Together with

Good Morning,

The crypto ravaging continued as prices fell further on Monday, some exchanges froze withdrawals, other crypto companies announced layoffs, US average gas prices broke $5 this weekend, Walmart is trying to onboard UK retailers to its online marketplace, Amazon will start drone deliveries in California this year, and the S&P is officially in bear market territory.

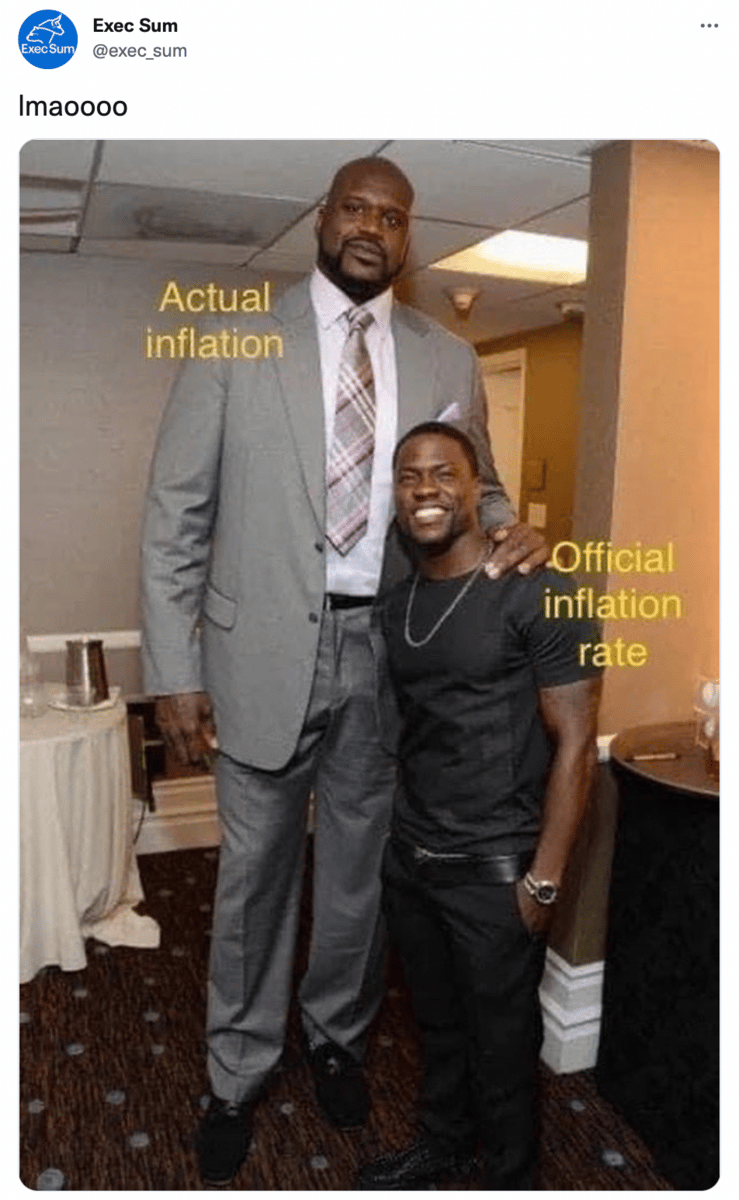

Stocks and crypto might be in bear markets, but the meme market has never been hotter 😤

Let's dive in.

Before The Bell

As of 6/13/2022 market close.

If you want to learn more about crypto trading strategies and the world of DeFi, check out our Foot Guns newsletter.

Markets

All three major indexes continued to fall in an ongoing reaction to Friday’s inflation report

The S&P 500 officially hit bear market territory with a 20% drawdown from its peak

10 year government bonds hit their highest levels since 2011 with growing speculation that the Fed could increase interest rates by more than the planned half percentage point on Wednesday

Bitcoin plunged to below $21,000 at one point, reaching an 18-month low

Earnings

Oracle beat Q4 expectations by a wide margin on the back of strong cloud revenue; their stock subsequently jumped 9%

What we’re watching today: Core & Main

Full calendar here

Headline Roundup

The UK government proposed new legislation to ditch certain post-Brexit trade rules for Northern Ireland, EU threatens legal action (AP)

Charles Schwab subsidiaries will pay $187M to settle SEC charges alleging failure to disclose and misleading of clients (RT)

Binance co-founder and CEO sees the current crypto slump as a great time to hire and acquire, as rival firms announce layoffs (BBG)

Dozens of companies and small business groups sent a letter to US Senators in support of bill to rein in big tech (RT)

US gas price average hit $5 per gallon for the first time ever last weekend (NPR)

India's Life Insurance Corporation lost $17B since its May 17th IPO, making it the second-biggest loser among Asia IPOs this year (BBG)

Walmart is seeking UK retailers to join its online marketplace in an attempt to lure British businesses from competitors like Amazon and EBay (BBG)

Amazon will begin delivering packages by drone in California later this year (AXIOS)

Ryanair's Spanish crew announce six days of strikes (BBG)

A Message From Mizzen+Main

You know when it’s so hot outside that even the walk from your car to the office has you breaking a sweat?

