Together with

Good Morning,

FTX investors are writing down their investments, BlockFi is the latest crypto company to get clapped, stocks ripped on a better-than-expected inflation print, the FTC is concerned with Twitter's security executives' exits, Musk's Twitter loan package is trading at a steep discount, and Amazon is reviewing unprofitable business units to cut costs.

Hard times create dank memes, and the meme cleanser is hot and heavy today 🤝

Shoutout to today's sponsor, Jambys, for kicking off their Black Friday sale way in advance. For anyone that needs some comfortable clothes to rock while scrolling memes or binging Netflix at home, they've got you covered. Use code EXECBLACKFRIDAY for 25% off your order.

Let's dive in.

Before The Bell

Markets

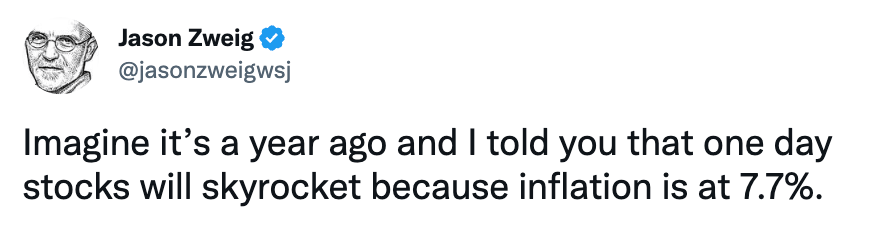

US stocks posted huge gains in their biggest rebound since the depths of the pandemic after October's CPI report showed inflation slowing to 0.4% MoM and 7.7% YoY

Nasdaq ripped 7.4% (that's not a typo) and outperformed the Dow Jones by the widest margin since 2002

The pan-European Stoxx 600 rose 2.8% with the tech sector gaining 7.6%

10Y and 2Y Treasury yields both dropped by ~30 bps

The dollar tumbled to its worst day since 2009

Earnings

WeWork posted a worse-than-expected Q3 loss, missed on revenue, and will close 40 US locations in a bid to turn profitable; their stock rose 7% yesterday (FT)

Six Flags missed Q3 EPS and revenue estimates on a relative lack of pricing power, as higher ticket charges hit attendance; their stock rose 13.4% yesterday (BRN)

Full calendar here

Headline Roundup

US CPI rose 7.7% YoY in October, down from 8.2% last month (CNBC)

30-year fixed mortgage rate fell sharply to 6.62% on optimistic inflation news (CNBC)

US budget deficit dropped to $88B in October, down 47% YoY (WSJ)

US Fed and Treasury are looking to broaden trading in US bond market, which is currently dominated by few big banks (WSJ)

Global PE and VC strategies lost on average 3.2% and 2.3% respectively in Q2: Pitchbook (CAM)

ECB is scrutinizing energy firms' multi-trillion derivative bets (RT)

US Treasury sees no currency manipulation by major trading partners (RT)

Massachusetts voters approved a 4% ‘millionaire tax' (CNBC)

Bank of Mexico hiked rates by 75 bps to a record 10% (RT)

US revoked Russia's 'market economy' status (RT)

Biden will raise Taiwan concerns during his meeting with Xi at G20 on Monday (AX)

FTC is 'deeply concerned' about Twitter's security executives' exits (RT)

Musk ended remote work for Twitter employees (RT)

Amazon became the world’s first public company to lose $1T in market value (BBG)

Sequoia wrote down its entire $214M investment in FTX (BBG)

Amazon is reviewing unprofitable business units to cut costs (WSJ)

UBS is focused on organic growth but will consider acquisitions if it needs to expand capabilities (RT)

Deutsche Bank will pay a ~$1.5k bonus to some employees to help offset soaring inflation (RT)

Cathie Wood’s ARK Innovation ETF surged 14% in its best day ever (CNBC)

AMD launched its latest data center chip with Microsoft, Google, and Oracle as customers (RT)

Keurig Dr Pepper CEO resigned within 4 months after violating company’s code of conduct (CNBC)

Paul Allen’s art collection sold for a record-smashing $1.6B in auction (CNBC)

A Message From Jambys

Early Black Friday: Former designers from Nike and Lululemon made the world’s best clothes for sitting down.

