Happy Friday,

Ryan Cohen rug pulled retail investors on Bed Bath & Beyond, US existing home sales fell for the 6th straight month, the UK wants to increase London listings, streaming passed cable for TV views in the US, the US government might stop paying for citizens' Covid shots, and Big Ten college football games will now have the CBS music that has been an SEC staple for decades (smh).

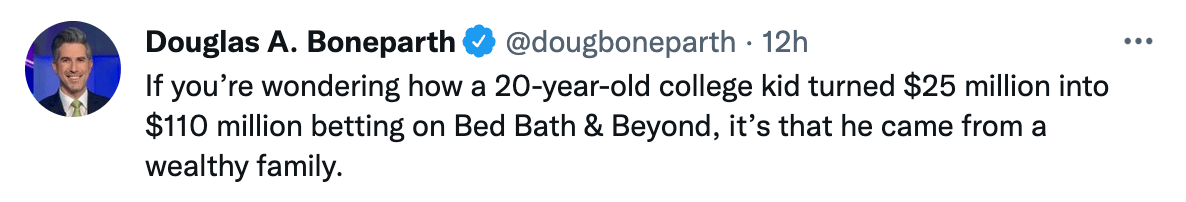

Remember the kid from yesterday who made $100M+ on his BBBY purchase? He's back again, with penny stock MindMed soaring on the news that he owns some shares. Retail degens gonna degen.

Every Friday we publish our Eight Ball newsletter, where we provide real insights about the economy based on real money prediction markets. You can sign up here to read about what we're tracking across Fed rate hikes, NYC rent growth, jobs, and even Hurricanes hitting Florida (good for hedging).

Let's dive in.

Before The Bell

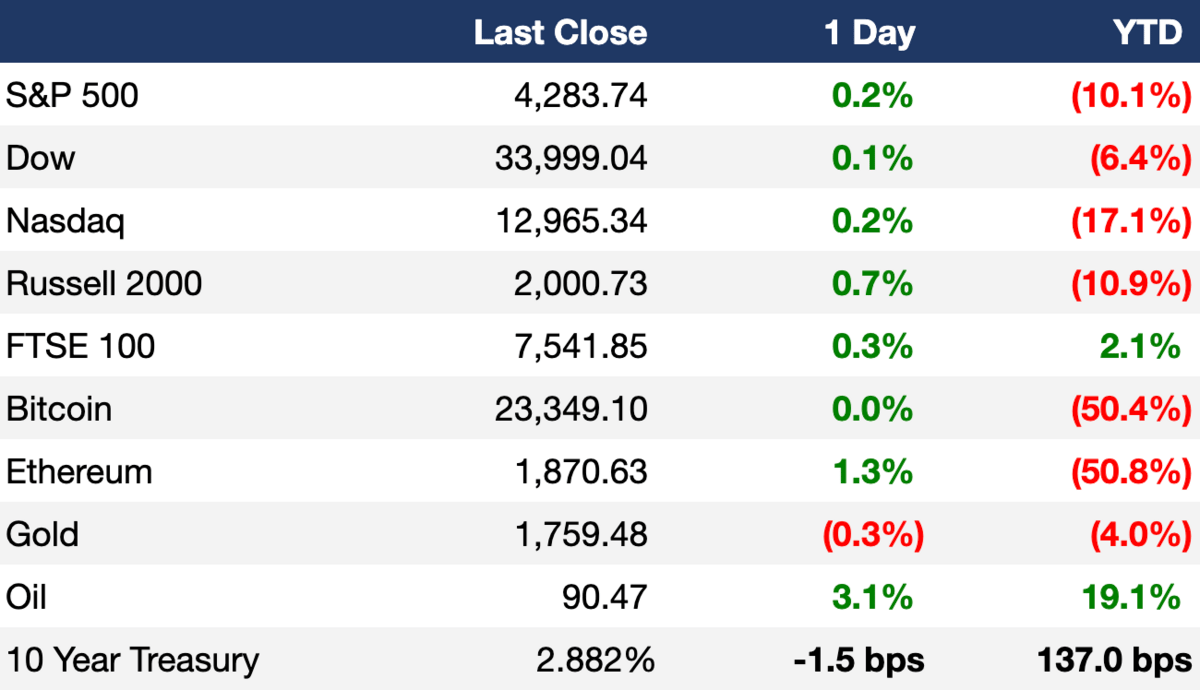

As of 8/18/2022 market close.

