Together with

Good Morning,

Stocks rebounded yesterday, Boris Johnson is stepping down as the UK's prime minister, Elon's Twitter acquisition is in peril, GameStop announced layoffs, the FDA paused its Juul ban, former Japanese prime minister Shinzo Abe was shot during a political event, and mortgage rates fell to ~5.3% as investors think we're headed for a downturn.

If you're looking for actionable global events to bet on such as timing of the recession, Biden's approval rating, or monthly oil prices, check out our new newsletter - Eight Ball, where we use data provided by real-time prediction markets to see what investors are betting on.

Let's dive in.

Before The Bell

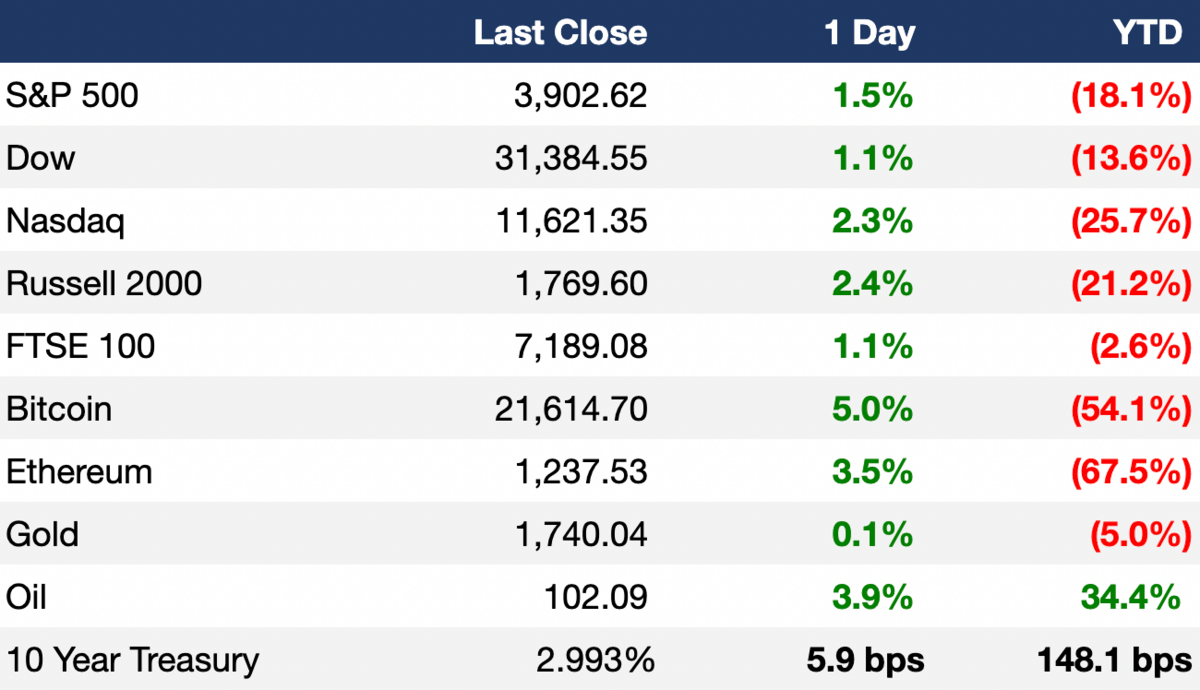

As of 7/7/2022 market close.

If you want to learn more about crypto trading strategies and the world of DeFi, check out our Foot Guns newsletter.

Markets

Stocks rose for the fourth straight session on Thursday, marking the S&P’s and Nasdaq’s longest winning streaks since March

10 of the S&P 500’s 11 sectors ended in the green

30-year fixed-rate mortgages recorded their largest weekly decline since 2008, falling to 5.30%

A Department of Labor report released Thursday showed the number of new applications for unemployment benefits rose to a 6-month high last week

The Bureau of Labor Statistics is releasing their monthly employment report today at 8:30am, expected job gains are 250k, down from 390k in May

Earnings

Headline Roundup

Boris Johnson will step down as prime minister of the United Kingdom (AX)

Vladimir Putin said that his Ukraine operation has 'hardly even started' (AX)

