Together with

Good Morning,

40 high-profile traders from Citadel and others are expected to debut their own funds this year, BOJ entered a new regime of monetary policy today, PE is seeking help from private credit, the corporate bond rush is defying high rate fears, and the Corinthia-Barings drama might just make for a thriller movie.

Want to know what’s in store for fintech in 2024? Today’s sponsor Plaid just released their highly insightful 2024 Fintech Predictions Guide!

Let’s dive in.

Before The Bell

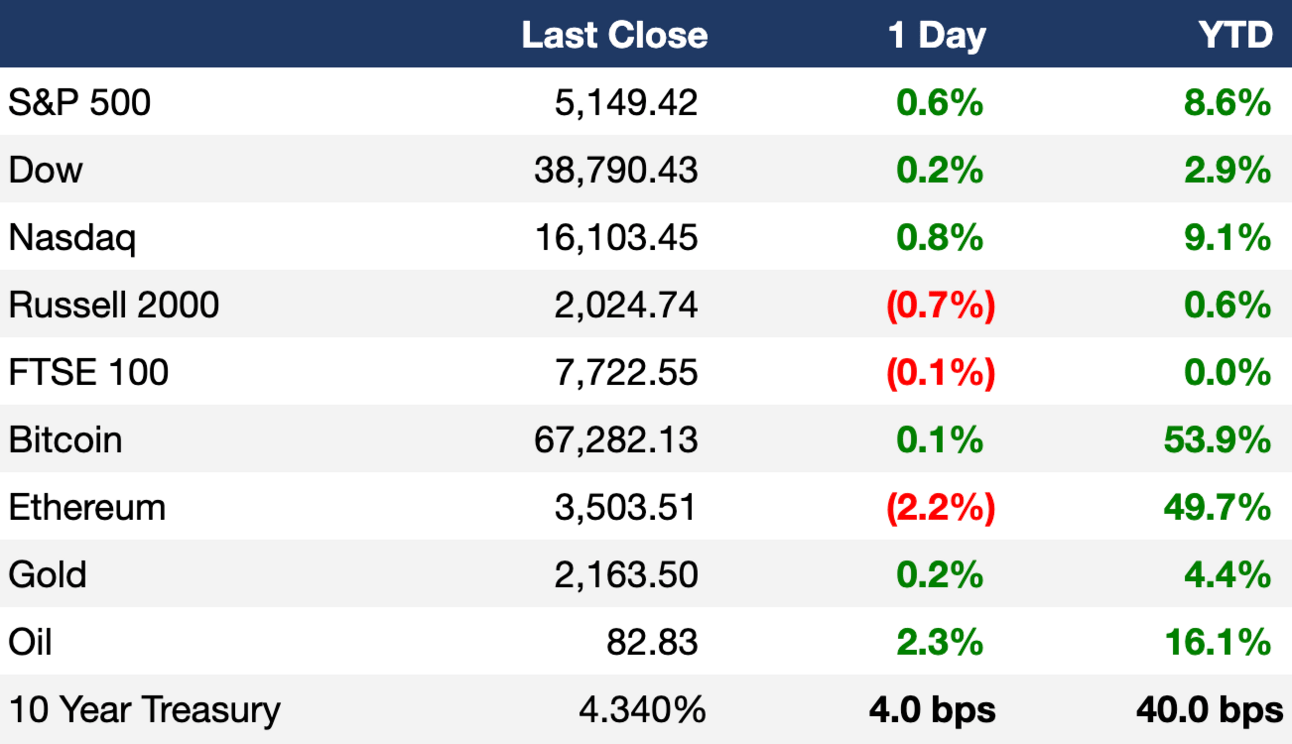

As of 03/18/2024 market close.

