Together with

Good morning,

Biden signed the $1T infra bill into law yesterday, stocks held steady, crypto sold off last night, and Elon Musk unloaded another $930M in Tesla stock after selling $6.9B last week.

Reminder that there are only a few days left to enter the S*per B*wl tickets giveaway in partnership with Ansarada (y'all know what the *s are, we just can't say it because legal said so...). Link to enter here. Make em good.

Let's dive in.

Before The Bell

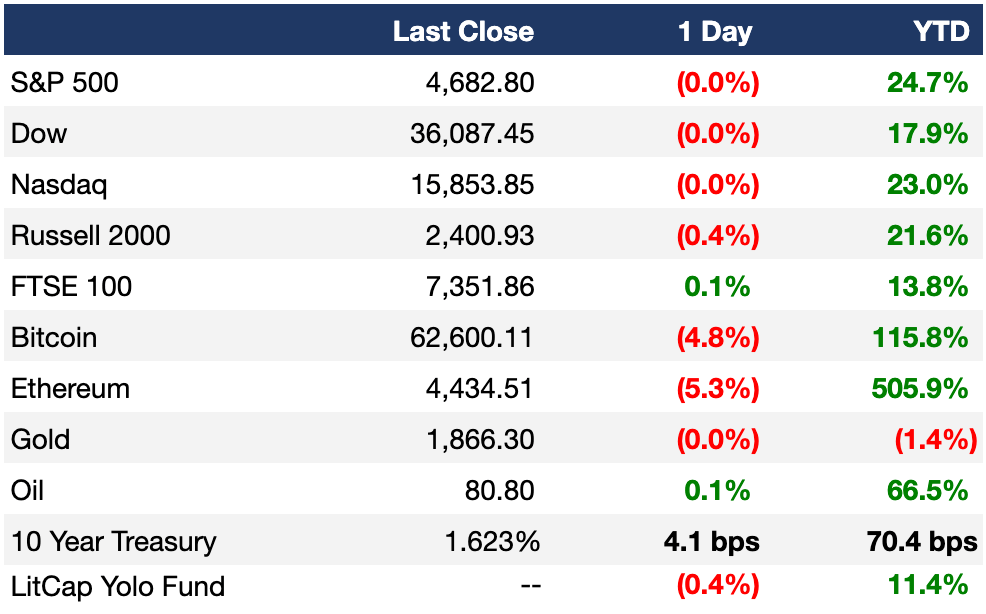

As of 11/15/2021 market close.

Markets

Markets were virtually unmoved yesterday as investors await new economic data and the rest of the Q3 earnings szn info; US stock index futures were unchanged in overnight trading last night as well

President Biden signed the $1T bipartisan infrastructure bill into law yesterday. It includes funding for transportation, broadband, and utilities

Today we’ll be hearing October’s retail sales figures which are expected to have increased 1.5%, compared with 0.7% in September

Industrial production numbers and the NAHB housing market index survey will also be released

Big retail companies reporting this week will give some insight into how much consumers are spending

Earnings

Warner Music Group shares fell after reported weaker-than-expected Q4 earnings numbers thanks to Covid-19 impacting certain revenue streams, but their CEO is optimistic for 2022 thanks to new music on the horizon from their most popular artists (TS)

WeWork rose slightly in early trading, reporting revenue growth of 11% and decreased losses in comparison to Q2; no analysts covered them for Q3 so there are no estimates to compare results against (CNBC)

What we’re watching today: Walmart, Home Depot

Full calendar here

Headline Roundup

Biden signs $1T bipartisan infrastructure bill into law, unlocking new funds for public works (CNBC)

Ex-Fed officials Dudley, Lacker see rates rising to at least 3% (BBG)

Calpers votes to use leverage, more alternative assets (WSJ)

China to impose security check on HK IPOs under big data rules (BBG)

GE Aviation chief is open to acquisitions to bolster engine unit (BBG)

Shell to move headquarters to London amid energy transition (WSJ)

Roblox looks to brings educational video games to schools (WSJ)

Point72 raises $600M for AI-assisted PE fund (BBG)

Tyson Foods raises meat prices as costs escalate (WSJ)

Ohio sues Meta over impact on children (WSJ)

A Message From Finance|able

Finance|able has re-imagined finance training with a new, more intuitive approach that will help you land the job….crush it when you get there…and have a little fun in the process.

…and early users love it!

"the financeable platform is really one-of-a-kind"

"You are building something amazing. I really believe that you are going to change the face of finance education"

ExecSum subscribers get 30% off Finance|able's courses and their sitewide pass which gives access to all of their current and planned courses over the coming year (>$2,000 value). Just use discount code: execsum1

Finance|able also offers Private Coaching (~90% success rate vs 1-5% acceptance rates in IB/PE/IM) to help you land your dream gig.

“I have never met anyone more dedicated to helping their students succeed!”

“I would not be where I am today, and cannot think of a better mentor & coach who has inspired me to reach for my wildest goals.”

