Together with

Good Morning,

The Fed cut rates and will halt QT, PIF will shift focus away from real estate, Starbucks sales finally rebounded, Nvidia hit a $5T market cap, Alphabet revenue topped $100B, Meta's stock took a beating, and OpenAI may IPO at a $1T valuation.

Fall season means it's time for a wardrobe overhaul. Check out our personal favorite Mizzen+Main for the most comfortable men's dress shirts in the game.

Let's dive in.

Before The Bell

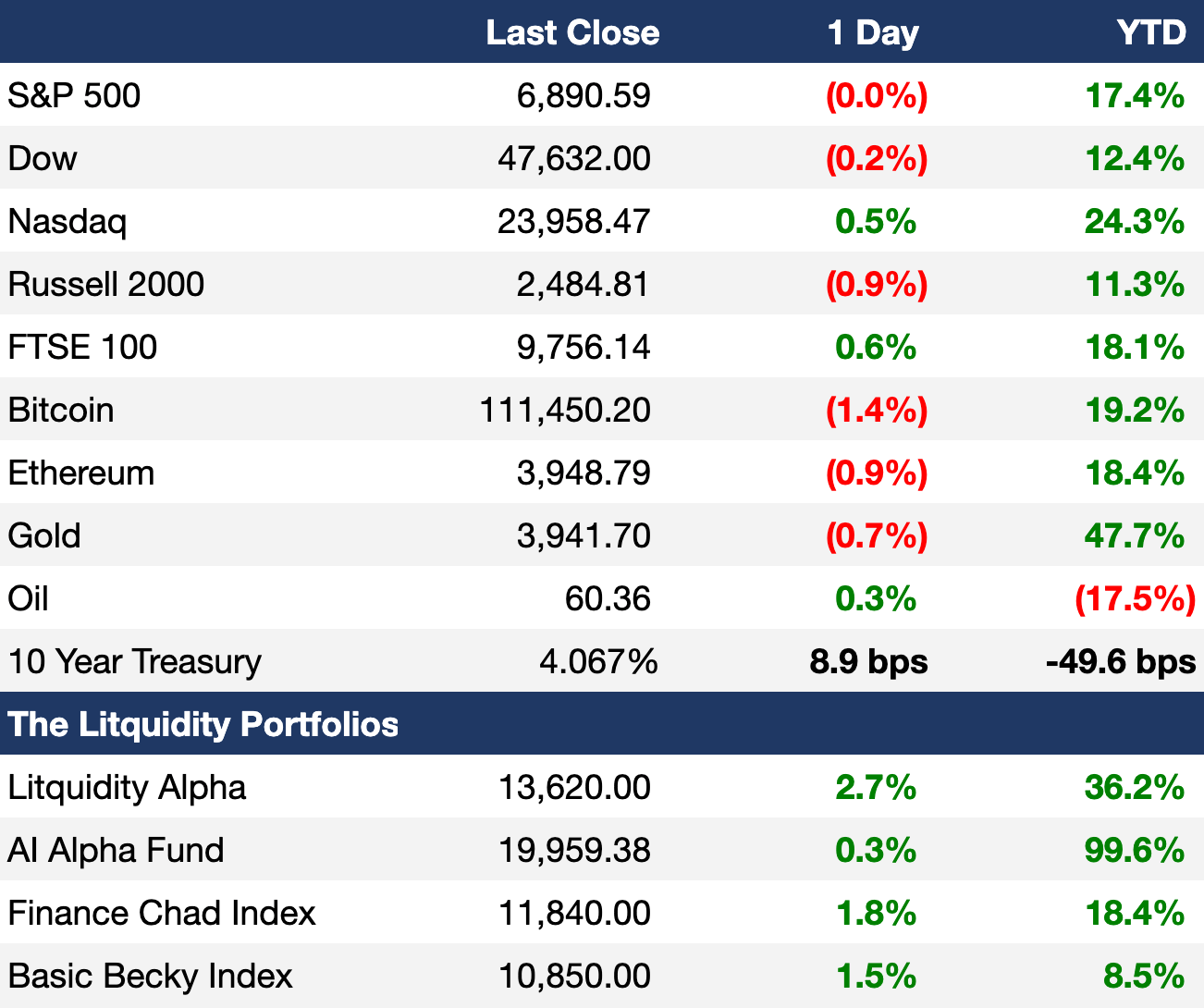

As of 10/29/2025 market close.

