Together with

Good Morning,

Americans are using BNPL for groceries, McCarthy unveiled a $1.5T debt ceiling increase proposal, UK inflation remained above 10% in March, Oil exports from Russia’s western ports hit a four-year high, CS bankers compete to retain jobs after UBS takeover, Microsoft is developing its own AI chip, and Reddit will charge companies for access to its API.

Let’s dive in.

Before The Bell

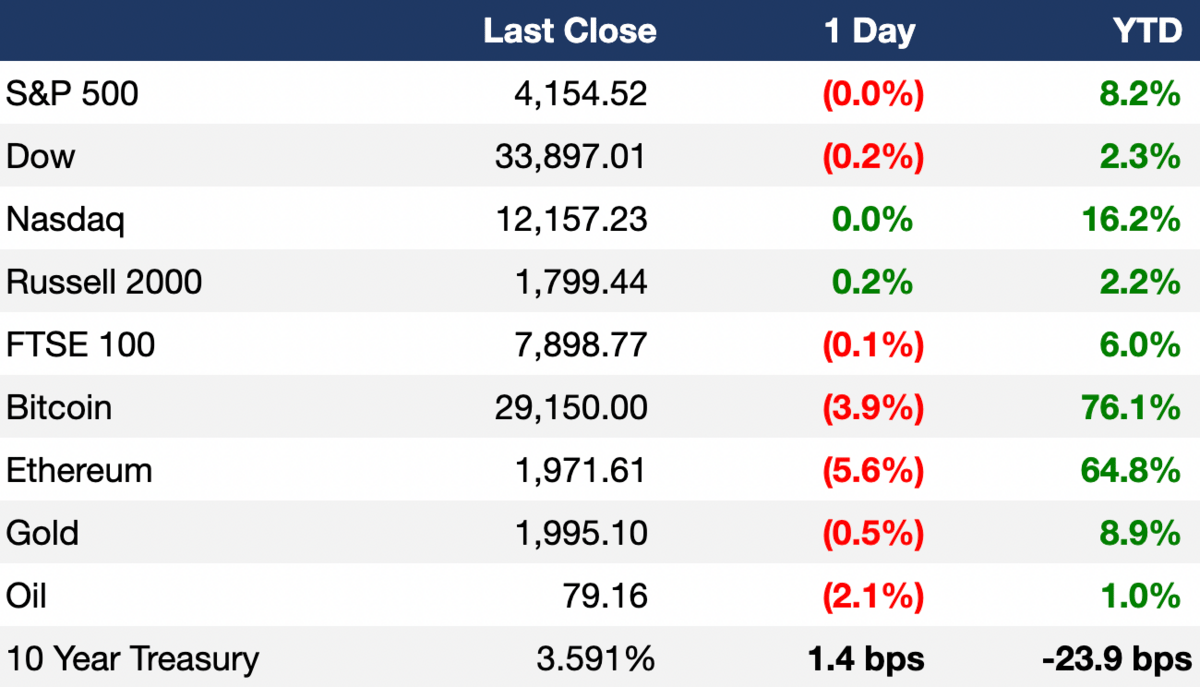

As of 4/19/2023 market close.

Markets

All three major US indexes closed relatively unchanged after another big day of corporate earnings

Earnings

Morgan Stanley beat Q1 EPS and revenue estimates on strong bond trading and wealth management revenue that offset slumps in IBD; the bank plans to continue expanding its asset management business (RT)

Tesla beat Q1 revenue estimates but missed on EPS as aggressive price cuts, underutilization of new factories, and higher costs squeezed profit margins; their stock fell ~7.5% (BBG)

What we're watching this week:

Today: Blackstone, Truist, TSMC

Friday: Procter & Gamble

Full calendar here

Headline Roundup

House Speaker McCarthy unveiled a $1.5T debt ceiling increase proposal (AX)

US Treasury cash pile jumped $108B on Tax Day ahead of potential debt default (BBG)

UK inflation remained above 10% in March (RT)

US economy stalled in recent weeks amid tightening credit (BBG)

Oil exports from Russia's western ports hit a four-year high (RT)

