Together with

Good Morning,

The US housing market declined by $2.3T in 2H 2022, mortgage applications are at their lowest level since 1995, Russia plans deep oil export cuts in March, global debt saw its first annual drop since 2015, US worker strikes were up 50% last year, JPMorgan restricted staff from using ChatGPT, and Mercedes partnered with Google.

Looking to eat healthier in 2023, but you never have time to meal prep? Check out today's sponsor, Organifi Green Juice, for a high-nutrient supplement that can be added to any drink in seconds.

Let's dive in.

Before The Bell

Markets

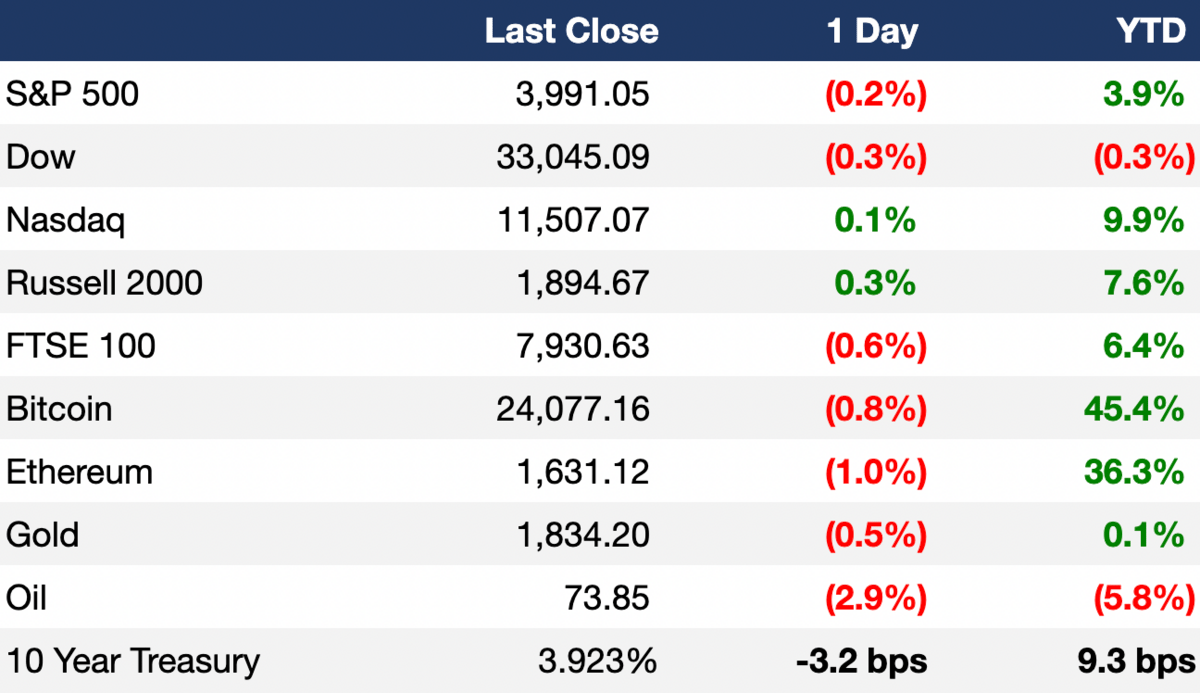

US stocks continued their slide yesterday after Fed minutes revealed the need for further rate hikes to curb inflation

The vast majority of Fed officials supported slowing the pace of US interest rates to 25 bps last month, according to latest meeting minutes

The S&P ended down for a fourth straight session

Futures traders are pricing the fed funds rate to remain above 5% all year

Swap markets are pricing in a record-high 3.75% ECB deposit rate to peak in September

Oil fell 3% on rate hike fears

Earnings

eBay beat Q4 EPS and revenue estimates but projected their sales decline to continue this year as the pandemic boom fades; their stock fell 4.9% AH (BBG)

Nvidia beat Q4 EPS and revenue estimates on continued growth in its data center / AI chips business; their stock rose 9.3% (CNBC)

