Together with

Good Morning,

BuzzFeed landed a deal with Meta and plans to use ChatGPT, US GDP rose 2.9% annualized in Q4 2022, US M2 money supply shrank for the first time ever last year, Toyota's president and CEO is stepping down, the IMF wants the BOJ to let long-term yields rise, and the University of California is investing another $500M in Blackstone's BREIT.

Want to make sure you land that IB job this spring? check out today's sponsor, Wall Street Prep, for the best resources to prepare you for your interview.

Let's dive in.

Before The Bell

If you want to learn more about crypto trading strategies and the world of DeFi, check out our Foot Guns newsletter.

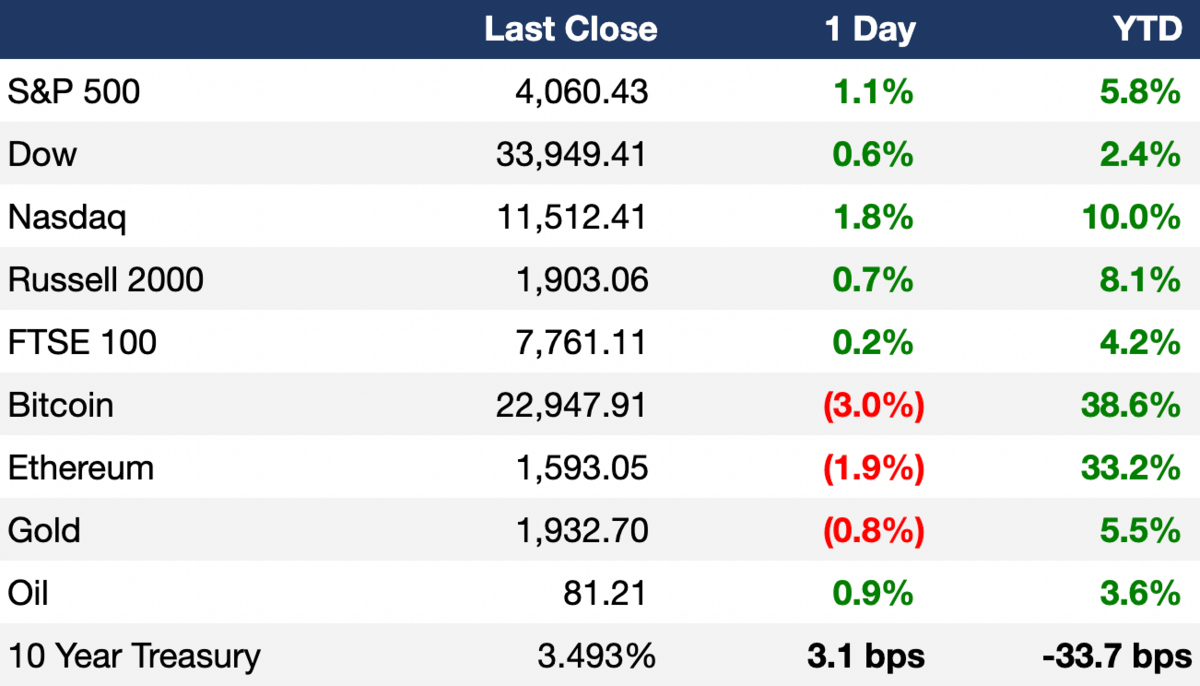

Markets

US stocks gained notably on Thursday after strong GDP growth numbers subdued fears of a deep recession

The Nasdaq is on pace for its best month since July

MSCI's all-country world index rose 0.62% to a fresh five-month high

Pakistani rupee fell 9.6% against the dollar after FX companies removed a cap on the exchange rate

Earnings

Blackstone's Q4 net income fell 60% YoY to $558M on drops in their real-estate investments valuations, while AUM came in just under the estimated $1T mark on weakened fundraising; their stock rose 4.2% yesterday (WSJ)

Intel missed on Q4 EPS and revenue estimates on a steeper than expected decline in PC chip sales while forecasting an adjusted net loss in Q1; their stock fell 9.7% AH (CNBC)

Visa beat Q1 EPS and revenue estimates on increased volume and number of transactions driven by resilient consumer spending and a surge in cross-border travel (INV)

Southwest Airlines posted record Q4 revenue but took a $220M net loss owing to their holiday-season meltdown and also expects to post a Q1 loss; their stock slid 3.15% (CNBC)

Full calendar here

Headline Roundup

US GDP rose 2.9% annualized in Q4 (CNBC)

US M2 money supply shrank for the first time ever last year (RT)

