Together with

Good Morning,

Ozempic risk has become a short thesis for restaurant stocks, stakes are rising in the Israel/Palestine fighting with new Hamas hostage threats, major airlines are suspending flights to Israel, Texas offices are vacant, Hollywood writers ratified their new contact with studios, and Robert F. Kennedy is running as an independent.

Quality research is easier than you think. Get access to expert calls, custom financial models, and public filing data — all in one place with Tegus. Kickstart your free trial today.

Let’s dive in.

Before The Bell

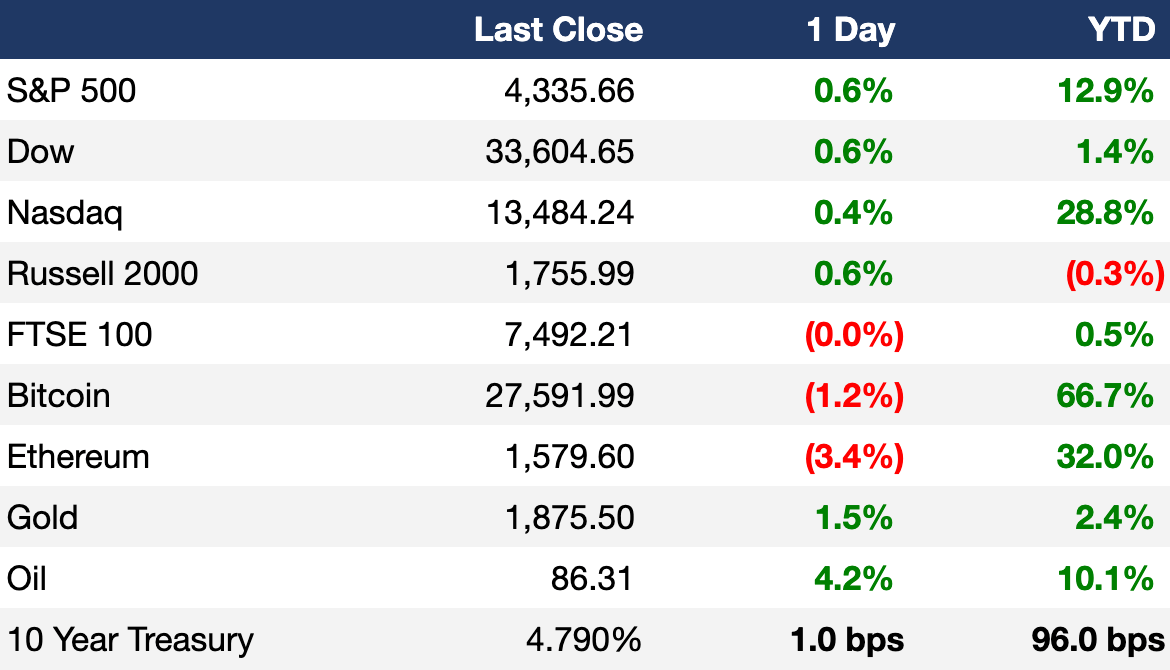

As of 10/9/2023 market close.

Markets

US stocks rose as investors digested news on the Israel-Hamas conflict

The S&P led indices with a 0.63% gain

WTI prices rallied over 4% as investors grew wary that escalations in the Middle East could adversely impact oil supply chains

Earnings

What we're watching this week:

Today: PepsiCo

Thursday: Delta Airlines, Domino’s Pizza, Walgreens

Friday: JPMorgan Chase, BlackRock, Wells Fargo, Citigroup, UnitedHealth Group

Full calendar here

Headline Roundup

Israel’s hostage crisis deepens with execution threat (WSJ)

Treasury’s debt deluge is finally straining US funding markets (BBG)

Yields set to slump with traders seeking havens (BBG)

Ozempic risk, higher rates fuel short bets on restaurant stocks (BBG)

California passes law mandating VC firms to release investments’ diversity information (TC)

Major airlines suspend Israel flights after attacks (CNBC)

Texas cities are booming, but their offices are the most vacant (WSJ)

Middle East conflict spurs bullish rush in oil options market (BBG)

Amtrak finally has the money to make over hundred-year-old stations (WSJ)

UAW goes on strike at Volvo’s Mack trucks unit (WSJ)

MUFG, Japan banks disrupted by glitches at money transfer system (BBG)

BoA’s wrong-way rate bet hurts Moynihan’s growth pledge (BBG)

Unity CEO is retiring from gaming software company after controversial pricing change (CNBC)

Hollywood writers ratify new contract with studios (CNBC)

Robert F. Kennedy Jr. shifts to Independent presidential bid (WSJ)

Saudi oil giant Aramco announces pilot project to suck CO2 out of the air, but some scientists are skeptical (CNBC)

A Message From Tegus

Imagine a day where every minute of your research is well spent. Where information gives you the freedom to be bold.

Tegus is research without all the tedious hunting, calling, parsing, and pasting. You get access to expert calls, custom financial models, and public filing data — all in one place.

The time for a more powerful perspective is here. Do what you do best, even better.

