Together with

Good Morning,

Senior Credit Suisse bankers are getting bonuses slashed bigly, VC funding is down 50% YoY, Tiger Global tried to sell VC fund stakes, Walmart sees sustained inflationary pressures, Tesla's EV dominance is fading, FedEx is merging its two main delivery networks, and Chamath dropped his 2022 annual letter (and got roasted on twitter for it).

Get economic and market insights from a team of former industry professionals from Bloomberg, UBS, Morgan Stanley, and more by checking out today's sponsor, Tendies Research.

Let's dive in.

Before The Bell

Markets

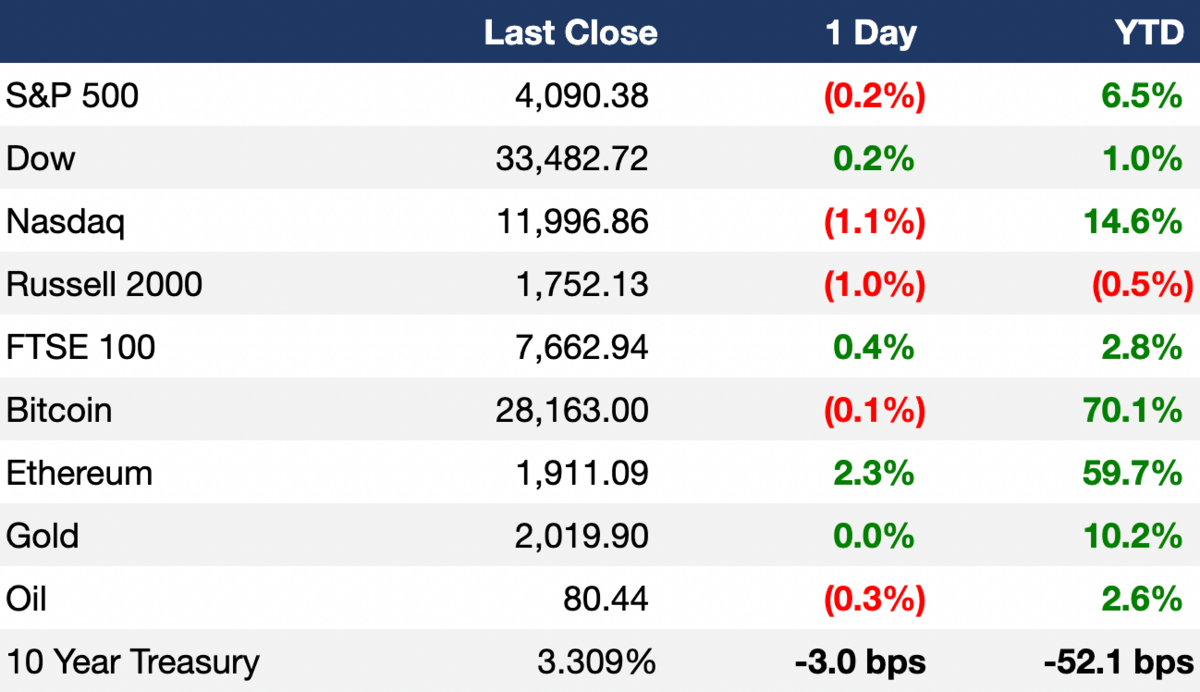

US stocks ended lower yesterday as weak economic data deepened recession fears

Nasdaq recorded a third-straight losing session

AI stocks tumbled after a short-seller attack on C3.ai

Dollar index rose 0.4% after hitting two-month lows

Gold held near a 13-month high to remain above $2k an ounce

Earnings

What we're watching this week:

Today: Constellation Brands, Levi Strauss

Full calendar here

Headline Roundup

New Zealand's central bank unexpectedly raised rates by 50 bps to 5.25% (RT)

US payroll growth slowed more than expected in March (BBG)

Short bets against TD Bank Group hit $4.2B (RT)

VC funding is down 50% YoY (FT)

Gender equality ETFs delivered best performance yet in 2022 (FT)

US-UK CEO pay gap is widening (WSJ)

Qualcomm and Nvidia spar for top spot in AI chip efficiency tests (RT)

