Together with

Good Morning,

Morgan Stanley's CIO expects a 10% S&P drawdown, nuclear energy stocks are rallying on the back of AI, gasoline short bets are at a seven-year high, Germany was sitting on ~$2B of Bitcoin, and Wall Street is taking interest in prediction markets.

Want to keep up with everything tech in just a daily 5 minute read? Check out today's sponsor, TLDR.

Let’s dive in.

Before The Bell

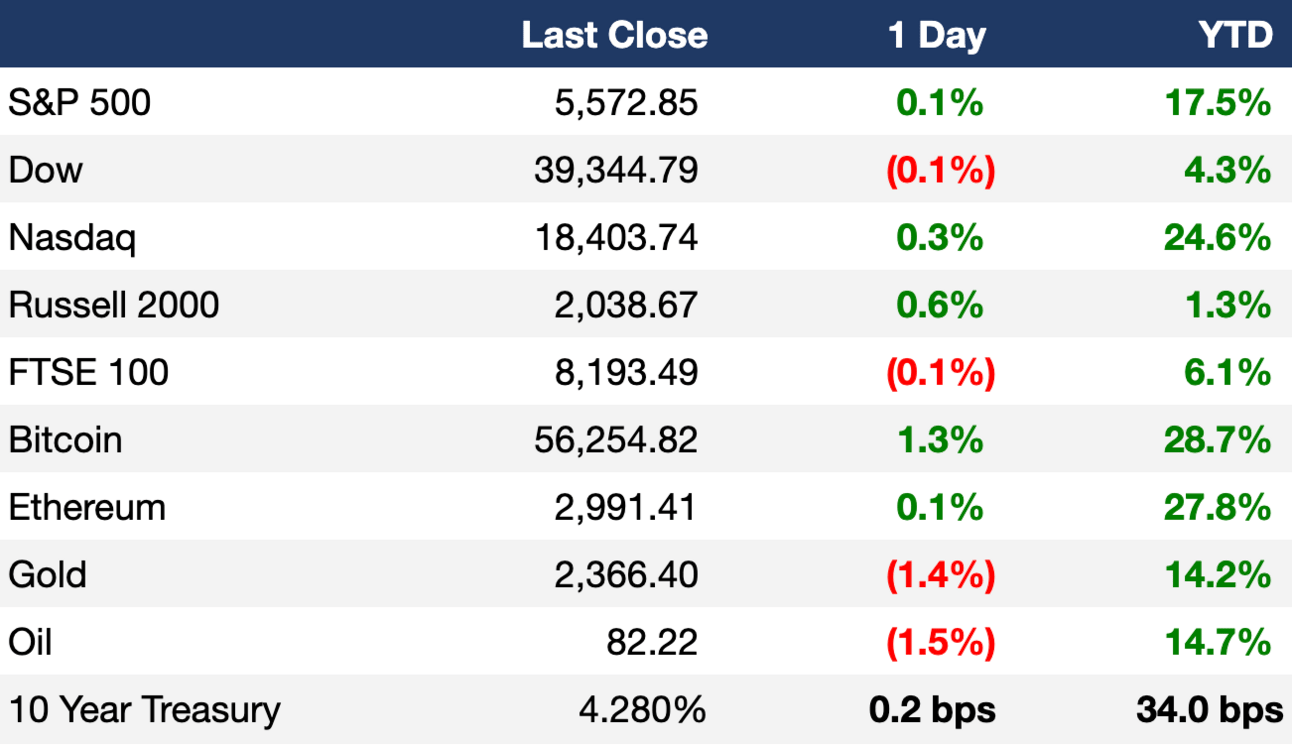

As of 07/08/2024 market close.

Markets

US stock indexes continued to push ATHs as investors await inflation data, J Pow's testimony, and crucial Q3 earnings

Oil settled to a one-week low on demand worries from Hurricane Beryl

France-Germany 10Y spread is at 65 bps, slightly lower than the 85 bps twelve-year high from June

Euro hit a multi-week high versus the dollar

Earnings

What we're watching this week:

Thursday: Delta, PepsiCo

Friday: JPMorgan, Wells Fargo, Citigroup

Full calendar here

Headline Roundup

Morgan Stanley CIO expects a 10% decline in S&P 500 by US elections (RT)

Nuclear energy stocks are rallying only second to AI amid AI energy demand (RT)

AI boom is driving chief information officer pay to ATHs (WSJ)

Eurozone investor morale dropped after eight months of gains (RT)

JPMorgan cut forecasts for emerging market corporate defaults (RT)

Hedge fund short bets against gas are at a seven-year high (BBG)

Returns continue to disappoint for funds focused on gender equality (FT)

Prediction markets are seeing growing interest from US financial firms (FT)

China's $1.6T LGFV bond market sees largest outflows in six years (BBG)

CalPERS allocated ~$1B to Sixth Street's asset-based finance strategy (BBG)

Boeing will plead guilty to fraud over 737 Max crash deal (FT)

A Boeing jet lost a wheel in repeat incident (BBG)

Activist Elliott threatened a proxy fight with Southwest Airlines (RT)

SEC will rethink 'swing pricing' rules in win for mutual funds (FT)

Property fraud allegations snowball as CRE values fall (WSJ)

Japan's base pay rose by the most in 31 years (RT)

Petrobras raises gasoline prices for first time in 11 months (BBG)

Microsoft is leaning on AI hype to spur PC market revival (BBG)

Insurers pocketed $50B from Medicare for untreated diseases (WSJ)

Tesla and shareholders clash over $7B legal fee request (RT)

Citi will exit Haiti after 50 years (RT)

Microsoft will offer Apple devices to China employees (RT)

Gen-Z social media app noplace debuted as No. 1 on App Store (TC)

A Message From TLDR

Love Hacker News but don’t have the time to read it every day? Try TLDR’s free daily newsletter.

