (ESPN)

World's second-largest diamond was found in Botswana (AP)

A Message From StavPay

StavPay was built for Alternative Asset Managers to automate the business spend and expense allocation process.

More than 90 managers with over $1.2T of AUM collectively use StavPay to manage their vendors, contracts, invoices, expense allocations, budgets, services, 1099 filings, inter-entity reimbursements, and payments.

Get more details at www.stavpay.com and schedule a demo today.

We promise you, it's an hour well spent.

Deal Flow

M&A / Investments

Skydance demanded Paramount to stop negotiating with Edgar Bronfman Jr. (WSJ)

CME and S&P Global are considering a sale of FX and derivatives post-trade service JV OSTTRA, which may be valued at $2B-$4B, including deb (BBG)

$3.7B-listed healthcare software provider Evolent Health is in sales talks after receiving takeover interest (RT)

Carlyle will acquire Advance Auto Parts' automotive parts wholesale distribution business Worldpac for $1.5B cash (WSJ)

Swedish medtech Getinge will acquire US organ transport firm Paragonix Technologies for $477M (RT)

Brighton Park Capital and Rory McIlroy’s Symphony Ventures made a $250M equity investment in ticketing service TickPick (BBG)

PE firm THL Partners agreed acquire a majority stake in forensic consulting firm YA Group (BBG)

Siemens selected Toyota's Vanderlande to acquire its airport logistics unit Siemens Logistics (RT)

Chanel acquired a 25% stake in high-end Swiss watchmaker MB&F (RT)

VC

One-click checkout startup Bolt is in talks to raise $450M at a $14B valuation led by The London Fund (TI)

Opkey, an AI-based ERP testing platform, raised a $47M Series B led by PeakSpan Capital (TC)

Data management platform for private credit and CLO markets Siepe raised a $30M Series B led by WestCap (PRN)

Live-shopping startup Tilt raised an $18M Series A led by Balderton Capital (TC)

BeMe Health, a digital behavioral health startup for teens, raised $12M+ in funding from Flare Capital and Polaris Partners (BW)

Creatopy, an AI-based ad creation platform, raised a $10M Series A led by 3VC and Point Nine (TC)

Cache Energy, a startup building an inexpensive way to store renewable energy, raised a $8.5M seed round from Climate Capital, Grantham Foundation, and others (TC)

AI-driven travel startup Otto raised a $6M seed round led by Madrona Ventures (TC)

Crypto-backed loan provider Arch Lending raised a $5M seed round led by Morgan Creek Digital and Castle Island Ventures (PRN)

IPO / Direct Listings / Issuances / Block Trades

TD will sell $2.6B of Charles Schwab shares to cut its stake to 10.1% (RT)

Bain Capital is planning a $500M Japan IPO of chipmaker Kioxia (BBG)

Blackstone-owned jewelry certification company International Gemological Institute filed for a $477M Indian IPO (RT)

Tax firm Andersen Global, is exploring an IPO of its US unit (WSJ)

Alibaba will upgrade its Hong Kong listing to primary status (RT)

Bristol-Myers-backed Zenas BioPharma filed for a US IPO (RT)

Debt

Mexico raised $1.1B in a Samurai bond issuance (BBG)

Budget carrier AirAsia raised $443M in dual-tranche private financing from Ares, Indies Capital Partners, and others (BBG)

Asian Infrastructure Investment Bank raised $300M in its first digital bond sale (BBG)

Mexican state oil firm Pemex raised financing from Citigroup and Deutsche Bank to help pay outstanding bills to oilfield services giant SLB (BBG)

Bankruptcy / Restructuring / Distressed

Private credit lenders led by Blue Owl agreed to take ownership of software education firm Pluralsight from Vista Equity Partners, who will lose $4B (BBG)

Pregnancy care firm Holdco Nuvo, which went public via SPAC four months ago, filed for Chapter 11 bankruptcy (BBG)

Over 95% of creditors voted in favor of FTX's restructuring plan (WSJ)

Fundraising

AQR Capital Management raised $350M for a L/S ESG fund (BBG)

Crypto Corner

Exec’s Picks

Looking for a profitable Bitcoin mining investment? The Chicago Atlantic Digital Mining Fund offers monthly distributions and to date, has delivered annualized returns of 36 percent. You can read about it here … Now open to all accredited investors.

Prominent CIO search exec Charles Skorina shared his perspective on why so many institutional investors invest alike.

