Together with

Good Morning,

AI is boosting BofA bankers' productivity, Goldman is set for its best M&A performance this century, Deutsche Bank unveiled plans to become Europe's 'champion in banking,' UBS talked to Bessent about moving their HQ to US, HRT's trading revenue surged to a record high, and Trump suddenly came out in support of releasing the Epstein files.

Join Plaid experts to explore what 2,000+ consumers want next – and how listening to their expectations can be your 2026 advantage. Tune in.

Let's dive in.

Before The Bell

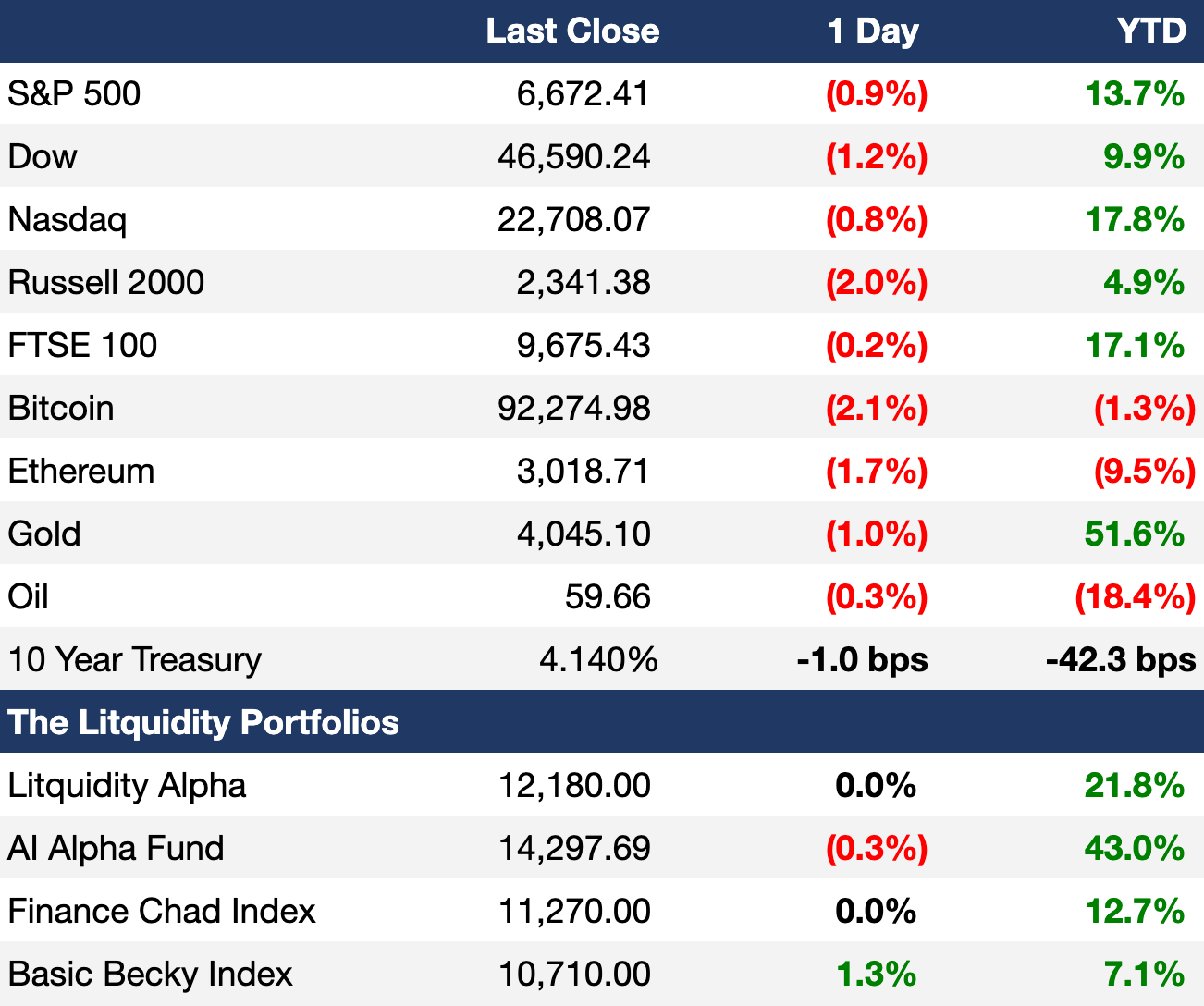

As of 11/17/2025 market close.