US new home sales increased for third straight month in December (RT)

IMF urged BOJ to let long-term yields rise (RT)

Russia proposed scrapping liquidity restrictions for spending on 'anti-crisis' investments (RT)

Canada expects to buck trend of big investment banking layoffs (RT)

Buzzfeed jumped over 192% on news of a multi-million dollar Meta deal and plans to use OpenAI (WSJ)

Bank of America promoted 360 people to MD with over 50% representing minorities (RT)

Musk has a playbook for Tesla as he expects a 'serious' recession (RT)

Blackstone is facing $5B of withdrawal requests from a second property vehicle (FT)

Morgan Stanley penalized employees up to $1M for WhatsApp breaches (FT)

Adani Group is evaluating 'remedial and punitive action' against Hindenburg Research amid bombshell report; Hindenburg will demand company documents if Adani sues (RT)

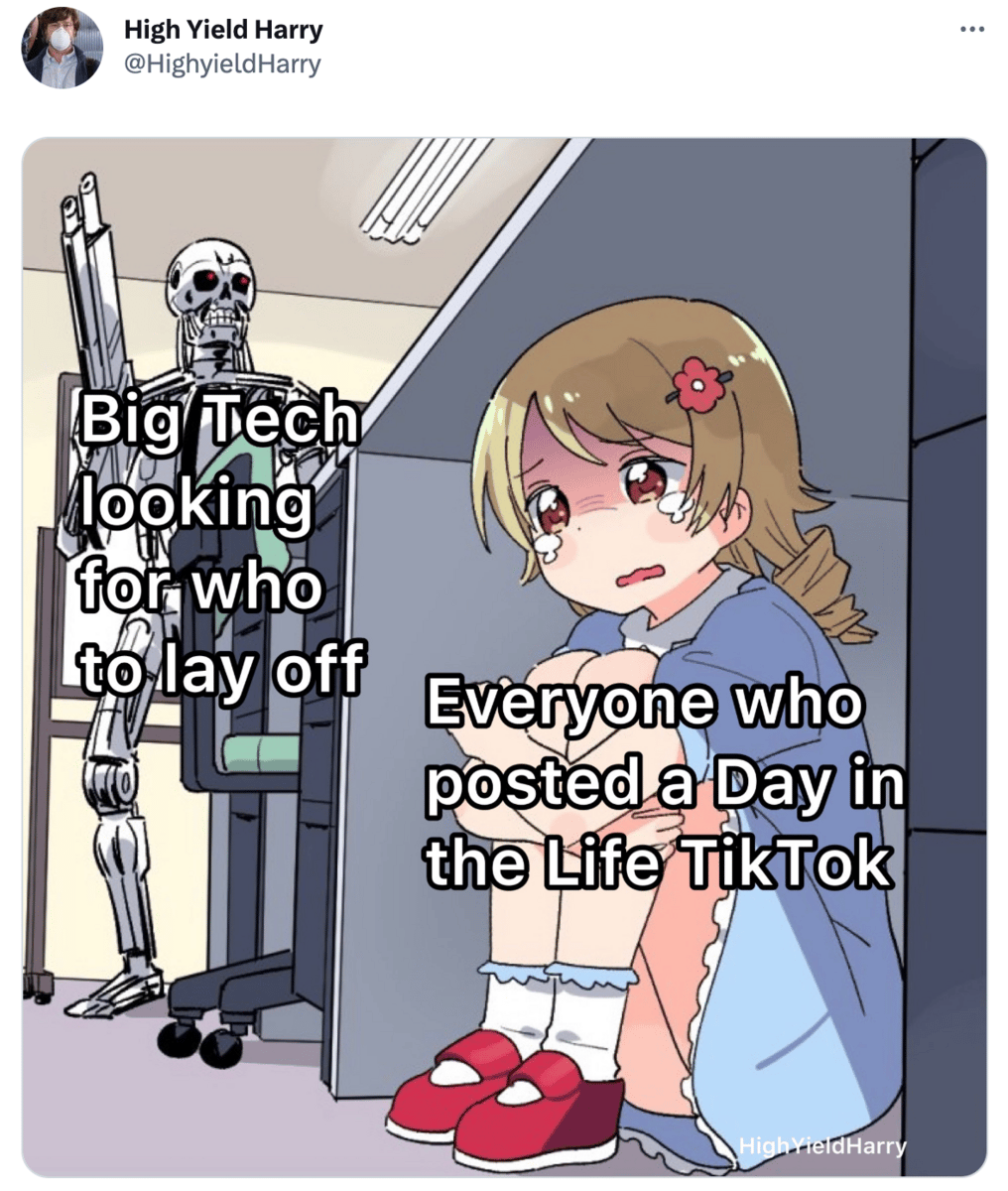

IBM will cut 3.9k jobs (CNBC)

