Together with

Good Morning,

LPs are wary of PE continuation funds, FTC is probing 'dynamic pricing' practices, US home prices hit a record-high, insurers are set to lose billions from CrowdStrike's glitch, and early Big Tech earnings came in mixed.

Supercharge your markets research with AI, with a free 3-hour Mini Course from today's sponsor, GrowthSchool.

Let’s dive in.

Before The Bell

As of 07/23/2024 market close.

Markets

Major US stock indexes slipped yesterday as investors swapped for small caps ahead of Big Tech earnings

Oil fell to a six-week low

Earnings

Tesla fell 10% after missing Q2 EPS estimates on a 7% drop in auto revenue (CNBC)

Alphabet beat Q2 Wall Street estimates on strength in search and cloud (CNBC)

Visa beat Q3 EPS estimates but reported a rare revenue miss as payments volume growth slows (RT)

Spotify surged 12% after reporting record Q2 profit, gross margin, and FCF thanks to its recent 'efficiency' strategy (YH)

UPS plunged 12% after missing Q2 EPS and revenue estimates and cutting revenue guidance due to weak freight demand and soft pricing (CNBC)

What we're watching this week:

Today: Chipotle, Ford, AT&T, IBM

Thursday: American Airlines

Full calendar here

Headline Roundup

US 2Y Treasury auction drew record demand (FT)

PE is getting creative in efforts to buy time (BBG)

US blue-chip bond sales hit a six-year high (BBG)

Small caps rally ignited a record options trading frenzy (RT)

Chinese firms raised a record $14B in offshore convertibles YTD (RT)

Singapore's GIC is eying Chinese units of MNCs who exit China (FT)

BofA named insider Kevin Brunner as head of TMT IB (RT)

Julius Baer named Goldman partner Stefan Bollinger as CEO (RT)

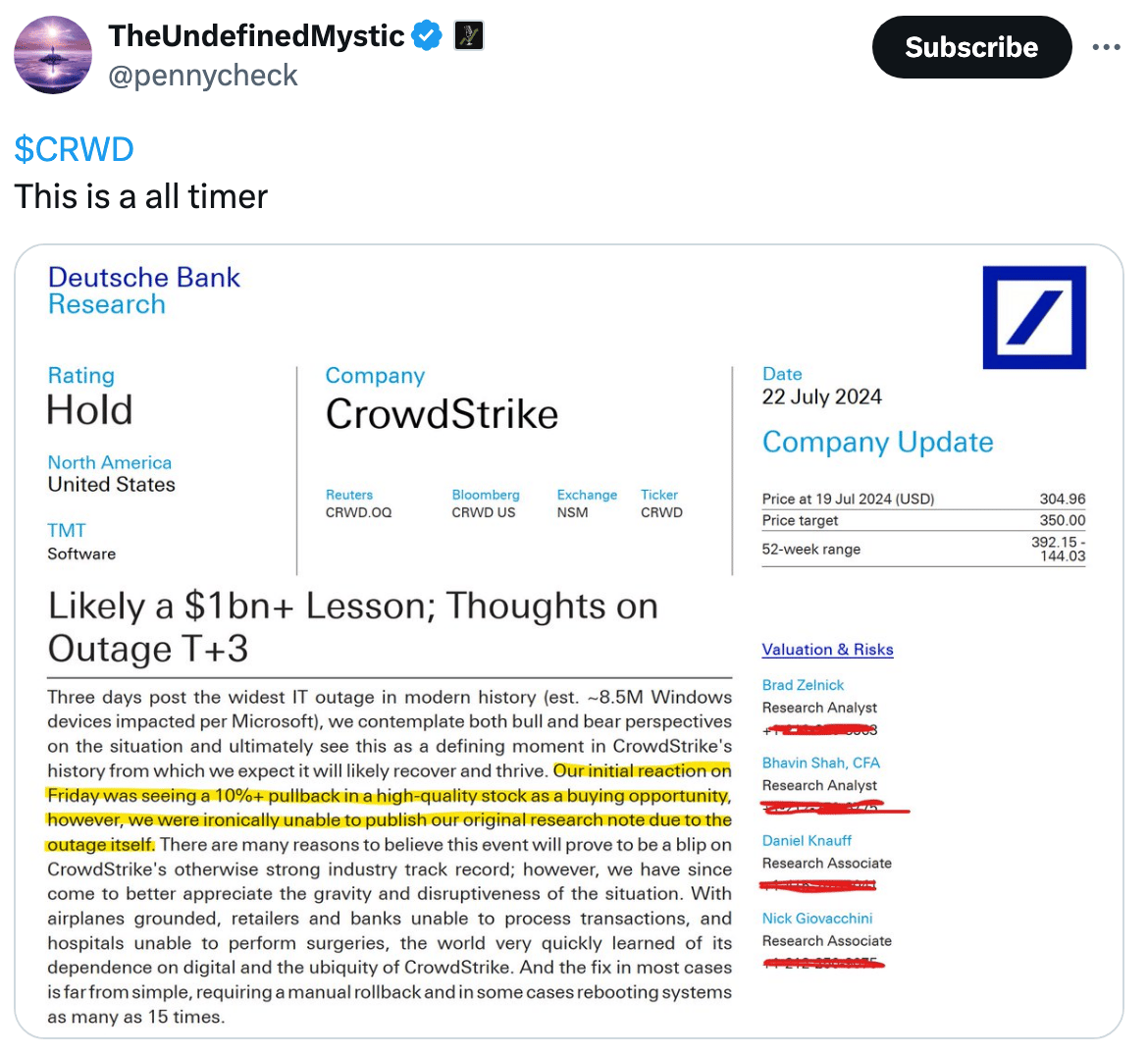

Insurers are set to lose billions from the CrowdStrike IT outage (FT)

FTC is probing dynamic pricing practices (TV)

Meta released Llama 3.1 to rival GPT-4o and Claude 3.5 (AX)

Ike Perlmutter sold his entire Disney stake after losing proxy fight (WSJ)

US home prices hit a record-high (WSJ)

Younger boomers are facing a cash crunch (WSJ)

Earth logged the hottest day on record (CNBC)

A Message From GrowthSchool

Become a 10x better & smarter investor with AI. Here's how:

This free 3-hour Mini Course on AI & ChatGPT (worth $399) will help you become a master of 20+ AI tools & prompting techniques and save 16 hours/week.

