Together with

Good Morning,

OpenAI is raw dogging all its deals, hedge funds are betting on tariff refunds, JPMorgan accused Charlie Javice of more fraud, market makers are closing in on banks, and stocks rallied to record highs ahead of a mega earnings week and Fed meeting.

UpSlide is bringing together leaders from KPMG, Nomura, Forvis Mazars, and Model ML for a conversation on how AI is reshaping M&A workflows. An insightful chat if you work in finance and are constantly trying and testing new AI tools. More info below.

Let's dive in.

Before The Bell

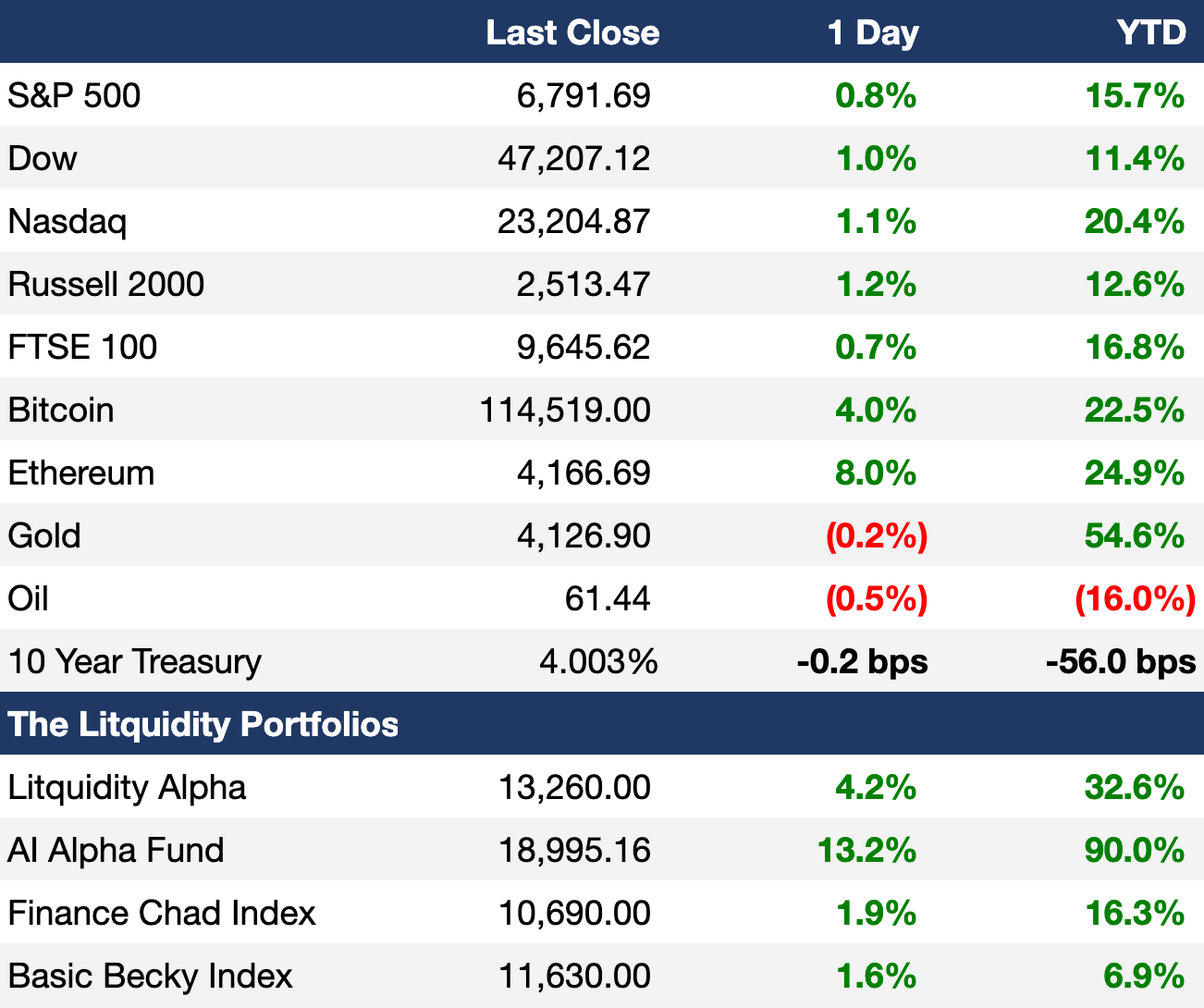

As of 10/24/2025 market close.

Click here to learn more about the Litquidity portfolios and subscribe to the strategies on Autopilot.*

Markets

US stocks rallied on Friday as investors digested optimistic inflation data and strong earnings

All three major indexes hit ATHs

Global stocks are on pace to beat US by the widest margin since 2009

MSCI All Country World ex-USA index is up 26% YTD on a dollar basis

UK's FTSE 100 is up 17% YTD at an ATH

Germany's DAX index is up 22%

Japan's Nikkei 225 is up 28% at an ATH

South Korea's KOSPI index is up 68% at an ATH

Europe's Stoxx 600 hit an ATH

Earnings

Procter & Gamble beat Q1 earnings and revenue estimates on strength in its beauty and grooming products but warned of a challenging geopolitical environment and K-shaped consumer behavior (CNBC)

Booz Allen Hamilton missed Q2 earnings and revenue estimates and lowered its FY forecast after announcing additional job cuts on slowing government contract work and weaker civil business demand (BBG)

General Dynamics beat Q3 earnings and revenue estimates on surging business-jet demand fueled by tax incentives and strong corporate profits, with unspent US defense funding supporting continued growth across its defense portfolio (WSJ)

Deckers Outdoor missed Q2 earnings and revenue estimates and issued lower guidance as tariff-driven price hikes and softer US consumer spending weighs despite momentum at Hoka and Ugg and new product launches (BBG)

Porsche posted a $1.1B operating loss in its first quarterly loss since listing in 2022 amid hefty charges related to its premature EV bet (WSJ)

What we're watching this week:

Today: Bed Bath & Beyond

Tuesday: UnitedHealth, UPS, PayPal, Visa, Electronic Arts

Wednesday: Alphabet, Meta, Microsoft, Boeing, Starbucks, Verizon, CVS, Chipotle, Caterpillar, Carvana, Kraft Heinz