SAP will cut 3k jobs (RT)

Chemical giant Dow will cut ~2k jobs (RT)

Hasbro will cut ~1k jobs (BBG)

Dotdash Meredith will cut ~7% of its staff (AX)

Corporate layoffs spread beyond high-growth tech giants (WSJ)

Hospital / health systems were highly vulnerable to layoffs in 2022 (BHR)

Toyota's President & CEO Akio Toyoda will step down (RT)

High-earning men are cutting back on their working hours (WSJ)

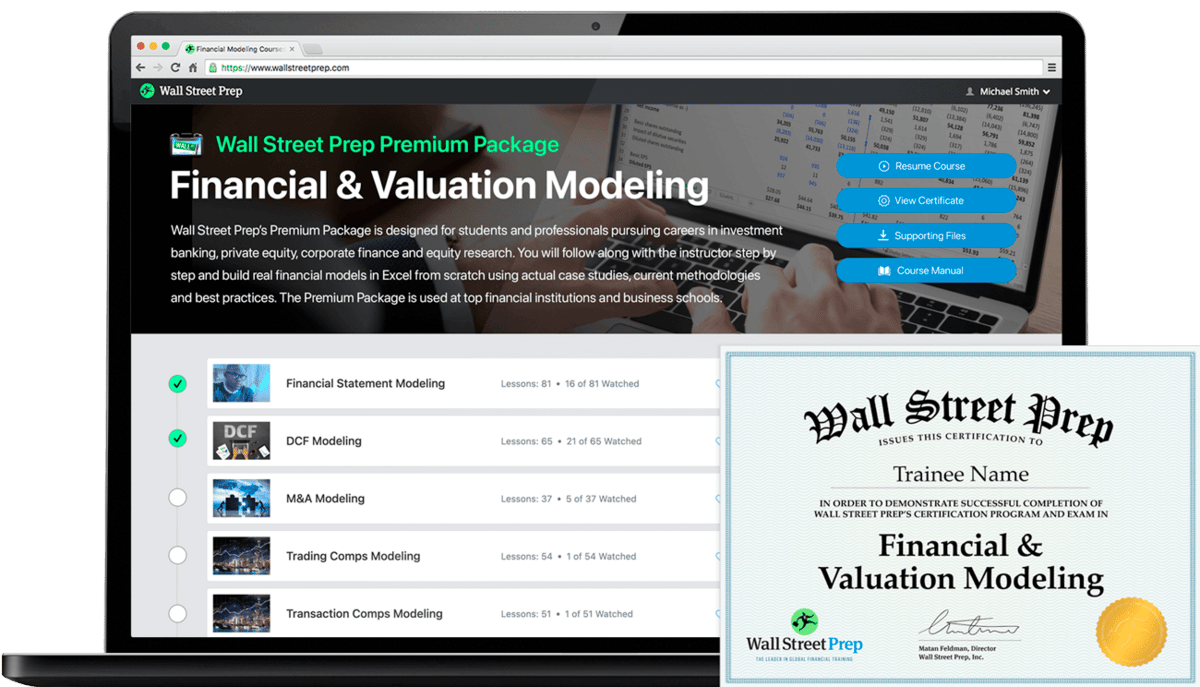

A Message From Wall Street Prep

Don't Blow Your Dream IB Interview

Finance nightmare, a short story:

Target undergraduate school. 4.0 GPA. Great extracurriculars. The MD plays golf with your dad.

You're set, this job is a lock. And you are breezing through the interview. The end is in sight, as long as you crush the case study. You are well on your way... until you can't remember how to run a DCF model.

And just like that, everything falls apart.

Game over. Have fun with the back office gig.

If you don't want to be a back-office guy, make sure you stick the interview by using Wall Street Prep.

Wall Street Prep offers a complete Financial and Valuation modeling training program, so you can learn financial statement modeling, DCF, Trading and Transaction Comps, M&A and LBO. Their content library has 850+ articles and 400+ templates too, and it's growing every single week.

So what are you waiting for? Crush your interview and land that dream job by checking out Wall Street Prep's course today! Get an extra 15% off with code "LITQUIDITY" at checkout.