This course will teach you how to:

Analyze and project market trends with AI in seconds

Solve complex problems, research 10x faster & simplify your workflow

Generate intensive financial reports with AI in less than 5 minutes

Build AI assistants & custom bots in minutes

Deal Flow

M&A / Investments

KKR is in talks to acquire a 25% stake in Eni's biofuel arm at a ~$13B valuation, including debt (FT)

German engineering firm Bosch agreed to acquire Johnson Controls' and Hitachi's residential HVAC businesses for $8B (RT)

UK events group Informa is in advanced talks to take private rival Ascential for over $1.4B (FT)

Medical supplies distributor Owens & Minor will acquire peer Rotech Healthcare for ~$1.4B cash (RT)

SWF ADIA is considering a $1.1B investment in Nestle's ice cream JV (BBG)

Industrial equipment maker IDEX will acquire filtration products maker Mott for $1B cash (RT)

Singaporean delivery app Grab acquired dining reservation platform Chope (RT)

SkyLake Equity Partners agreed to acquire a 71% stake in Korean SaaS firm BusinessOn (BBG)

DeFi exchange DYdX is in talks to sell its derivatives trading software (BBG)

Credit firm Crestline is exploring options including a sale (BBG)

VC

Legal tech startup Clio raised a $900M Series F at a $3B valuation led by NEA (TC)

Retirement tech startup Human Interest raised a $267M round at a $1.33B valuation led by Marshall Wace and Baillie Gifford (BBG)

GenAI legaltech startup Harvey raised a $100M Series C at a $1.5B valuation led by GV (TC)

Headway, a mental healthcare system, raised a $100M Series D at a $2.3B valuation led by Spark Capital (PRN)

Gcore, an AI cloud solutions provider, raised a $60M Series A led by Wargaming (EU)

Mytra, a robotics startup for warehouse automation, raised a $50M Series B led by Greenoaks and Eclipse (TC)

Level AI, a suite of AI-powered tools to automate customer service tasks, raised a $39.4M Series C led by Adams Street Partners (TC)

QA Wolf, an app QA-testing suite, raised a $36M Series B led by Scale Venture Partners (TC)

Strive, an asset management platform, raised a $30M Series B led by Cantor Fitzgerald (PRN)

TigerBeetle, a database optimized for financial transactions, raised a $24M Series A led by Spark Capital (TC)

NPC Labs, a developer of gaming tech for blockchain networks, raised an $18M seed round led by Pantera Capital (FN)

UK fintech Plum raised a $16.4M Series B led by Ventura Capital and more (EU)

Code Metal, an AI-powered development workflows for the edge, raised a $16.5M pre-seed / seed round led by J2 Ventures and Shield Capital (BW)

Customer intelligence platform Momentum raised a $13M Series A led by FirstMark Capital (PRN)

Bitlayer, a Bitcoin layer 2 platform, raised an $11M Series A led by Franklin Templeton and ABCDE (PRN)

IPO / Direct Listings / Issuances / Block Trades

Medical supplies firm Medline Industries is exploring a 2025 IPO at a $50B valuation (BBG)

Wiz rejected a $23B Google acquisition deal and will IPO instead (BBG)

Toyota will buy back $5.2B of stock from from major Japanese investors (BBG)

Fintech Revolut is nearing a deal to sell $500M of shares at a $45B valuation (WSJ)

KKR-backed financial software maker OneStream priced its IPO above its range to raise $490M (RT)

South Korea's OCI is considering listing its Malaysian polysilicon unit in a $320M IPO (BBG)

Debt

Occidental Petroleum is planning a $5B bond sale to help fund its takeover of shale driller CrownRock (BBG)

UK pub operator Stonegate Pubs is nearing a $3.9B refinancing agreement and a $258M cash injection from PE owner TDR Capital (BBG)

Ares and HPS will lend $3B to finance Carlyle's potential LBO of Baxter International's kidney-care division (BBG)

Funds including Davidson Kempner will lend $600M to finance a Golden Energy and Resources-led acquisition of an Australian coal mine (BBG)

Cameroon sold $550M in dollar bonds (BBG)

Bankruptcy / Restructuring

Fundraising

Crypto Corner

Exec’s Picks

Whether you're living on the courts like me or are simply out and active this warm summer, there's nothing more ideal than some Wilson fits—the pinnacle of style and performance and my personal favorite! Get free shipping on all orders over $50 today.

Financial Services Recruiting 💼

If you're currently a junior banker looking to break into the buy side, lateral to another investment bank, or consider new paths amid changing market dynamics, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates across private equity, hedge funds, venture capital, growth equity, debt funds, and investment banking.

To get started, simply head over to Litney Partners and create your profile by dropping your resume / filling out the form:

Meme Cleanser

Advertise with us // Visit our merch store // Invest alongside Lit Ventures // Book a call with Lit // Launch your own newsletter