FDIC forecasts a $3.3B net loss for its deposit-insurance fund (WSJ)

Short positions on TD Bank Group rose to $6.1B (RT)

Credit Suisse bankers compete to retain jobs after UBS takeover (RT)

Corporate bonds are being cut to junk at fastest pace since 2020 (BBG)

Dominion's Fox lawsuit settlement earned Staple Street Capital a 1,500% return (BBG)

Miami named #1 city in the US for Gen Z tech workers (SFA)

Credit Suisse lodged a $440M claim against SoftBank in London (RT)

Microsoft is developing its own AI chip (TI)

Microsoft is dropping Twitter from its ad platform next week, ~2 months after Twitter announced it’ll begin charging users to access its API (TC)

Reddit will charge companies for access to its API (NYT)

Meta began its second lay-off round focusing on tech teams (CNBC)

UK investment group Abrdn is cutting one-fifth of its multi-asset team (FT)

Opendoor cut ~22% of its workforce amid slowing housing market (RT)

Tesla cuts US prices for sixth time this year (RT)

Americans are using BNPL to pay for groceries (BBG)

TSMC is seeking is seeking up to $15B in US chip subsidies (WSJ)

WeWork received a non-compliance notice from NYSE (RT)

India's population will overtake China by mid-2023 (RT)

A Message From Secureframe

Fast and easy compliance.

Demonstrating a strong security and compliance posture has increasingly become a prerequisite to doing business across many industries.

A SOC 2 report, for most companies, provides the necessary validation that customers are requiring; but achieving SOC 2 has historically been a time consuming and expensive process.

Secureframe’s platform, through intuitive workflows and automated evidence collection via 1-click integrations, backed by a support team of industry experts; will let you obtain a SOC 2 report in weeks, not months, without requiring a heavy investment of your time or team’s resources.

Deal Flow

M&A / Investments

Mexico’s Finance Ministry agreed to buy a 51% stake in development bank trust Fonadin’s $6B deal to buy power plants from Spanish energy company Iberdrola for $2.5B (BBG)

Zara fashion brand-founder Amanci Ortega agreed to buy an office building in central London for $102.1M (BBG)

Abu Dhabi’s M42, a healthcare JV between Mubadala Investment Co and AI firm G42, agreed to buy Diaverum, investment firm Bridgepoint’s European dialysis clinic chain (RT)

Indian conglomerate Tata Group is seeking the competition regulator’s approval for a merger between its Air India airline and Vistara, the company’s JV with Singapore Airlines (RT)

Dutch brewer Heineken asked Russian regulators to approve the sale of its business in the country (RT)

VC

Dental 3D printing startup Chamlion raised a $236M Series B led by 3H Health (FN)

EdgeQ, a provider of 5G wireless infrastructure, raised $75M in funding from Phaistos Investment Fund, Strategic Development Fund (SDF), and others (BW)

Mid-market cybersecurity platform Coro raised a $75M funding round from Energy Impact Partners and others (BW)

Cortica, a physician-led autism services company, raised $75M in funding led by Deerfield Management and Optum Ventures (FN)

Ditto, a startup providing a distributed database that runs “practically anywhere,” raised a $45M Series A led by Acrew Capital (TC)

CropX, an agronomic farm management startup, raised a $30M Series C led by Aliaxis (PRN)

3D Glass Solutions, a startup developing glass-based solutions for radio frequency, photonics, and datacenter markets, raised a $30M Series C led by Walden Catalyst Ventures (FN)

Israeli cybersecurity startup Avalor raised $30M in funding: a $25M Series A led by TCV and a $5M seed round led by Cyberstarts (FN)

Cloud infrastructure startup Volumez raised a $20M Series A led by Koch Disruptive Technologies (PRN)

Lexion, a provider of an AI-powered contract management and operations workflow platform, raised a $20M Series B led by Point72 (FN)

Goals, a Stockholm-based remote-first AAA game studio, raised a $20M Series A led by Seven Seven Six (FN)

Optable, a SaaS data collaboration platform and clean room solution for the advertising ecosystem, raised a $20M Series A from backers including Hearst Ventures, Brightspark Ventures, Desjardins Capital, Deloitte Ventures, and asterX (FN)