Deal Flow

M&A / Investments

Shell is launching a strategic review of its European domestic energy unit (BBG)

German software company SAP is exploring a sale of its 71% stake in software firm Qualtrics, which has a current $8.8B market cap (BBG)

Monde Nissin, the Philippines’ largest instant noodle maker, agreed to buy a 15% stake in local coffee chain and restaurant operator Figaro Coffee, sending shares up 5.6% (BBG)

French food group Danone will explore strategic options, including a potential sale, for its organic dairy activity in the US, comprised of the Horizon Organic and Wallaby businesses (RT)

VC

Pearl Health, a startup focused on physician enablement and risk bearing in value-based care, raised a $75M Series B ($55M in equity / $20M line of credit) led by a16z’s growth fund and Viking Global Investors (PRN)

Job searching and recruitment platform Welcome to the Jungle raised a $54M Series C from Revaia, XAnge, blisce, and others (TC)

Grey Wolf Therapeutics, a biotech company focused on generating anti-tumour immune responses, raised a $49M Series B led by Pfizer Ventures and Earlybird Venture Capital (PRN)

Smart thermostat startup Tado raised a $46.9M round led by Trill Impact Ventures (TC)

Anti-money laundering and fraud prevention platform Hawk AI raised a $17M Series B led by Sands Capital (TC)

Insurtech startup iLife Technologies raised a $17M Series A led by Foundation Capital, Brewer Lane Ventures, and SCOR Ventures (PRN)

Method, a startup enabling fintech developers to embed repayment and balance transfer features in their apps, raised a $16M Series A led by a16z (TC)

Nuclear fusion startup Renaissance Fusion raised a $15M seed round led by Lowercarbon Capital (TC)

PortPro, a drayage management software startup, raised a $12M Series A led by Avenue Growth Partners (BW)

Design platform Kittl raised an $11.6M Series A led by Left Lane Capital (TC)

Web3 infrastructure and hardware startup Spatial Labs raised a $10M seed round led by Blockchain Capital (TC)

Supernormal, a startup automating meeting notes and transcription, raised a $10M round led by Balderton (TC)

Elaborate, a startup helping doctors communicate with patients about lab results, raised a $10M seed round led by Tusk Venture Partners (PRN)

Senken, a trading platform for on-chain carbon credits, raised $7.5M in funding led by Obvious Ventures (PRN)

StoryCo, a startup building a collaborative storytelling platform, raised a $6M seed round led by Collab + Currency and Patron (PRN)

People Science, a D2C scientific research company, raised a $5.3M seed II round led by Acre Venture Partners (PRN)

Suppli, a digital accounts receivable platform for construction suppliers, raised a $3.1M seed round led by Equal Ventures (PRN)

Viking Analytics, a Swedish startup developing AI-based machine health monitoring technology, raised a $3M+ Series A led by Finindus and Industrifonden (PRN)

Fractional homeownership startup Roots Homes raised a $2.2M round led by Other Ventures (PRN)

Digital health platform Free From Market raised a $2.1M seed round led by Bluestein Ventures (PRN)

IPO / Direct Listings / Issuances / Block Trades

Fintech giant Stripe hired Goldman Sachs and JPMorgan to advise on a direct listing or secondary offering that they will decide on within the next year (CNBC)

Debt

Fundraising

VC giant New Enterprise Associates raised over $6.2B for two new funds: $3.05B for its 18th fund now focused on early-stage deals and $3.18B for its debut growth equity fund (AX)

University of California will invest another $500M in Blackstone's BREIT common shares, bringing its total BREIT investment to $4.5B (BX)

Vision Ridge Partners, a sustainable real assets investor, raised $700M for its SAF Annex Fund (BW)

FJ Labs, a global early and growth-stage investor, raised $260M across a pre-seed fund and an opportunity-style “Series B and beyond” fund (TC)

Florida-based Govo Venture Partners debuted a new $50M VC fund to invest in government and regulatory-focused startups (BJ)

Crypto Corner

FTX published a 116-page creditor list naming organizations to whom it owes money (CD)

FTX opposed a DOJ independent investigation request as management already probes SBF's connections (RT)

SBF’s mother and brother are not cooperating with financial probe (CD)

Amazon is planning an NFT initiative (BW)

The Dutch central bank fined Coinbase $3.6M for failing to obtain correct registration (RT)

Ex-UK finance minister Philip Hammond will join crypto firm Copper as chair (FT)

Exec's Picks

Invest in the Company Behind The Walking Dead – If you could invest in the company behind one of television’s biggest hits ever, would you? Well here’s your chance. Skybound entertainment, the entity behind The Walking Dead, Invincible, Impact Winter, and 150+ other intellectual properties announced its first-ever Regulation A+ campaign. Check out their offering here.

