Together with

Good Morning,

BlackRock added Saudi Aramco’s CEO to its board, Goldman cut its probability of a US recession, the ECB expects a July rate hike but hasn’t made a decision on September, Apollo Global wants to target the world’s top family offices, Ford is cutting its F-150 prices, FedEx has a new CFO, and Netflix is well-positioned in the Hollywood strikes.

Tired of receiving 20 spam calls per day? Get your personal data off the internet with today’s sponsor, Incogni.

Let’s dive in.

Before The Bell

As of 7/17/2023 market close.

Markets

Stocks ended higher as Wall Street braced for quarterly reports from some of the world’s biggest companies

The Dow climbed to its highest closing level in 2023

Markets priced in a 97% chance of a 25 bps Fed rate hike next week

Dollar traded at a near one-year low while the euro hit a seventeen-month peak

Earnings

What we're watching this week:

Today: Bank of America, Morgan Stanley, Lockheed Martin

Wednesday: Goldman Sachs, Tesla, Netflix, IBM, United Airlines

Thursday: Johnson & Johnson, TSMC, American Airlines, Capital One

Friday: American Express

Full calendar here

Headline Roundup

Goldman Sachs cut probability of US recession in next 12 months (RT)

BlackRock names Saudi Aramco CEO Amin Nasser to board (CNBC)

World economy in a difficult place but not destined to stay there - World Bank (RT)

Analysts forecast a 7%+ decline in YoY S&P 500 earnings (FS)

US money-market fund balances retreat from all-time high (BBG)

NY Fed report finds Americans increasingly facing borrowing headwinds (RT)

Americans have 10%-15% more in the bank than they did pre-pandemic (WP)

ECB’s Nagel sees hike in July but data to decide September (BBG)

Temu sued Shein in US over alleged antitrust violations (BBG)

AT&T shares hit three-decade low as lead cables risk weighs (RT)

BlackRock offers a vote to retail investors in its biggest ETF (FT)

Cathie Wood’s ARK writes down Twitter stake by 47% (WSJ)

Apollo Global builds team to target world’s top family offices (BBG)

US companies score partial reprieve from global minimum tax deal (WSJ)

Ford slashes prices of F-150 Lightning trucks as EV wars heat up (RT)

Hollywood strikes hit theaters, but Netflix is best positioned (YF)

US chip lobby presses Biden to refrain from further China curbs (RT)

FedEx appoints new CFO (RT)

Russia pulls out of Black Sea grain deal (FT)

A Message From Incogni

Stop the Spam with Incogni

Spam phone calls are a huge problem in 2023. Every single day, I receive at least 5 automated robocalls asking about my car’s extended warranty. Why do these telemarketers have access to our contact info?

Because data brokers profit from selling sensitive info—phone number, DOB, SSN—to the highest bidder. If you’re sick of receiving these same spam calls and emails, it's time you check out Incogni.

Incogni scrubs your personal data from the web, confronting the world’s data brokers on your behalf. And unlike other services, Incogni helps remove your sensitive information from all broker types, including those tricky People Search Sites.

Help protect yourself from identity theft, spam calls, and other malicious uses of your data by checking out Ingoni. Plus, just for Exec Sum readers: Get 55% off Incogni using code EXECSUM.

Deal Flow

M&A / Investments

British telecom operator Proximus Group agreed to buy a 58% stake in Indian cloud communication service provider Route Mobile for $721M for access to high-growth markets (BBG)

Mortgage data vendor Black Knight will sell its Optimal Blue data business for $700M to Canadian business software firm Constellation Software to address regulatory concerns over its acquisition by NYSE-owner Intercontinental Exchange (RT)

Searchlight Capital Partners agreed to buy British asset manager Gresham House for $615M (RT)

Irish building materials company Kingspan Capital agreed to buy a 51% stake in German building materials maker Steico from its founder for $282M (BBG)

Online sports betting company Ladbrokes-owner Entain agreed to acquire US-based sports forecaster Angstrom Sports for up to $266M (RT)

Indian mattress maker Sheela Foam will buy a 95% stake in rival Kurlon for $262M cash (RT)

