Together with

Good Morning,

Bitcoin rallied more than 10% on ETF optimism, Ackman and Gross closed their bond shorts, SpaceX signed a new deal to launch European satellites, revitalizing America’s downtowns will be expensive, and Tesla is facing a new DOJ probe.

Being a founder is tough, but today’s sponsor, Mercury, is making the job a little bit easier. Check out Mercury Raise, the comprehensive founder success platform built to remove roadblocks at every step of the startup journey.

Let’s dive in.

Before The Bell

As of 10/23/2023 market close.

Markets

US stocks closed mixed as investors reacted to the US 10Y yield retreating from 5% and awaited big tech earnings

The Dow fell 0.58%, while the Nasdaq rose 0.27%

Asian stocks fell due to a risk-off move across global markets

Bitcoin rallied more than 10% to $34,000+ as investors bet on the SEC approving a spot Bitcoin ETF

Earnings

What we're watching this week:

Today: Microsoft, Alphabet, Coca-Cola, 3M, GE, GM, Spotify, Snap, Verizon, Visa, Cleveland-Cliffs

Wednesday: Meta, Boeing, Evercore, Hilton, T-Mobile, IBM

Thursday: Amazon, Chipotle, Comcast, UPS, Intel, Ford, US Steel

Friday: Exxon, Chevron, AbbVie, Piper Sandler, T. Rowe Price

Full calendar here

Headline Roundup

Ackman, Gross abandon bearish bond view with yields bouncing off 5% (BBG)

Tesla discloses DOJ probes over vehicle range, personal benefits, and more (CNBC)

SpaceX signs deal to launch key European satellites (WSJ)

New age for treasuries means 6% yield isn’t ‘out of the picture’ (BBG)

America’s downtowns are empty. Fixing them will be expensive (WSJ)

Biden aims to boost investment in clean energy, biotech, semiconductors with tech hubs (CNBC)

Taiwan presidential frontrunner assails China over Foxconn probe (RT)

Treasuries wild swings turn haven asset into source of turmoil (BBG)

Intel stock drops on report Nvidia is working on an Arm-based PC chip (CNBC)

Money managers with $100T confront end of the bull market (BBG)

UAW expands strike to Stellantis pickup truck plant in Michigan (CNBC)

Smaller banks look to shrink their way back to health (WSJ)

Brazil’s Petrobras spooks traders with threat to extraordinary dividends (BBG)

Alaska Airlines pilot is arrested after alleged attempt to disable engines midflight (WSJ)

A Message From Mercury

Give your startup an advantage with Mercury Raise.

Even with big ambitions, only a small percentage of startups make it.

We’re here to change that. Introducing Mercury Raise, the comprehensive founder success platform built to remove roadblocks at every step of the startup journey.

Looking for the connections for your next fundraise? Get personalized intros to active investors. Craving the company of people who get it? Join our founder community to exchange advice and support. At an impasse with how to take your company to the next stage? Tune in to unfiltered discussions with industry experts to glean direction-setting insights.

With Mercury Raise, you don’t have to go it alone.

Deal Flow

M&A / Investments

Chevron will buy oil and gas producer and explorer Hess in a $53B all-stock deal to gain a larger US footprint and a stake in Exxon’s Guyana discoveries (RT)

India’s Reliance Industries is nearing a cash and stock deal to acquire a controlling stake in Walt Disney’s Indian operations Disney Star at an ~$10B valuation (BBG)

Investment firm Stonepeak Partners agreed to buy Textainer Group Holdings in a deal that values the container leasing firm at ~$7.4B EV (BBG)

Swiss pharma giant Roche will pay an initial $7.1B to Roivant and Pfizer for Telavant Holdings, which owns the rights to a new inflammatory bowel disease drug (WSJ)

DAZN Group and Comcast’s Sky Italia were awarded Italy’s Serie A football league TV broadcasting rights for the next five years for a combined $4.8B (BBG)

PE firm Vista Equity Partners will acquire business software company EngageSmart in a $4B deal (WSJ)

International Flavors & Fragrance is exploring a sale of its pharma solutions business, which could fetch over $3.5B in a sale (BBG)

Campbell Soup’s $2.3B acquisition of Rao’s owner Sovos Brands was delayed until next year due to a request from the FTC for more details on the deal (RT)