TLDR covers the best tech, startup, and coding stories in a quick email that takes 5 minutes to read.

No politics, sports, or weather (we promise). And it's read by over 1,250,000 people!

Deal Flow

M&A / Investments

Paramount Global will merge with Skydance Media in a $28B deal (FT)

Brookfield and the founding family of Spanish drugmaker Grifols will launch a joint take-private offer for Grifols, which has a $7.1B market cap (RT)

Devon Energy agreed to acquire the Williston Basin assets of EnCap Investments' Grayson Mill Energy for $5B in cash and stock (BBG)

Danish brewer Carlsberg agreed to acquire UK pepsi bottler Britvic for $4.2B (BBG)

Bain Capital is nearing a deal to acquire US financial software vendor Envestnet for ~$3.5B (RT)

Eli Lilly agreed to acquire US gut-drug maker Morphic in a ~$3.2B cash deal (BBG)

Vista Outdoor rejected investment firm MNC Capital's final buyout offer of $3.2B while agreeing to sell its ammunition unit to Czechoslovak Group for ~$2B (RT)

A consortium comprising PE firms CD&R and Permira is in advanced talks to take $2.2B-listed French cybersecurity firm Exclusive Networks private (BBG)

Sensor manufacturer Masimo received a $850M-$950M offer for its consumer business from a potential JV partner (RT)

Juicebox-maker Capri-Sun is exploring a minority stake sale of over $500M (BBG)

Argentina’s largest forex Mercado Abierto Electronico and futures market Matba-Rofex agreed to merge at a potential $500M+ post-merger valuation (BBG)

UK MP Maurice Saatchi is weighing leading a consortium to bid for The Daily Telegraph (BBG)

Turkey’s SWF TWF is considering a sale of its 26.2% stake in Turkey's biggest telecom operator Turkcell (BBG)

VC

HarmonyCares, a provider of value-based in-home longitudinal care, raised a $200M round led by General Catalyst, McKesson Ventures, and a national payor (FN)

Gymdesk, a member management SaaS for fitness/wellness firms, raised a $32.5M growth investment from Five Elms Capital (PRN)

Polystyvert, a recycling startup focused on styrenic plastics, raised a $16M Series B led by Infinity Recycling (PRN)

Database startup Tembo raised a $14M round led by GreatPoint Ventures (TC)

Eneida, a Portuguese deep grid operational analytics platform, raised a $11.4M Series B led by Junction Growth Investors (FN)

Niva, a global business identity platform, raised a $3.3M seed round led by Gradient Ventures (BW)

GoJoe, a gamified employee health and fitness app, raised a $3M seed round led by Venrex Partners and Redrice Ventures (EU)

Debt

UK lender Metro Bank is in talks to sell a residential mortgage loan portfolio worth up to $5.1B (RT)

Broadcom sold $5B of bonds to refinance some debt backing its $69B acquisition of VMware (BBG)

Underwriters led by Bank of Montreal kicked off a ~$2.6B loan sale to back Advent, Novacap, CDPQ, and management's $6.3B LBO of payments processor Nuvei (BBG)

Brookfield-backed French data center group Data4 is exploring a $2B debt deal with six banks (BBG)

KKR and GIP-backed data center firm CyrusOne secured a $7.9B ESG-linked credit line (BBG)

Indian shadow bank Piramal Capital and Housing Finance is planning a $300M-$500M debut dollar bond sale (BBG)

Canadian pipeline operator Wolf Midstream is planning a $440M debut bond sale (BBG)

Fundraising

HongShan, Sequoia's China split-off, raised $2.5B for its latest tech VC fund (FT)

Norwest Capital Advisors raised $1.4B across its latest MM buyout fund and a mezzanine fund (BW)

MetLife's investment arm formed a $1.2B FOF to acquire PE LP stakes and make PE co-investments (WSJ)

MM infrastructure manager Orion Infrastructure Capital closed its inaugural growth fund at $370M (BW)

Crypto Corner

Exec’s Picks

Earn 5% on gold, paid in gold! Monetary Metals pays a yield on gold and silver, and they've done it for 8 years. Click here to learn more about their latest opportunity.

With Jefferies shares currently at ATHs, CEO Rich Handler shared ten observations about why this that might differ from what we expect.

Litney Partners - Financial Recruiting 💼

If you're currently a junior banker looking to break into the buy side, lateral to another investment bank, or consider new paths amid changing market dynamics, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates across private equity, hedge funds, venture capital, growth equity, debt funds, and investment banking.

To get started, simply head over to Litney Partners and create your profile by dropping your resume / filling out the form:

Meme Cleanser

Advertise with us // Visit our merch store // Invest alongside Lit Ventures // Book a call with Lit // Launch your own newsletter