In the wake of several high-profile crypto exchange implosions, The ISDA published a guide for navigating bankruptcy in digital asset markets.

Bloomberg's Odd Lots covered an interesting topic: Why does corporate America still run on old software that breaks?

Litney Partners - Financial Recruiting 💼💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

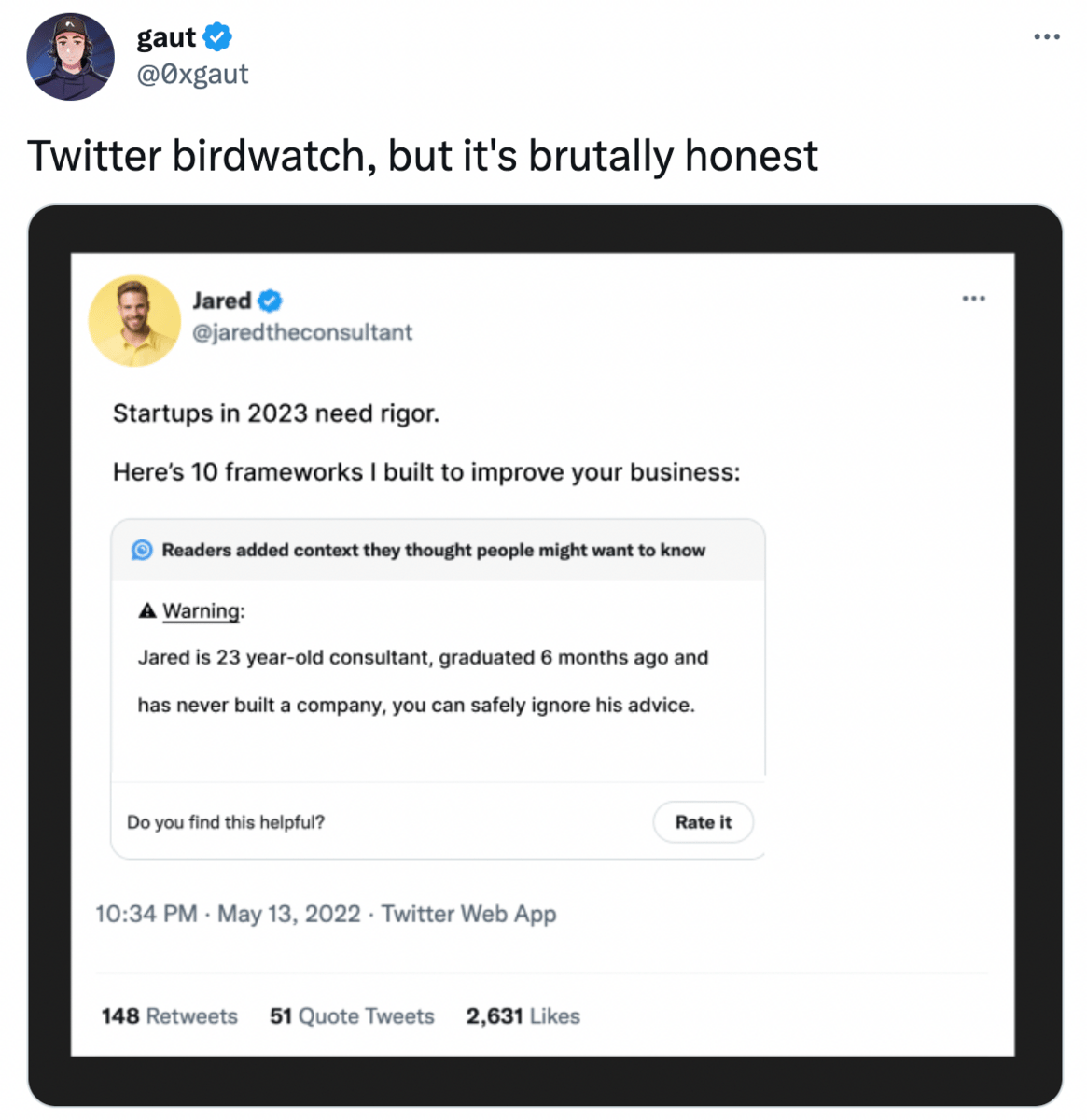

Meme Cleanser

Thinking of starting your own newsletter? Beehiiv is the best platform for creators, period. Click here to get started building your own audience.