Together with

Good morning,

Biden tested positive for Covid, UK inflation hit a 40-year high, the Nord Stream 1 pipeline resumed gas deliveries to Europe, China fined Didi $1.2B, Amazon is expanding its empire into the healthcare sector, and we finally got the first crypto insider trading case in the US.

If you're looking to gain exposure to real estate at the neighborhood level, you're gonna wanna learn more about today's sponsor, Parcl.

And if you're looking to gain access to early-stage VC investing, we may have an opportunity coming shortly for our accredited investor community 👀. If you want access, you'll need to fill out this form and verify that you are an accredited investor and/or qualified purchaser.

Happy Friday and have a great weekend y'all!

Let's dive in.

Before The Bell

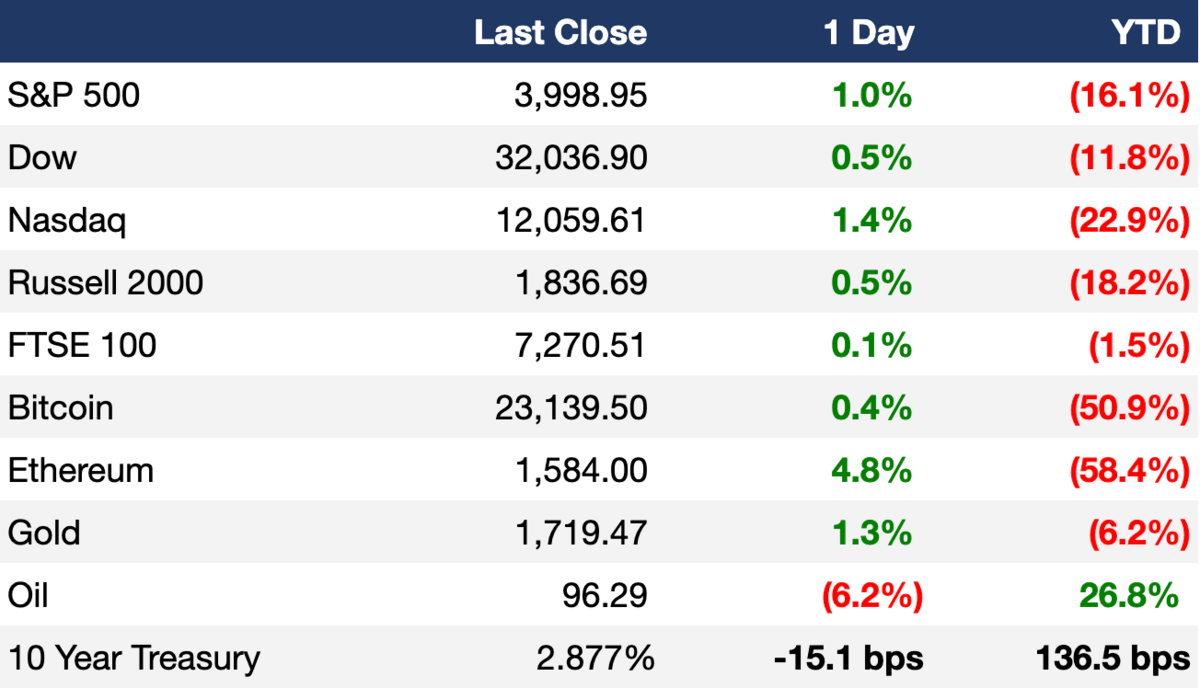

As of 7/21/2022 market close.

Markets

Stocks rose for the third straight session on Thursday as the three major benchmarks are on pace to finish the week positive