Industrial technologies company Fortive will acquire German manufacturer EA Elektro-Automatik Holdings for $1.5B cash (RT)

Swedish residential property rental company Heimstaden Bostad, which owns ~13,500 homes in the Netherlands, is looking to sell 2,500 units for a cash injection of at least $620M to avoid a credit downgrade (BBG)

Healthcare talent solutions provider AMN Healthcare will acquire healthcare staffing company MSDR for $300M (GNW)

Canadian media conglomerate Bell Media will acquire OUTFRONT Media’s Canadian business for $299M (PRNW)

Buyout fund HIG Capital is preparing to put its sports management agency Sportfive up for sale (RT)

Privately held investment firm Liwathon Group acquired Exxon’s 25% stake in the Miro refinery in Germany (BBG)

Los Angeles FC is in early talks with the Chinese owners of Grasshopper Club Zurich to buy the Swiss football club (BBG)

VC

Crusoe, a cloud provider for compute-intensive applications, raised $200M in financing from Upper90 (BW)

Enterprise browser startup Island raised a $100M Series C at a $1.5B valuation led by Prysm Capital (BW)

SynFutures, a decentralized exchange for perpetual futures, raised a $22M Series B led by Pantera Capital (FN)

Nomad Homes, a marketplace for residential real estate listings across Europe and the Middle East, raised a $20M Series A extension led by Acrew Capital (TC)

Cloud spend management startup Ternary raised a $12M Series A led by Jump Capital (TC)

FarmInsect, a Munich-based agritech startup, raised an $8M Series A led by Sandwater (FN)

Fintech startup Finerio raised a $6.5M round led by Third Prime (TC)

Open-source AI framework ZenML raised a $6.4M seed extension round led by Point Nine (TC)

Flash Pack, an adventure travel company for solo travelers in their 30s and 40s, raised a $6.2M round led by JamJar Investments (PRN)

Prism Data, a cash flow underwriting and data analytics platform provider, raised a $5M seed round led by Obvious Ventures (FN)

Basis, an AI platform for accounting firms, raised a $3.6M seed round led by Better Tomorrow Ventures (PRN)

Singaporean cyber risk management startup Protos Labs raised a $3M seed round from Beenext, VinaCapital Ventures, Artem Ventures, and more (FN)

German primary care platform Lillian Care raised a $2.6M pre-seed round led by Nina Capital (EU)

Revv, a SaaS startup focused on automotive repair diagnostics, raised a $2.1M seed round led by 1984 Ventures (VC)

Laxis, an AI assistant for revenue teams, raised a $1.5M seed round from Elevate Ventures, Flywheel Fund, Allos Ventures, and more (FN)

IPO / Direct Listings / Issuances / Block Trades

Saudi Arabia’s PIF is exploring an IPO of the kingdom’s largest medical procurement firm, Nupco, as early as next year (BBG)

Debt

British Columbia Investment Management, which manages $170B in assets, raised ~$910M through a 10-year bond sale (BBG)

Bankruptcy / Restructuring

As part of its Chapter 11 filing, bankrupt Cyxtera Technologies is in advanced talks to sell a large portion of its data centers to Brookfield Infrastructure Partners (BBG)

Baby products company Hello Bello, which was founded by actors Kristen Bell and Dax Shepard, filed for bankruptcy due to high shipping and production costs (BBG)

Fundraising

Goldman Sachs Asset Management raised $4B for West Street Infrastructure Partners IV, which will invest in infrastructure assets globally (RT)

Crypto Corner

Bitcoin hits $35,000 for the first time since 2022 on ETF optimism (BBG)

A federal appeals court formalized a victory for Grayscale Investments over the SEC in its bid to create an ETF based on Bitcoin (BBG)

The iShares spot Bitcoin ETF proposed by BlackRock has been listed on the DTCC suggesting potential approval by the SEC (CT)

Exec’s Picks

Earning money from your idle funds has never been easier! With Onyx Private, you can enjoy a competitive APY in your checking account or opt for a high-yield account with an impressive 4% or more interest rate. For those seeking a more traditional investment, US Treasury bills offer a solid 5% return. To sweeten the deal, open your account with the exclusive LIT010 code and receive a generous 10% discount on the premium membership. Join Onyx today.

