Together with

Good Morning,

Wall Street is ditching China for India, Meta has figured out how to sell the Metaverse, the Senate released its bipartisan Israel/Ukraine/border security proposal, tech layoffs continue, Dartmouth is reinstating SAT requirements, and Bill Gross is betting on a steeper yield curve.

Did you know that BILL Spend & Expense can save you hours and hours of bookkeeping each month? If you sign up for a 30 minute demo, BILL will give you a $100 Visa gift card to go towards the concert or game of your choice.

Let’s dive in.

Before The Bell

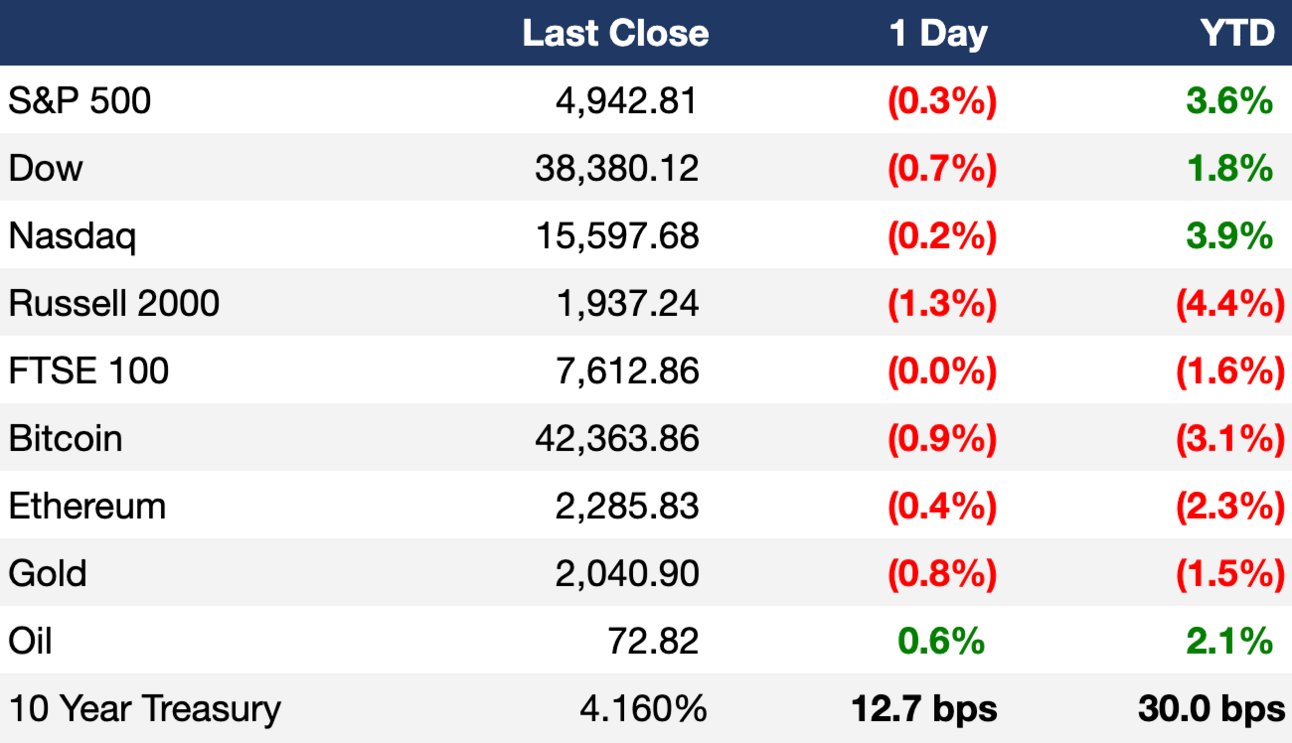

As of 2/5/2024 market close.

