Together with

Good morning,

Lots going on before we head out for Christmas. Omicron is (hopefully) weaker than we thought. Musk got rid of his paper hands. Biden is letting students defer loan payments a little bit longer. Pfizer created a COVID pill. Santa rally is on.

Final reminder: US equity markets are closed on Friday and so is the LitCapital office. This will be the last Exec Sum this week.

LASTLY, we reintroduced our referral program with new links for y'all to use. Test it out by referring your friends with the link below. All we're asking for this Christmas is at least one referral from all y'all and we'll continue to deliver the news and the memes 🙏

Merry Christmas and Happy Holidays to all 🤝 See y'all on Monday.

Let's dive in.

Before The Bell

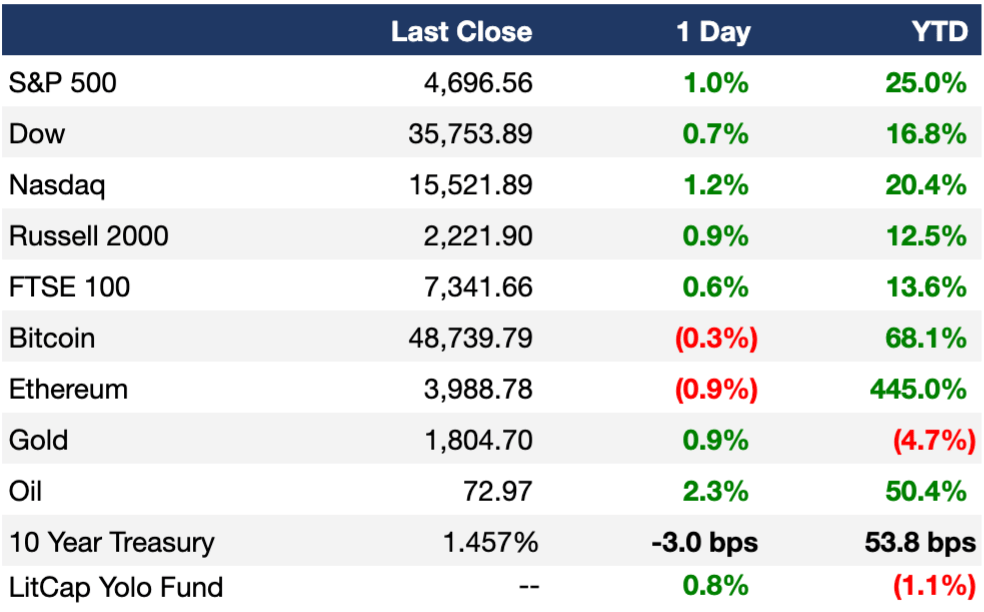

As of 12/22/2021 market close.

To see the LitCap Yolo Fund's portfolio holdings, download the Iris Social Stock app here and give Litquidity a follow. If you want to learn more about crypto trading strategies and the world of DeFi, check out our Foot Guns newsletter.

Markets

US stocks rose yesterday for a second day in a row, continuing to rebound after their omicron-induced losing streak

Investors seem to be increasingly bullish on the future, hoping that omicron will not have the same economic impact as other waves in the past

Earnings

Carmax stock rose after they posted better-than-expected earnings and revenue numbers, showing strong demand for used cars and high prices offsetting higher costs (IBD)

Cintas posted a beat-and-raise report thanks to success in its health care and hygiene division throughout the pandemic and increased prices to respond to increasing costs and inflation (IBD)

Full calendar here

Headline Roundup

Omicron has 80% lower risk of hospitalization, new study shows (BBG)

Musk says he has sold enough stock to unwind 10% of stake (BBG)

US consumer confidence rose in December, defying omicron fears (BBG)

Hynix wins China’s approval to take over Intel’s memory arm (BBG)

Warburg Pincus raises $2.8B for its first Asia real estate fund (BBG)

Biden extends student-loan payment pause after virus surges (BBG)

Steph Curry sells $333 NFT sneakers you can ‘wear’ in different metaverses (BBG)

Pfizer’s Covid pill wins FDA emergency-use authorization (BBG)

Homes sold in November at fastest pace in 10 months (WSJ)

Crypto.com will run its first Super Bowl ad amid marketing blitz (WSJ)

House Committee investigates Live Nation’s role in Astroworld tragedy (WSJ)

Aviation, telecom groups agree to share data to help resolve 5G safety concerns (CNBC)

‘Spider-Man No Way Home’ is on pace to be the first and only billion-dollar movie of 2021 (CNBC)

New York City weighs fresh restrictions for Times Square NYE celebration (CNBC)

A Message From AsomBroso

The tequila market is growing fast.

That’s right - it’s expected to surpass $14.7B by 2028. So it’s no surprise that big name players are getting into the market.

A good friend of mine, Ricardo Gamarra is bringing his 20 years of experience in the tequila industry to attempt to take over the market, with AsomBroso.

The market has more than enough to go around, so no you don’t have to walk a red carpet, be a TikTok influencer, or a member of congress to get involved.

You can invest in AsomBroso for as little as $480.

Grab a seat with us at the bar and take a shot on us. Promise you won’t need a chaser with this one.