TJX met Q4 EPS estimates on a 5% YoY jump in sales as inflation pushed shoppers to seek out lower-priced clothing, but forecasted weaker than expected FY profits (WSJ)

Bumble beat Q4 EPS and revenue estimates on strong subscriber growth this holiday / cuffing season; their stock gained 4.8% (INV)

What we're watching this week:

Today: Alibaba, Wayfair, Carvana

Full calendar here

Headline Roundup

Fed minutes revealed unanimity over need for higher rates, but openness to slower hikes (RT)

US housing market lost $2.3T in H2 2022 in biggest drop since 2008 (BBG)

Mortgage applications are at their lowest level since 1995 (AX)

Russia plans deep oil export cuts in March (RT)

Emerging market private credit investments surged 89% in 2022 (RT)

Global debt saw its first annual drop since 2015 (RT)

NLBR ruled that companies cannot demand silence as part of severance packages (AX)

US worker strikes increased ~50% last year amid growing union popularity (AX)

China urged state firms to drop Big Four auditors (BBG)

JPMorgan restricted staff from using ChatGPT (AX)

Mercedes partnered with Google to offer 'supercomputer-like performance' (RT)

Ex-Tiger Global partner Edward Lei is launching a new hedge fund, Astroll Management (BBG)

Citigroup raised CEO Fraser's pay to $24.5M (RT)

AI's rise is generating new 'prompt engineer' jobs (AX)

Wells Fargo laid off 500+ mortgage bankers (CNBC)

NPR will lay off 10% of its staff (BBG)

Layoff plans tend to be exaggerated (WSJ)

Restaurants are experimenting with subscription programs (NPR)

Third Point plans to launch a proxy fight at Bath & Body Works to address excess executive pay and lagging financial performance (WSJ)

The Pentagon revealed that it spent at least $1.5M on missiles to down three high-altitude objects (WSJ)

A Message From Organifi

Everyone wants to eat healthier in 2023, but no one has time to actually prepare homemade, nutritious meals every single day. Luckily, you can get all the nutrients you need in no time at all with Organifi Green Juice.

Organifi Green Juice is the 100% USDA Certified Organic, Gluten-Free, Glyphosate Residue Free, all-natural, and Non-GMO supplement that will improve your daily diet.

All you have to do is mix one scoop into water (or plant-based milk of your choice) and enjoy a natural boost any time of day. Plus, Organifi has 11 healthy superfoods and adaptogens in amounts that are actually, you know, helpful.

So why is Organifi Green Juice so effective? The secret is its main ingredient: Ashwagandha. It supports lower stress, lower cravings, and even healthy weight management. (Bonus: it’s really fun to say.)

Order your Organifi today, and get 20% Off + a Free S2S Kit. CODE: EXEC20.

Deal Flow

M&A / Investments

Exchange operator Euronext submitted a preliminary offer to buy fund distribution firm Allfunds for $5.85B (RT)

Germany’s soccer governing body plans to kick off the sale of a stake in the Bundesliga’s media rights business that could fetch $2.9B (RT)

Amazon’s $3.9B purchase of primary-care clinic operator 1Life Healthcare has finally closed, giving Amazon access to medical offices in 20+ US markets (WSJ)

Microsoft founder Bill Gates agreed to minority stake in brewer Heineken for ~$902M (BBG)

Affiliates of investment firms Centerbridge Partners and GIC Real Estate agreed to buy and take private US-based logistics company INDUS Realty Trust in an ~$868M deal (RT)

Apollo is in talks invest $750M to support the leveraged-finance business of First Boston, Credit Suisse’s investment-banking spinoff (BBG)

Indian financial services firm Kotak Mahindra’s asset management arm agreed to invest $129M in biopharmaceutical company Biocon to help fund its acquisition of peer Viatris’s biosimilars business (RT)

British PE firm Cinven invested $106M into Italian life insurer Eurovita (RT)

Ares Management, Elliott Investment Management and Oaktree Capital are also looking to finance a bid for Premier League team Manchester United (RT)