Learn more about the Litquidity portfolios and subscribe to the strategies on Autopilot.*

Markets

US stock indexes pulled back further yesterday as the tech selloff resumed

UK 10Y gilt yields surged 14 bps to 4.6% in its worst day since July on fiscal policy concerns

South Africa bond yields fell to the lowest-ever after a rare credit rating increase

Japanese yen weakened to its lowest-ever versus euro

Bitcoin lost $600B in market cap after falling from its October high to erase all YTD gains

Earnings

What we're watching this week:

Today: The Home Depot, Baidu, Klarna

Wednesday: Nvidia, Target, Bullish, TJX, Palo Alto Networks

Thursday: Walmart, Webull

Full calendar here

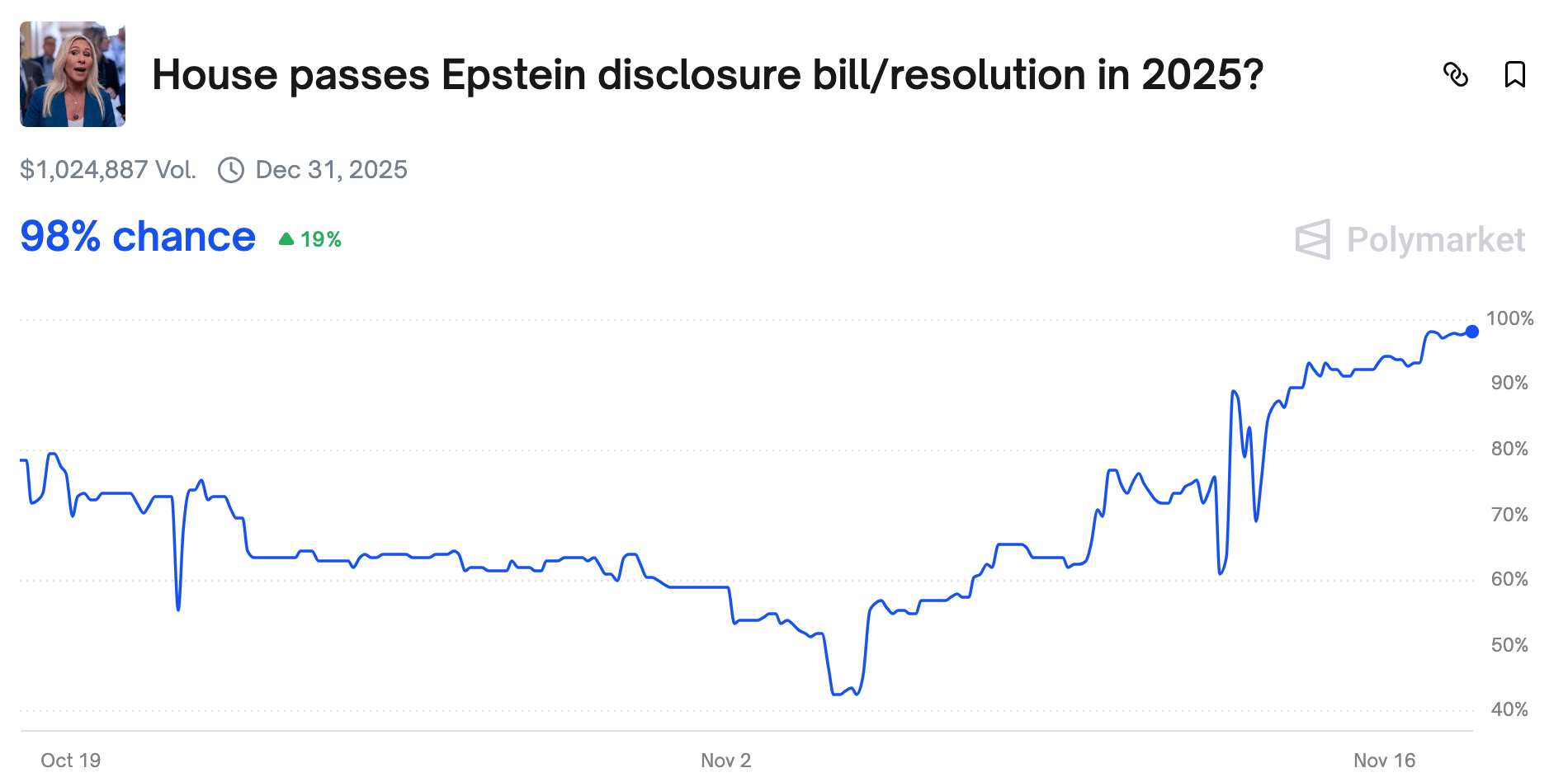

Prediction Markets

Trump threw in the towel on the Epstein files.