Deal Flow

M&A / Investments

Australian regulators gave conditional approval to PE firm Brookfield’s $12B takeover of Australia’s largest energy producer Origin Energy (BBG)

An order from EU regulators to Illumina to sell cancer detection test maker Grail, which the US life sciences company acquired for $7.1B in 2021 without EU approval, could come as early as next week (RT)

Billionaire Schaeffler family’s Bavarian car parts maker Schaeffler offered to acquire rival auto group Vitesco in a $3.8B deal (BBG)

HSBC agreed to buy Citigroup’s $3.6B AUM retail wealth management portfolio in mainland China (BBG)

A unit of insurer Prosperity Life Group will buy National Western Life Group in a $1.9B deal (RT)

CMB will acquire a combined 26% stake in Belgian shipping enterprise Euronav from oil tanker owner Frontline and Norwegian shipping billionaire John Fredriksen in a $1.1B stake sale (BBG)

A consortium led by Singapore state investor GIC and another group headed by sovereign fund Indonesia Investment Authority are among final bidders for a 35%, $750M stake in state-owned toll operator PT Jasa Marga’s Transjawa Tol (BBG)

Cipriani, the operator of celebrity-packed restaurants and clubs, is seeking to raise as much as $526M for global expansion (BBG)

Uniper is looking to sell its German district heating business, which could be valued at $316M-$421M (RT)

The Nolet Group, the maker of Ketel One vodka, launched a management-backed offer to buy Dutch gin and spirits maker Lucas Bols for $285M (RT)

VC

Alzheimer’s drug startup AstronauTx raised a $61M Series A led by Novartis (PRN)

Regent Craft, an all-electric seaglider startup, raised a $60M Series A led by 8090 Industries and Founders Fund (FN)

LimmaTech Biologics, a biotech startup developing next-generation vaccines, raised a $37M Series A led by Adjuvant Capital, AXA IM Alts, and the Novo Holdings REPAIR Impact Fund (FN)

CropX Technologies, a startup providing digital solutions for agronomic farm management, raised a $30M Series C led by Aliaxis (FN)

Insurtech startup Onsurity raised a $24M Series B led by the World Bank’s International Finance Corporation (TC)

UK care home marketplace Lottie raised a $21M Series A led by Accel (TC)

Triastek, a 3D-printing startup for the pharmaceutical industry, raised a $20.4M pre-C round led by Guoxin Investment (FN)

Jetson, a startup building an eVTOL you can own and fly for short point-to-point flights, closed a $15M seed round led by will.i.am and other angel investors (EU)

Gaiia, a startup providing a SaaS solution for billing and operations for ISPs, raised a $13M seed round led by YCombinator, Kima Ventures, and oxio alums (FN)

Circular, a Singaporean tech subscription service, raised a $7.6M seed round led by AirTree Ventures (TC)

Pixelgen Technologies, a spatial proteomics startup for single cells, raised a $7.3M Series A led by Industrifonden and Navigare Ventures (PRN)

Wanda Fish, an Israeli food tech startup, raised a $7M seed round led by Aqua Spark (TC)

Insulation startup VARM raised a $7M pre-seed round led by Foundamental and A/O (EU)

AI-powered automotive data platform Sensigo raised a $5M seed round led by UP Ventures (FN)

Sustainable packaging startup FlexSea raised a $3.7M seed round led by Indico Capital Partners (FN)

Ostium Labs, a London-based provider of a hybrid pooled liquidity model, raised $3.5M in funding led by General Catalyst and LocalGlobe (FN)

FourJaw, a startup helping manufacturers optimize productivity and reduce energy use, raised a $2.2M round from NPIF, and Mercia Equity Finance (FN)

Komment, a developer tools startup, raised a $1M pre-seed round led by Craft Ventures (FN)

IPO / Direct Listings / Issuances / Block Trades

Debt

Indian conglomerate Hinduja Group is in talks with private credit funds to raise ~$800M to back the acquisition of Reliance Capital (BBG)

Bankruptcy / Restructuring

Fundraising

Appian Capital Advisory, a mining-focused PE firm, raised $2B for its Fund III to focus on middle-market investments in the mining industry (BBG)

Investment firm Accolade Partners raised $325M for Accolade Empowerment Fund II to invest in venture and growth-equity funds run by minority and female managers (WSJ)

Crypto Corner

Exec’s Picks

T-Bills are exempt from state and local taxes, and they offer the perfect blend of security and high yields at 5.51%+, ensuring your hard-earned money works as hard as you do. You can easily invest with Onyx Private, an FDIC-insured modern digital private bank app that unifies Premium Banking, Personalized Investment, and a 24/7 Lifestyle Concierge, in just three clicks. Interested? Get started with Onyx Private today.

This Wired piece explains how X was drowning in Israel/Palestine disinformation.

The New York Times gave an interesting look into everything that tenants have to do before leaving commercial properties.

Litney Partners - Financial Recruiting 💼💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

Meme Cleanser

Advertise with us // Visit our merch store // Invest alongside Lit Ventures // Book a call with Lit // Launch your own newsletter