Together with

Good Morning,

Car owners are falling behind on payments at the highest rate on record, European money managers are betting on higher ECB rates, Argentina’s Peronists outperformed expectations in the country’s general election, Hollywood actors and studios restarted contract negotiations, and big tech earnings will put the stock market to the test this week.

SPVs are a useful tool for investors looking to pool capital, but it can be difficult to know where to start. On October 26th, today’s sponsor, Carta, is hosting a free webinar covering all things SPV. Sign up here.

Let’s dive in.

Before The Bell

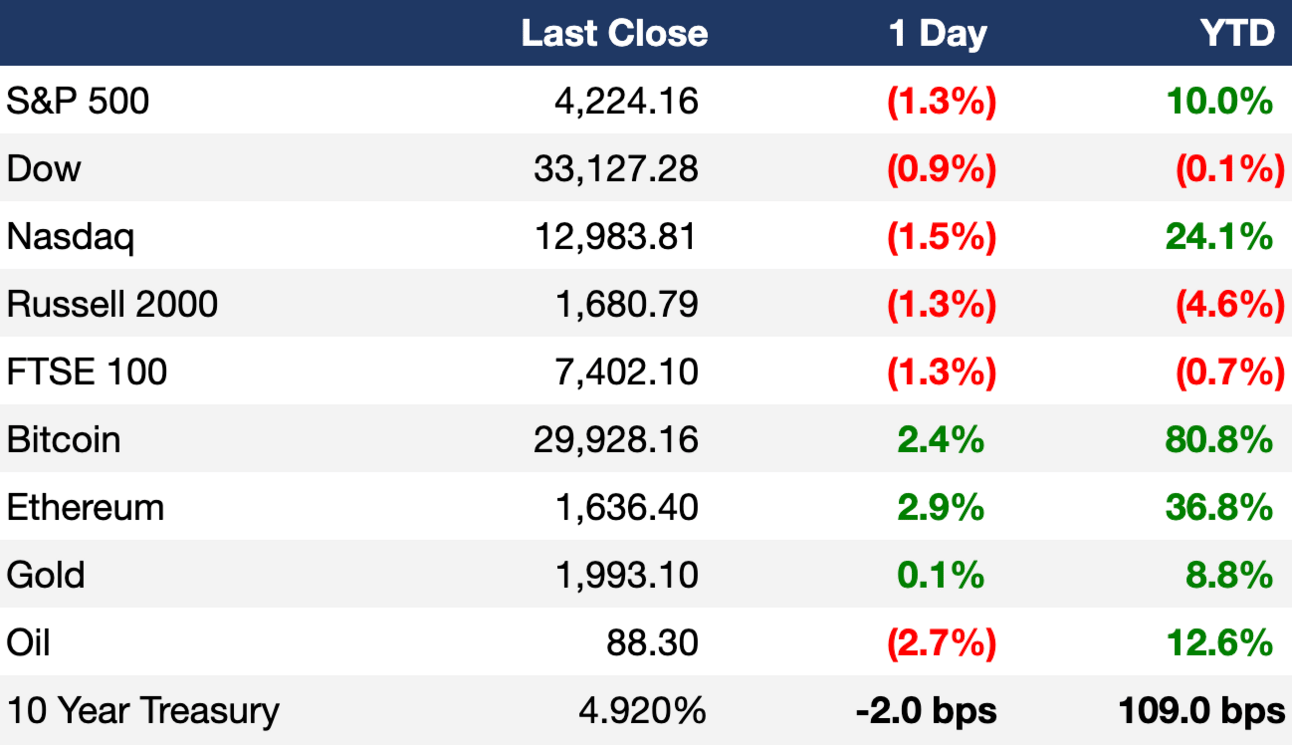

As of 10/20/2023 market close.

Markets

US stocks fell after the US 10Y crossed 5% for the first time since 2007, prompting concerns about the economy

The Nasdaq led indices with a 1.53% decline

European stocks fell, closing on Friday at their lowest level since the start of the year

Bitcoin price jumped above $30k for the first time since July as investors remain bullish after a flurry of spot Bitcoin ETF applications were amended this month

Earnings

American Express shares fell ~5% despite reporting a 12% YoY increase in revenue and Q3 earnings that beat expectations thanks to robust spending from wealthy customers (RT)

What we're watching this week:

Monday: Cleveland-Cliffs

Tuesday: Microsoft, Alphabet, Coca-Cola, 3M, GE, GM, Spotify, Snap, Verizon, Visa

Wednesday: Meta, Boeing, Evercore, Hilton, T-Mobile

Thursday: Amazon, Chipotle, Comcast, UPS, US Steel

Friday: AbbVie, Piper Sandler, T. Rowe Price

Full calendar here

Headline Roundup

Fresh growth numbers are set to show US remains economic powerhouse (BBG)

Europe’s biggest money managers bet ECB rates haven’t hit a peak (BBG)

Car owners fall behind on payments at highest rate on record (BBG)

Argentina’s Peronists soar in election to seal run-off with radical Milei (RT)

Foxconn faces China tax probe amid Taiwan election (RT)

Saudi wealth fund, Hyundai motors agree to build auto plant (BBG)

Hollywood actors, studios to restart contract negotiations (WSJ)

Republican hopefuls crowd into speaker race after Jordan’s exit (WSJ)

Gazprom will boost gas supplies to China, Hungary, CEO says (BBG)

There’s never been a worse time to buy instead of rent (WSJ)

Web Summit CEO Cosgrave quits after Israel controversy (BBG)

Global billionaire tax could yield $250B annually, study says (RT)

Meta, Amazon earnings put stock market to the test (WSJ)

A Message From Carta

Demystify SPVs with Carta

SPVs are a valuable tool for investors looking to pool capital. The problem is that they have so many different uses and structures that it can be difficult to know where to start.

