Together with

Good Morning,

Biden announced up to $10k in student loan debt relief for millions, SPACs are in the gutter, the labor market has been crushing it this year, investors are running away from hedge funds, Tesla enacted a 3-1 stock split, there's an ETF where you can invest in betting, alcohol and pharma companies, the PGA is expanding benefits to pull golfers back from LIV, and Tiger Woods / Rory McIlroy are launching their own golf league.

Happy student loan cancellation day to those who celebrate.

Let's dive in.

Before The Bell

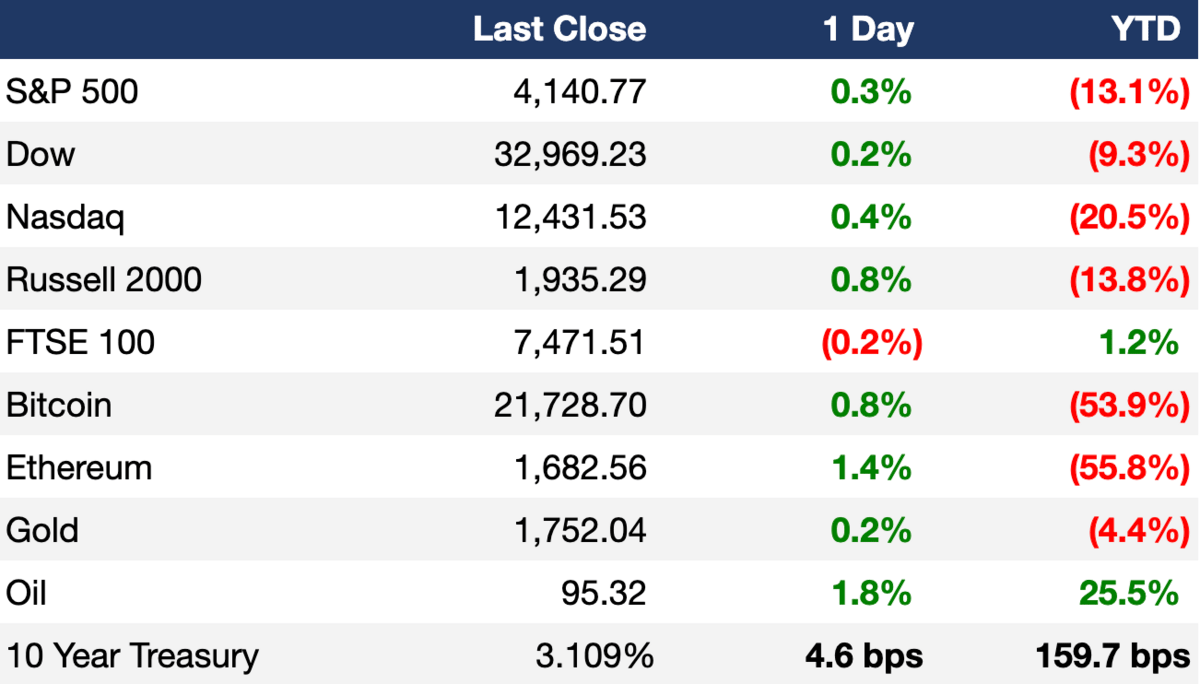

As of 8/24/2022 market close.

Markets

Stocks edged higher on Wednesday to snap a three-day losing streak

The energy sector of the S&P 500 led the day’s gains, rising around 1%

In Asia the major benchmarks declined, with the Shanghai Composite Index and Hong Konh’s Hang Seng down 1.9% and 1.2%, respectively

The Fed’s annual Jackson Hole symposium begins today, with Jerome Powell set to speak on Friday

Earnings

Nvidia came up short on Q2 earnings expectations and reduced its Q3 forecasts; the company’s stock fell ~4.4% after hours (YHOO)

Salesforce reported earnings and revenue that topped expectations but gave a disappointing forecast for fiscal 2023, causing its stock to fall ~7% after hours (CNBC)

What we’re watching today: Peloton, TD Bank

Full calendar here

Headline Roundup

Biden cancels up to $20K in student loans for Pell Grant recipients, $10K for millions of others (AX)

The IRS will waive late-filing penalties and issue $1.2B in refunds to 1.6M taxpayers (WSJ)

Employers added about 462k more jobs in the year through March than the Labor Department originally estimated (WSJ)

Investors withdrew a net $7.8B out of hedge funds in Q2 (RT)

Canada’s seed investment volume increased 30% in Q2, an opposite pattern to US (TC)

SPAC winter is so bad one advisor opened a liquidation business (BBG)

China halted over 20 IPOs sponsored by China Merchants Securities amid probe (RT)

New orders for durable goods in July were unchanged MoM at $273.5B (WSJ)

Emerging nations’ foreign reserves shrunk by $379B this year through June (WSJ)

California will ban the sale of new gas cars by 2035 (NYT)

UAE healthcare provider Burjeel plans to invest ~$1B in Saudi Arabia by 2030 (BBG)

Tesla enacted a 3-for-1 stock split after Wednesday’s closing bell (WSJ)

Peloton will begin selling its fitness equipment and apparel on Amazon (WSJ)

~65% of restaurant operators don’t have enough employees to support customer demand (WSJ)

Ex-RBC worker arrested for death threats to women colleagues (BBG)

PGA Tour is bolstering prizes and expanded benefits to gain loyalty from players flocking to new rival LIV Golf (CNBC)

Tiger Woods and Rory McIlroy announced a new golf league called TGL, that will tee off in January 2024 (FOS)

A Message From Kalshi

Trade directly on student debt

Kalshi has created an entirely new asset class – the event contract – letting you trade the outcomes of world events on a fully CFTC-regulated exchange.

