Together with

Good Morning,

Japan PE nearly tripled last year, China is investigating PwC for its role in Evergrande’s fraud, Goldman’s hedge fund clients are getting active in crypto, big tech founders are cashing out on stocks, Canada will cap mortgages for certain borrowers, and Cathie Wood valued Bitcoin at $1.5M.

Looking to diversify into a range of private credit opportunities? Check out Percent, a highly democratized private credit market allowing investors to access exclusive private credit deals.

Let’s dive in.

Before The Bell

As of 03/22/2024 market close.

Markets

US stocks ended mixed on Friday but clinched their best week YTD, with the Nasdaq and S&P rising 2.9% and 2.3% respectively

Europe's Stoxx 600 paused near record highs after dovish cues from major central banks

Swaps traders are pricing in three 25 bps BoE rate cuts by 2024-end to match the Fed

Japanese yen traded near multi-decade lows versus the dollar but may see intervention by Japan

Argentina's dollar bonds hit record highs, gaining ~60% since Milei's election

Earnings

What we're watching this week:

Tuesday: Gamestop

Wednesday: Cintas, Jefferies, MillerKnoll

Thursday: Walgreens Boots Alliance

Full calendar here

Headline Roundup

Goldman’s hedge fund clients are getting active in crypto options (BBG)

Japan PE deals jump in otherwise gloomy year for Asia (BBG)

US investment funds pull $13.3B from BlackRock in anti-ESG campaign (FT)

US firms' stock purchases via buybacks and M&A will hit 6-year high this year (RT)

Investors pour into US corporate bond funds at record rate (FT)

Thiel, Bezos and Zuckerberg join parade of insiders selling tech stocks (FT)

CRE CLOs face unprecedented stress amid real estate pain (BBG)

Oil execs talk down shift to green energy amid booming profits (FT)

China banned Intel and AMD chips in government computers (FT)

A banned trader worked ~20 years before regulators caught on (BBG)

Canada will cap number of mortgages to highly indebted borrowers (RT)

China is investigating PwC for role in Evergrande's $78B fraud (BBG)

A Signa MD is under investigation for fraud (RT)

Cathie Wood's ARK Invest scooped ~10k Reddit shares (RT)

Activist investor Politan is planning a second proxy fight for two more seats at Masimo (WSJ)

England homes are more cramped than those in NYC (BBG)

Stanley looks to replicate the water-bottle hype among guys (WSJ)

Russia detained 11 suspects after a deadly terrorist attack (FT)

A Message From Percent

The asset class generating returns of up to 20% APY

Private credit has been one of the fastest growing markets in recent years — tripling in size over the past 15 years. Having powered over $1B in transactions, Percent is the private credit marketplace that lets accredited investors invest with as little as $500.

Private credit are loans negotiated privately and not originated by banks. They can command much higher interest rates and offer largely uncorrelated risk profiles.

What makes private credit appealing?

Low minimums: Invest as little as $500 to start

Welcome bonus: Earn up to $500 bonus on your first investment

Shorter-term investments: Many deal durations are between 9 months to several years, some have liquidity available after the first-month

As a welcome offer, earn up to a $500 bonus on your first investment.

Deal Flow

M&A / Investments

Vodafone's $16.4B deal to combine its UK unit with CK Hutchison's Three faces an in-depth antitrust investigation (BBG)

Robert Bosch, Lennox International, and Samsung Electronics are among industrial firms competing to acquire heating and ventilation assets worth over $6B from Johnson Controls International (RT)

Ageas will halt its pursuit of UK insurer Direct Line Insurance Group after two takeover proposals were rejected; its last offer valued Direct Line at ~$4.1B (BBG)

PE firms Advent International and CVC teamed up to bid for PE firm Cinven’s Hungary-based Partner in Pet Food; Cinven previously sought a valuation of ~$2.2B (FT)

Blackstone held informal talks with advisors over a $1.9B sale of flexible workspace provider The Office Group amid a pickup in demand (BBG)

Anthropic is weighing a slate of SWFs to acquire FTX's ~$1B, 7.84% stake in the AI startup (CNBC)

Midstream company MPLX will acquire pipeline operator Summit Midstream Partners’ Utica assets for ~$625M cash (RT)

Qualcomm ended its bid to acquire Israeli automobile-focused chipmaker Autotalks due to regulatory hurdles (RT)

Newmont kicked off the sale of its Akyem gold mine in Ghana, which is attracting interest amid soaring gold prices (BBG)

VC

IPO / Direct Listings / Issuances / Block Trades

Chime, a fintech firm offering fee-free services, is targeting a 2025 US IPO; the fintech was valued at $25B in 2021 (BBG)

Galderma soared 21% in its trading debut, giving the skin-care company a $16.7B market cap (BBG)

$5.3B Hong Kong-listed Samsonite International is keeping the possibility of a take-private deal open as the luggage maker considers a dual listing in the US (BBG)

LatAm-focused health chain Auna fell 20% in its trading debut after its $360M US IPO, which was priced below a marketed range (BBG)