Markets

Stocks rose Thursday as investors parsed earnings reports and economic data for clues about the trajectory of the economy and interest rates

Energy stocks outperformed as oil prices climbed, with the S&P 500 energy sector up 2.5%

New applications for unemployment benefits remained steady, indicating the jobs market is holding up despite signs of weakness in the broader economy

Earnings

Kohl’s fell 7.7% after its earnings shrank by nearly two-thirds in Q2 and the retailer again slashed its forecast for the year, saying high inflation has greatly reduced demand (CNBC)

Ross Stores reported Q2 results that beat earnings expectations but came up short on revenue; its stock fell 0.7% after hours (INV)

What we’re watching today: John Deere

Full calendar here

Headline Roundup

US existing home sales fell in July for the sixth straight month, the longest streak in over eight years (WSJ)

Initial jobless claims inched down to 250k last week from 252k the week prior (WSJ)

The Philadelphia Fed's monthly manufacturing index rose to 6.2 this month from -12.3 in July (RT)

The FinTech IPO Index is up ~15% MTD as tech earnings season ends (PYMT)

US and Taiwan will hold trade talks as China tensions rise (AX)

The UK government is looking for ways to increase London listings (BBG)

Streaming surpassed cable TV as America's most popular television service (AX)

Turkey’s central bank unexpectedly cut rates by 1% despite ~80% inflation (WSJ)

Five of the six largest US banks have outperformed the S&P 500’s 13% gain since end of June (WSJ)

The Big Ten struck a $7.5B seven-year TV rights deal with Fox, CBS and NBC (WSJ)

The US may soon stop paying for Americans' Covid-19 shots and treatments (WSJ)

Bed Bath & Beyond sank 23% after investor Ryan Cohen filed to sell his stake in the company (WSJ)

Trump's CFO pleaded guilty in a Trump-related tax fraud scheme (AX)

A federal judge will unseal part of the affidavit that led to the FBI’s search of Trump’s Mar-a-Lago residence (WSJ)

The Hong Kong investment bank behind AMTD Digital's 32,000% IPO surge is being probed by regulators (BBG)

A Message From Litquidity

Got a few updates on things we're working on, some of which we could use your help:

VC investment opportunities: got a few opportunities to bring the community into some Seed and Series A funding rounds. If you're an accredited investor / qualified purchaser and want access to Litquidity Syndicate deals, please fill out this survey. Priority given to the most active community members through newsletter signups and open rates!

Partnership opportunities: if you want to partner with me across social media, email newsletters, or other mediums, you can submit an inquiry here. Let's build.

Deal Flow

M&A / Investments

PT Telkom Indonesia is planning to combine its IndiHome broadband business and Telkomsel wireless business which could be valued at several billion dollars (BBG)

Denbury, a ~$4B Texas-based independent oil company, is exploring a sale (BBG)

PE firm TPG is exploring a sale of blood test maker Immucor for over $2B (BBG)

Brazil regulators approved steelmaker Cia Siderurgica Nacional's ~$1B purchase of Swiss building material company Holcim's local cement business (RT)

Japanese semiconductor maker Renesas Electronics is exploring the sale of a US chip making unit, which could fetch ~$1B (BBG)

Swedish gaming group Embracer acquired six companies including Limited Run Games, Stingtrix, Tuxedo Labs and Tripwire Interactive for ~$571M (RT)

Japanese bank Mitsubishi UFJ is in advanced talks to acquire consumer lender Home Credit’s assets in Indonesia and Philippines at a combined ~$500M valuation (BBG)

Chinese data center firm Bohao Internet Data Services is close to receiving a $450M investment at a $1B+ valuation from US PE firm Warburg Pincus and Australia's Macquarie Asset Management (BBG)

Refinery Phillips 66 increased ownership in DCP Midstream pipeline to 43.3% and pipeline company Enbridge increased ownership in Gray Oak pipeline to 58.5% in a swap deal in which Phillips 66 will pay Enbridge $400M in cash as part of the transaction (BBG)

Indian merchant payment services platform Razorpay bought offline payments firm Ezetap in a $150M deal (RT)

PE firm Apollo is interested in acquiring a minority stake in Manchester United FC (BBG)

NYC's Madison Square Garden Entertainment is exploring a spinoff of its live entertainment business (CNBC)

Health information publishing giant WebMD will acquire Jim.fr, a French medical news and information website aimed at healthcare professionals (TC)

VC

Chinese AI-chip startup Horizon Robotics is looking to raise up to $200M in fresh capital and also IPO soon in Hong Kong, Horizon is currently valued at ~$8B (BBG)

US EV-focused startup Atom Power received a $100M investment from Korea's SK Group (RT)

TXOne Networks, a cybersecurity provider for the industrial IoT, raised a $70M Series B led by TGVest Capital (BW)