Switzerland cut bonuses for ~1k senior Credit Suisse bankers (FT)

Tiger Global tried to sell VC fund stakes in sign of strategy shift (TI)

Tiger Global posts 7.3% Q1 gain after losses in 2022 (BBG)

Walmart sees sustained pressure from inflation (RT)

Vanguard plans to exit its China JV (FT)

Tesla's dominance fades as EV adoption grows (AX)

Exxon believes its decarbonization business could outgrow oil (RT)

Exxon quit drilling in Brazil after failing to find oil (WSJ)

Kirkland & Ellis defies dealmaking slump as revenues reach $6.5B (FT)

Western Alliance deposits fell 11% in Q1 (RT)

FedEx will merge its two main delivery networks in $4B cost cut plan (BBG)

Zuckerberg is spending most of his time on AI (CNBC)

Hawaii is weighing a tourism fee amid environmental concerns (AX)

Cash App founder Bob Lee was fatally stabbed in San Francisco (WSJ)

A Message From Tendies

Institutional Insights for Everyday Investors

Tendies Research was started to remove the barriers preventing individual investors from accessing the research banks and hedge funds use to make decisions. We’ve built a team of former industry professionals, from Bloomberg, UBS, Morgan Stanley, and others to bring daily insights to your inbox, for free.

Our coverage spans across multiple sectors and categories. Commodity articles cover the latest energy, metals, and agricultural news.

Economics coverage provides weekly market reviews with key macro- and micro-economic market drivers. Equities coverage spans across sectors like Banking, Consumer Technology, Healthcare, Biotech, and Retail.

Thought-provoking Opinion pieces dive deeper into topics few outlets cover, and Special Reports provide distilled, institutional quality equity research to our readers.

Start making investing decisions like a pro, and check out Tendies Research here.

Deal Flow

M&A / Investments

FDIC hired BlackRock to sell $114B of SVB and Signature Bank securities portfolios (YH)

PE firm NGP Energy Capital Management is exploring the sale of two Permian Basin-focused oil producers that could collectively fetch $7B+ (RT)

A Mexican state-owned fund is buying the bulk of Iberdrola's Mexican power-generating assets for $6B (FT)

E-sports and games company Savvy Games agreed to buy mobile game maker Scopely for $4.9B (AX)

Apollo is among potential buyers for British telecom group Vodafone’s Spanish unit that could be worth $4B+ (BBG)

Offshore drilling contractor Vantage Drilling International is exploring strategic options including a potential sale; it has a market value of ~$207M (BBG)

British gambling group Entain agreed to buy sports media business 365scores for up to $160M (RT)

Germany’s Deutsche Telekom now holds a majority stake in US mobile provider T-Mobile (RT)

PE firm Aurelius agreed to buy LSG Group, the airline catering business of German airline Lufthansa (BBG)

Japanese restaurant group Toridoll offered to buy restaurant- and food services-focused investment firm Fulham Shore, sending shares up 33% (BBG)

Chemical producer Versalis entered exclusive talks to buy the part of Italian chemical group Novamont it does not already own (RT)

The Raine Group, a merchant bank focused on TMT, agreed to acquire SF-based boutique investment bank Code Advisors (WSJ)

VC

Cybereason, a Boston-based XDR company, raised $100M in funding led by SoftBank (FN)

Oxos Medical, a medtech startup developing X-ray solutions, raised a $23M Series A led by Parkway Venture Capital and Intel Capital (FN)

4.screen, a provider of a driver interaction platform, raised a $23M Series A led by S4S Ventures and Continental Corporate Venture Capital (FN)

Mojo Vision, a startup building smart contact lenses, raised a $22.4M Series A from NEA, Khosla Ventures, Dolby Family Ventures, Liberty Global Ventures, and others (TC)

E-mobility startup Magenta Mobility raised a $22M Series A-1 led by bp ventures (FN)

Vytelle, a Lenexa, KS-based precision livestock company, raised a $20M Series B led by Forage Capital Partners (FN)

Strivacity, a low-code customer identity and access management (CIAM) solution, raised a $20M Series A-2 led by SignalFire (FN)

Felix, a Canadian startup providing on-demand treatment for everyday health, raised a $13.4M Series B led by BDC Capital (BW)