Markets

US stocks fell over concerns that the Fed may not cut rates as much as expected; the Fed expects to make three rate cuts this year

The Dow led indices with a 0.71% decline

Chinese stocks plunged before reversing losses after Chinese officials vowed to stabilize equity markets; China’s CSI 300 closed 0.65% higher, while the CSI 1000 fell 6.16%

Earnings

McDonald’s shares fell ~4% after beating Q4 earnings expectations but missing on revenue due to turmoil in the Middle East (CNBC)

Palantir shares jumped 18% after reporting higher-than-expected Q4 revenue thanks to AI demand (CNBC)

What we're watching this week:

Today: Eli Lilly, Snap, Spotify, KKR

Wednesday: PayPal, Walt Disney, Uber, Alibaba, CVS

Thursday: Apollo Global, ConocoPhillips, Affirm, Pinterest, Cloudflare

Friday: PepsiCo

Full calendar here

Headline Roundup

Meta finally figures out how to sell the Metaverse (WSJ)

Wall Street snubs China for India in a historic markets shift (BBG)

Morgan Stanley and Goldman spoil private credit’s record deal (BBG)

Dow falls after Powell says caution needed on rate cuts (WSJ)

Senators releases $118B bipartisan aid proposal for Israel, Ukraine, border security (CNBC)

Hong Kong government markets multi-currency digital green bonds (BBG)

Mortgage rates jump back over 7% as economic data rolls in (CNBC)

Tech layoffs continue to roil industry with 32,000 jobs cut (BBG)

TikTok and Universal will stage a reunion soon (RT)

Luxury retailers are buying out their landlords (WSJ)

King Charles diagnosed with cancer (CNBC)

Liquidity tops trader concerns for volatile 2024, JPMorgan finds (BBG)

Oil market will face supply shortage by the end of 2025, Occidental CEO says (CNBC)

First Bank of Canada rate cut seen in April, market participant survey suggests (WSJ)

Bill Gross is betting on a steeper yield curve (BBG)

Snap to lay off 10% of workers (WSJ)

Dartmouth reinstates SAT requirement in first for Ivy League (WSJ)

A Message From BILL

Travis & Taylor, meet BILL & your business.

Talk about couple goals. BILL Spend & Expense + your business finances can save you hours and hours every month. So you can close your books in record time and get back to cheering on your favorite global mega pop star and their favorite football player as they fight for a spot in the big game.

Try BILL Spend & Expense for yourself with a quick, 30 minute demo and we'll give you a $100 Visa gift card to go towards the concert or game of your choice.*

Deal Flow

M&A / Investments

Novo Holdings, the controlling shareholder of anti-obesity drugmaker Novo Nordisk, will acquire US drug manufacturer Catalent for $16.5B; Novo Nordisk will acquire three of Catalent’s manufacturing sites for $11B from its parent company in a three-way transaction (FT)

Media entrepreneur Byron Allen began talks with Paramount Global regarding his $14.3B bid to acquire the film and TV giant (BBG)

PE firms Bain Capital and Hellman & Friedman are losing interest in acquiring $10.9B DocuSign due to valuation differences with the online signature services firm (BBG)

A group of Russian investors agreed to acquire Yandex’s Russian business, dubbed ‘Russia’s Google,’ in a $5.2B deal (RT)

Drug maker Novartis will acquire cancer treatment developer MorphoSys for $2.9B (BBG)

MultiChoice Group rejected a $2.5B proposed takeover offer from Vivendi SE’s Canal+, the South African company’s biggest shareholder, saying the price undervalued the business (BBG)

PE firms Hellman & Friedman and Valeas will acquire a majority stake in US accounting firm Baker Tilly at an EV of over $2B (FT)

PE firm Thoma Bravo is taking critical event management software company Everbridge private in a $1.5B all-cash deal (TC)

CVC Capital Partners is exploring a sale of South Korean hotel and travel booking app Good Choice, which could be worth $1B-$1.5B in a transaction (BBG)

Merck agreed to buy Elanco Animal Health’s aqua unit that makes farmed fish health products for $1.3B (BBG)

Stainless steel manufacturer Acerinox will acquire Haynes International, a manufacturer of high-performance alloys, in a $970M deal (BW)

Chinese conglomerate Fosun International is considering a sale of its 10% stake in Belgium’s largest insurer Ageas, which is worth ~$792M (BBG)

Hilton Worldwide Holdings is in talks to purchase the Graduate Hotels brand, which is attached to over 30 locations in the US and UK (BBG)

