Together with

Good Morning,

BCG consultants modeled relocating Palestinians to Somalia, UK PE earners have dwindled ahead of a tax crackdown, European earnings are lagging behind US, and Berkshire shares are underperforming the S&P by the biggest margin in decades.

Automate your complicated business spend and expense allocation process with StavPay, the leading software for alternative asset managers.

Let's dive in.

Before The Bell

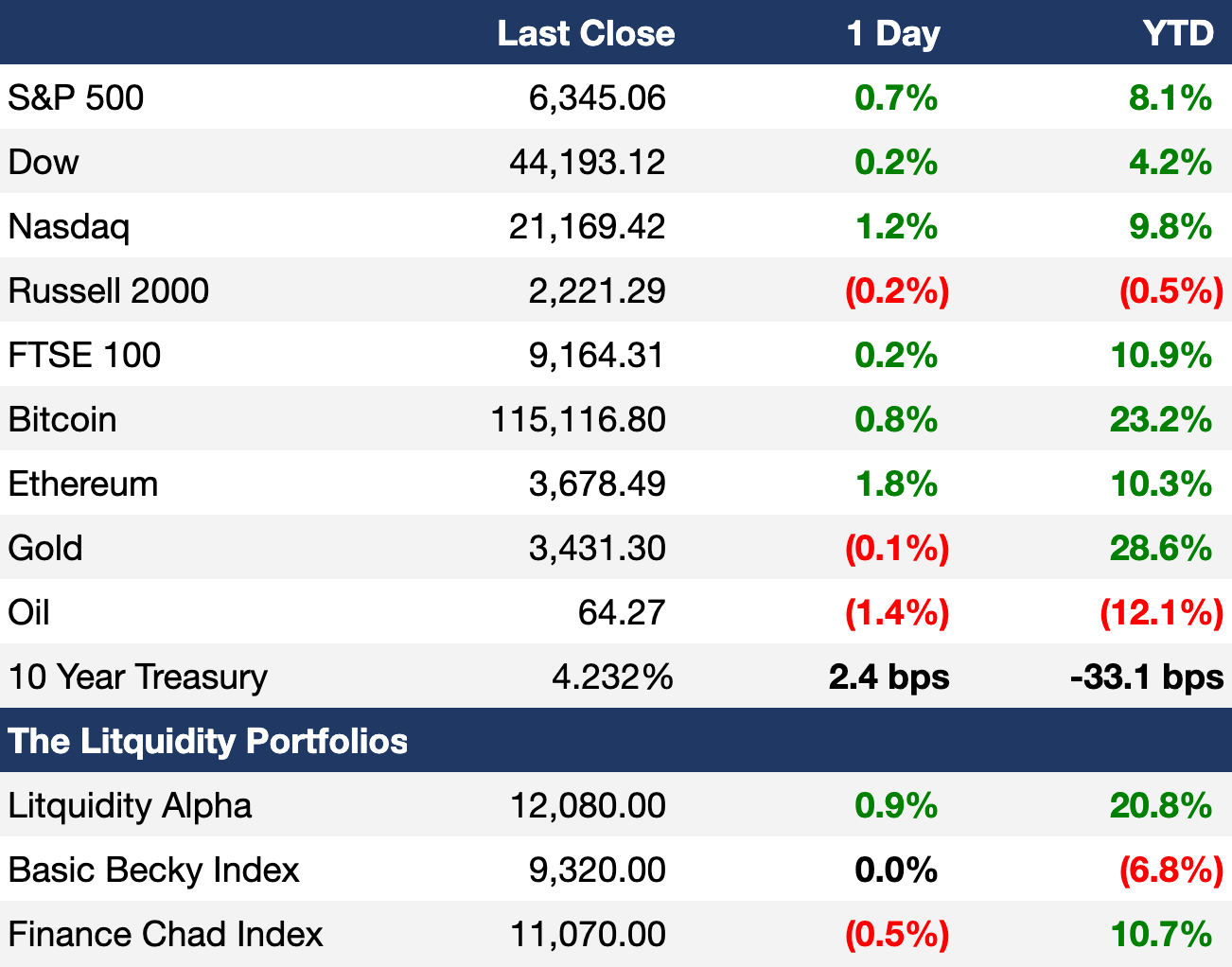

As of 8/6/2025 market close.

