Together with

Good Morning,

PwC is requesting silence in exchange for voluntary severance, retail traders are pushing India equity options volumes above S&P 500, dozens of biotechs are lining up IPOs, KKR will join the S&P 500, and GM is leaning on Costco to drive EV sales.

With yet another misguided banking policy being pushed in Congress, The Points Guy explains why your credit card rewards and points are at threat of further decimation. Read more below.

Let’s dive in.

Before The Bell

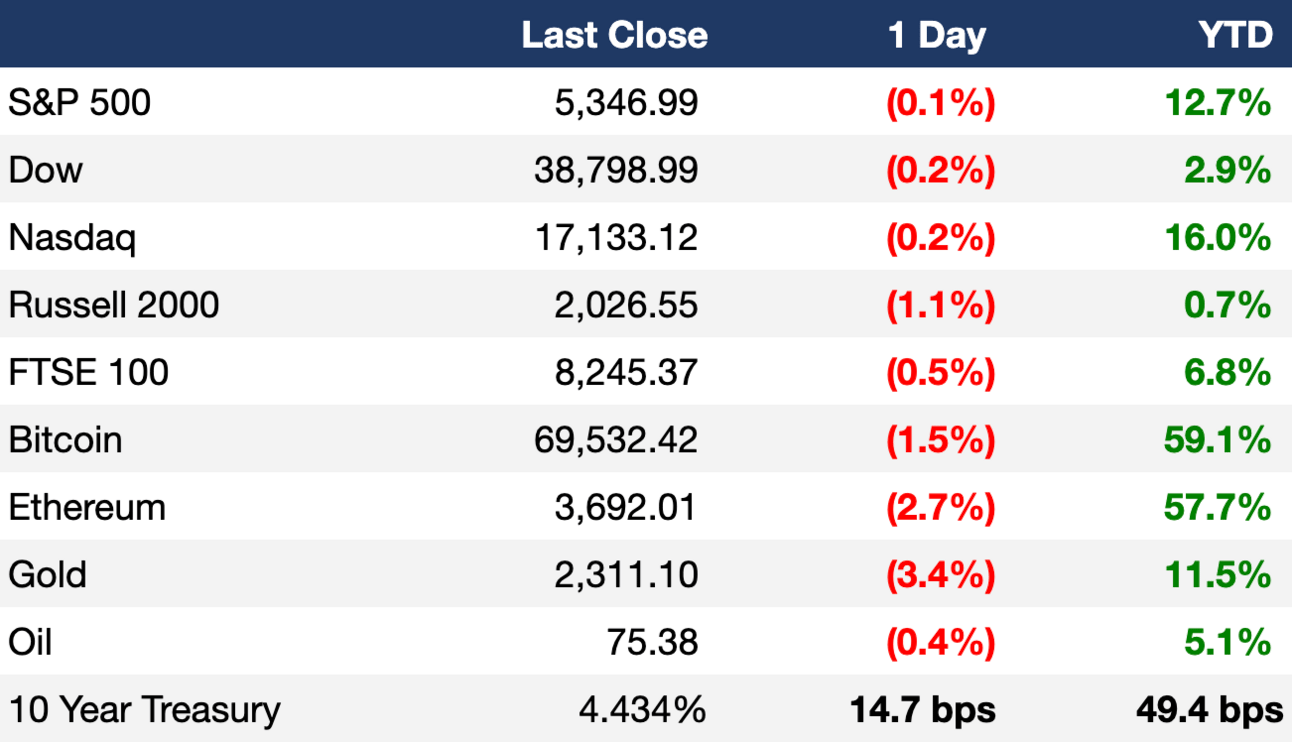

As of 06/07/2024 market close.

Markets

US stocks slipped on Friday after a stronger-than-expected jobs report dimmed hopes of a Fed rate cut

All three major US indexes notched a winning week

Traders slashed odds of a September Fed rate cut from 70% to 56%

Canada's TSX fell for a third-straight week on a rebounding dollar

US yields rose ~15 bps for their biggest one-day jump in two months

Oil steadied after a weekly drop

Euro fell to a one-month low

UK carbon credit futures are trading at YTD highs on speculation of a Labour party election victory

Earnings

Headline Roundup

PwC asks laid off staff to keep silent (FT)

Equity listings in Dallas are no laughing matter (WSJ)

US added 272k jobs in May, dimming rate cut hopes (RT)

Activist Elliott built a $2B stake in Southwest Airlines (WSJ)

Top Moelis banker punches woman in apparent Brooklyn altercation (BBG)

Retail traders push India stock option volumes above S&P 500 (FT)

Hedge fund shorts on European government bonds hit a two-year high (FT)

Biotechs line up IPOs in bullish sign for US IPO market (FT)

Emerging market traders flock to local debt as elections upend FX bets (BBG)

CrowdStrike, KKR and GoDaddy will join the S&P 500 (RT)

Norway's $1.3T wealth fund to vote against Musk's $56B Tesla pay package (RT)