Track and trade live odds on Polymarket.

Headline Roundup

A quiet Wall Street force fueled the $17T alternatives boom (BBG)

Goldman Sachs is set for its best M&A performance in 24 years (FT)

BofA says AI is boosting bankers' productivity, revenue (RT)

Fed governor Kugler's exit came amid forbidden trading activity (RT)

Trump supports bill to release Epstein files (WSJ)

Lackluster returns dampen outlook for US firms waiting on IPOs (BBG)

Distressed firms' earnings are falling too fast for quick fixes (BBG)

Private credit is pushing re-insurers into riskier business (FT)

'Ugly' technicals put US stock rally at risk of correction (BBG)

Retail investors' dip-buying confidence is waning (RT)

Impending layoff notices surged to the highest level ever (BBG)

SEC will permit firms to exclude shareholder proposals from proxies (FT)

China raised gold reserves by 15 tons in September (BBG)

UBS chair talked to Bessent about moving bank to US (FT)

Deutsche Bank unveiled plan to become 'European champion in banking' (FT)

CalPERS adopts new approach to assess risk and returns (FT)

HRT trading revenue surged to a record $3.7B (BBG)

Jeff Bezos will serve as co-CEO at AI startup Project Prometheus (TC)

HSBC board is at odds over candidates to succeed Mark Tucker as chair (FT)

EY named Dante D'Egidio as US managing partner (WSJ)

US is investigating firm that borrowed $400M from BlackRock's HPS (FT)

ECB board revamp exposes diversity failings that could impact policy (RT)

Number of new international students in US fell by 17% (FT)

A Message from Plaid

Wanna know our new favorite game?

It's not 'follow the leader'… it’s 'follow the user.'

This same game is used by top fintech companies to stay ahead of the competition, and the concept is simple: Instead of trying to decide what's next for the category, just listen to what consumers are looking for—and watch your competitive advantage skyrocket.

Lucky for you, Plaid is making the game easier than ever with their latest free Fintech Tech Talk. Their experts talked to 2,000+ consumers to find out what they want in 2026 and beyond.

Learn how to:

Turn expectations into product strategy

Align teams around AI, open banking, and financial education

Bridge the gap between consumer wants and needs

For anyone looking to develop fintech products for the future and strategically plan for 2026, this is a must-watch.

Deal Flow

M&A / Investments

Chevron and Carlyle are exploring options to buy global assets from sanctioned Russian oil giant Lukoil in a potential $20B deal

Dutch paints giant Akzo Nobel is in talks to merge with peer Axalta Coating Systems to form a ~$17B paint giant

PE firm CD&R agreed to take-private packaging firm Sealed Air at a $10.3B valuation, representing a 16% premium

French O&G giant TotalEnergies acquired 50% of portfolio of assets owned by Czech investment fund Energeticky a Prumyslovy for $5.9B

PE firm Thoma Bravo offered to acquire $6B-listed financial services software maker Clearwater Analytics

HICL Infrastructure and The Renewables Infrastructure Group agreed to merge to form UK's largest listed infrastructure investor worth ~$5.2B

Johnson & Johnson agreed to acquire cancer treatment biotech Halda Therapeutics in a $3.05B all-cash deal

University of California's investment arm UC Investments is in talks with NCAA D1 conference Big Ten universities over a $2.4B partnership centered around media rights

Accounting firm Grant Thornton is considering options for its Grant Thornton Bharat India unit, including a minority stake sale to PE or merger with its PE-backed US or Europe operations at an over $2B valuation

Bain Capital agreed to acquire private golf club operator Concert Golf Partners from Clearlake Capital for $1.3B, including debt

Residential buildings product manufacturer Gibraltar Industries agreed to acquire roofing products manufacturer OmniMax from Strategic Value Partners for $1.34B cash