Deal Flow

M&A

KKR and GIP agreed to buy data-center owner CyrusOne in a ~$15B deal (BBG)

BNP Paribas is working with advisers on a potential $15B sale of its US arm Bank of the West (RT)

Spanish lender BBVA offered $2.56B for the other ~50% it doesn’t already own in its Turkish unit, Turkiye Garanti Bankasi (BBG)

Heineken agreed to buy South African wine and spirits maker Distell for $2.5B (BBG)

Booking Holdings agreed to buy B2B distributor of hotel rooms Getaroom for $1.2B (HN)

Belgian lender KBC agreed to buy Raiffeisen’s Bulgarian operations in a $1.16B deal (BBG)

Burger King-parent Restaurant Brands International agreed to buy chain Firehouse Subs for $1B (RT)

The government of Hungary is in talks with German airport management company AviAlliance, the biggest shareholder in Budapest Airport, to buy the hub (BBG)

Medical device maker Globus Medical is in early talks to buy smaller competitor NuVasive (BBG)

Infrastructure company SPX agreed to buy Cincinnati Fan & Ventilator from Dominus Capital (TMM)

US stock exchange operator Cboe agreed to buy Canadian stock exchange operator NEO (RT)

Syneos Health said its not currently in talks on a merger with Labcorp’s Covance clinical research division (BBG)

Uber agreed to buy transportation Transplace from TPG (TMM)

Fintech firm BM agreed to buy business lender First Sound Bank for $23M (BBG)

Mattress company Casper surged 90%+, its biggest intraday jump since their debut, after Durational Capital Management agreed to take the struggling mattress company private for $6.90/share, down from their $12 IPO price (BBG)

VC

Crypto VC firm Paradigm raised a $2.5B venture fund, surpassing a16z’s $2.2B closing, for the biggest ever crypto-centric fund (TC)

Software making startup Podium raised a $201M round at a $3B+ valuation led by YC Continuity (BBG)

Mixpanel, a product analytics startup, raised a $200M Series C at a $1.05B valuation led by Bain Capital Tech Opportunities (TC)

Frozen food product startup Daily Harvest raised a $77M round at a $1.1B valuation led by Lone Pine Capital (BBG)

Korean proptech startup Rsquare raised a $72M Series C from STIC Investments (TC)

E-bike subscription service Zoomo raised a $60M Series B led by Grok Ventures, Skip Capital, and ArcTerm Ventures (TC)

French digital healthcare infrastructure startup Lifen raised a $58M Series C led by Creadev and Lauxera Capital Partners (TC)

Imprint, a fintech offering branded payments and rewards products, raised a $38M Series A led by Stripe and Kleiner Perkins (TC)

Southeast Asian proptech startup Homebase raised $30M in funding from Y Combinator, Partech Partners, and more (TC)

Aplazo, a Mexican BNPL startup, raised a $27M Series A led by Oak HC/FT (TC)

Writer, a startup aiming to build an intelligent integrated style guide, raised a $20M Series A led by Insight Partners (TC)

Jordan-based online learning platform Abwaab raised a $20M Series A led by BECO Capital (TC)

Monograph, a startup providing a cloud-based platform for architecture and design professionals to manage projects, raised a $20M Series B led by Tiger Global (TC)

Healthcare startup Africa Health Holdings raised an $18M Series A led by Asia Pacific Land/Natural World Limited (TC)

Corporate service platform Sleek raised a $14M Series A led by White Star Capital and Jungle Ventures (TC)

Virtuoso, a UK-based software testing startup, raised a $13.3M Series A led by Paladin Capital (TC)

Vietnamese B2B e-commerce startup Kilo raised a $5M pre-Series A led by Altos Ventures and January Capital (TC)

Nigerian e-health pharmaceutical distribution startup DrugStoc raised a $4.4M Series A led by AAIC (TC)

UK-based fintech Nomod raised a $3.4M seed round at a $50M valuation led by Global Founders Capital (TC)

Doula, a startup helping global entrepreneurs form a US business, raised a $3M seed round led by Nexus Venture Partners (TC)

IPO / Direct Listings / Issuances / Block Trades

Meicai, a Chinese startup that connects restaurants with vegetable producers, picked China International Capital, Citigroup, and Nomura for its $300-500M Hong Kong IPO (BBG)

Dubai may IPO its flagship air carrier, Emirates (BBG)

Telecom company Vodacom may consider a separate listing of its financial services business in South Africa (BBG)

Ahold Delhaize, the owner of grocer Stop & Shop, is considering an IPO for its Dutch online retail unit Bol.com (BBG)

SPAC

Skincare company Obagi and makeup brand Milk Makeup are merging with Waldencast Acquisition Corp in a $1.2B deal (WSJ)

Wynn Resorts and Austerlitz Acquisition Corp. I terminated their $3.2B merger agreement for Wynn’s online betting unit (Axios)

Accelus, a medtech company focused on minimally invasive spine surgery, agreed to merge with CHP Merger Corp. in a $482M deal (GNW)

Exec's Picks

Fantasy Stocks. Real Money.

Do you like Fantasy Sports action? Think you have the best stock picks?

INTRODUCING VIG - home of Daily Fantasy Stock Games.

Free to play with daily cash prize winners.

Download the vig app here. Get in on the action today.

Also:

The Hiring Block

If you're looking to break into finance, lateral, or move out, check out our job board, where we curate highly relevant roles for you. We've got 80+ jobs spanning IB, S&T, VC, tech, private equity, DeFi, CorpDev and more. We sift through all the noise on LinkedIn, Indeed, Monster, etc. so you don't have to.

If you're looking to hire candidates and want to post a job, all you have to do is hit "+ Post a Job" on the top right of the job board.

Candidates: We've also partnered up with Portal Jobs for a more hands-on approach to matching talent with relevant jobs. Fill out the form here and we'll get to work on placing you in a relevant gig.