The folks at Mizzen+Main hate that feeling. That’s why they created the world’s first (yup, first) performance fabric dress shirt.

And while other brands have tried to copy their moisture-wicking, wrinkle resistant, machine washable fabric, no one has made anything better than The Leeward.

Ten years ago, Mizzen+Main created The Leeward dress shirt as a solution for any man who is tired of paying for dry cleaning, tired of wearing itchy cotton shirts, and tired of the status quo. If that’s you, you’re ready for Mizzen+Main.

Deal Flow

M&A / Investments

World's largest warehouse owner Prologis will acquire rival Duke Realty for $26B, as e-commerce experiences cooling demand (WSJ)

PE firm Clayton, Dubilier & Rice's $8.8B takeover of British supermarket group Morrisons cleared its last regulatory hurdle on Thursday (RT)

Leading car battery manufacturer Contemporary Amperex Technology kicked off an A-share private placement that is expected to raise ~$6.7B (BBG)

CVC Capital Partners is exploring a sale of cloud solutions company VelocityEHS for ~$2B (RT)

India's IndInfravit Trust will buy five operational road projects from Brookfield in a deal valued at ~$1.2B (RT)

Singapore-listed Frasers Property proposed to take its hospitality arm Frasers Hospitality Trust private in a ~$970M deal (RT)

A consortium of Australian bus operator Kinetic Holding and infrastructure management company Globalvia is looking to takeover Go-Ahead Plan, London's biggest train and bus operator (BBG)

British Petroleum Company acquired 35% of Cenovus Energy’s stake in offshore exploration east of Canada, while selling 50% of its Canadian oil sands stake to Cenovus (RT)

UK home builder Countryside Partnerships put itself up for sale after succumbing to shareholder pressure (BBG)

UK's Octopus Energy joined the three-way bidding race for customers of Bulb Energy, an electricity supply company that collapsed in 2021 (FT)

VC

Radar platform startup Echodyne raised $135M in funding co-led by Bill Gates and Baillie Gifford (TC)

Cereal maker Magic Spoon raised an $85M Series B led by HighPost Capital, as three of its brands landed spots on Target shelves (TC)

Alice Technologies, a startup developing software for construction companies, raised a $30M Series B led by Vanedge Capital with participation from Access Partners, Bouygues, Gaingels, GRID Capital, JLL Spark, and MetaPlanet (TC)

E-commerce provider of medical supplies bttn raised a $20M Series A led by Tiger Global (TC)

Microschool startup Prenda raised a $20M Series B led by Seven Seven Six (TC)

Chinese biotech firm META Pharmaceuticals raised a $15M seed and pre-A round from Forcefield Ventures, XtalPi, IMO Ventures, and Tiantu Capital (PRN)

Metacrafters.io, a collaborative Web3 developer curriculum, raised a $4.5M multichain grant from Solana, Flow, Avalanche, and Polygon Foundations (PRN)

IPO / Direct Listings / Issuances / Block Trades

Bahrain's sovereign wealth fund is considering a Saudi Arabia listing of their government-owned aluminum smelter Alba (YHOO)

SPAC

Another biotech SPAC bites the dust as Blade Therapeutics’ planned merger is canceled (FB)

Fundraising

Crypto Corner

Celsius and Binance temporarily paused cryptocurrency transactions on Monday amid rampant crypto sell-offs and a transaction backlog (CNBC)

Binance.US and its CEO were sued on Monday upon allegations of false marketing of Terra USD as a safe asset ahead of its collapse last month (RT)

Technology company MicroStrategy is now down $1B after purchasing just under 130,000 bitcoin over the course of 2020 (BI)

BlockFi announced layoffs of "roughly 20%" of its workforce while Crypto.com lets go of 5% of corporate staff (DC)

Exec's Picks

The $300B fast food industry is no stranger to the effects of the Great Resignation. With annual employee turnover at a whopping 150%, brands like Jack in the Box, White Castle, and Buffalo Wild Wings are already "hiring" kitchen assistants from Miso Robotics to fill their operations. June 23 is the final day to invest in Miso's robots—don’t miss out.

If you wanna know why crypto is selling off hard this week, you should read up on the Celsius Network's blow up. Here is a good twitter thread from Jack that breaks it down in simple terms.

The Hiring Block 💼

If you're looking to break into finance, lateral, or move out, check out our job board on Pallet, where we curate highly relevant roles for you. We've got 40+ jobs spanning IB, S&T, VC, tech, private equity, DeFi, crypto, CorpDev and more. We sift through all the noise on LinkedIn, Indeed, Monster, etc. so you don't have to.

💼 Today's highlighted job 💼

Liquidibee, a capital provider for businesses of all sizes, ranging from startups to established companies, is hiring an underwriting analyst. Responsibilities for this role include the analysis of financial documents such as credit reports and bank statements, detailed financial analysis to determine credit worthiness, and communication with ISOs, sales managers, and merchants. Think you're the perfect candidate? Apply here through our job board!

Meme Cleanser

Catch the latest episode of our Big Swinging Decks podcast, presented by CoinFLEX.US, on Spotify, Apple, and YouTube 🤝