Oman’s state energy company OQ picked HSBC for the listing of its exploration and production business and Morgan Stanley for its methanol and LPG unit (BBG)

Walmart-backed digital marketing firm Ibotta filed for a US IPO (RT)

SPAC

Shareholders approved Digital World Acquisition Corp’s $5.7B merger with Trump Media & Technology Group (RT)

Debt

A group of debt arrangers led by Morgan Stanley and JPMorgan priced $6.1B in high-yield bonds and leveraged loans to support Stone Point Capital and CD&R’s acquisition of Truist Financial’s insurance business (BBG)

Banks and direct lenders are competing to arrange a ~$2B debt package to back the potential LBO of real estate and facility manager Apleona Group owned by PAI Partners (BBG)

Cerberus-backed Electrical Components International held discussions with private credit firms for a new $1.1B loan to refinance the company’s debt (BBG)

Swedish real estate group SBB will buy back debt worth $440M at a 60% discount to calm investor nerves (RT)

Centerview Partners held conversations with private credit lenders to refinance ~$270M of debt of wheel supplier Superior Industries (BBG)

Senior lenders to theater chain AMC are weighing options to tackle debt (BBG)

Bankruptcy / Restructuring

Fundraising

TPG will close its eighth Asia buyout fund at ~$5B and slash its China allocation by half (BBG)

VC World Fund closed its first fund at ~$325M to invest in decarbonization technologies (TC)

Diversity focused VC Impact X Capital Partners is looking to raise $126M for its second fund and is already backed by Bank of America (RT)

BMO partnered with Carlyle to launch a private markets fund for Canadian investors (RT)

Crypto Corner

Exec’s Picks

WSJ published interesting insights into the problematic growth of US’s $27T Treasury debt.

Litney Partners - Financial Recruiting 💼💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

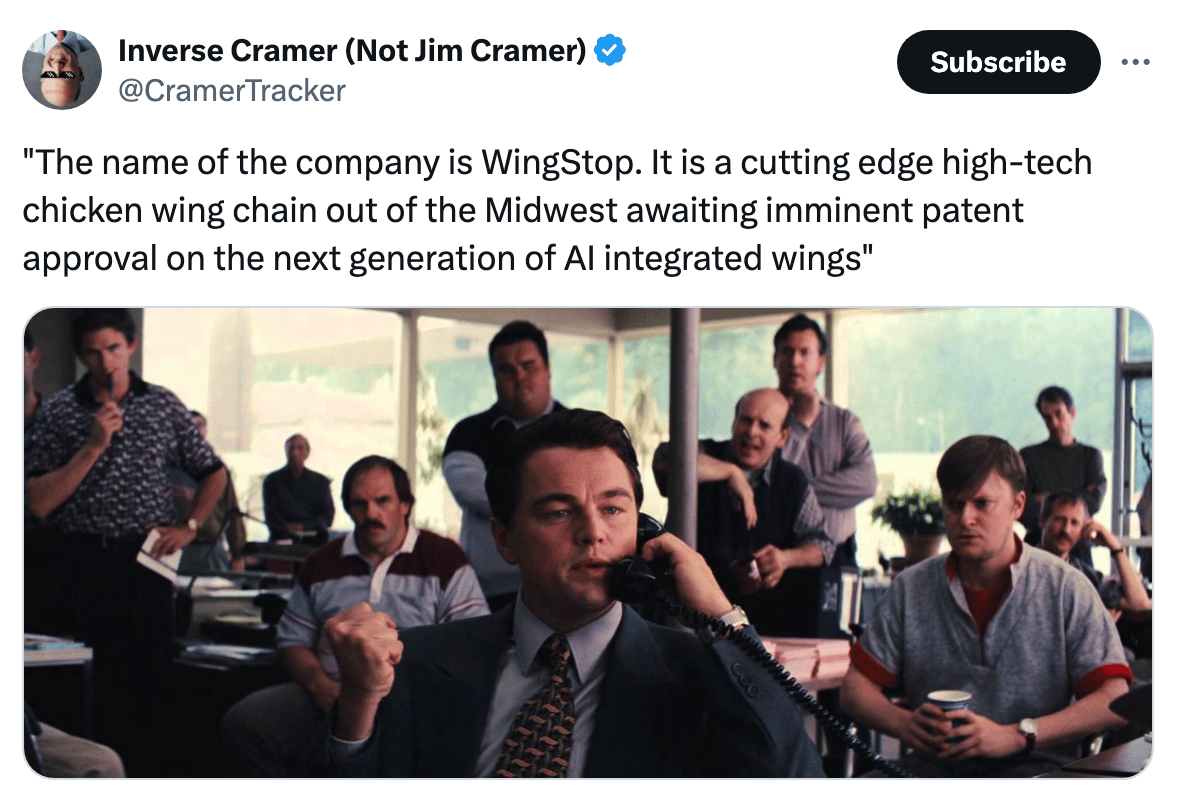

Meme Cleanser

Advertise with us // Visit our merch store // Invest alongside Lit Ventures // Book a call with Lit // Launch your own newsletter