Blackstone is considering a bid for skin-care company L’Occitane International (BBG)

VC

Procyrion, a medical device company focused on patients with cardiac and renal impairment, raised a $57.7M Series E led by Fannin Partners (PRN)

ProducePay, a startup giving fresh growers and buyers greater transparency and flexibility in the grocery supply chain, raised a $38M Series D led by Syngenta Group Ventures (TC)

Sports gaming startup StatusPRO raised a $20M Series A led by Google Ventures (PRN)

Jua, a Swiss startup building an AI model for the physical world, raised a $16M seed round led by 468 Capital and the Green Generation Fund (TC)

Vektor Medical, a startup developing a non-invasive AI-based arrhythmia analysis tool, raised a $16M Series A led by Solas BioVentures and TVM Capital Life Science (BW)

Digital home insurance startup Kin raised a $15M round at a $1B+ valuation led by Activate Capital (BW)

Nauticus Robotics, a developer of subsea robots and software, raised $12M in funding (PRN)

Nibiru Chain, a layer 1 blockchain, raised a $12M round from Kraken Ventures, ArkStream, NGC Ventures, Master Ventures, Tribe Capital, and Banter Capital (PRN)

Hybrid crypto trading platform Cube.Exchange raised a $12M Series A led by 6th Man Ventures (FN)

Naboo, a French startup aiming to create an ‘Airbnb for company seminars,’ raised an $8M round from ISAI, Kima Ventures, and Better Angle (TC)

Meme Kombat, a provider of a Web3 igaming platform, raised $8M in its funding campaign (FN)

Rivia Health, a provider of a revenue cycle management solution for healthcare provider organizations, raised a $3.3M seed round led by PHX Ventures (FN)

Clean chemistry startup AZUL Energy raised a $3.2M Series A led by Spiral Capital (BW)

IPO / Direct Listings / Issuances / Block Trades

Hyundai Motor is exploring an IPO of its Indian unit to raise at least $3B at a valuation of up to $30B in what would be the country's largest IPO (RT)

LuLu Group International, an operator of one of the Middle East’s largest hypermarket chains, invited banks to pitch for a potential $1B IPO (BBG)

German tank gearbox manufacturer Renk is seeking to debut on the Frankfurt bourse this week; PE owner Triton Partners is seeking to sell $485M of shares through a private placement valuing Renk at $1.5B (RT)

Metagenomi Technologies, a genetic medicines company backed by Bayer and Moderna, is targeting a $638M valuation for its US IPO (RT)

E-commerce logistics provider ShipBob is seeking to hire underwriters for a possible 2024 US IPO (RT)

Oman’s state energy firm OQ asked banks to pitch for roles on the IPOs of two of its units (BBG)

SPAC

Satellite-direct-to-standard-phone telecom provider Lynk Global will merge with Slam Corp. in an $800M deal (BW)

Debt

Bankruptcy / Restructuring

Invitae, a SoftBank-backed medical genetics company, hired restructuring advisers and is preparing to file for bankruptcy within weeks to address $1.5B of debt (WSJ)

Scandinavian airline SAS expects to allocate up to $325M for the debt recovery of its general unsecured creditors as part of an updated Chapter 11 bankruptcy plan (BBG)

Physician group and medical-center operator Cano Health filed for Chapter 11 bankruptcy with a restructuring deal to reduce debt and solicit potential offers (WSJ)

WeWork is exploring a new bankruptcy loan due to slower-than-expected progress on rent negotiations (RT)

Chemicals producer Unigel Participacoes is preparing to file for bankruptcy protection in Brazil after talks with creditors stalled (BBG)

Fundraising

Brookfield Asset Management raised $10B in a first close of its second energy-transition fund and is seeking to raise another $15B (AX)

Crypto Corner

Exec’s Picks

The Economist explained how social media dynamics have changed in the 20 years since Facebook’s founding.

Lux Capital’s Danny Crichton wrote a great post-mortem on Tech Crunch+ and where the company goes from here.

Litney Partners - Financial Recruiting 💼💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

Meme Cleanser

Advertise with us // Visit our merch store // Invest alongside Lit Ventures // Book a call with Lit // Launch your own newsletter