Previously, hedging or speculating on real-world outcomes was an inaccurate and expensive process, reserved for institutions using complex derivatives — but no longer.

Inflation, the Fed, gas prices, Biden's approval rating, entertainment, weather, travel — you name it, there’s a market for it on Kalshi. One we’re watching? Biden’s decision on student loan forgiveness, which will impact an estimated 40 million people. Over the last few weeks, the odds of Biden extending forbearance past the end of August jumped up from 70% to 90%.

The most exciting part? Studies show that the “wisdom of the crowd” generates better predictions than experts, and Kalshi’s markets are already outperforming economists.

Deal Flow

M&A / Investments

French industrial conglomerate Schneider is considering buying out the remaining 40% minority stake in software company AVEVA, which has a current $10.1B market cap (RT)

Investment firms EQT, KKR, Gaw Capital, PAG and Stonepeak are bidding for data center company Global Switch, which is expected to attract a ~$10B valuation (BBG)

India is weighing a 51%+ stake sale in state-backed IDBI Bank, currently valued at $5.3B (BBG)

Global mining giant Rio Tinto increased its offer for smaller peer Turquoise Hill Resources to $3.1B (BBG)

E-commerce company Farfetch acquired a 47.5% stake in online retail business YNAP from Swiss luxury conglomerate Richemont, the sale was a $2.7B writedown for the latter (BBG)

Blackstone is among several bidders for British rock band Pink Floyd's ~$500M catalog (RT)

Vietnamese retailer Mobile World is planning a 20% stake sale of grocery chain Bach Hoa Xanh at a $1.5B valuation (RT)

Singapore infrastructure conglomerate Keppel will buy an 80% stake in Singapore waste management firm 800 Super at a $273M valuation (RT)

Brazilian bank Banco Bradesco will buy 51% of smaller peer Banco BV's broker BV DTVM (~$8B AUM) and create an independent asset management firm (RT)

Britain's Octopus Energy bought a 24% stake in large-scale battery developer and solar power firm Exagen (BBG)

The British leadership of Dutch state railway Nederlandse Spoorwegen will acquire the railway's UK unit Abellio UK via a management buyout (BBG)

VC

Equipment service platform Servify raised a $65M Series D led by Singularity Growth Opportunity Fund (BBG)

Nitra, a fintech company focusing on the healthcare industry, raised a $62M funding round from a16z, New Enterprise Associates, and others (PRN)

Carbon Direct, a science-first carbon management firm and software provider, raised a $60M funding round led by Decarbonization Partners (BW)

Zilliz, a China-based vector database for enterprise AI, raised a $60M Series B extension led by Prosperity7 Ventures (BW)

Petfolk, a veterinary care practice, raised a $40M Series A led by White Star Capital and angel investor Michael Wystrach (PRN)

Lily AI, an AI-platform helping retailers increase sales, raised a $25M Series B led by Canaan (TC)

Plume, a provider of virtual health care services for the transgender community, raised a $24M Series B led by Transformation Capital (PRN)

Spectral, a credit risk assessment infrastructure web3 startup, raised a $23M funding round led by General Catalyst and Social Capital (TC)

Lumachain, an AI platform transforming meat production, raised a $19.5M Series A led by Bessemer Venture Partners (TC)

Bite Ninja, a tech company enabling remote work for the restaurant industry, raised an $11.3M bridge funding round from Manta Ray Ventures, Owl Ventures, and others (PRN)

The Good Face Project, a data and technology company in the personal care industry, raised a ~$5.7M seed round led by VMG Catalyst (PRN)

Ventrk, a physical therapy tech company led by ex-Seahawks wide receiver Doug Baldwin, received a $1M investment from HBSI Capital (PRN)

IPO / Direct Listings / Issuances / Block Trades

Equipment service platform Servify is planning to IPO at a $2.5B valuation by April 2024 (BBG)

Chinese Nickel producer Lygend Resources & Technology is planning to raise ~$1B in a Hong Kong IPO in September (BBG)

Music and audio firm Music Tribe is considering an IPO after failing to obtain a $2B valuation in a planned stake sale (BBG)

SPAC

Digital health solution provider Biolog-id will go public via merger with Genesis Growth Tech Acquisition Corp. at a $312M equity value (GNW)

Debt

US retail chain Bed Bath & Beyond clinched a loan deal to help pay down existing debt; the retailer had been seeking about $375M to shore up its liquidity but final size and terms of the deal are unclear at the moment (WSJ)

Bankruptcy / Restructuring

Packable, a top Amazon seller, is preparing to liquidate one year after a failed SPAC attempt (CNBC)

Fundraising

Singapore's Genesis Alternative Ventures, a private lender to venture and growth-stage companies, is looking to raise $150M for a second fund to finance startups across Southeast Asia (BBG)

Crypto Corner

Exec's Picks

Tired of all the ESG bullsh*t? Want to gain exposure to historically recession resistant industries? The BAD ETF (NYSE:BAD) holds the largest companies in the Betting, Alcohol, and Drug (pharma & biotech) industries. Check them out here.

Microsoft Gaming CEO Phil Spencer shared some thoughts on the future of crypto, specifically play-to-earn gaming, and his vision for the metaverse. Check it out here.

The Hiring Block 💼

If you're looking to break into finance, lateral, or move out, check out our job board on Pallet, where we curate highly relevant roles for you. We aim to curate jobs across IB, S&T, VC, tech, private equity, DeFi, crypto, CorpDev and more. We'll sift through all the noise on LinkedIn, Indeed, Monster, etc. so you don't have to.

If you're a company looking to hire candidates and want to list a job opening on our board and feature on Exec Sum, click the button below:

Meme Cleanser

Thinking of starting your own newsletter? Beehiiv is the best platform for creators, period. Click here to get started building your own audience.