Click here to learn more about the Litquidity portfolios and subscribe to the strategies on Autopilot.*

Markets

US stocks rose yesterday as investors digested tariff developments the latest batch of corporate earnings

MSCI Asia index gained 0.8% in its best day in two weeks

US 5Y relative yield hit a four-year low

Earnings

Uber beat Q2 revenue estimates and met on earnings on a 15% rise in MAU and steady consumer demand; the firm is also expanding features and robotaxi services to better serve 'families across all stages of life' (CNBC)

McDonald's beat Q2 earnings and revenue estimates as US same-store sales rose for the first time in three quarters and global comps jumped 3.8% in its strongest gain in two years; the firm noted ongoing pressure on low-income consumers and is working to improve core menu affordability (CNBC)

Airbnb beat Q2 earnings and revenue estimates despite global economic uncertainty as travel demand picked up and nights booked accelerated from April to July, though it forecast slower growth for H2 (CNBC)

Shopify beat Q2 earnings and revenue estimates and issued upbeat Q3 guidance as sales jumped 31% and tariff impacts 'did not materialize' (CNBC)

DoorDash beat Q2 earnings and revenue estimates on a 20% rise in total orders and anticipates significant levels of ongoing investment in new categories and international markets (CNBC)

DraftKings beat Q2 revenue estimates as favorable sports outcomes drove stronger-than-expected results, with MAU and ARPU both rising; the company continues expanding its footprint representing nearly half of US and Canada's population (YH)

Disney missed Q2 revenue estimates but beat on earnings as strength in streaming and parks offset weakness in traditional TV (CNBC)

Novo Nordisk missed Q2 earnings and revenue estimates and cut FY guidance despite Wegovy sales rising 67% as the firm warned of weaker US sales growth amid ongoing competition from compounded versions; it named Mike Doustdar as new CEO, signaled cost cuts and layoffs, and reaffirmed plans to push its Trump-era 'cash channel' pricing strategy ahead of a new obesity pill launch this year (CNBC)

AppLovin issued a Q2 beat-and-raise but slower growth projections and concerns over AI integration tempered investor enthusiasm, even as management touted LLM leadership (BRN)

What we're watching this week:

Today: Eli Lilly, Celsius, Vistra, Sony

Full calendar here

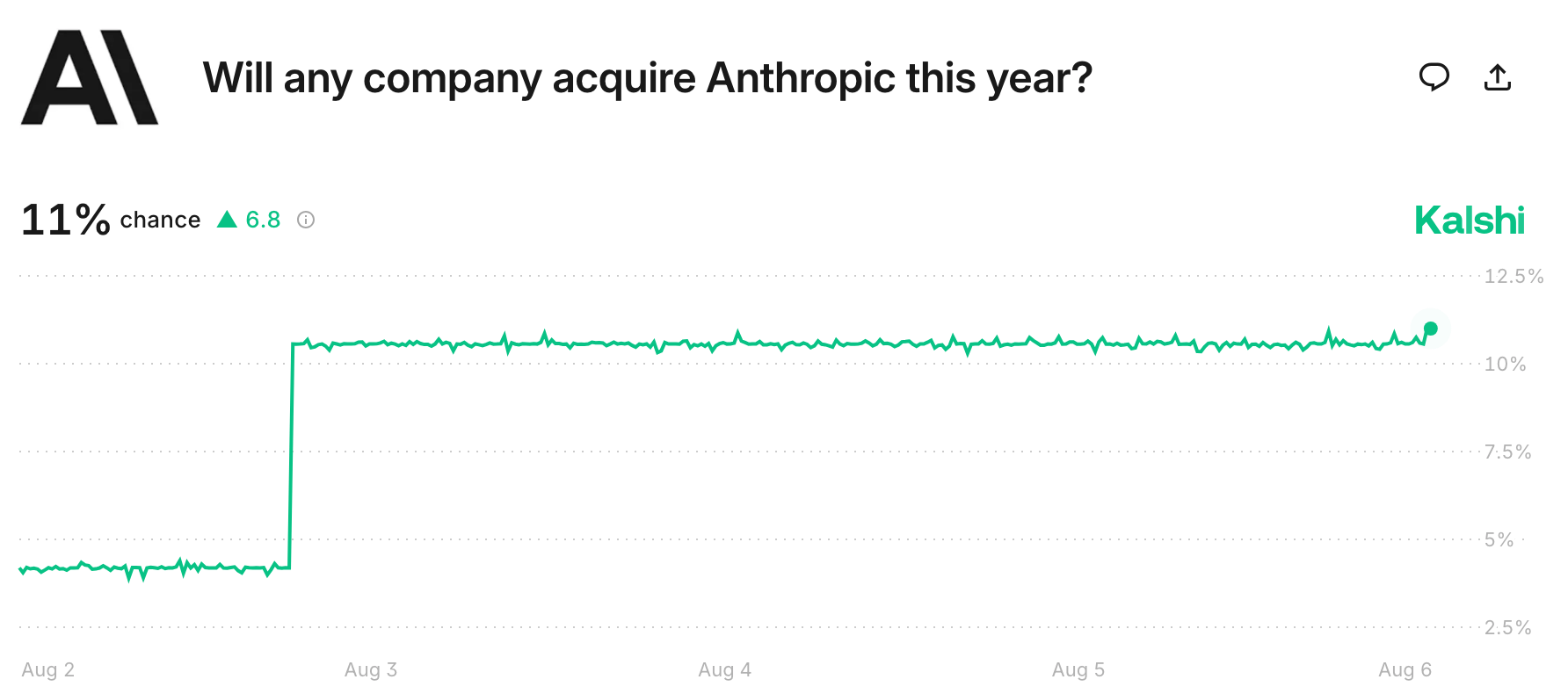

Prediction Markets

We got Fantasy M&A before the Epstein Files.

Headline Roundup

US raised India tariffs to 50% over Russian oil purchases (CNBC)

US threatened 100% tariffs on chips (BBG)

US trading partners race to secure exemptions from US tariffs (WSJ)

Jensen Huang met with Trump ahead of semiconductor tariffs (BBG)

Berkshire shares are trailing S&P by biggest margin in decades (FT)

Number of UK PE dealmakers who received carried interest fell for first time in seven years (FT)

European earnings lag behind US as trade war saps market revival (FT)

Swiss president left White House with no success (BBG)

Wall Street's transition to faster trading is paying off for credit (BBG)

Carlyle revved up PE exits in Q2, lifting profits (BBG)

Shopify overtook RBC as Canada's most valuable company (BBG)

Microsoft is an AI darling with core businesses also booming (BBG)

Apple will commit $100B to domestic manufacturing (BBG)

Apple hit by string of departures in AI talent war (FT)

Microsoft raids Google's DeepMind AI with promise of less bureaucracy (WSJ)

OpenAI will offer ChatGPT for $1/year to US government workers (BBG)

Disney will combine Hulu and Disney+ into one app (CBS)

BCG consultants modeled relocating Gazans to Somalia (FT)

A Message from StavPay

StavPay was built for Alternative Asset Managers to automate the business spend and expense allocation process.

More than 100 managers with over $2.3T of AUM collectively use StavPay to manage their vendors, contracts, invoices, expense allocations, accruals, budgets, services, legal matters, 1099 filings, inter-entity reimbursements, time tracking and payments.

Get more details at stavpay.com and schedule a demo today.

We promise you, it's an hour well spent.