Learn more about the Litquidity portfolios here and subscribe to the strategies on Autopilot.*

Markets

US stocks closed mixed yesterday as investors digested another Fed rate cut, J Pow's hawkish commentary, and a slew of Big Tech earnings

Nasdaq closed at a fresh ATH

Traders lowered odds of a third December rate cut from 90% to 67%

UK's FTSE 100 hit a fifth-straight ATH

US yields surged across the board

2Y yield rose 10 bps past 3.6%

Gold edged higher after four days of losses

Copper hit a record high amid fears of a supply shortage

Pound hit its weakest versus euro since 2023

Earnings

Alphabet beat Q3 earnings and revenue estimates on a historic $100B quarterly revenue driven by double-digit growth across every major business unit, including 34% growth in cloud and a $155B backlog; over 70% of cloud customers are now using its AI tools (CNBC)

Meta beat Q3 revenue and earnings estimates on a 26% sales increase, though shares fell 9% after reporting a $15.9B one-time tax charge tied to Trump's new tax law and skepticism over its rising ~$70B AI CapEx (CNBC)

Microsoft beat Q1 earnings and revenue estimates despite a $3.1B hit from its OpenAI investment as Azure cloud revenue grew 40% and AI-related demand remained strong, though CapEx forecast hurt investor sentiment (CNBC)

Boeing beat revenue expectations and returned to positive cash flow for the first time since 2023 on jetliner deliveries, but took a $4.9B charge on 777X delays as the company ramps up production toward its highest deliveries since 2018 (CNBC)

Starbucks missed Q3 earnings estimates but beat revenue forecasts as global same-store sales grew 1% for the first time in two years, aided by a turnaround strategy under new CEO Brian Niccol (CNBC)

Verizon beat Q3 earnings and wireless subscriber estimates, adding 44k bill-paying subscribers as strong iPhone promotions and phone upgrades drove growth (RT)

CVS Health beat Q3 earnings and revenue estimates and raised its profit guidance, amid improvements in its insurance unit and strong performance at Caremark (CNBC)

Chipotle met Q3 earnings estimates but missed on revenue, and lowered FY same-store sales forecasts as younger and lower-income diners cut back on visits (CNBC)

Caterpillar beat Q3 earnings and revenue estimates as strong demand from AI data center development drove a 17% rise in its energy and transportation division, prompting the firm to raise its FY sales outlook (BBG)

Carvana beat Q3 revenue estimates on record revenue driven by a 44% jump in retail units sold but missed on earnings due to weak margins (WSJ)

Kraft Heinz missed Q3 revenue estimates and lowered its FY outlook as weaker consumer sentiment and food inflation weighed on US demand (WSJ)

UBS beat Q3 profit estimates supported by IB revenue and released provisions but investor focus shifted to legal risks from canceled Credit Suisse AT1 bonds and Swiss capital reforms (RT)

What we're watching this week:

Today: Amazon, Apple, Coinbase, Eli Lilly, Comcast, Reddit, Blue Owl, Roblox

Friday: ExxonMobil, Chevron, AbbVie

Full calendar here

Prediction Markets

Another Fed rate cut combined with hawkish commentary.

Headline Roundup

Trump-Xi meeting resulted in key US-China agreements (CNBC)

Fed cut rates again by 25 bps to 3.75%-4% (CNBC)

J Pow's hawkish commentary casted doubt on third December rate cut (BBG)

Fed will end QT (BBG)

Bessent and Sen. Warren want to raise FDIC insurance cap to $10M (WSJ)

US government shutdown may cost US economy $14B (RT)

S&P 500's $17T rally sparks debate over cashing in or going long (BBG)

Options pros see opportunity in retail-aimed structured products (BBG)

Private credit hits back at 'misinformation' over First Brands collapse (RT)

Private credit to big companies is showing signs of froth (RT)

Hedge funds invoke antitrust laws in new frontier of distressed debt wars (FT)

Hedge fund tactics fuel Europe's market for non-existent debt (FT)

Nvidia hit a $5T market cap in historic first (CNBC)