VC

The EV battery unit of Sunwoda Electronic is considering raising up to $580M in fundraising ahead of an IPO (BBG)

South African car subscription company Planet42 raised $100M: $15M in equity co-led by Naspers Foundry and ARS Holdings, a $75M credit facility from Rivonia Road Capital, and $10M in debt from private investors (TC)

Tome, a platform using AI to reimagine PowerPoint and other digital storytelling formats, raised a $43M Series B led by Lightspeed Venture Partners (FB)

Finch, a startup helping companies connect to various HR apps, raised a $40M Series B co-led by General Catalyst and Menlo Ventures (TC)

Customer success platform Vitally raised a $30M Series B led by Next47 (TC)

Metomic, a startup helping protect sensitive data in SaaS apps, raised a $20M Series A led by Evolution Equity Partners (BW)

Cloud permissions management platform Entitle raised a $15M seed round led by Glilot Capital Partners (PRN)

Scoot, a startup adding a dynamic chat interface to video meetings, raised a $12M Series A led by Woodland Capital (TC)

BioSqueeze, a startup commercializing biomineralization technology designed to eliminate methane emissions from oil and gas wells, raised a $7.4M round led by Valo Ventures (PRN)

Gauge, an online auction dealer for used cars, raised a $5.3M seed round led by Maniv Mobility (BW)

Brand tracking startup Tracksuit raised a $5M seed round led by Blackbird (TC)

System 3, a startup helping companies manage their leadership talent, raised a $2.7M seed round led by Round13 Capital (BW)

Debt

Global commodity trader Trafigura entered into a $500M five-year loan backed by Italy’s export credit agency Sace (GT)

South Africa’s government plans to take on 50%+ of struggling state power company Eskom’s debt over next three years to help strengthen its balance sheet and operations and enable it to restructure (RT)

Bankruptcy / Restructuring

Bankrupt theater operator Cineworld received 40 non-binding bids but none were for its UK and US assets, and none covered its $6B secured debt load (RT)

Fundraising

PE firm Arctos Sports Partners is close to raising $2.5B for its Arctos Sports Partners Fund II (BYI)

The Alaska Permanent Fund Corporation committed $107M to Antin Infrastructure Partners V, $50M to Morgan Stanley's North Haven Infrastructure Partners IV, $50M to Berkshire Digital Infrastructure Fund and $50M to EnCap Energy Transition Fund II (IFI)

New Zealand's Pencarrow Private Equity raised $186M for its Pencarrow VI buyout fund (DSA)

Dubai-based Cypher Capital is looking to raise over $100M for a new web-3/crypto VC fund (BBG)

European VC firms Amadeus Capital Partners and APEX Ventures raised $30M for a targeted $85M VC fund to invest in early-stage deeptech startups in DACH region (TC)

Apollo will launch a PE secondaries fund this year (SI)

Crypto Corner

Dapper Labs faces a lawsuit claiming that NBA Top Shot NFTs are securities (RT)

BlackRock started a Metaverse-themed ETF (CD)

BlockFi appealed to cancel bankruptcy status for SBF’s Emergent Fidelity Technologies offshore investment vehicle (CT)

Stablecoin issuer Circle listed euro-backed stablecoin on Coinbase (YH)

Exec's Picks

You don’t have to be a billionaire to invest like one. Top-tier private market fund managers outperform public markets, but access has been almost impossible (unless you have at least $50M in capital to deploy). Gridline users gain access to a curated selection of rigorously vetted managers and up-to-date information about the most compelling investment opportunities. Membership to the platform is free and access is instant. Upgrade your portfolio with Gridline now.

Financial Times published an interesting piece on Vanguard CEO's decision to pull the asset manager out of the Net Zero Asset Managers initiative.

Sneaker resale prices are coming back down to earth, according to Axios's Kate Marino.