Aero Technologies, a next-gen premium air travel company, raised $65M in funding: a $50M Series B by AlbaCore Capital Group, Expa, and Keyframe Capital, and $15M in convertible notes (BW)

Jar, an Indian fintech allowing users invest in digital gold, raised a $22.6M Series B at a $300M+ valuation led by Tiger Global (TC)

Bravo Sierra, a military-native performance wellness company, raised a $17M Series B led by The Merchant Club (BW)

Sabanto, a startup developing autonomous agricultural machinery, raised a $17M Series A led by Fulcrum Global Capital (PRN)

Motivo Health, an online marketplace connecting mental health therapists with clinical supervisors, raised a $14M Series A led by Cox Enterprises (PRN)

FOMO Pay, a mobile payments platform, raised a $13M Series A led by Jump Crypto (BT)

SynSaber, an early-stage ICS/OT cybersecurity and asset monitoring company, raised a $13M Series A led by SYN Ventures (PRN)

PushPress, a fitness studio management software company, raised an $11M Series A led by Altos Ventures (PRN)

iProcure, a Kenyan B2B agtech, raised $10.2M in funding: a $9M Series B led by Investisseurs & Partenaires, and $1.2M in debt (TC)

Rocketplace, a next-gen asset management platform for crypto, raised a $9M seed round led by Launchpad Capital (TC)

Sofy, a testing platform for mobile app developers, raised a $7.75M seed round led by Voyager Capital (TC)

Trial Libary, a cancer clinical trials startup, raised a $5M seed round led by Lux Capital (WSJ)

Demoleap, an AI-powered live demo assistant and sales discovery platform, raised a $4.4M seed round led by Bonfire Ventures and Differential Ventures (PRN)

GitPOAP, a contributor recognition platform that integrates POAP issuance into GitHub, raised a ~$4.3M seed round led by Inflection.xyz and Libertus Capital (PRN)

Meson, a cross-chain protocol for stablecoins, raised a $4M funding round led by GSRV (PRN)

Rebill, a LATAM automated payment collection and subscription management tools platform, raised a $3M seed round led by Tiger Global Management and a $600k pre-seed round (TC)

Koolboks, a sustainable refrigerator company, raised a $2.5M seed round led by Aruwa Capital Management (TC)

IPO / Direct Listings / Issuances / Block Trades

Global travel retail giant China Tourism Group Duty Free raised ~$2.1B after pricing its Hong Kong IPO above the midpoint of a marketed range (BBG)

Hong Kong-based online marketplace provider GigaCloud Technology surged 28% to raise $36M in its Nasdaq IPO (BBG)

Brüush Oral Care, a Toronto-based electric toothbrush company, raised $15.5M in its NASDAQ IPO (BK)

China's biggest oil and gas producer PetroChina is planning to spinoff its marketing and trading business and seek a separate listing (BBG)

SPAC

Mexican digital and banking services platform Covalto will list on Nasdaq via a merger with LIV Capital at an implied $547M enterprise value (RT)

Fundraising

Abu Dhabi-based AI firm G42 is setting up a $10B fund in partnership with the Abu Dhabi Growth Fund to focus on technology investments in emerging markets (BBG)

VC firm Cherubic Ventures closed its $110M Fund V to invest in both late-stage startups and high-potential teams that have yet to acquire any funding (PRN)

Crypto Corner

The DOJ wants to probe crypto lender Celsius's collapse into bankruptcy (CD)

Crypto exchange Crypto.com quietly let go of hundreds more employees after publicly laying off 260 employees in June (TV)

Tether Holdings, the issuer of the world’s largest stablecoin, switched its accounting firm that signs off on its attestation reports from MHA Cayman to BDO Italia (WSJ)

Exec's Picks

The world runs on spreadsheets these days, but Excel is full of #REFs and untraceable errors that just create more stress. Causal is a better way to work with numbers. It's like Excel minus the arcane formulas, plus it has live data integrations. Interested in leveling up your spreadsheet game? Check out Causal here.

Medha Agarwal, a partner at Redpoint Ventures, recently shared her views of the fintech ecosystem and compiled a market map of the fintech startup landscape. Check it out here.

The Hiring Block 💼

If you're looking to break into finance, lateral, or move out, check out our job board on Pallet, where we curate highly relevant roles for you. We aim to curate jobs across IB, S&T, VC, tech, private equity, DeFi, crypto, CorpDev and more. We'll sift through all the noise on LinkedIn, Indeed, Monster, etc. so you don't have to.

If you're a company looking to hire candidates and want to list a job opening on our board and feature on Exec Sum, click the button below:

Meme Cleanser

Thinking of starting your own newsletter? Beehiiv is the best platform for creators, period. Click here to get started building your own audience.