Markets

All three major US indexes rose yesterday as investors prepared for an important week in global monetary policy updates

The S&P snapped a three-day losing streak

24 S&P stocks hit new all-time highs

US 2Y and 5Y yields climbed to the highest levels since December

Oil prices climbed ~2% to a four-month high

Swaps traders are pricing in a < 50% chance of a June rate cut

Earnings

What we're watching this week:

Wednesday: Micron, General Mills, Chewy

Thursday: FedEx, Nike, Lululemon, Accenture

Full calendar here

Headline Roundup

Corinthia poached 20+ leaders from Barings' private credit team; Barings sued (BBG)

Corinthia eyes Barings' assets after poaching 20+ employees (BBG)

Barings pauses new private credit deals after facing mega corporate raid (BBG)

40 PMs from Citadel, Oaktree, others line up hedge fund launches for 2024 (RT)

BOJ ended YCC and raised rates for first time in 17 years (CNBC)

PE firms stuck with old assets tap private credit for help (BBG)

Corporate bond rush is defying high-rate refinancing fears (BBG)

Bond vigilantes snooze as Treasury market shrugs off vast US borrowing (FT)

Treasury ETF hit by record losing streak, $2B of outflows (BBG)

Commodity traders are sitting on $120B in cash after years of record profits (FT)

Hedge funds buy largest bulk of bank stocks in a year (RT)

Hedge fund groups sue SEC over broker-dealer rule (FT)

Super Micro Computer joined the S&P 500 (RT)

Apple is in talks to let Google Gemini power iPhone AI features (BBG)

Musk defends his ketamine use as beneficial for investors (RT)

Berkshire Hathaway speeds up stock buybacks (RT)

Saudi Aramco CEO says energy transition is failing (CNBC)

European patent applications hit record high in 2023 (RT)

Goldman veteran Stephanie Cohen resigned in latest senior exit (RT)

Evergrande was accused of falsifying revenue by $78B (BBG)

College graduates enter cooling job market (WSJ)

A Message From Plaid

6 Huge Fintech Trends for 2024

Gather round, dear readers, for a rare chance to peer into the Crystal Ball of Fintech…

Of course, it’s not an actual crystal ball – it’s just what we call Plaid, since they have an outstanding track record of nailing where the industry is headed and what that means for your business.

Their latest and greatest report is the 2024 Fintech Predictions Guide.

This guide is basically a cheat code for anyone involved or interested in Fintech, giving you rich insights into where the industry is headed, as well as real-life stories from companies who have overcome challenges to thrive.

In it, Plaid unpacks 6 of the biggest trends for 2024 and how you can stay ahead of the curve… making it a must-read for anyone in the business.

Deal Flow

M&A / Investments

State-backed Japan Investment Corp. will launch a $6B tender offer for chipmaking materials firm JSR Corp. today (BBG)

CVC Capital Partners is exploring options including a sale of Universidad Alfonso X El Sabio, a Spanish private university that could be valued at as much as $2.2B (BBG)

Selena Gomez hired advisors to weigh offers looking to invest in or acquire her $2B cosmetics company Rare Beauty (BBG)

PE giant Carlyle will enter advanced talks to acquire a majority stake in Thyssenkrupp's naval shipbuilding unit in a $1.6B deal, including debt (BBG)

Australia cement firm Boral urged shareholders to reject its largest shareholder Seven Group Holdings' $1.3B offer for the company (RT)

Telecom Italia may sell assets worth ~$1.1B, including its stake in ~$238M-valued mobile tower operator Inwit, to reduce debt (BBG)

Chinese conglomerate Fosun International is open to a sale of its remaining stake in Portugal bank Millennium worth ~$910M (RT)

LNG developer Tellurian, which has a $574M market cap, is exploring options including a potential sale (RT)

French PE firm PAI Partners will buy a 51% stake in professional hair products maker Beautynova from PE firm Bluegem for $359M (FT)

Australia-listed hedge fund GQG Partners acquired stakes in three PE firms for $71M (PI)

Vietnam conglomerate Vingroup will sell a 41.5% stake in Vincom Retail and will retain an 18.8% stake (BBG)