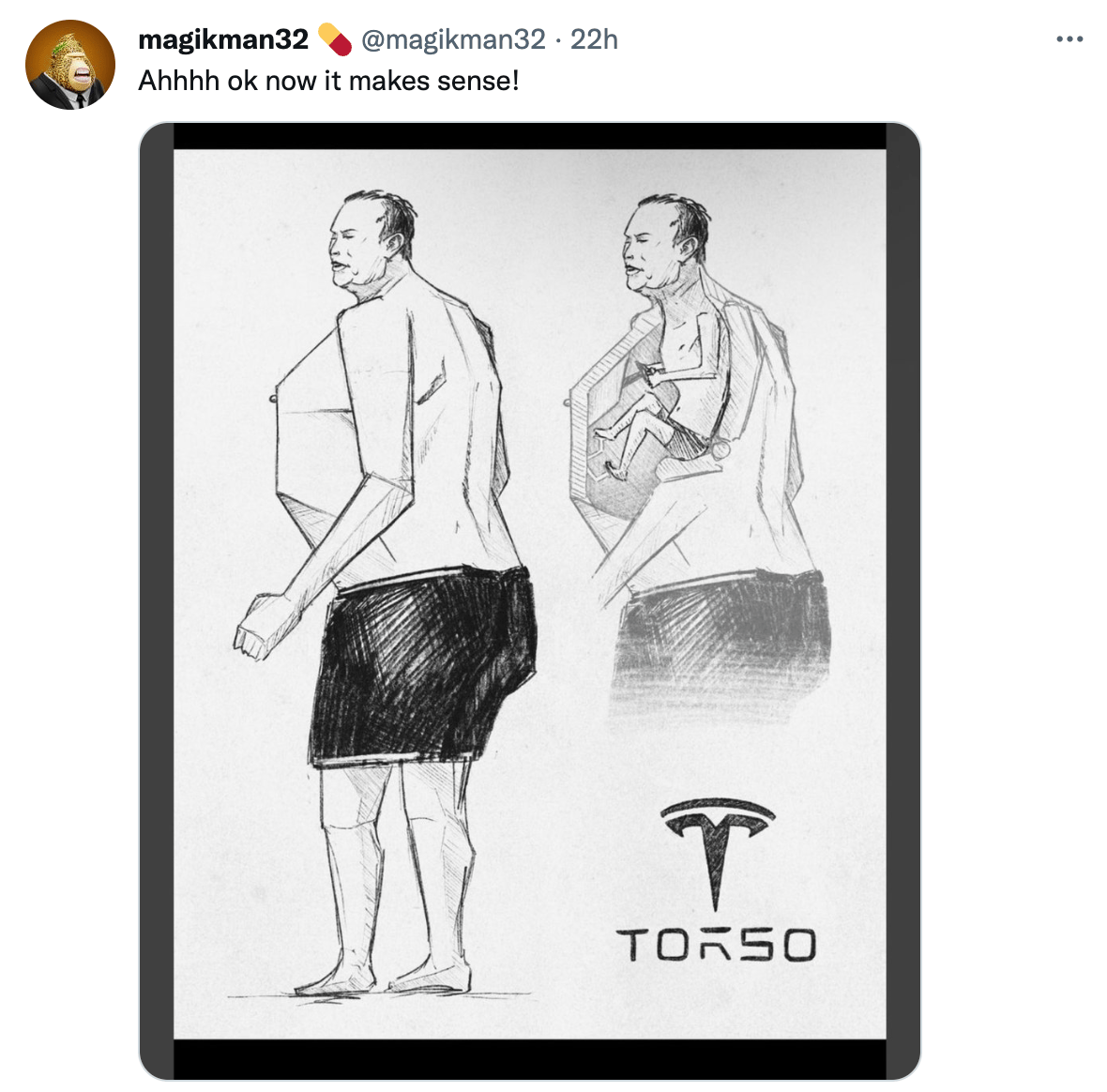

S&P 500 gains were led by Tesla, which surged up 9.8% after releasing better-than-expected Q2 earnings

Oil prices fell partly due to a government report that showed lower gasoline demand during the summer

The ECB raised interest rates by a greater-than-predicted 50 bps, the first increase in 11 years

Earnings

AT&T exceeded expectations for profit and subscriber growth, but fell flat on its free cash flow generation and took down guidance by $2B for the full year; its stock dropped 8% on the day (B)

American Airlines fell 8% after it reported its highest quarterly revenue in history but came up short of profit expectations (YHOO)

Snap missed Q2 earnings expectations and neglected to provide Q3 guidance due to the current financial climate after the bell on Thursday, shares plunged 23% in the immediate aftermath (YHOO)