Brizo Data, a data and analytics company for the foodservice industry, raised a $9M Series A led by FRAMEWORK Venture Partners and BDC Capital's Industrial Innovation Venture Fund (PRN)

Spendflo, the provider of a SaaS buying and management solution, raised an $11M Series A led by Prosus Ventures and Accel (FN)

LightMetrics, a Bengaluru, India-based video telematics solution company, raised $8.5M in funding from backers including Sequoia Capital India (FN)

Forefront RF, a UK-based fabless semiconductor startup, raised an $8.4M round from BGF, Science Creates Ventures, and more (FN)

Clue, a Berlin-based period tracker and reproductive health companion, raised a $7.6M round led by Balderton Capital and Union Square Ventures (FN)

Kashet, a Switzerland and London-based digital finance services firm, raised ~$6.8M in funding led by Joint CEO Chris Jones (FN)

UK-based technology group KCA Holdings raised $6.6M in funding from BGF (FN)

Helical Fusion, a Tokyo-based provider of a helical fusion reactor, raised a $6M seed round led by SBI Investment (FN)

Teton.ai, a Copenhagen, Denmark-based health tech startup building an AI companion for nurses, raised $5.3M in funding led by Plural (FN)

Dr. B Dental Solutions, a premium oral care brand for denture, implant, and removable dental appliance users, raised $5M+ in seed funding from backers including the Hall Group (FN)

Iteration X, a collaboration platform for teams to iterate on products and websites, raised a $4.7M seed round led by Connect Ventures (PRN)

Flyby Robotics, a drone delivery company, raised a $4M pre-seed round led by MaC Venture Capital (PRN)

Zero Cow Factory, a New York-based biotechnology company producing animal-free protein and dairy products, raised a $4M seed round led by Green Frontier Capital, GVFL and piVentures (FN)

Eli Health, a Montreal-based healthcare tech startup, raised $3.7M in funding led by Muse Capital (FN)

Web3 community engagement platform Zealy raised a $3.5M pre-seed round led by Redalpine (FN)

Marketing tech provider for the drinks and hospitality sector MRM Global raised $2.5M in funding from BGF (FN)

Coast, a demo platform for ‘API-first’ companies, raised a $2.1M seed round from Y Combinator, Liquid2 Ventures, GTMfund, Brickyard, and others (TC)

IPO / Direct Listings / Issuances / Block Trades

Debt

A group of banks led by Goldman Sachs offloaded $3.84B of Citrix bonds at a discount of 79 cents on the dollar for an all-in yield of 14.047% (BBG)

Mexican conglomerate Grupo Carso plans to raise up to $250M in a local bond sale (LF)

ADNOC is considering reviving dollar-denominated bond issue plans (NDQ)

Fundraising

Morgan Stanley is seeking $2B for its latest junior debt fund (WSJ)

VC firm Bidra raised $200M to back sustainable ag and energy startups (AGF)

VC firm Ensemble raised a $100M debut fund to bet on startup teams (TC)

VC Equator secured $40M in commitments for a fund targeting climate tech startups in Africa (TC)

Indian seed-stage VC firm Speciale Invest launched a first growth fund at $24M (DSA)

Crypto Corner

Dubai is tightening scrutiny of crypto license seekers (BBG)

Binance rejected Justin Sun’s proposal to buy his stake in rival exchange Huobi (CD)

Switzerland-owned bank PostFinance will offer customers crypto (CD)

Crypto-focused Menai Financial Group is shuttering is market-making business in London and Tokyo (CD)

Exec's Picks

The Collison brothers published an insightful letter for Stripe's 2022 annual report.

Jason Zweig published a great piece detailing the seven virtues of great investors.

Chamath Palihapitiya dropped his annual letter discussing the macro environment, his view on the future of several industries, and his SPAC business implosion (SC)

Just discovered Patent Drop, a new newsletter that investigates Big Tech patents to uncover below-the-source trends. Sign up here.

Litney Partners - Financial Recruiting 💼💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

Meme Cleanser

Thinking of starting your own newsletter? Beehiiv is the best platform for creators, period. Click here to get started building your own audience.