Disclaimer: You should read the Offering Circular (Asombroso OC) and Risks (Asombroso Risks) related to this offering before investing. This Reg A+ offering is made available through StartEngine Primary, LLC, member FINRA/SIPC. This investment is speculative, illiquid, and involves a high degree of risk, including the possible loss of your entire investment.

Deal Flow

M&A

Thailand's largest department store owner, Central Group, is ‘days away’ from closing a $5.31B acquisition of the UK’s Selfridges (RT)

Maersk agreed to buy Asian warehouse specialist LF Logistics in a $3.6B deal (BBG)

Canadian software firm Dye & Durham jumped up to 21% after agreeing to buy Australian data services firm Link Administration for $2.5B (BBG)

Novartis agreed to buy Gyroscope Therapeutics, a UK based ocular gene therapy company, for up to $1.5B (BBG)

Commodities group Cargill agreed to buy most of British specialty chemicals group Croda’s performance technologies and industrial chemicals division in a $1B deal (RT)

Blackstone’s real estate arm is exploring the sale of budget hotel brand Motel 6 in a potential $1B+ deal (BBG)

US educational technology company Skillsoft agreed to buy rival Codeacademy for $525M (WSJ)

China Minmetals Rare Earth Co agreed to merge with Chinalco Rare Earth & Metals and China Southern Rare Earth Group in a consolidation of the country’s rare earth producers (RT)

Wyloo Metals agreed to buy Canada’s Noront Resources in a $478.11M deal (RT)

China’s Zhejiang Huayou Cobalt agreed to buy the Prospect Lithium, the owner of the Arcadia hard-rock lithium mine in Zimbabwe, for $422M (RT)

Jinchuan Group, the state-owned parent of Chinese metal miner Jinchuan International Resources, is planning to take the Hong Kong-listed company private (BBG)

Carlyle agreed to buy fiber network and data center operator Involta (BBG)

New York-based developer Silverstein Properties agreed to buy 116 John St., a lower Manhattan apartment tower, for $248M (BBG)

The Italian Sea Group agreed to buy bankrupt luxury yacht maker Perini Navi for $91M (RT))

Discount carrier Wizz Air agreed to buy takeoff and landing slots from Norwegian Air Shuttle and London’s Gatwick hub in a $34-$45M deal (BBG)

VC

Beijing-based autonomous driving startup Haomo.AI raised a ~$150M Series A led by Meituan, Qualcomm Ventures, and others (BW)

Hyperscience, a human centered automation startup, raised a $100M Series E led by Global Founders Capital, Tiger, Stripes, and Bessemer (BW)

Anti-inflammatory antibody therapy company Sorriso Pharmaceuticals raised a $31M Series A led by New Enterprise Associates and Arix Bioscience (PRN)

Privoro, a mobile security hardware company, raised a $30M Series B led by Tracker Capital Management (PRN)

Computational platform for wet labs TandemAI raised a $25M seed / pre-Series A round led by OrbiMed and Chengwei Capital (BW)

Micro investing startup Ant Money raised $20M in funding led by Franklin Templeton (TC)

Biotechnology company X-Therma raised a $13M Series A led by LOREA (PRN)

European venture capital data company Dealroom raised a $6.8M Series A led by Beringea (TC)

TendedBar, an automated bar service, raised a $5 million Series A led by BASE Capital (PRN)

Ocurate, a startup using AI to predict customer lifetime value for e-commerce businesses, raised a $3.5M seed round led by 8-Bit Capital, DCF Capital, Data Community Fund, and others (TC)

IPO / Direct Listings / Issuances / Block Trades

SPAC

Social-video platform Triller, a TikTok competitor, agreed to merge with Seachange International in a ~$5B deal (BBG)

Exec's Pick

If you're a guy planning to escape the freezing winter cold and heading down to Miami or Tulum for the winter, up your swimsuit game with a pair of Meriggi shorts. Inspired by the relaxed Mediterranean vibe, these shorts will have the ladies coming to your beach cabana asking you where you're from.

Not able to follow all of the twitter chatter about Web3 / DeFi? Check out this Web3 primer from a16z (Jack Dorsey's least favorite VC firm).

The Hiring Block

If you're looking to break into finance, lateral, or move out, check out our job board on Pallet, where we curate highly relevant roles for you. We've got 50+ jobs spanning IB, S&T, VC, tech, private equity, DeFi, crypto, CorpDev and more. We sift through all the noise on LinkedIn, Indeed, Monster, etc. so you don't have to.

If you're looking to hire candidates and want to post a job, all you have to do is hit "+ Hire Talent" on the top right of the job board. If you want the role to be featured on Exec Sum, check out our "Featured" and "Premium" tiers.

Meme Cleanser

👀 If you're an accredited investor or qualified purchaser and want access to proprietary early-stage venture deal flow from the LitCap team, fill out this survey. Got some exciting deals coming up in Q1'21. Preference will be given to those who are most involved with our platform (subscribed to Exec Sum, our Foot Guns newsletter, and actively opening the emails).

Cop our new sticker pack in partnership w/ Bullish Studio here