What we’re watching today: Verizon, American Express, Twitter

Full calendar here

Headline Roundup

The Fed will opt for another 75 basis point rate hike at its meeting next week (RT)

President Biden tested positive for Covid-19 and has 'very mild' symptoms (AX)

It is still cheaper to rent than to buy in 3/4 US cities, despite inflation's rout on the real estate market (AX)

US jobless claims rose to the highest weekly level since mid-November (CNBC)

UK inflation hit 9.4%, a new 40-year high (WSJ)

The Russian Nord Stream 1 gas pipeline resumed supplies to Europe on Thursday, as the region deals with fears of Russian retaliation (AX)

Natural-gas futures jumped 48% this month as heat waves send demand for air conditioning soaring (WSJ)

HSBC became the first foreign lender to install a Chinese Communist party committee in its Chinese investment banking unit (FT)

China fined ride-hailing giant Didi Global over $1.2B for violating cybersecurity and data laws (BBG)

PE firms spent a record $226.5B globally to take firms private in H1 2022, up 39% from the same time period last year (RT)

The London Stock Exchange is lobbying hard for the chip designer Arm to list in the UK, as political turmoil threatens the UK's IPO market (BBG)

Blackstone's Q2 distributable earnings surged 86% from a year earlier to $2B as it cashed out of big deals in Q2 to mitigate losses from turbulent markets (BBG)

Italy is headed for an early election after Prime Minister Draghi resigns, Parliament dissolves (AP)

Amazon's new electric Rivian delivery trucks hit the road on Thursday (AX)

A Message From Parcl

Start building your global real estate portfolio and diversify your portfolio when you need it most.

Real estate is the cornerstone of the ‘American Dream,’ yet there has always been structural inequity in the housing market. Current market conditions are accelerating this, from rampant housing inflation and a supply crisis, to heightened levels of institutional participation. Web3 provides crucial innovation to real estate to make investments accessible, lucrative, and seamless for the next generation of real estate investors.

With cryptocurrency in a bear market, Parcl provides security and stability because it's tied to real world assets – real estate prices that are tracked through the Parcl Price Feed (PPF) and the Parcl Protocol. For many first-time buyers, buying a home is incredibly difficult, or even impossible. This generation of investors and homebuyers is looking for a method that doesn't require a costly, lengthy, and untrustworthy property acquisition process.

Parcl is a blockchain-based real estate platform that allows you to invest in a digital square foot of real estate in the most desirable neighborhoods around the world. Created on behalf of everyone, so that everyone can participate in real estate (renters, first-time buyers, enthusiasts), Parcl is making real estate investing possible for all. Parcl requires no minimum investment, is highly liquid, and carries low transaction fees so investors can now trade their favorite neighborhoods just like they trade Bitcoin, Ethereum, or other crypto assets.

Don’t miss out on their MainNet launch on July 27th!

Deal Flow

M&A / Investments

Cable television company Altice USA is exploring a sale of south-central US cable and internet service provider Suddenlink for up to $20B (BBG)

Amazon will buy primary-care company One Medical in an all-cash $3.49B deal (BBG)

REITs Capitaland Integrated Commercial Trust and Link REIT are bidding for Singapore conglomerate NTUC Enterprise's $2.9B portfolio of Singapore shopping malls (BBG)

Software firm Dye & Durham will acquire Australian data-services company Link in a $1.7B deal (BBG)

Natural gas producer ConocoPhillips is looking to sell its 15.9% holding in their Gulf of Mexico's Ursa/Princess development, which may likely be valued close to $1B (RT)

Gold mining company Caledonia will buy Zimbabwe’s top gold-mining project Bilboes Gold for $53.3M (BBG)

Financial services firm HSBC will exit Russia after it agreed to sell its Russian unit to local lender Expobank (BBG)

VC

South Korean EV battery maker SK On is in talks with global PE firms including Carlyle Group and BlackRock to raise ~$3.1B in a pre-IPO funding round (YHOO)