Shell plans to divest 1k retail sites in shift to EV charging (BBG)

Soho House & Co. jumped 21% on news of progress regarding a go-private deal (BBG)

Shift4 Payments said PE take-private bids failed to sufficiently value the payments firm (BBG)

British insurer Legal & General is lining up investment bank Rothschild for a potential sale of its housebuilder arm Cala (RT)

CarelonRx, a unit of US health insurer Elevance Health, agreed to acquire Kroger’s specialty pharma business for undisclosed terms (RT)

VC

BigID, an AI-based data security and privacy platform, raised a $60M growth round at a $1B+ valuation led by Riverwood Capital (PRN)

Figure Technologies, a decentralized custody crypto exchange and blockchain-native security marketplace, raised a $60M Series A led by Jump Crypto, Pantera Capital, and Lightspeed Faction (BW)

Carlsmed, a personalized surgery medtech company, raised a $52.5M Series C led by B Capital and US Venture Partners (BW)

Payments automation platform FlexPoint raised $35M in debt / equity: $5M in equity led by Haymaker Ventures and a $30M credit facility from Tacora Capital (BW)

Journey management platform TheyDo raised a $34M round led by Blossom Capital (FN)

Poseidon, a startup building technology for aquaculture, raised a $20.8M Series B led by Ecosystem Integrity Fund (BW)

Superlinked, a startup providing a solution for turning complex data into vector embeddings, raised a $9.5M seed round led by Index Ventures (FN)

Nigerian fintech Zone raised an $8.5M seed round led by Flourish Ventures and TLcom Capital (TC)

Cache, a startup building a brokerage specifically for large stock positions, raised an $8.5M seed round led by First Round Capital and Quiet Capital (FN)

Neupulse, a startup building a wearable device to help those with Tourette’s, raised a $3.2M seed round led by Eos Advisory (BW)

Synch, a provider of an integrated global trade management solution, raised a $3M seed round led by AltCap and Haystack (FN)

IPO / Direct Listings / Issuances / Block Trades

Edtech and publishing firm Encyclopaedia Britannica is seeking a $1B valuation in its potential June IPO (BBG)

Indian conglomerate Tata is seeking to raise over $1.1B via a share sale in their Tata Consultancy Services software services unit (BBG)

Intel-backed semiconductor connectivity company Astera Labs raised the size of its planned IPO by 26%, seeking to now raise over $673M (BBG)

Oman Investment Authority plans to IPO its logistics firm Asyad Group (BBG)

Alibaba-backed logistics provider Ninja Van put off plans for an IPO until profitability improves (BBG)

Occupational health services provider Concentra Group, a unit of Select Medical confidentially filed for a US IPO (RT)

Debt

UK defense company BAE Systems is seeking to raise $4B to refinance a bridge loan it used to acquire Ball Aerospace (BBG)

A consortium led by Golden Energy and Resources is seeking private credit and bank lending to finance its $1.65B acquisition of coal mine Illawarra Metallurgical Coal from Australia-based South32 (BBG)

Messaging platform Telegram raised $330M in a bond sale last week (RT)

Bankruptcy / Restructuring / Distressed

Swiss logistics firm and Signa Prime-shareholder Kuehne, and some banks, are considering an emergency loan of over $109M to buy time as Signa Prime creditors meet to discuss its restructuring plan (BBG)

Signa lenders including banks, insurers and SWFs, backed a proposal for Signa to sell off assets to recoup ~30% of their money (BBG)

Crafts retailer Joann filed for Chapter 11 bankruptcy protection (AP)

Crypto Corner

Exec’s Picks

Financial Times recently interviewed renowned NYU professor Aswath Damodaran, who explains why ‘Investing is an act of faith.’

Litney Partners - Financial Recruiting 💼💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

Meme Cleanser

Advertise with us // Visit our merch store // Invest alongside Lit Ventures // Book a call with Lit // Launch your own newsletter