Saudi's Arada Developments acquired an 80% stake in a London development Thameside West, which has a $3.2B development value

PE firm Lone Star acquired a portfolio of UK properties from UK wealth manager St. James's Place in a $527M deal

Comcast's media spinout Versant is exploring a sale of youth-sports app SportsEngine at a $400M-$500M valuation

MTY Food Group, the franchisor of restaurant chains such as Cold Stone Creamery, is exploring a sale

French cosmetics giant L'Oreal acquired a minority stake in mass-market Chinese skincare brand Lan

Siemens Healthineers, the medical equipment unit spinning off from German engineering conglomerate Siemens, is weighing a sale of its diagnostics business

UK law firm Ashurst and US law firm Perkins Coie agreed to merge to form a major global legal powerhouse

Top VC picks by Fundable

Online marketplace Faire is selling secondary shares at a $5.2B valuation led by WCM Investment Management as it eyes an IPO

Project Prometheus, an AI-for-the-physical-economy startup, raised a $6.2 billion funding round backed in part by Jeff Bezos

Alembic Technologies, a Causal AI platform company, raised a $145M Series B and growth funding round led by Prysm Capital and Accenture

GenAI startup Sakana AI raised a $135 million Series B led by MUFG

Gridware, a grid-monitoring hardware startup, raised a $55M growth round led by Tiger Global and Generation Investment Management

Nurse-focused AI startup Voize raised a $50M Series A round led by Balderton Capital

Infinite Orbits, a GEO satellite servicing startup, raised a $46M round from the EIC, Matterwave Ventures, and more

AI-native developer intelligence startup Span raised a $25M Seed and Series A round from Alt Capital, Craft Ventures, SV Angel, and more

PowerLattice, a power-saving chiplet startup, raised a $25M Series A led by Playground Global and Celesta Capital

Micronic precision printing startup Hummink raised a $17M funding round co-led by KBC Focus Fund, Cap Horn, and Bpifrance

Food-AI startup AKA Foods raised a $17.2M seed round led by Alex and Michael Bronstein

Mate, a cybersecurity startup, raised a $15.5M seed round led by Team8 and Insight Partners

AI agent security startup Runlayer raised an $11M seed round from Khosla Ventures

Keychain, an AI platform for private-label product development, secured a $10M investment from W23 Global

BluePill, an AI consumer-insights startup, raised a $6M seed round led by Ubiquity Ventures

GPU compiler optimization startup Luminal raised a $5.3M seed round led by Felicis Ventures

Get real-time updates on any startup, VC, or sector, only on Fundable.

IPO / Direct Listings / Issuances / Block Trades

Aluminum maker China Hongqiao is seeking to raise $1.2B in a share sale at a 9% discount

Australian mining firm Hancock Prospecting increased its stake in US rare earths miner MP Materials to 8.4%, valuing the holding at $1B

UAE SWF ADIA is seeking to sell a 5% stake in Qatari telecoms firm Ooredoo in a secondary share sale that could raise $572M

Novo Holdings, a vehicle for the Novo Nordisk Foundation, is set to exit its remaining 7.8% stake in UK medtech firm Convatec in a $460M block trade

Japanese streetwear brand Human Made raised $115M at a $460M valuation in a Japan IPO priced at the top of a marketed range

Peter Thiel's hedge fund Thiel Macro sold its entire stake in Nvidia worth $100M

'Baby Shark' maker Pinkfong raised $53M in its Korea IPO

Broadcasting giant Sinclair acquired an 8.2% stake in local TV broadcaster E.W. Scripps for $15M, with Sinclair eyeing a potential acquisition

Welsh Carson-backed diagnostic imaging provider Lumexa Imaging filed for an IPO

AE Industrial Partners-backed satellite firm York Space Systems filed for an IPO

Debt

KKR agreed to purchase $75B of European BNPL loans from PayPal

Amazon raised $15B in its first dollar bond offering in three years

JPMorgan and Bank of America are among banks providing $7.9B in debt financing to back CD&R's $10.3B LBO of Sealed Air

China began marketing $4.6B of euro-denominated sovereign bonds

RBC Capital Markets is leading an effort to raise $1B in private credit to finance Novacap's $1.9B acquisition of Integral Ad Science