Karate Combat, a full combat martial arts sports league, raised an $18M funding round led by Bitkraft Ventures (DC)

Lithium extraction startup Novalith Technologies raised a $15.4M Series A led by Lowercarbon Capital (FN)

Kindred, a home-swapping network, raised a $15M Series A led by New Enterprise Associates (TC)

Accounting automation startup Trullion raised a $15M round led by StepStone Group (TC)

Gather Health, a primary care solution for older adults, raised a $15M Series A from backers including Khosla Ventures, Maverick Ventures, Commonwealth Care Alliance, and others (BW)

Quantum Source, an Israel-based startup developing the tech needed to bring photonic quantum computers to market, raised a $12M seed extension led by Dell Technologies Capital (BW)

Data security platform Dasera raised a $12M Series A led by Storm Ventures (FN)

eniferBio, a biotech startup extracting protein from mushrooms, raised a $12M Series A led by Aqua-Spark (FN)

Social Value Portal, a provider platform measuring and monitoring social impact, raised a $10.6M Series B led by Mercia (FN)

Cortical Labs, a startup creating “stem cell” AI, raised a $10M round led by Horizons Ventures (TC)

Eco-friendly home essentials startup EcoSoul Home raised a $10M Series A led by Accel and Singh Capital Partners (PRN)

Groundlight, a visual understanding service for natural language instructions, raised $10M in funding led by Madrona (FN)

UK local delivery startup Evermile raised a $6M seed round led by 10D (TC)

Wayland Additive, an electron beam 3D printing manufacturer, raised a $5.7M round from backers including Longwall Ventures, Parkwalk Advisors, ACF Investors, and Metrea Discovery (FN)

C4T, a Belgian startup building a cloud-based customs declarations platform, raised a $4.4M seed round with participation from Hi-Innov and Dentressangle (FN)

Front office solution for medical practices Third Way Health raised a $1.55M pre-seed round led by Apollo Medical Holdings (PRN)

Web3 payment infrastructure solutions provider Coinflow Labs raised a $1.45M pre-seed round led by Jump Crypto and Reciprocal Ventures (BW)

IPO / Direct Listings / Issuances / Block Trades

SPAC

Solar energy company Sunergy Renewables agreed to merge with ESGEN Acquisition Corp in a $475M deal (RT)

Debt

Australia received $41B worth of bids for $9.4B of new 10-year Treasury bonds (NDQ)

FC Barcelona is close to raising $1.6B via a bond sale (EWN)

Austrian steel firm Voestalpine launched a $274M convertible bond offering (YH)

Adani Ports, a group company of Indian conglomerate Adani Group, is considering buying back certain debt securities (RT)

Bankruptcy / Restructuring

Bed Bath & Beyond is again preparing to file for bankruptcy as soon as this weekend (WSJ)

Fundraising

Crypto Corner

Russia plans to mine crypto for cross-border deals (CD)

Crypto firms scramble for banking partners after recent banking collapses (RT)

A Hong Kong court recognized crypto as property capable in a case involving shuttered crypto exchange Gatecoin (CD)

Australia now has more Bitcoin ATMs than all of Asia (CT)

Exec’s Picks

Axios published a playbook that the Fed could use to handle a possible debt crisis.

Unlike most celebrity promoters, Taylor Swift did perform her due diligence on FTX , per The Block.

The Litquidity angel investing syndicate has some deals coming down the pipeline soon. If you’re an accredited investor and want access to VC deals, fill out this form.

Litney Partners - Financial Recruiting 💼💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

Speaking of Litney Partners, Litquidity and Bennett Jordan sat down with the Mayor of Miami, Francis Suarez, for some cafecito and recorded a podcast.

Litquidity provides an origin story of the brand and Bennett explains how Litney Partners is disrupting financial services recruiting, with plans to help bring strong Wall Street talent down to Miami.

Meme Cleanser

Want to chat social media growth, newsletter strategy, angel investing, Wall Street careers, or something else? Book a call with Litquidity here.

Thinking of starting your own newsletter? Beehiiv is the best platform for creators, period. Click here to get started building your own audience.