US bond funds saw their largest weekly inflow in four weeks (RT)

Billionaires Mittal and Ambani take on Musk in India’s internet space race (FT)

GM partnered with Costco to drive EV sales (CNBC)

Shein's pre-IPO charm offensive hits roadblocks in Europe (RT)

Japan banks to divest strategic Toyota shareholdings worth $8.5B (RT)

60% of Aramco's $11.2B share sale went to foreigners (BBG)

Shari Redstone receives fewest votes in Paramount board election (RT)

Bill Gross seeks record $20M sale of stamp collection (FT)

US household wealth hit a record $160T in Q1 (RT)

Far-right makes significant gains in European parliament elections (FT)

Research shows hybrid work is as valuable as a raise (CNBC)

A Message From The Points Guy

The Durbin Amendment of 2010 virtually wiped out debit card rewards overnight...and a perpetually misguided Congress is pushing repeat legislation to now encroach on your credit card points and rewards.

Under the guise of competition, the Credit Card Competition Act will allow corporate megastores to process your spending on cheaper payment networks, which could eliminate incentive for your favorite credit card issuers to reward your spending with points.

A slew of research shows similar legislation in the Durbin Amendment not only failed to reduce debit card swipe fees, but effectively ended the means by which banks would reward our debit spends with points.

And with repeat legislation being pushed again, the CCCA all but guarantees retailers to now also pocket your credit card swipe fees, and eliminate the benefits associated with your favorite credit cards...

...practically carving you out of your preferred network to earn you:

Fewer points 🔻

Higher fees 📈

Fewer rewards 🔻

Find out why the CCCA is a recipe for fewer points, higher fees, and fewer rewards and what you can do to protect your points.

Deal Flow

M&A / Investments

Bain Capital agreed to take education software firm PowerSchool private in a $5.6B cash deal, including debt (WSJ)

EU will investigate UAE-controlled telecoms group e&'s proposed $2.4B acquisition of Czech PPF Group’s telecoms assets in Eastern Europe (FT)

Marketing SEO software firm Yext, which has a ~$650M market cap, is exploring a sale after attracting takeover interest (RT)

PE firm TDR Capital will acquire Zuber Issa's 22.5% stake in UK supermarket chain Asda for an estimated ~$636M to gain a majority 67.5% stake (FT)

Digital asset marketplace Bakkt, which has a $255M market cap, is exploring a potential sale (BBG)

Fidelity and Singapore's Temasek acquired a $200M stake at a $5B valuation in Indian eyewear retailer Lenskart (TC)

Italian bad loan manager doValue will acquire rival Gardant in a cash-and-stock deal (RT)

LatAm financial services firm Banco BTG Pactual is nearing a deal to acquire a wealth-management bank in New York (BBG)

VC

Legal AI-startup Harvey is weighing raising a $600M round at a $2B valuation and acquiring legal research firm vLex (TI)

AI-powered cybersecurity platform Seven AI emerged from stealth with a $36M seed round led by Greylock (WSJ)

Unify, a platform that finds the best LLM for every prompt, raised an $8M round led by Y Combinator, Essence, A Capital, and more (FN)

Browserbase, an AI-first, headless web browser API, raised a $6.5M seed round led by Kleiner Perkins (VC)

Retail SaaS startup Dealt raised a $6.6M Series A led by La Poste Ventures and Go Capital (EU)

IPO / Direct Listings / Issuances / Block Trades

Gamestop announced a stock offering worth over $3B (RT)

Health-care payments software maker Waystar's shares fell 3.7% in its trading debut after its $968M IPO, the biggest YTD by a US company (BBG)

India's Bajaj Housing Finance, a unit of non-bank lender Bajaj Finance, filed for a local IPO to raise up to $838M (RT)

SoftBank-backed South Korean travel app Yanolja is aiming for a $400M July US IPO at an up to $9B valuation (BBG)

Walgreens Boots Alliance shelved plans for a potential IPO of its UK drugstore chain Boots (BBG)

Debt

Tech-focused PE firm Thoma Bravo is soliciting private credit lenders for a $3.5B refinancing of professional services SaaS firm ConnectWise (BBG)

Blackstone is in talks with private credit lenders to raise up to $2.8B in financing for its AV and event-services company Encore Group (BBG)

Italy’s Open Fiber is set to secure $2.2B through debt and equity funding to relieve financial strains (BBG)

Private credit lenders including Ares, HPS, Blackstone, and Blue Owl will finance Bain Capital's $5.6B acquisition of PowerSchool (BBG)

Bankruptcy / Restructuring

Fundraising

Crypto Corner

Exec’s Picks

Reuters published an insightful profile on Keith Gill, the online influencer sending GameStop shares soaring again.

Litney Partners - Financial Recruiting 💼💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

Meme Cleanser

Advertise with us // Visit our merch store // Invest alongside Lit Ventures // Book a call with Lit // Launch your own newsletter