Traders are hedging against Oracle's growing debt (BBG)

Mining companies are raising equity at the fastest pace since 2013 (BBG)

Chinese financials' earnings growth is set to outpace wider market (BBG)

$1T SWF PIF will shift focus from real estate to logistics, minerals, and AI (RT)

Jensen Huang joined Big Tech titans funding White House ballroom (RT)

Citi probe did not interview women who complained about exec's conduct (FT)

Democrats push back against PE in 401(k)s (WSJ)

Microsoft suffered cloud outage days after Amazon AWS outage (BBG)

Portuguese police raided KPMG office in Novo Banco corruption probe (BBG)

A Message from Mizzen+Main

"I legit love my Mizzen+Main shirts." – Hank, CEO of Litquidity

Fall szn means it's time to consider a wardrobe overhaul, but it's hard to find a shirt that meets all our needs. Don't stress, Mizzen+Main has your back.

With their Leeward No Tuck Dress Shirt, you can have all the comfort of your favorite homey T-shirt with the style of that dress shirt you can wear to the office every day. This shirt is made from machine washable performance fabric that's quick drying and wrinkle resistant – so you'll never have to worry about looking your best.

Stop sacrificing comfort for style, because you can have both in your Mizzen+Main's Leeward dress shirt. Use code EXECSUM and take $35 off any order of $125+ today.

Deal Flow

M&A / Investments

Toyota does not plan to sweeten its $31B buyout offer for Toyota Industries

Biotech Thermo Fisher will acquire drug trial software maker Clario for $8.9B in cash

Porsche-Piëch, the family that controls Volkswagen, is looking to invest in Volkswagen's planned $7B spinoff of its diesel engine unit Everllence; PE firms are also studying the business

Japanese IT giant NEC agreed to buy telecom customer care and billing services CSG Systems International for $2.9B, representing a 17% premium

European app investor Bending Spoons agreed to acquire internet pioneer AOL from Apollo for $2.8B

Tech PE firm Francisco Partners agreed to take-private mobile device management firm Jamf for $2.2B, representing a 50% premium

Mastercard is in late-stage talks to acquire crypto infrastructure startup Zerohash for $1.5B-$2B

Bain Capital will acquire a minority stake in a Canadian managed accounts provider amid Innocap Investment Management

Germany is weighing nationalizing Russian oil producer Rosneft's German unit

Morgan Stanley will acquire private shares platform EquityZen

Trump-linked memecoin issuer Fight Fight Fight is in talks to acquire the US operations of crowdfunding site Republic.com

VC

Legal AI startup Harvey raised a $150M round at an $8B valuation led by a16z

Berry farmer Fruitist raised a $150M round at a $1B valuation led by JPMorgan Asset Management

Enterprise AI infrastructure startup Fireworks AI raised a $250M Series C at a $4B valuation led by Lightspeed Venture Partners, Index Ventures, and Evantic

Whatnot, a live shopping platform, raised a $225M Series F at a $11.5B valuation led by DST Global and CapitalG

Electric Mind, an AI-led services firm focused on engineering transformation for financial institutions, raised $100M in funding from Motive Partners

ConductorOne, an AI-native identity security platform, raised a $79M Series B led by Greycroft

CoreStory, an AI powered code intelligence platform, raised a $32M Series A led by Tribeca Venture Partners, NEA, and SineWave Ventures

Syllo, an AI-powered litigation platform, raised a $30M round led by Venrock and Two Seas Capital

Reflectiz, an AI-powered web threat management platform, raised a $22M Series B led by Fulcrum Equity Partners

Uptiq.ai, an AI infrastructure platform for financial services, raised $12M in funding led by Silverton Partners

TestSprite, an agentic testing tool for AI-native software, raised a $6.7M seed round led by Trilogy Equity Partners

WorkHero, an AI-based back office platform for small HVAC contractors, raised a $5M seed round led by Navitas Capital

Cylerity, a healthcare fintech startup using AI and ML to improve payments, raised a $4M seed round led by HealthX Ventures

Mappa, an AI-powered behavioral intelligence platform, raised a $3.4M seed round led by Draper Associates

Access the most comprehensive VC deal flow data on Fundable.