Jefferies is seeking buyers for $1.2B of debt for power infrastructure companies Forgent Power Solutions and Central Moloney to refinance debt

Indonesian energy firm Chandra Asri Pacific secured a $750M private credit package from KKR to support its acquisition of ExxonMobil's Esso-branded gas station network in Singapore

Colombia is looking sell eurobonds to fund another debt buyback

Bankruptcy / Restructuring / Distressed

UK utility Castle Water made an improved bid for struggling peer Thames Water, offering a cash injection of $1.3B above current proposals

Distressed Hong Kong developer New World Development is set to cut perpetual security debt by $1B via a swap

Brazilian PE firm Fictor agreed to buy troubled Brazilian lender Banco Master for $560M in a second attempt to save the bank

Trade finance platform Raistone is looking to sell itself after the collapse of its biggest client First Brands

Compass Diversified-backed high-end jewelry boutique operator Lugano filed for bankruptcy and sued its ex-CEO for stealing millions

New Fortress Energy is in talks with creditors over a forbearance agreement

JPMorgan is shuttering VW Pay, the payments platform is acquired from Volkswagen, amid lack of profitability

Fundraising / Secondaries

South Africa's $175B pension Public Investment Corp. is in talks with SWFs to co-invest across Africa

Warburg Pincus raised $12B for a targeted $17B global PE fund

European PE firm CVC raised $7B for its sixth secondaries fund it continues to expand into the market

Pension MainePERS is seeking to offload ~$1B of natural resources LP stakes in secondary markets as it streamlines its real assets exposure

European biotech VC Sofinnova Partners raised $755M for its eleventh flagship fund

The LegalTech Fund, a VC that invests in early-stage legal technology startups, raised $110M for its second fund

UK litigation finance fund Nera Capital raised $50M for a debut litigation secondaries fund

Crypto Sum Snapshot

Stocks go 24/7 in crypto betting markets with 100x leverage via perpetual swaps

Major crypto exchanges have moved ~$30B for money launderers, drug traffickers, and hackers to date

Run on stablecoins could force ECB to rethink interest rates

SEC dropped emphasis on crypto sector for 2026 oversight agenda

Strategy acquired $835M Bitcoin in its largest transaction since July

Bitcoin, Ethereum, Solana fall as crypto crisis deepens

Altcoins dropped to Covid-era lows

Crypto Sum compiles the most important stories on everything crypto. Read it here.

Exec’s Picks

Bloomberg Odd Lots sat down with 'Bond King' Jeff Gundlach to hear his stance on the current state of markets. The main takeaway: all assets are overpriced. Tune into their conversation here.

Also, just how big is the wealth effect? Callie Cox shared her take on the college-level economics concept to make sense of the booming stock market and pessimistic economic outlook.

Upcoming Events🥂

Paradise Portfolio: Cocktails, Conversation, and Costa Rica

Join us for cocktails this Wednesday, November 19 at Tommy Bahama Restaurant & Bar in NYC as we bring together New York's most discerning investors, real estate professionals, and lifestyle enthusiasts to discuss some interesting real estate and investing opportunities. Spots are limited. RSVP here.

Financial Services Recruiting 💼

If you're a junior banker looking for your next career move, check out Litney Partners, a recruiting firm established by Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates across private equity, hedge funds, venture capital, credit, family offices, fintechs, and investment banking.

We're currently seeking talent for some incredible roles. Head over to Litney Partners to drop your resume / create your profile and we'd love to get in touch!

Meme Cleanser

🛒 Merch Store: Visit our merch store to shop our latest apparel, shoes, bags, accessories and more.

💵 Litquidity Ventures: Accredited investors & qualified purchasers within the Litquidity community can gain access to alternative investments such as venture, late-stage growth, and private equity through Litquidity Ventures. Interested? Fill out this form.

☎️ Book a call with Lit: Want to pick Litquidity's brain on business advice, insights, or just chat to say what's up? Buy his time here.

📧 Launch your own newsletter: Have great content ideas and looking to launch your own publication? We highly recommend beehiiv to get started.

*DISCLAIMER: Investment advice provided by Autopilot Advisers, LLC ("Autopilot"), an SEC-registered investment adviser. Past performance does not guarantee future results. Investing carries risks, including loss of principal. As always, be smart out there. Litquidity is compensated to promote AutoPilot. Compensation details available upon request.