Together with

Good Morning,

PE will lobby Trump for access to 401(k)s, McDonald's dropped some DEI efforts, Bridgewater laid off 7% of staff, Chinese VCs are coming after personal assets of failed founders, and Meta named Dana White to the board.

Deal flow is picking up, but does modeling still have to take hours? Mosaic is what top funds are using to flip the script - building models in minutes instead. If you've ever questioned how much time gets eaten up in Excel, it's time to see what Mosaic can do.

Let's dive in.

Before The Bell

As of 1/6/2025 market close.

Markets

US stocks jumped yesterday on the back of chipmakers

S&P and Nasdaq rose to more than one-week highs

US 30Y yield hit 4.85%, its highest in over a year

US 10Y yield is up 50 bps MoM

US 2Y-10Y yield curve is the steepest since May 2022 at 35 bps

US 10Y term premium climbed to its highest since 2015 after only recently turning positive

China's CSI 300 is already down 4.1% YTD

Yuan slid to a 15-month low versus dollar

Canadian dollar gained 1.2% on Justin Trudeau's resignation

Used luxury watches index fell to a three-year low in 2024

Natural diamond prices are down 8% since 2020

Earnings

What we're watching this week:

Wednesday: Jefferies, Albertsons

Friday: Delta, Walgreens, Constellation Brands

Full calendar here

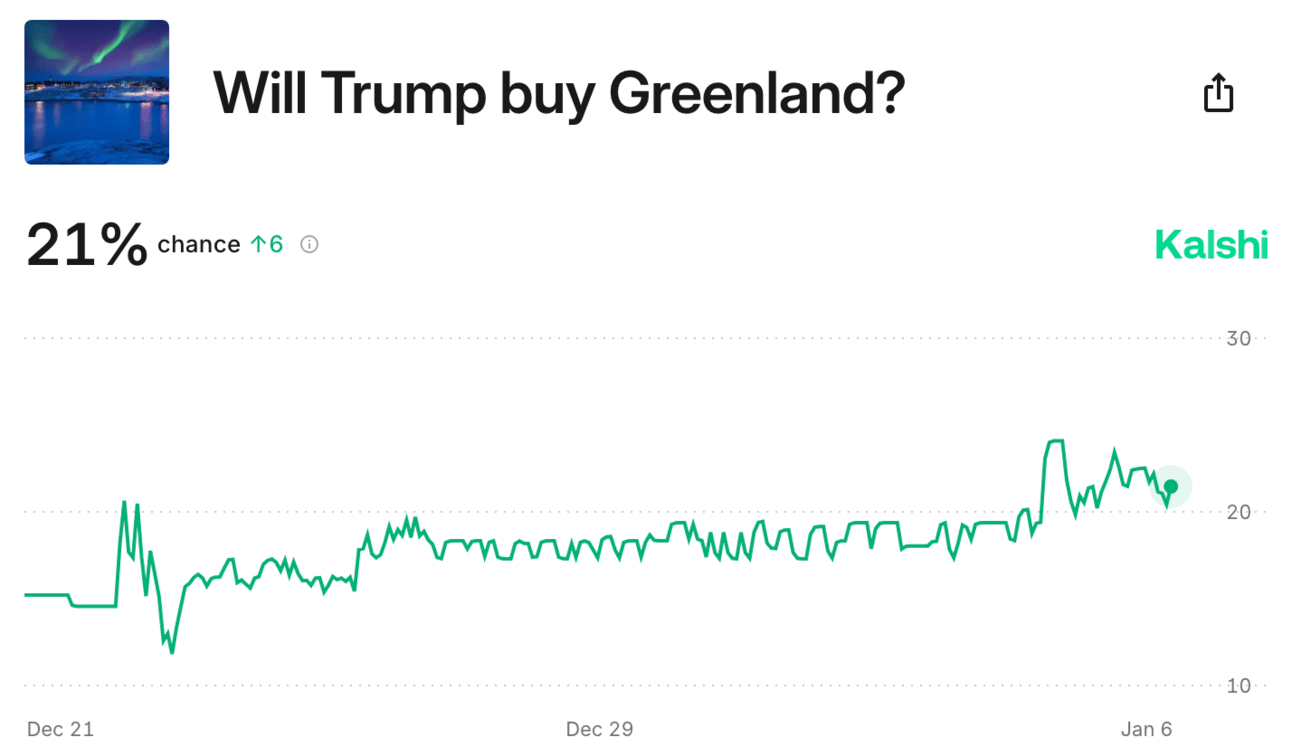

Prediction Markets

Put your money where your mouth is.

Headline Roundup

PE will lobby Trump for access to savers' retirement funds (FT)

Investment banks prepare for crunch year in 2025 (FT)

Spinoffs outperforming S&P 500 boost case for breakups (BBG)

Firms swarm high-grade bond market in busiest day since September (BBG)

Fed’s top banking regulator will step down to avoid clash with Trump (CNBC)

Trump denied report that he is eyeing pared-back tariffs (RT)

China rushes to reassure investors as stocks and yuan fall (FT)

Chinese VCs force failed founders on to debtor blacklist (FT)

Money managers turn increasingly bullish on oil to start 2025 (BBG)

Bridgewater cut 7% of staff (BBG)

HSBC named Lisa McGeough as US CEO (RT)

Meta named UFC CEO Dana White to the board (CNBC)

McDonald's dropped DEI goals (BBG)

Boardroom diversity stalls amid backlash (RT)

Netflix and WWE aim to fuel wrestling fervor worldwide (RT)

Canada PM Justin Trudeau resigned (BBG)

Unemployed white collars are having a harder time finding new jobs (WSJ)

Diamond market faces turning point as lab-growns become too cheap (WSJ)

A Message from Mosaic

Why Are We Still Spending Hours on Grunt Work?