Thursday: Amazon, Apple, Coinbase, Eli Lilly, Comcast, Reddit, Blue Owl, Roblox

Friday: ExxonMobil, Chevron, AbbVie

Full calendar here

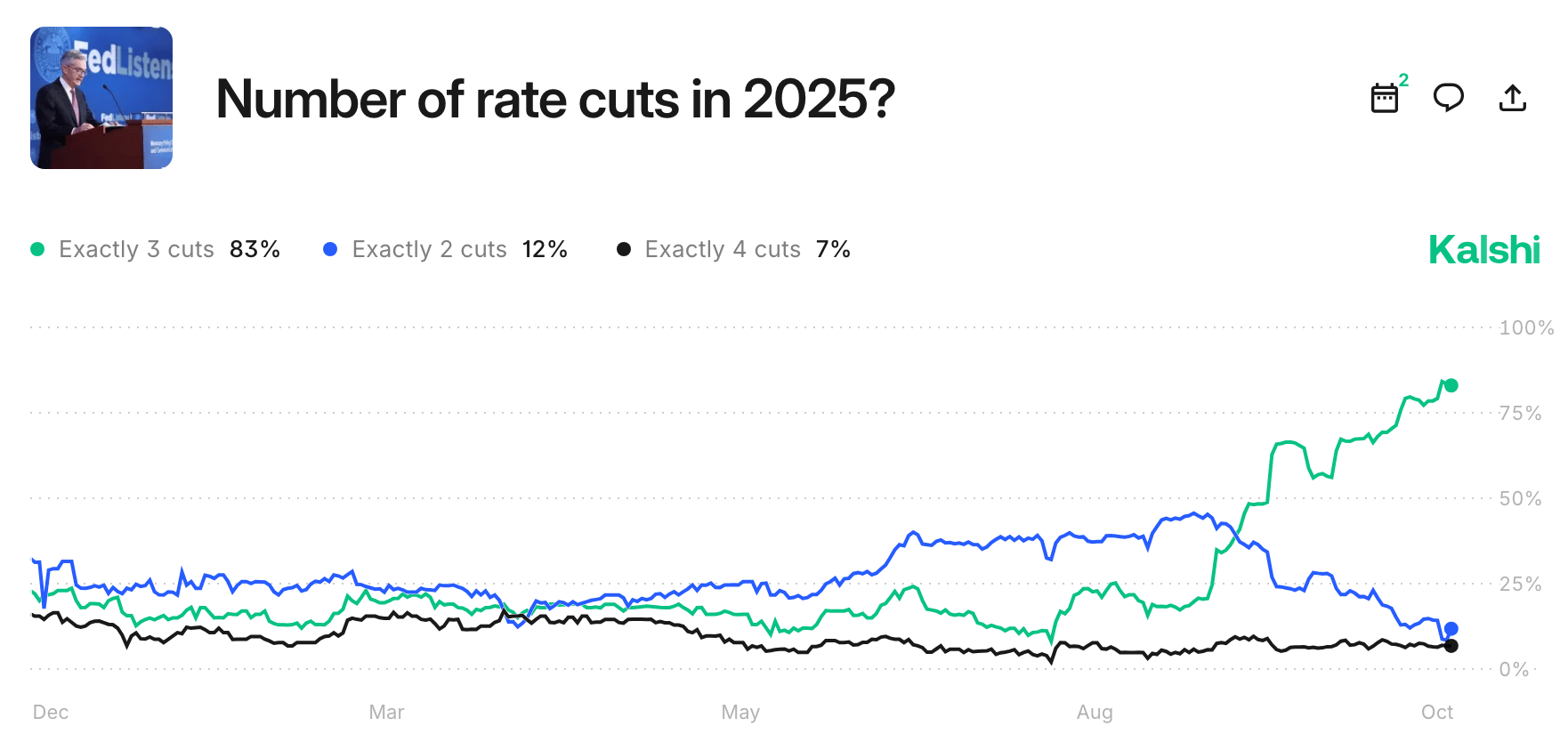

Prediction Markets

Traders fully priced in a second Fed rate cut this week.

Headline Roundup

Bull market's make-or-break week arrives with Big Tech earnings (BBG)

US and China reached agreements on key disputed issues (BBG)

US signed deals on trade and critical minerals in Southeast Asia (RT)

US CPI rose 3% YoY (CNBC)

US will 'probably' not release October inflation data (BBG)

Fed will give banks more say on upcoming stress tests changes (BBG)

Overseas yuan lending surges as China steps up de-dollarization (FT)

Gold and bond inflows are set to break records (BBG)

OpenAI shunned advisers on $1.5T of deals (FT)

NFL commissioner sees PE investments as 'incredibly successful' (BBG)

Canada's OMERS dismissed its entire Asia PE team (BBG)

UK is weighing shorter IPO timelines to boost listings (BBG)

Private credit titans eye opportunity in Saudi liquidity squeeze (BBG)

Market makers now command one-fifth of global trading revenue (BBG)

Hedge funds are betting on tariff refunds (BBG)

Hedge funds boost AI tech bets to highest since 2016 (RT)

CVC tax fraud probe threatens to rock Spain's PE sector (FT)

Trump named Michael Selig as CFTC chair (BBG)

AMD chips can be used for quantum computing error correction (CNBC)

UBS shuffled leaders as Credit Suisse integration closes (BBG)