Deal Flow

M&A / Investments

Blackstone agreed to acquire energy data platform Enverus from Hellman & Friedman and Genstar Capital for over $6B

Energy Capital Partners is in advanced negotiations for a minority stake in Canadian waste management firm GFL Environmental's infrastructure affiliate Green Infrastructure Partners at a $3.1B valuation, including debt

UK PE firm Hg is exploring the sale of its financial data firm FE fundinfo at a potential $2B valuation

Disney's ESPN will acquire exclusive rights to TKO Group's WWE in a $1.6B deal

Argentina's state-run energy firm YPF agreed to acquire France's TotalEnergies' assets in Vaca Muerta for $500M

Apollo agreed to acquire a majority stake in data center developer Stream Data Centers

Canadian insurance giant Manulife agreed to acquire a majority stake in Comvest Credit Partners, creating an $18B private credit platform

Turkish Airlines is preparing a binding offer to acquire a stake in Spanish airline Air Europe

VC

AI-powered experience orchestration startup Genesys raised $1.5B from Salesforce and ServiceNow

First Due, a software platform for public safety agencies, raised $355M in funding led by JMI Equity

HR platform Employee Navigator raised $100M in funding from JMI Equity and Spectrum Equity

AI accounting startup Rillet raised a $70M Series B at a $500M valuation co-led by a16z and ICONIQ

AI drug discovery start-up Chai Discovery raised a $70M round at a $550M valuation from Menlo Ventures, DST Global Partners, and Yosemite

Capitolis, a fintech unlocking capital constraints and enabling greater access to more diversified capital, raised $56M in a strategic round from Barclays, BNP Paribas, Canapi Ventures, and others

Stavtar, a business spend management and expense allocation SaaS for alternative investment firms, raised a $55M Series A from Elephant

Full-service digital bank Grasshopper raised a $46.6M round led by Patriot Financial Partners

Lorikeet, a startup creating AI concierges for customers, raised a $35M Series A led by QED Investors

Mineral recovery and uranium remediation startup DISA Technologies raised a $30M Series A2 led by Evok Innovations

Pantomath, an AI-powered data operations platform, raised a $30M Series B led by General Catalyst

Brazilian fintech platform NG.CASH raised a $26.5M Series B led by New Enterprise Associates

Tavily, a startup connecting AI agents to the web, raised a $20M Series A led by Insight Partners

Endex AI, a startup building AI agents explicitly for Excel, raised a $14M round led by OpenAI Startup Fund

Business management software provider D-Tools raised a $12M Series C led by StellarIQ

Lava, a payments platform for the 'agent-native economy,' raised a $5.8M seed round led by Lerer Hippeau

Menos AI, an AI-powered research agent for hedge funds, raised a $5.2M seed round led by Silicon Valley family offices and VC firms

Bisly, an Estonian smart building automation startup, raised a $5M funding round led by 2C Ventures

IPOs / Direct Listings / Issuances / Block Trades

India's Tata Motors will raise equity to pay off some of the $4.4B loan for its buyout of Italian truck maker IVECO

Northrop Grumman-backed space and defense startup Firefly raised $868M at a $7B valuation in an upsized IPO

Indian IT firm Sify Technologies' data center unit Sify Infinit Spaces is seeking to raise $500M at a $3B valuation in an India IPO

French hospitality group Accor is considering a US IPO of its lifestyle hotel JV Ennismore, last valued in 2022 at $2.3B

India's National Securities Depository rose 17% in its trading debut after raising $464M in its India IPO

Saudi developer Dar Al Majed Real Estate raised $336M for a $1.1B valuation in an upsized Saudi IPO

Heart disease AI software platform Heartflow raised its IPO offering to $300M, targeting a $1.46B valuation

Baidu-backed Chinese streaming platform IQiyi is seeking to raise $300M in a Hong Kong listing

Activist hedge fund Starboard Value built an over 9% stake in ~$1.5B-listed engineering materials maker Rogers Corp.