Byrne Hobart wrote about the economics of “start-up swag,” discussing why company merch is sometimes a smart investment.

Joe Weisenthal and Tracy Alloway discussed what it will take for the US to undergo a nuclear energy renaissance.

Litney Partners - Financial Recruiting 💼💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

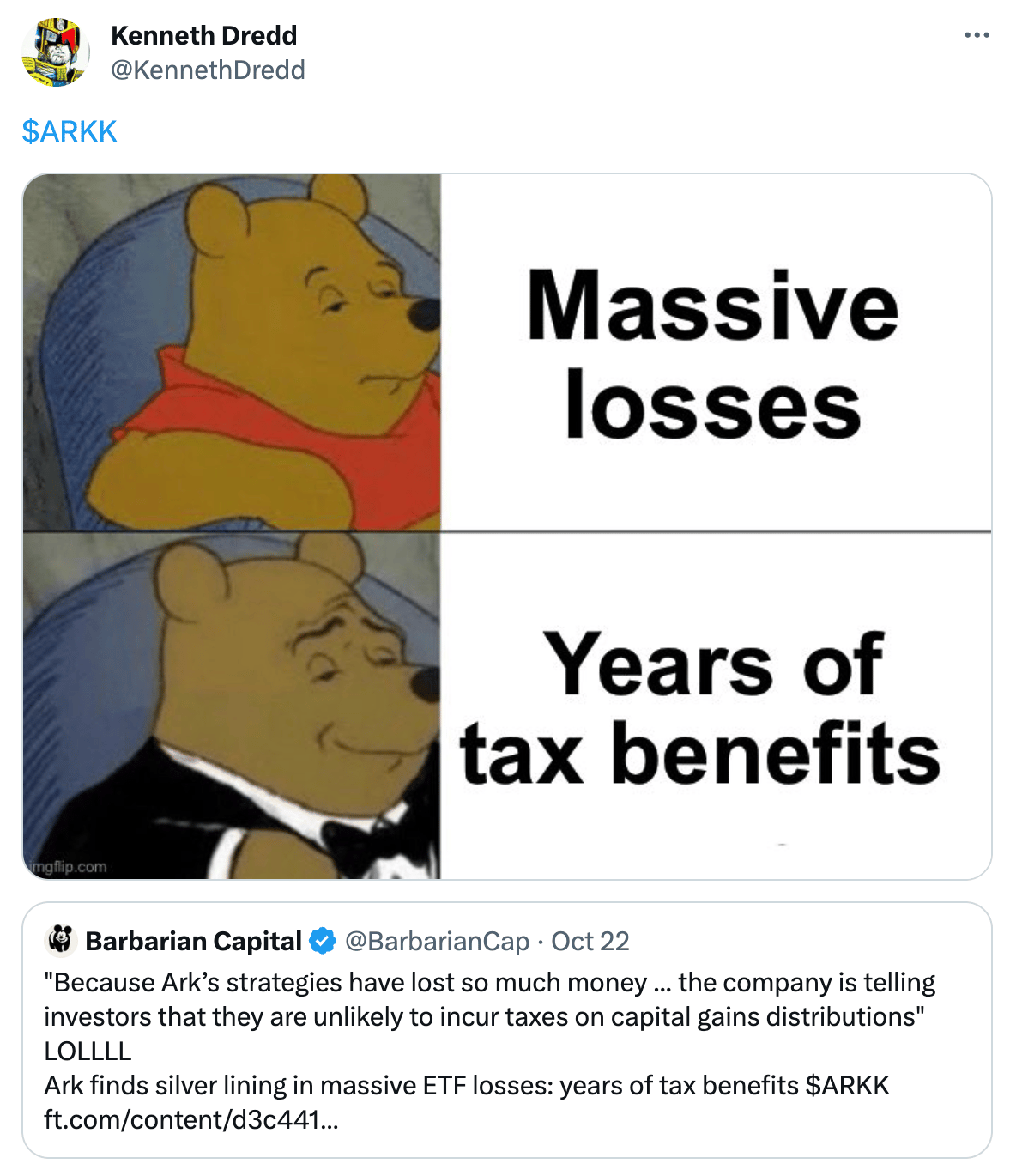

Meme Cleanser

Advertise with us // Visit our merch store // Invest alongside Lit Ventures // Book a call with Lit // Launch your own newsletter