JPMorgan plans to cut junior bankers and shift jobs to India (EFC)

JPMorgan named BofA veteran Kevin Brunner chair of IB and M&A (RT)

JPMorgan poached three senior bankers from Goldman and Deutsche (RT)

HSBC took a $1.1B hit on Bernie Madoff litigation (BBG)

JPMorgan accused Charlie Javice of more fraud over legal bills (WSJ)

Suspects in Louvre heist were arrested (BBG)

A Message from UpSlide

UpSlide is bringing together leading voices from Nomura, KPMG, Forvis Mazars, and Model ML to answer a critical question: How is AI reshaping M&A workflows?

From analysts to MDs, they’ll cover how the largest M&A teams are streamlining workflows, reducing review loops, and preparing their teams for the next wave of automation. Plus, they'll share insights on:

How AI is currently used across the deal lifecycle – and where it's falling short

What's missing from today's strategies – and what could unlock fundamental transformation

The long-term vision: could one prompt generate an entire pitch book?

Save the date:

📅 November 5th

⌚ 10:00 am ET

⌛45 minutes

Deal Flow

M&A / Investments

Italian state-controlled electric grid Terna is exploring a minority stake sale at a ~$28B valuation

Swiss pharma giant Novartis agreed to acquire Avidity Biosciences for $12B cash, representing a 46% premium

Management offered to buyout dating app Grindr for $3.5B, representing a 51% premium

European aerospace and defense firms Airbus and Thales-Leonardo announced plans to merge their satellite businesses in a JV valued at $7B

Ares and real estate investment firm Makarora and struck a deal to buy Plymouth Industrial REIT for $2.1B cash deal, representing a 50% premium

Eli Lilly agreed to buy vision-focused biotech Adverum Biotechnologies in a $261M deal

French PE firm Wendel is in exclusive talks to acquire a 56% stake in secondaries specialist Committed Advisors for $300M

South Africa is in talks with over six companies to secure $100M in funding needed to bring Formula 1 Grand Prix racing back to the country

Angola bid for a majority stake in minger Anglo American's diamond unit De Beers; Botswana is also seeking a controlling stake

French energy giant TotalEnergies is considering selling a 50% stake sale in battery storage systems in Germany

Brookfield is in talks to acquire two inactive nuclear reactors in South Carolina from utility Santee Cooper

French media giant Canal+ is considering buying out the remaining 30% stake in African streaming platform Showmax from Comcast

Gold miner Newmont is studying a potential deal to gain control of Canadian rival Barrick Mining's prized Nevada gold assets

Top VC deals by Fundable

SoftBank approved the remaining $22.5B of its $30B investment in OpenAI

Neolix, a Chinese autonomous delivery vehicle startup, raised a $600M+ Series D led by StoneVenture

FieldFlo, a project and safety management software for subcontractors, raised a $35M round led by Mainsail Partners

AI biodefense startup Valthos raised a $30M round from Lux Capital, Founders Fund, and OpenAI

Immaterial, a UK advanced materials company developing monolithic metal-organic frameworks, raised an $18M Series A-2 led by SLB

Streetbeat, an agentic AI for financial professionals and retail investors, raised a $15M Series A led by CDP Venture Capital

OneAM, a fintech startup improving the early pay market for SMB suppliers, raised a $4.7M seed round led by TTV Capital

AI video generation platform Golpo raised a $4.1M seed round led by BNVT Capital

UK-based quantum startup QFX raised a $2.5M seed round led by Y Combinator co-founder Paul Graham

Access data on every VC-backed startup in real time. Try Fundable here.