Commodities giant Glencore will buy the remaining 18% stake in PolyMet Mining for ~$73M (RT)

State-owned Pakistan Refinery and local firm Air Link Communications are seeking to buy a 77% stake in Shell Pakistan, which Shell is selling due to economic challenges in Pakistan (RT)

New Jersey wealth advisor Pathstone acquired multifamily office Veritable, which has 200 clients with over $75M in assets each (BBG)

Ligand Pharmaceuticals offered $15M cash to acquire assets of dermatology-focused pharmaceutical company Novan, which filed for Chapter 11 reorganization (BW)

VC

Thunes, a provider of a B2B payment infrastructure platform, raised a $72M Series C led by Visa, EDBI, and Endeavor Catalyst (FN)

Herself Health, a primary care service for women aged 65+, raised a $26M Series A led by Accretive (TC)

OrganOx, a startup developing a non-invasive machine perfusion platform to preserve donor livers, raised a $32.7M growth round led by Lauxera Capital Partners (FN)

Web3 music platform Sound raised a $20M Series A led by a16z crypto (FN)

South Korean blockchain startup Skyplay raised $10M from LDA Capital (FN)

Figure, a Bay-area robotics startup, received a $9M investment from Intel Capital (TC)

Cannabis-infused edible makers Botanica raised a $9M Series B led by KEY Investment Partners and GreenAxs Capital (FN)

Flash, an Egyptian fintech startup, raised a $6M seed round led by Addition (TC)

Portuguese stablecoin startup Ethena raised a $6M seed round led by Dragonfly (FN)

Shardeum, an EVM-based layer-1 blockchain company deploying dynamic state sharding, raised a $5.4M round from Amber Group, Galxe, J17 Capital, and more (FN)

Web3 wallet governance platform Narval raised a $4M seed round led by BlockTower VC (FN)

Cakewalk, a startup providing SMBs with an IDAM solution, raised a $3.4M round led by Fly Ventures (FN)

SpeedyBrand, an AI-powered content marketing platform for SMBs, raised a $2.5M round led by Y Combinator and Google Ventures (BW)

Mascotte Health, a Miami-based veterinary tech startup, raised a $1.2M pre-seed round led by Nuwa Capital (FN)

IPO / Direct Listings / Issuances / Block Trades

Debt

JPMorgan sold $4.5B of callable bonds, with a 128 bps premium on its six-year part (BBG)

Wells Fargo sold $1.725B of callable bonds yielding 7.625% (BBG)

Silver Lake is looking for $1.1B of debt financing to fund its takeover of German technology group Software AG (RT)

Abu Dhabi renewable energy company Masdar hired Citi and First Abu Dhabi Bank as joint global coordinators for a potential $500M+ debut green bond sale (RT)

JPMorgan is looking to sell a $350M loan backed by Manhattan’s HSBC Tower (MM)

Mexican vehicle leasing company TIP México raised $236M in a two-part bond sale in the local market (LF)

Bankruptcy / Restructuring

ViewRay, the maker of a radiation-therapy system for cancer patients, filed for bankruptcy due to extended unprofitability (WSJ)

Fundraising

Crypto Corner

Customers Bancorp, a small Pennsylvania Bank, is a reluctant new favorite bank for the crypto industry (BBG)

Coinbase CEO Brian Armstrong will meet with House Democrats to discuss digital asset legislation and other topics (BBG)

SEC Chair Gary Gensler is ‘disappointed’ with a judge’s ruling that Ripple Lab’s XRP token wasn’t a security when sold to retail investors over an exchange (BBG)

Exec’s Picks

Stream smarter with the deepest collection of documentaries at Curiosity Stream! Exec Sum readers can use code "ES23" for 25% off annual plans.

Matt Levine covered Elon Musk’s attempt to sue Watchell for billing Twitter $90M for helping the company force Musk to acquire it (yes, this actually happened).

Axios’s Felix Salmon explained how FedNow could change the US banking system.