Let's be real - how much time do we actually spend doing real analysis versus cleaning up spreadsheets? Mosaic changes the game. It's not just faster; it's smarter, taking everything tedious about modeling and automating it.

Recently featured in Bloomberg and the Financial Times, Mosaic is what top funds are using to build rock-solid LBOs in minutes, not hours. It's built by PE pros who've been in the trenches and designed to handle the complexity and precision we all deal with - without the grunt work.

And now, with integrations for CapIQ and FactSet, Mosaic brings real-time market data right into your workflow. No manual updates. No wasted steps. Just faster, smarter models.

The biggest firms are already saving hours with Mosaic, and honestly, I wish this existed back in my PE days. Late nights, endless revisions, and formatting chaos? Mosaic solves for all of that. No wonder it's becoming the industry standard for deal modeling.

Deal Flow

M&A / Investments

A consortium backed by Apollo and BC Partners is nearing a deal to acquire GFL Environmental's environmental services unit at a $5.6B valuation, including debt

Medical device maker Stryker agreed to acquire blood clot treatment producer Inari Medical for $4.9B cash

Oil refiner Phillips 66 will acquire EPIC NGL in $2.2B cash deal

$1.5B-listed Japanese chemicals firm Taiyo is exploring a merger with $2B peer DIC

Walt Disney agreed to merge its Hulu + Live TV streaming service with $1.7B-listed sports streaming company FuboTV

Japanese oven maker Paloma Rheem will acquire Fujitsu's AC unit Fujitsu General for $1.6B

Advent International agreed to acquire condiments maker Sauer Brands from Falfurrias Capital Partners for $1.5B

$940M-listed freight forwarding company Forward Air is exploring a sale or merger amid activist pressure

Swiss insurer Helvetia is considering a sale of its loss-making German insurance operations, which could fetch $663M

LatAm's largest investment bank Banco BTG Pactual will acquire Swiss private bank Julius Baer's Brazil unit for $164M

Japan's SBI Holdings agreed to take an over 70% stake in German fintech Solaris

VC

Oral macrocycle drug discovery startup Orbis Medicines raised a $97M Series A led by NEA

DocketAI, a startup using AI to transform revenue enablement, raised a $15M Series A led by Mayfield and Foundation Capital

Robotics startup RoboForce raised $10M in early stage funding from economist Myron Scholes, VC Gary Rieschel, and Carnegie Mellon University

JAN3, a Salvadorian digital infrastructure startup, raised a $5M seed round led by Fulgur Ventures

IPO / Direct Listings / Issuances / Block Trades

Smithfield Foods filed for a US IPO at a potential $5.4B valuation

Debt

Mexico launched an $8.5B dollar-bond sale

Ally Financial reestablished an agreement with Carvana to buy up to $4B in used-vehicle loan receivables

Vehicle battery maker Clarios International is considering raising several billion in new debt to fund a dividend recap to owners including Brookfield and Canada's CDPQ

Stonepeak-backed Digital Edge raised $1.6B in debt and equity to fund data center expansion in Asia

Aluminum producer China Hongqiao sold a $330M dollar bond

Bankruptcy / Restructuring / Distressed

Wireless network firm Ligado Networks filed for Chapter 11 bankruptcy with plans to cut $7.8B of debt

Crafts retailer Joann is working with advisers to shore up its balance sheet and ease liquidity pressures less than one year after exiting bankruptcy

Fundraising

Early stage VC Trinity Ventures closed a multi-asset continuation fund at $435M

Biotech VC Aditum Bio closed its third fund at $428M

Crypto Sum Snapshot

Ripple CEO sees TradFi firms flocking to crypto after Trump victory (DC)

MicroStrategy now holds $44.3B of Bitcoin (BBG)

Check out Crypto Sum for the full stories on everything crypto!

Exec’s Picks

Alt Managers, stop wasting your time managing vendors, contracts, invoices, and expense allocations manually in Excel. StavPay automates and streamlines this process and now has over 95 clients with $2.2T AUM leveraging the system daily. Get more details at stavpay.com and schedule a demo today.

Ruchir Sharma authored Financial Time's latest big read on the top 10 trends for 2025.

Callie Cox wrote another great piece on how American investors, consumers and business leaders are uniquely optimistic right now.

Financial Services Recruiting 💼

If you're a junior banker looking for your next career move, check out Litney Partners, a recruiting firm established by Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates across private equity, hedge funds, venture capital, growth equity, credit, and investment banking.

We're currently seeking talent for some incredible roles. Head over to Litney Partners to drop your resume / create your profile and we'd love to get in touch!

Meme Cleanser

🛒 Merch Store: Visit our merch store to shop our latest apparel, shoes, bags, accessories and more.

💵 Litquidity Ventures: Accredited investors & qualified purchasers within the Litquidity community can gain access to alternative investments such as venture, late-stage growth, and private equity through Litquidity Ventures. Interested? Fill out this form.

☎️ Book a call with Lit: Want to pick Litquidity's brain on business advice, insights, or just chat to say what's up? Buy his time here.

📧 Launch your own newsletter: Have great content ideas and looking to launch your own publication? We highly recommend Beehiiv to get started.