On October 26th at 10 AM PT / 1 PM ET, Carta is holding a free webinar to demystify SPVs for investors.

During the event, they’ll discuss:

Key differences between hosted master-series structures vs. self-managed standalone SPVs

Overview of (some surprising) benefits of SPVs

SPV use cases & insights

Register below to learn how you can maximize SPV benefits for your firm.

Deal Flow

M&A / Investments

Asset manager Blue Owl Capital is considering a potential acquisition of rival lender Hayfin Capital Management, which would help them expand into Europe; a deal would add $32B AUM to Blue Owl (BBG)

EU antitrust regulators resumed their investigation into Adobe’s $20B acquisition of cloud-based designer platform Figma and set a February 5th deadline for their decision (RT)

Merck will acquire the rights to sell Japanese pharmaceutical company Daiichi Sankyo’s three experimental cancer drugs for $4B upfront and up to $22B to market and develop the drug candidates (BBG)

A consortium backed by PE firms Permira and Blackstone is reconsidering their offer for European online classifieds company Adevinta, which has an $11.4B market cap, due to worsening market outlook since September and a price gap between the consortium and Adventina (BBG)

Jazz Pharmaceuticals, which has an $8.6B market cap, is exploring strategic options including a potential sale (BBG)

A consortium led by PE firm RRJ Capital is considering a $5.3B offer for Vodafone Group’s Spanish business (BBG)

Abu Dhabi state fund Mubadala Investment and Japanese oil and gas explorer Inpex are among firms competing to acquire SapuraOMV in a deal expected to be worth ~$1.2B (RT)

Anhui Jianghuai Automobile Group, Nio’s EV-making partner, placed a car factory and other assets worth an estimated $615M up for sale (BBG)

PE firm Omnes Capital put Power Capital Renewable Energy, one of the UK’s biggest developers of solar energy and battery storage, up for sale with an expected valuation of $424M (BBG)

GameSquare, which is backed by Jerry Jones, is acquiring peer Faze Holdings, an esports company once worth $1B, for an estimated $17M in an all-stock deal (RT)

VC

Debut, a vertically integrated synthetic biology company, raised a $40M Series B led by BOLD (VC)

Petfolk, a veterinary care startup, raised a $40M Series B led by Movendo Capital (VC)

Plant-based meat startup Umiami raised a $34.7M round from Bpifrance-SPI, French Partners, KIMA Ventures, and more (FN)

Cosmos Innovation, an AI-first company building perovskite silicon tandem solar cells, raised a $19.7M Series A led by Xora Innovation (FN)

Cionic, a neurotech company, raised a $12M Series A extension led by L Catterton (FN)

Noodle Cat Games, an independent game development studio, raised a $12M Series A led by Hiro Capital (PRN)

AI assistant platform Luzia raised a $10M Series A led by Khosla Ventures (PRN)

Digital personal finance platform Credit Genie raised $10M in financing led by Khosla Ventures (PRN)

Veruna, a startup providing an agency management system built on Salesforce’s CRM platform, raised a $10M Series B led by Berkley Ventures, Guidewire Software, and others (FN)

Web3 metaverse platform Upland raised a $7M Series A extension led by EOS Network Ventures (FN)

K2 Space, a Torrance, CA-based startup building large satellite buses, raised $7M in funding from Alpine Space Ventures (FN)

Skoon Energy, a Dutch startup providing an AI-powered software platform for clean mobile energy, raised a $5.6M Series A led by Blue Bear Capital (FN)

micro1, a startup using AI to hire software engineers, raised a $1.3M round at a $30M valuation led by Dream Ventures (FN)

IPO / Direct Listings / Issuances / Block Trades

Mexican industrial REIT Fibra Uno Administracion is planning to raise ~$1.5B through an IPO in what could be Mexico’s biggest listing in the over 5 years (BBG)

Vietnamese EV maker VinFast entered into a share subscription of up to $1B with US fund Yorkville Advisors to fund expansion in overseas markets (RT)

Russian men's clothing chain Henderson plans to IPO on the Moscow Exchange next month (RT)

Debt

Bankruptcy / Restructuring

Johnson & Johnson is exploring a new bankruptcy filing for its talc-related liabilities using a different corporate structure than the Texas Two-Step filings that failed twice (WSJ)

Crypto Corner

Exec’s Picks

From comprehensive compliance policy templates to over 150 integrations with your core technology services, the Secureframe platform significantly increases the speed with which organizations can confidently begin a SOC 2 audit, without increasing overhead or slowing your team down. Schedule a personalized demo let us show you how.

Ben Carlson wrote about why everyone seems miserable, despite Americans being wealthier than ever.

Ark has finally found a silver lining in their massive ETF losses: years of tax benefits.

Litney Partners - Financial Recruiting 💼💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

Meme Cleanser

Advertise with us // Visit our merch store // Invest alongside Lit Ventures // Book a call with Lit // Launch your own newsletter