IPO / Direct Listings / Issuances / Block Trades

OpenAI is preparing for a 2027 IPO at a $1T valuation

Billionbrains Garage Ventures, the parent company of Indian investment platform Groww, is seeking to raise $752M at a $7B valuation in an India IPO

Steel and iron-ore giant Cleveland-Cliffs is seeking to raise $982M in a share sale

UK metal engineering group Doncasters is exploring a US IPO

SPAC

Portable healthcare stations firm OnMed will merge with Berto Acquisition Corp in a $500M-$1B deal

Debt

Bank of America, Citigroup, and Morgan Stanley are among ~20 banks joining JPMorgan's $20B debt financing backing Silver Lake, PIF, and Affinity Partners' $55B LBO of Electronic Arts

Goswami Infratech, a unit of Indian conglomerate Shapoorji Pallonji, is planning a $2.5B debt sale

Suriname plans to raise $1.5B in global debt markets

Namibia repaid its $750M eurobond, the largest single-day debt maturity in its history

Slovenia plans to sell $700M of China panda bonds

Bitcoin miner TeraWulf is seeking to raise $500M in a convertible bond sale

Bankruptcy / Restructuring / Distressed

Distressed debt hedge fund Black Diamond is seizing control of the Palisades Center shopping mall in New York after acquiring the sole mortgage backing the CMBS tied to the mall; an AAA-rated slice lost $72M in the second such loss for top-rated CMBS investors since 2008

Fundraising / Secondaries

Secondaries investor Lexington Partners raised $4.6B for its sixth co-investment fund

UK secondaries investor Hollyport Capital raised $4.5B for its ninth flagship fund

Private credit firm Viola Credit raised a $2B ABF fund targeting fintech startups

European PE firm Armira raised it $1.2B for a fund to invest in 'hidden champions'

PE firm Warburg Pincus and real estate investment firm Madison International Realty partnered to invest $300M in real estate secondaries

Crypto Sum Snapshot

Strategy was tagged junk by S&P Global in initial rating

Ex-FTX president Brett Harrison's Architect Financial Technologies plans to offer perpetual futures contracts for FX, rates, stocks, stock indexes, and commodities

British crypto staking company KR1 plans to move its listing to London

Crypto Sum compiles the most important stories on everything crypto. Read it here.

Exec’s Picks

The US health insurance market is bracing for upheaval. After nearly five years of expanded subsidies, the scheduled end of enhanced advanced premium tax credits (eAPTCs) in 2025 threatens to raise premiums for millions, pressure insurers, and trigger economic aftershocks. Read more.

CFA Institute published an insightful post on the best practices for assessing secondaries deals.

Jonathan Chevreau reviewed some recent investing books by prominent investors, including by Jim Cramer and Barry Ritholz.

Finance & Startup Recruiting 💼

Litney Partners

If you're a junior banker looking for your next career move, check out Litney Partners, a recruiting venture between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm), Litney Partners places talent at leading firms in PE, hedge funds, VC, growth, credit, IB, and fintech and is currently recruiting for some incredible roles. Head over to our website to drop your resume and we'd love to get in touch!

Next Play

If you're down bad, realizing finance isn't for you, and want to explore the world of startups (BizOps, chief of staff, strategic finance, etc.), fill out this form. Next Play will reach out to schedule a 1:1 video call if they think they can help as your own, personal startup matchmaker. They've grown their community to over 50k talented professionals and have deep relationships across the tech ecosystem.

Meme Cleanser

🛒 Merch Store: Visit our merch store to shop our latest apparel, shoes, bags, accessories and more.

💵 Litquidity Ventures: Accredited investors & qualified purchasers within the Litquidity community can gain access to alternative investments such as venture, late-stage growth, and private equity through Litquidity Ventures. Interested? Fill out this form.

☎️ Book a call with Lit: Want to pick Litquidity's brain on business advice, insights, or just chat to say what's up? Buy his time here.

📧 Launch your own newsletter: Have great content ideas and looking to launch your own publication? We highly recommend beehiiv to get started.

*DISCLAIMER: Investment advice provided by Autopilot Advisers, LLC ("Autopilot"), an SEC-registered investment adviser. Past performance does not guarantee future results. Investing carries risks, including loss of principal. As always, be smart out there. Litquidity is compensated to promote AutoPilot. Compensation details available upon request.