Elon Musk's deal to buy Twitter is in peril amid disagreements on Twitter's spam account numbers (WP)

Former Japan Prime Minister Abe unconscious after shooting (BBG)

GameStop fired its CFO and announced layoffs as part of an aggressive turnaround plan (CNBC)

The US trade deficit narrowed for the second consecutive month in May (WSJ)

Copper prices fell to their lowest level in nearly two years, with investor concerns about an economic slowdown intensifying (WSJ)

French President Emmanuel Macron proposed 20B Euros in new measures aimed at softening inflation’s impact on French households (WSJ)

Shell is continuing to invest billions of dollars into drilling in the Gulf of Mexico despite political uncertainty (WSJ)

The US Food and Drug Administration paused its ban on sales of Juul e-cigarettes (RT)

Sunny Balwani, former president of bankrupt blood-testing company Theranos, was found guilty of 12 counts of fraud six months after a similar verdict was handed down for founder Elizabeth Holmes (AX)

UnitedHealth Group was hit with a class action lawsuit accusing it of systematically underpaying for telehealth services (RT)

TikTok is facing a renewed round of bipartisan alarms over how it protects US users' data from the Chinese government (AX)

The Carlyle Group’s new $8.5B Asia fund will cut its exposure to Greater China by up to half and invest the difference in India (BBG)

Chinese IPO applications doubled in June, bucking global trends (RT)

US state debt levels rose in 2021 at the fastest pace in five years (BBG)

A Message From Eight Ball

A Macro Newsletter with Skin in the Game

In Skin in the Game, Nassim Taleb said, "Don’t tell me what you think, tell me what you have in your portfolio."

Every day, economists and talking heads give their predictions about the economy, interest rates, and the stock market. "We are going into a recession!" "Oil is going to $150 per barrel!" And every day, most of these predictions are wrong. The problem is that none of these economists put their money where their mouth is, so their accuracy doesn't matter.

We launched Eight Ball to solve this problem. With our new newsletter, Eight Ball, we use data provided by real-time prediction markets to see where investors are forecasting interest rates, oil prices, GDP growth, and more.

Our forecasts are determined by investors who put their real money on the line, not media personalities looking for air time.

If you want economic forecasts that have "skin in the game," subscribe to Eight Ball here!

Deal Flow

M&A / Investments

Elliott Investment Management is building a stake in smokeless tobacco company Swedish Match, with hopes to oppose the company's pending $16B sale to Philip Morris (BBG)

A consortium led by Seoul-based device maker SD Biosensor agreed to acquire medical-testing company Meridian Bioscience for $1.53B (BBG)

Chinese state-owned pharmaceutical group Sinopharm is exploring a potential acquisition of life sciences products and services company BBI Life Sciences in a potential $1B deal (BBG)

The Carlyle Group will sell its stake in pharmaceutical company AmbioPharm at a potential $1B valuation (RT)

Providence Equity Partners and Apollo provided $800M in financing to The North Road Company, a new global independent content studio backed by media veteran Peter Chernin. PEP is investing up to $500M of equity and Apollo provided $300M of debt financing. The company was formed after it acquired the US production assets of Red Arrow Studios for ~$180M (AX)

Luxury fashion brand Tom Ford hired Goldman Sachs to explore a potential sale (BBG)

VC

YuLife, a tech-driven insurance company that rewards everyday wellness activities, raised a $120M Series C at an $800M valuation led by Dai-ichi Life Insurance Company (TC)

Hidden Road, a global credit provider for institutional investors, raised a $50M Series A led by Castle Island Ventures (BZGA)

Happeo, a platform that uses intranets to connect employees with company tools, raised a $26M Series B led by Endeit Capital, Smartfin, and Evli Growth Partners (TC)

Ganymed Robotics, a developer of computer vision software and robotics technologies for orthopedic surgeons, raised a ~$25.2M Series B led by Cathay Health (BW)

Kernal Biologics, a development-stage mRNA-technology company developing cancer therapeutics, raised a $25M Series A led by Hummingbird Ventures (PRN)

Traba, a jobs board designed to help entry-level workers find available shifts at fulfillment centers and event venues, raised a $20M Series A led by Khosla Ventures (TC)