Lucky Ace International, China's operator of coffee chain % Arabica, is looking to raise ~$300M at a $1.2B valuation (BBG)

Online community marketplace Whatnot raised a $260M Series D at a $3.7B valuation co-led by DST Global and CapitalG (TC)

TomoCredit, a company that helps young people more easily obtain credit, raised $100M in debt financing and a $22M Series B with participation from Morgan Stanley’s Next Level Fund and Mastercard (TC)

Fonoa, a tax automation platform, raised a $60M Series B led by Coatue (TC)

15Five, a performance management platform, raised a $52M Series C led by Quad Partners (TC)

Normative, a Stockholm-based carbon accounting platform, raised a ~$31.7M Series B led by Blume Equity (SC)

ZEDEDA, a provider of distributed edge orchestration and virtualization software, raised a $26M Series B led by Coast Range Capital and Lux Capital (BW)

Anvilogic, a modern Security Operations Platform, raised a $25M Series B led by Outpost Ventures (PRN)

TaskHuman, a digital coaching platform for a variety of topics, raised a $20M Series B led by Madrona (PRN)

Better Stack, an observability product that helps improve software speed, raised an $18.6M Series A led by Creandum (TC)

Quantifi Photonics, an emerging leader in high-density photonics test and measurement, raised a $15M Series C led by Intel Capital (PRN)

CivicEye, a provider of cloud-based public safety software used in the legal realm, raised a $12.4M Series A led by Cercano Management (PRN)

Velosimo, a startup that helps integrate and modernize government technology, raised an $11M Series A led by Macquarie Capital Principal Finance (PRN)

Private plane charter service AeroVanti Air Club raised a $9.75M Series A led by Network1 Financial Securities (TC)

Singapore-based edtech platform Creative Galileo raised a $7.5M Series A from Kalaari Capital, East Ventures, Affirma Capital and others (TC)

Covey, a community of equity analysts that are rewarded for being the top performers, raised a $2.5M seed round led by Social Leverage and Portage Ventures (PRN)

Treggo, a last-mile delivery solutions platform for Latin America, raised $1.7M in funding from Newtown Partners, Verve Capital, Latin Leap, Bluewatch Ventures, Kube VC and others (TC)

IPO / Direct Listings / Issuances / Block Trades

Three Chinese firms: building materials manufacturer Keda Industrial Group, lithium battery materials maker Ningbo Shanshan, and battery manufacturer Gem, are planning to start taking investor orders for their global depository receipts in Zurich as soon as Friday (BBG)

Singapore automation company Republic Power filed for a US IPO on Thursday (MW)

Debt

Banks led by Citigroup and Bank of America postponed their $5.4B leveraged loan and high-yield bond offering for PE firm Apollo’s acquisition of automotive original equipment manufacturer Tenneco until the US Labor Day holiday (BBG)

Crypto Corner

A former Coinbase product manager and two others were charged in the first insider trading case involving cryptocurrency (RT)

Crypto exchange platform Blockchain.com cut 25% of its workforce (CD)

Court documents revealed that Benzinga's CEO Jason Raznick is among bankrupt crypto lender Voyager’s largest creditors (DC)

Exec's Picks

Long-time angel investor Jason Calacanis joined Bloomberg's Joe Weisenthal and Tracy Alloway on the Odd Lots podcast to rip VC "grift" in the crypto token space over the last year or so. Catch their conversation here.

The Hiring Block 💼

If you're looking to break into finance, lateral, or move out, check out our job board on Pallet, where we curate highly relevant roles for you. We aim to curate jobs across IB, S&T, VC, tech, private equity, DeFi, crypto, CorpDev and more. We'll sift through all the noise on LinkedIn, Indeed, Monster, etc. so you don't have to.

Featured jobs:

Lerer Hippeau, an early stage VC fund, is hiring for a Principal role based in New York

a16z, the global VC firm, is hiring an Investor Relations Associate based in Menlo Park

If you're a company looking to hire candidates and want to list a job opening on our board and feature on Exec Sum, click the button below:

Meme Cleanser

Thinking of starting your own newsletter? Beehiiv is the best platform for creators, period. Click here to get started building your own audience.