Litney Partners - Financial Recruiting 💼💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

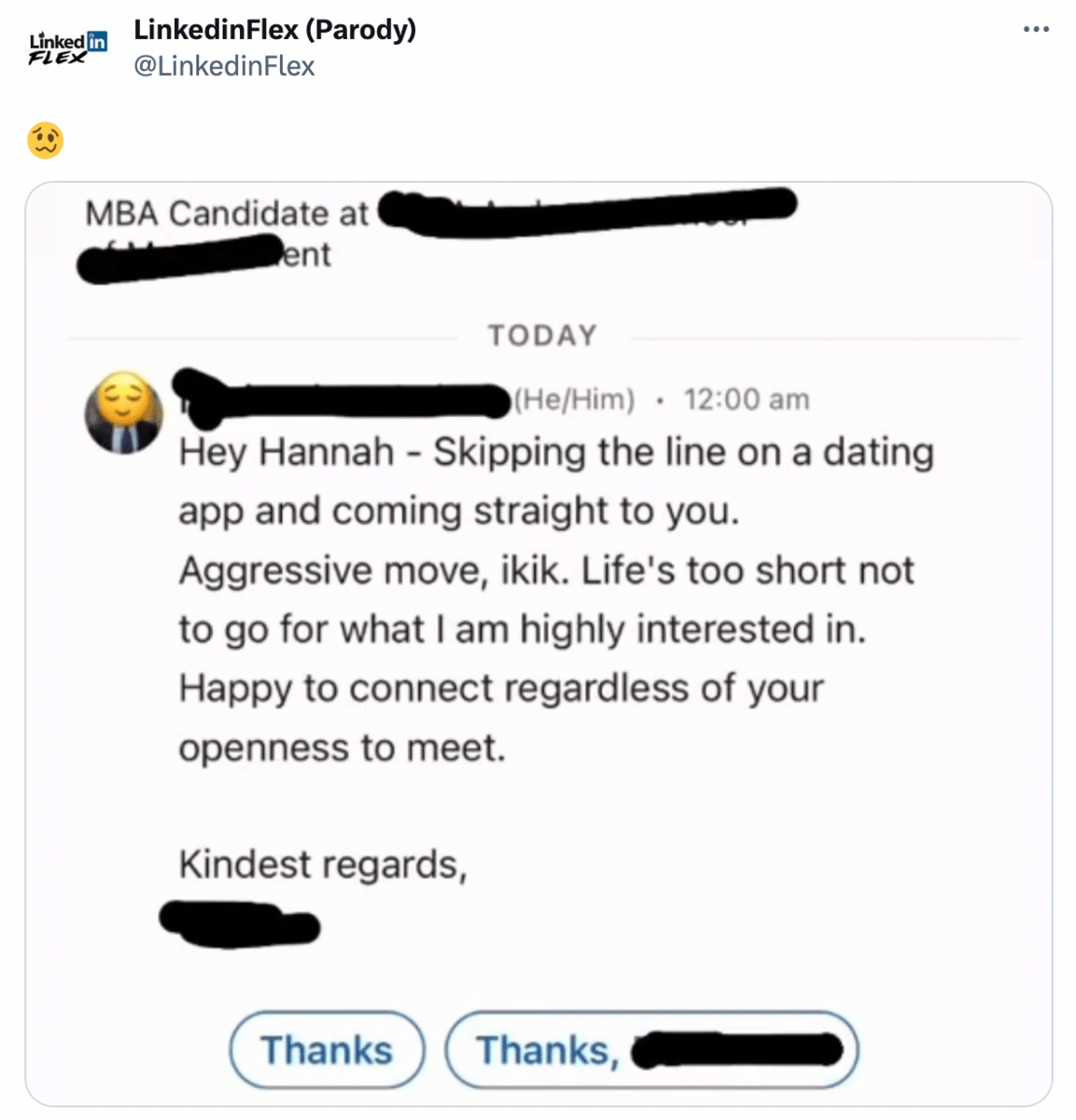

Meme Cleanser

Thinking of starting your own newsletter? Beehiiv is the best platform for creators, period. Click here to get started building your own audience.