Oasys, a startup building a blockchain for gaming developers, raised $20M through a private token sale led by Republic Capital (TC)

ACTO, an omnichannel learning and enablement platform for life sciences, raised an $18M Series B led by Questa Capital (GNW)

Lucinity, a developer of anti-money laundering software, raised a $17M Series B led by Keen Venture Partners (PRN)

Fyto, a startup developing “superplants” that can grow in a wide variety of environments, raised a $15M Series A led by GV (TC)

Sortera Alloys, an industrial scrap metal sorting and recycling company powered by AI, raised a $10M Series B led by Assembly Ventures (PRN)

Instabox, an e-commerce shipping company, raised ~$9.5M in funding from Swedbank Robur (MW)

Adaptive, a startup building software to help construction companies manage and automate back office functions, raised a $6.5M seed round led by a16z (TC)

Ranger, a startup focused on helping insurance agents via smarter and more streamlined tools, raised a $5.25M seed round led by Lerer Hippeau Ventures (TC)

Octopus, a new waste management application to efficiently collect and connect waste to the recycling industry, raised a $5M seed round led by Openspace and SOSV (TC)

b-rayZ, a Swiss startup that aims to improve cancer diagnostics with AI technology, raised a ~$4.1M Series A led by LifeCare Partners, Protagon, and Convergence Partners (ST)

IPO / Direct Listings / Issuances / Block Trades

General Atlantic, an investment firm with $79B AUM, is exploring an IPO (BBG)

South Korean battery-parts maker W-Scope Chungju Plant Co. is seeking to raise as much as $765M in an IPO (BBG)

Volkswagen added BNP Paribas, Deutsche Bank and Morgan Stanley to its list of underwriters for its planned IPO of Porsche (BBG)

UAE-owned utility provider Empower selected Citigroup, Emirates NBD Bank and JPMorgan Chase as joint global coordinators to work on an IPO planned for later this year (BBG)

Debt

Banks led by Citigroup and Bank of America are sounding out investors for a $5.4B debt package to help fund Apollo Global Management’s buyout of original automotive equipment manufacturer Tenneco (BBG)

Fundraising

SoftBank's Rajeev Misra is stepping down as CEO of SoftBank Global Advisors to launch a new $6B fund backed by Abu Dhabi, Misra will continue to serve as both the CEO of SoftBank Investment Advisors and executive vice president of SoftBank Group (FT)

Stellar Ventures raised $23M for its first fund, SV Andromeda Fund LP, which is committed to investing in the future of space technology (PRN)

Crypto Corner

Crypto lender Celsius deposited $500M in bitcoin derivative WBTC to crypto exchange FTX, just hours after Celsius repaid its debt to the decentralized lending protocol Maker and reclaimed $450M of collateral in WBTC (CD)

The US Treasury developed a 'framework' for international crypto regulation (CD)

Crypto-focused phishing attacks rose 170% across social media sites in Q2 compared to Q1 (TC)

Crypto exchange Bitstamp canceled its inactivity fee amid customer outrage and plummeting trading volumes (FRB)

A class action lawsuit filed against blockchain platform Solana Labs claims that token SOL is an unregistered security (FRB)

Exec's Picks

Picture this: it's Summer in the city. It's hot af. You ride the subway to work. By the time you get to the office, you're dripping buckets. Mizzen + Main fixes this with their performance fabric dress shirts (think: comfort of golf polos with the look of tailored dress shirts). Check em out here.

Looking for THE perfect album for the upcoming recession? Check out Jeezy's 2008 album called "The Recession" on Spotify. It's got some certified bangers and will make the stock market decline a little less painful.

The Hiring Block 💼

If you're looking to break into finance, lateral, or move out, check out our job board on Pallet, where we curate highly relevant roles for you. We aim to curate jobs across IB, S&T, VC, tech, private equity, DeFi, crypto, CorpDev and more. We'll sift through all the noise on LinkedIn, Indeed, Monster, etc. so you don't have to.

If you're a company looking to hire candidates and want to list a job opening on our board and feature on Exec Sum, click the button below:

Meme Cleanser

Thinking of starting your own newsletter? Beehiiv is the best platform for creators, period. Click here to get started building your own audience.