Meet Jambys, the clothes engineered for maximum comfort at home. Jambys started a few years back with boxers with pockets, which are, in our opinion, the world’s best shorts for working from home. They’re basically a hybrid of shorts and boxers that you can wear commando, and they are insanely soft.

Their designers helped create the original ABC pants, and it shows — everything they make just fits right. Almost everything Jambys makes is made from the same fabric, which feels amazing and stays cool. They recently introduced a Chilluxe heavyweight fleece, which is a bit more structured and warm, and nice enough to wear out to dinner (with today’s dress codes, at least).

In a world where everyone says they make the softest clothes, Jambys backs it up with a 77-day no-questions-asked guarantee. Come see why everyone loves their Jambys, and take advantage of their Black Friday deal early. Get 25% off with our code: EXECBLACKFRIDAY or using this link HERE.

Deal Flow

M&A / Investments

French lender Credit Agricole said its regional-bank shareholders, through the holding entity SAS Rue La Boetie, would buy up to $1B of the lender’s shares by the first half next year (BBG)

Investment company Prosus gave up its $403M stake in VK, Russia’s largest social network, for nothing as it exits the US sanctioned country (BBG)

Suitors including CVC Capital Partners have demonstrated preliminary interest in business process outsourcing provider Ibex, which has a market value of ~$366M (BBG)

14 firms including companies led by billionaires Gautam Adani and Mukesh Ambani have submitted EOIs for debt-laden India-based supermarket company Future Retail (RT)

Major League Pickleball merged with PPA’s week-old VIBE Pickleball League (CNBC)

VC

Cloud broadcast and targeted advertising software startup Amagi raised a $100M+ Series F at a $1.4B valuation led by General Atlantic (TC)

Ordergroove, an e-commerce subscription-as-a-service startup, raised a $100M+ round led by Primus Capital (TC)

Veterinary startup Modern Animal raised a $75M Series C led by Addition (PRN)

Kyte, an on-demand car delivery service, raised a $60M Series B led by InterAlpen Partners (PRN)

SubjectWell, an platform matching patients with relevant clinical trials, raised a $35M Series B led by Asset Management Ventures (BW)

Blnk, a fintech firm providing instant consumer credit in Egypt, raised $32M: $12.5M in pre-seed / seed rounds led by EEIC, Sawari Ventures, and others, $11.2M in debt financing, and $8.3M via a securitized bond issuance (TC)

Tellus, a smart savings platform powered by real estate, raised $26M: a $16M seed round led by a16z and a $10M SAFE (BW)

Mem, an AI-organized note-taking app, raised a $23.5M round at a $110M valuation led by OpenAI (TC)

Rewst, a robotic process automation platform for MSPs, raised a $21.5M Series A led by OpenView (PRN)

Coefficient, a startup allowing for real-time data connectivity and automation in spreadsheets, raised an $18M Series A led by Battery Ventures (BW)

Even Healthcare, an Indian healthcare membership company, raised $15M in funding from Alpha Wave and Lightrock (TC)

Savvy Wealth, a digital-first platform for financial advisors, raised an $11M Series A-1 led by The House Fund (BW)

Skincare startup Topicals raised a $10M round led by CAVU Consumer Partners (PRN)

Male contraceptive startup Contraline raised a $7.2M round led by GV (TC)

Keyo, a biometric palm verification network, raised a $7M seed round (TC)

Directus, an open source software company focused on democratizing data across the enterprise, raised a $7M Series A led by True Ventures (PRN)

Voyce.Me, a manga and webtoon creator platform, raised a $2.5M seed round led by Red Sea Ventures, Torch Capital, RiverPark Ventures, and more (PRN)

Physical access control and smart building startup Spintly raised a $2.5M pre-Series A led by Lets Venture, AccelNest, and more (BW)

Perfekto, a startup creating a subscription box of imperfect and otherwise wasted food, raised a $1.1M pre-seed round (TC)

IPO / Direct Listings / Issuances / Block Trades

Saudi Arabia’s Public Investment Fund will sell an additional 10% stake through the country’s stock exchange, which could raise ~$669M (BBG)

French office support technology firm Teleperformance will buy back up to ~$149M of its shares after a sharp sell-off (RT)

Fund manager CI Financial plans to reduce its debt and separate its US and Canadian business through an IPO of its US wealth management unit (BBG)

Germany’s United Internet selected banks for the planned IPO of its web hosting business Ionos Group (BBG)