IPO / Direct Listings / Issuances / Block Trades

Biotech MapLight Therapeutics will raise $260M in the first IPO and private placement since the US government shutdown

Central bank Swiss National Bank sold its $227M stake in mining giant Rio Tinto

Debt

China plans to sell up to $4B in dollar-denominated bonds in Hong Kong

Crypto miner TeraWulf raised $3.2B led by Morgan Stanley, the biggest junk bond sale by one Wall Street bank since 1989

Goldman Sachs is gauging investor interest for a debt refinancing for pet supplies retailer Petco's $1.6B term loan as the company's financial position improves

Chilean forestry and pulp company Celulosa Arauco issued $840M in peso bonds in the largest corporate sale in Chile's history

Blackstone will invest $705M in India's Federal Bank for a 9.9% stake to become the largest shareholder

Bankruptcy / Restructuring / Distressed

Creditors to bankrupt subprime auto lender PrimaLend raised 'grave concerns' over its Chapter 11 filing, citing exclusion of its 'most distressed' entity

Banco Bradesco, one of Brazilian waste-management company Ambipar's top bank creditors, is trying to prevent director Thiago da Costa Silva from selling assets alleging that him and other officers may be responsible for the firm's trouble

Private credit lender Pemberton took over UK auction house Bonhams

Blackstone-backed theme park operator Merlin Entertainments is facing heightened fears of a potential restructuring ahead of a critical refinancing

Fundraising / Secondaries

VC Thrive Capital is seeking to raise $6B-$8B for its tenth flagship fund

Spanish renewables investor Qualitas Energy is seeking to raise $3.8B for its sixth fund to target renewable energy investments

OCIO Cambridge Associates raised $100M for new secondaries fund

Crypto Sum Snapshot

JPMorgan will allow Bitcoin and Ether as collateral in crypto push

Binance founder CZ prepares for second act as pardon wipes slate clean

Stablecoin use for payments jumped 70% since US regulation

Stablecoin giant Tether expects profit to increase to $15B this year

Ferrari integrates AI and crypto for exclusive Le Mans car auction

Crypto Sum compiles the most important stories on everything crypto. Read it here.

Exec’s Picks

The AI for Business & Finance Certificate Program from Columbia Business School Exec Ed and Wall Street Prep delivers 8 weeks of relevant, hands-on case studies + MBA-level networking. No coding experience needed. Enroll by November 10 with code LITQUIDITY to save $300.

Barry Ritholtz's published a short but highly relevant essay on the history of bubbles.

Also, bubbles aren't historically called out by so many people. Check out what Ben Carlson thinks about the bubble claims of today.

Finance & Startup Recruiting 💼

Litney Partners

If you're a junior banker looking for your next career move, check out Litney Partners, a recruiting venture between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm), Litney Partners places talent at leading firms in PE, hedge funds, VC, growth, credit, IB, and fintech and is currently recruiting for some incredible roles. Head over to our website to drop your resume and we'd love to get in touch!

Next Play

If you're down bad, realizing finance isn't for you, and want to explore the world of startups (BizOps, chief of staff, strategic finance, etc.), fill out this form. Next Play will reach out to schedule a 1:1 video call if they think they can help as your own, personal startup matchmaker. They've grown their community to over 50k talented professionals and have deep relationships across the tech ecosystem.

Meme Cleanser

🛒 Merch Store: Visit our merch store to shop our latest apparel, shoes, bags, accessories and more.

💵 Litquidity Ventures: Accredited investors & qualified purchasers within the Litquidity community can gain access to alternative investments such as venture, late-stage growth, and private equity through Litquidity Ventures. Interested? Fill out this form.

☎️ Book a call with Lit: Want to pick Litquidity's brain on business advice, insights, or just chat to say what's up? Buy his time here.

📧 Launch your own newsletter: Have great content ideas and looking to launch your own publication? We highly recommend beehiiv to get started.

*DISCLAIMER: Investment advice provided by Autopilot Advisers, LLC ("Autopilot"), an SEC-registered investment adviser. Past performance does not guarantee future results. Investing carries risks, including loss of principal. As always, be smart out there. Litquidity is compensated to promote AutoPilot. Compensation details available upon request.