Litney Partners - Financial Recruiting 💼💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

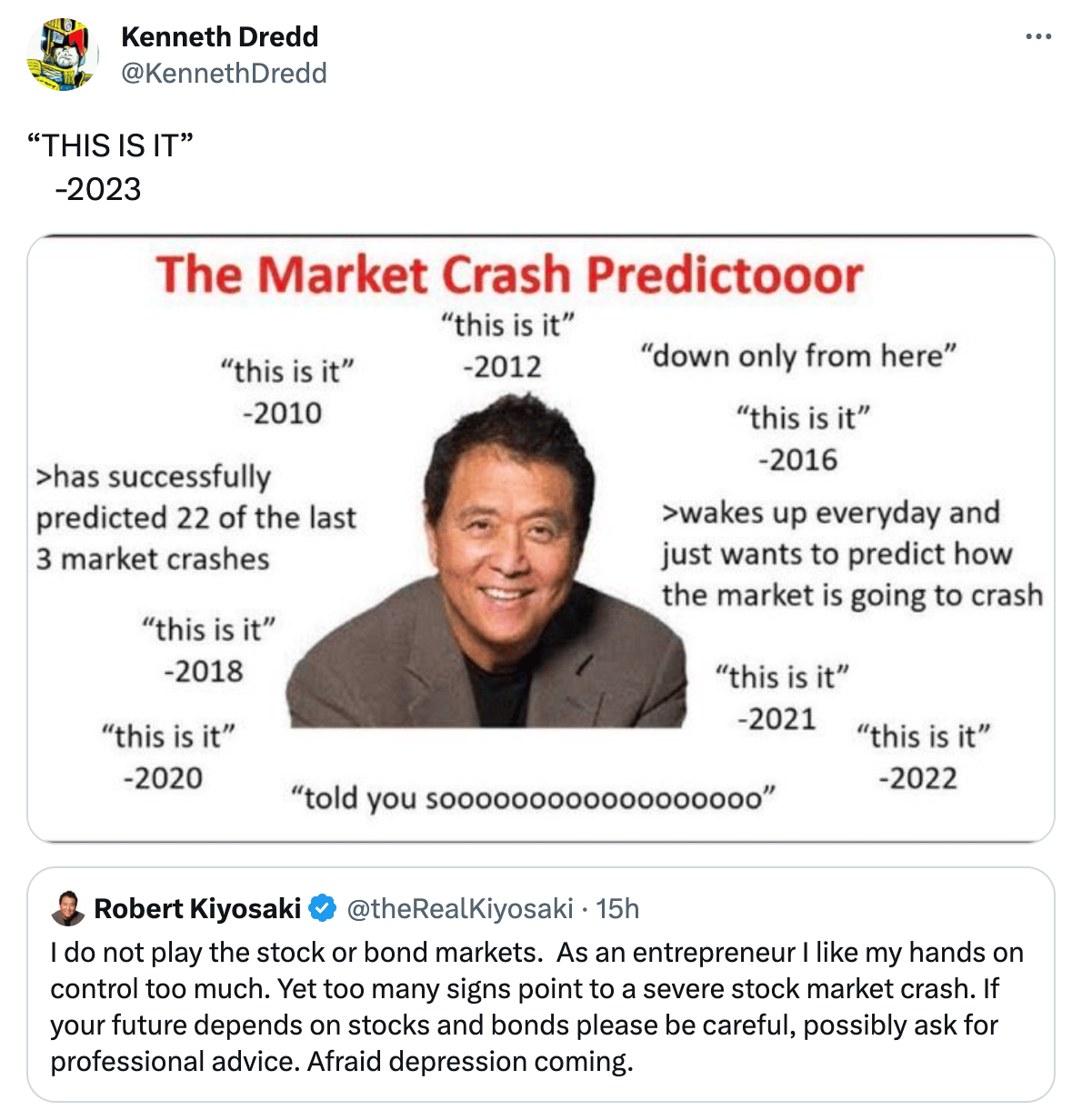

Meme Cleanser

Advertise with us // Visit our merch store // Invest alongside Lit Ventures // Book a call with Lit // Launch your own newsletter