Debt

Hedge funds and other asset managers are offering to take a piece of the $13B loan package used to fund Elon Musk’s purchase of Twitter for as low as 60 cents on the dollar (BBG)

BBQ grill maker Weber accepted a $60M unsecured loan from its largest shareholder, BDT Capital Partners, which is seeking to take the company private (BBG)

Bankruptcy / Restructuring

Fundraising

Growth-equity firm Brighton Park Capital raised $1.8B, vs. its targeted $1.5B, for its second fund focused on early stage software, healthcare, and technology-enabled service industries (BBG)

HighBrook, a deep value-oriented real estate investment firm, closed a $632M Fund IV (BW)

VoLo Earth Ventures, a VC firm focused on early stage climate tech startups, raised $90M for its inaugural fund (BW)

Colorado-based VC firm SpringTime Ventures raised a $25M second fund to invest in seed stage tech startups in Colorado (TC)

Crypto Corner

BlockFi halted withdrawals in fresh contagion from FTX crisis (BBG)

Sam Bankman-Fried said he 'f*cked up' as he blames self for FTX’s collapse (CNBC)

SBF will shut down crypto trading firm Alameda and promised FTX US customers that funds are 'fine' (CD)

FTX assets frozen by Bahamas regulator as crypto exchange fights to survive (FT)

Crypto derivative trading volumes have exploded as investors scramble to hedge positions after market turmoil triggered by FTX (RT)

US Senate Banking Committee Chair called for a probe into FTX collapse (RT)

Mercedes F1 will keep FTX sponsorship logo despite collapse of company (MTR)

Largest stablecoin Tether increased its US Treasury bill holdings to $39.7B (RT)

Crypto exchange Coinbase cut jobs again (RT)

Yea we know we've got an insane number of FTX headlines above lol

Exec's Picks

Christmas is coming up quick, and there's no better gift for dad than a new set of clubs. Golf Galaxy has the best deals on golf clubs, balls, and apparel that you'll find this holiday season. Head over to Golf Galaxy now and get 50% off on select holiday sales!

Per popular request, 'FTX Risk Management Department 2022' shirts are now available on the Litquidity store, get yours here!

Mike Pence wrote a detailed piece on The Wall Street Journal about his last few days with President Trump back in January, check it out here.

The Hiring Block 💼

If you're looking to break into finance, lateral, or move out, check out our job board on Pallet, where we curate highly relevant roles for you. We aim to curate jobs across IB, S&T, VC, tech, private equity, DeFi, crypto, CorpDev and more. We'll sift through all the noise on LinkedIn, Indeed, Monster, etc. so you don't have to.

If you're a company looking to hire candidates and want to list a job opening on our board and feature on Exec Sum, click the button below:

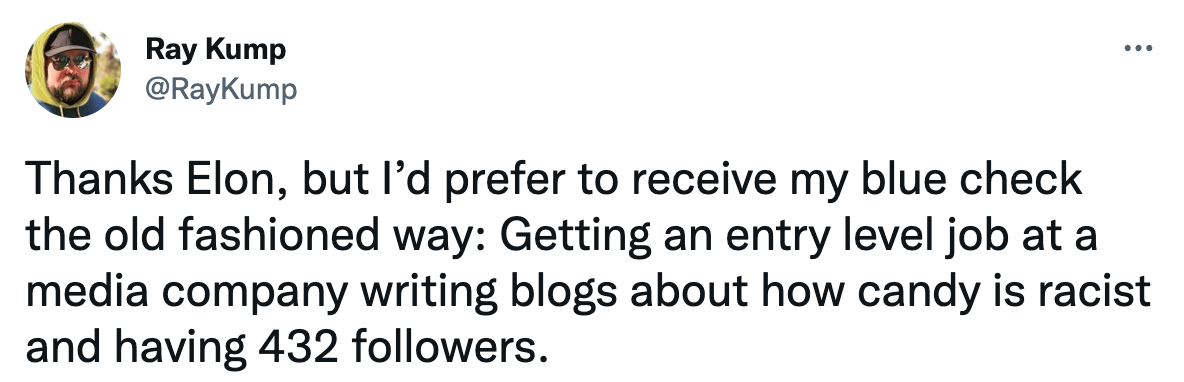

Meme Cleanser

Thinking of starting your own newsletter? Beehiiv is the best platform for creators, period. Click here to get started building your own audience.