SPAC

Parataxis, a digital-asset management platform, agreed to merge with SilverBox Corp IV in a $400M deal

Debt

Blackstone is seeking $3B in private credit to back its $6B acquisition of energy data platform Enverus from Hellman & Friedman

Verizon will raise $2.3B in its first European debt sale in over a year

Pipeline operator Oneok launched a $3B high-grade bond sale

BMW US Capital launched a $2.75B in a high-grade bond sale

Property firm The Durst Organization closed a $1.3B CMBS loan on NYC skyscraper One Five One in Manhattan's largest office loan this year

Hong Kong broadband service provider HKBN is seeking a $510M loan for refinancing

Bankruptcy / Restructuring / Distressed

Budget jewelry retailer Claire's filed for Chapter 11 bankruptcy, its second since 2018

A French court approved French telecom Altice France's debt restructuring, paving the way for a sale of its French telecoms unit SFR

Fundraising / Secondaries

Germany is launching a $115B investment fund Deutschlandfonds to secure strategic sectors such as defense, energy and raw materials

PE firm TPG raised $4.8B for its sixth growth fund

Ares is close to raising $3B for its third infrastructure secondaries fund

MM secondaries specialist Painswick Capital raised $1.5B for its debut fund

TPG raised $1.3B for its second GP-led vehicle

Investment firm Post Road raised over $1B for its latest corporate PE fund targeting digital infrastructure, real estate and specialty finance

Growth investor Prelude raised $600M for its third growth equity fund

Australian VC Airtree Ventures received backing for a $420M fund from US investors including MetLife and Harvard University

Millennium allocated $250M to Korean hedge fund Billionfold Asset Management to invest in Korean stocks

Brookfield is launching a dedicated strategy focused on developing AI infrastructure

Specialist impact GP Blue Earth Capital registered a second EM secondaries fund

Crypto Sum Snapshot

China tests out stablecoins amid fears of capital outflows

JPMorgan named Kara Kennedy as global co-head of blockchain division Kinexys

Coinbase's grip on crypto faces test in market that won't slow down

UK crypto investors hail regulatory changes as 'pivotal moment'

Check out our Crypto Sum newsletter for the full stories on everything crypto!

Exec’s Picks

Get paid $140/hr to train AI models in financial topics for a leading AI lab. Mercor is looking for IB / PE / Equity Research professionals with 2+ years of experience to help train AI models in excel, complex valuation methodologies and more. The work is async, part time, and remote. There is also a $1,000 referral if you refer someone who is accepted to train AI models. Learn more here.

Bloomberg launched a great tool to track every Trump tariff and its economic effect.

Finance & Startup Recruiting 💼

Litney Partners

If you're a junior banker looking for your next career move, check out our recruiting firm, Litney Partners. Established by Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm), Litney Partners has placed strong candidates across leading firms spanning private equity, hedge funds, venture capital, growth equity, private credit, investment banking, and fintech. Head over to our website to drop your resume / create your profile and we'd love to get in touch!

We are able to move faster than most firms due to our paralleled reach, decades of industry expertise, and ability to attract top caliber candidates.

Next Play

If you're down bad, realizing finance isn't for you, and/or are curious to explore the world of startups (BizOps, chief of staff, strategic finance, etc.), fill out this form. Next Play reviews every submission and will reach out to schedule a 1:1 video call if they think they can be helpful as your own, personal startup matchmaker. They’ve grown their community to over 50k talented individuals and have strong relationships across the tech ecosystem.

Meme Cleanser

🛒 Merch Store: Visit our merch store to shop our latest apparel, shoes, bags, accessories and more.

💵 Litquidity Ventures: Accredited investors & qualified purchasers within the Litquidity community can gain access to alternative investments such as venture, late-stage growth, and private equity through Litquidity Ventures. Interested? Fill out this form.

☎️ Book a call with Lit: Want to pick Litquidity's brain on business advice, insights, or just chat to say what's up? Buy his time here.

📧 Launch your own newsletter: Have great content ideas and looking to launch your own publication? We highly recommend Beehiiv to get started.

*DISCLAIMER: Investment advice provided by Autopilot Advisers, LLC ("Autopilot"), an SEC-registered investment adviser. Past performance does not guarantee future results. Investing carries risks, including loss of principal. As always, be smart out there. Litquidity is compensated to promote AutoPilot. Compensation details available upon request.