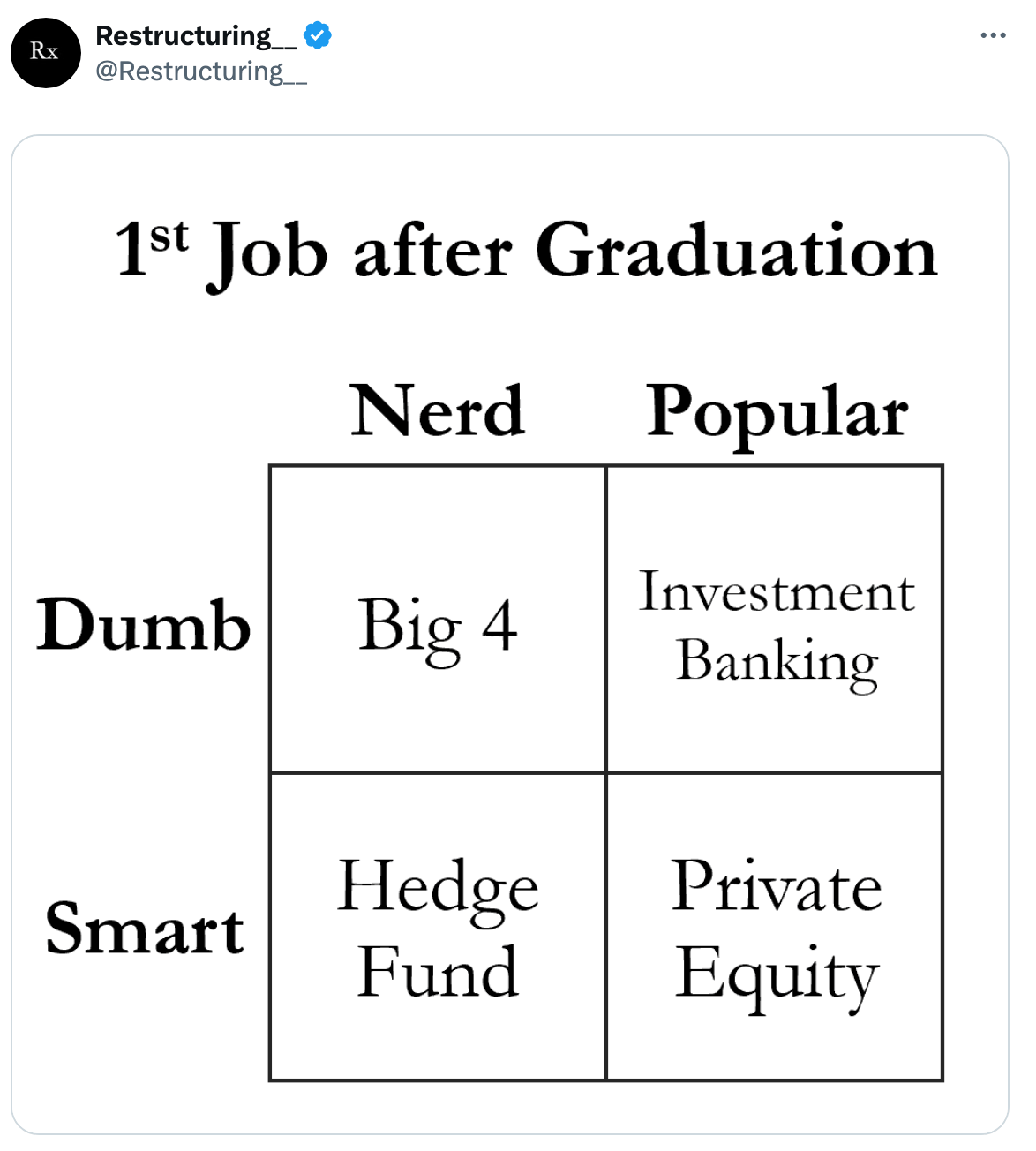

Financial Services Recruiting 💼

If you're currently a junior banker looking to break into the buy side, lateral to another investment bank, or consider new paths amid changing market dynamics, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates across private equity, hedge funds, venture capital, growth equity, debt funds, and investment banking.

To get started, simply head over to Litney Partners and create your profile by dropping your resume / filling out the form:

Meme Cleanser

Advertise with us // Visit our merch store // Invest alongside Lit Ventures // Book a call with Lit // Launch your own newsletter