Together with

Good Morning,

Berkshire is sitting on a record $157B cash pile, Musk released his ‘Grok’ AI to combat ChatGPT, Jack Dorsey is taking a more hands-on approach at Block again, Washington Post is projected to lose $100M this year, Tesla is raising wages for German workers, and bankers are looking for legal cover after backing $1.5T of ESG debt.

Tired of receiving 20 spam calls per day? Get your personal data off the internet with today’s sponsor, Incogni.

Let’s dive in.

Before The Bell

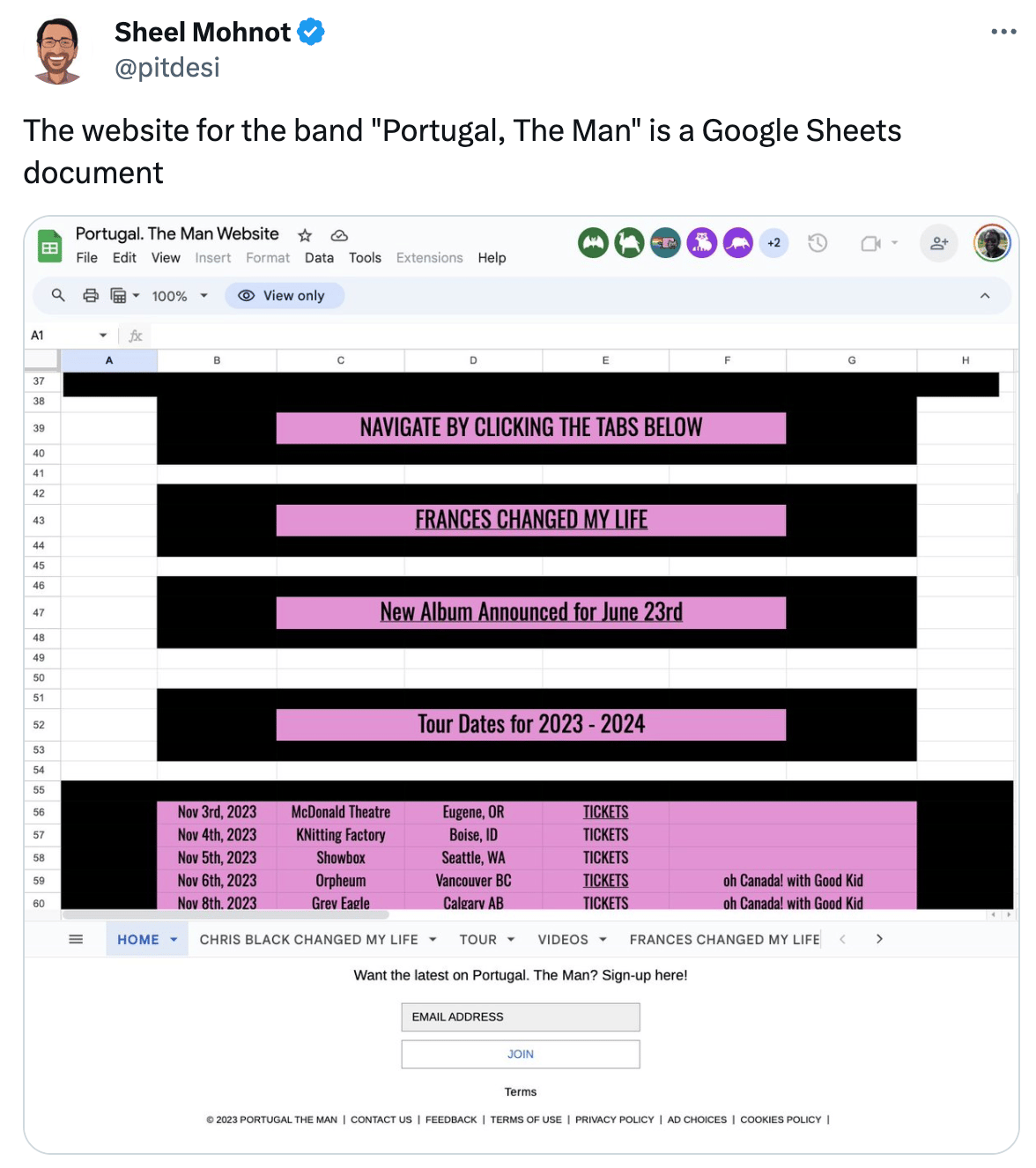

As of 11/3/2023 market close.

Markets

US stocks rose after a soft jobs report drove bond yields lower

The Nasdaq led indices with a 1.38% gain

Asian stocks followed US stocks on Friday as investors grew more confident that interest rate hikes have come to an end

Earnings

Berkshire Hathaway reported a $12.8B Q3 loss mostly due to unrealized losses from stocks; its operating profit jumped 41% to $10.8B, and it now has $157B in cash (AP)

What we're watching this week:

Today: Diamondback Energy

Tuesday: Uber, Bumble, Rivian, Datadog, Realty Income

Wednesday: Disney, Arm Holdings, Roblox, AMC, Warner Bros Discovery, Affirm

Thursday: Li Auto, Unity

Full calendar here

Headline Roundup

Warren Buffett’s Berkshire Hathaway sits on record $157B cash pile (WSJ)

The price of money is going up, and it’s not only because of the Fed (BBG)

Pimco, JPMorgan are gearing up for long winter in China markets (BBG)

Elon Musk debuts ‘Grok’ AI bot to rival ChatGPT (CNBC)

Jack Dorsey to take a more hands-on leadership approach with Block’s stock down 80% (WSJ)

Washington Post appoints William Lewis as CEO; to reduce headcount by 10% as the company is projected to lose $100M this year (CNBC)

China’s fight against deflation may be far from over (BBG)

Bankers seek legal cover after backing $1.5T of ESG debt (BBG)

South Korea to ban short-selling of stocks until June 2024 (BBG)

Tesla raises wages for German workers amid union pressure (WSJ)

Harvard, Yale warned by top law firms about antisemitism (BBG)

Russia to stick with voluntary oil exports cuts until year-end (BBG)

Michigan warns Big Ten against disciplining team over sign-stealing allegation (WSJ)

Afghanistan opium poppy supply plummets 95% after Taliban ban, UN says (RT)

Tamirat Tola sets NYC Marathon course record to win men’s race; Hellen Obiri takes women’s title (CNBC)

A Message From Incogni

You might be wondering—where do spammers get my phone number and email address? The most likely answer is data brokers. These companies specialize in collecting personal information and selling them in bulk to marketers (and sometimes scammers).

The good news is, you can still avoid the Black Friday spam madness before it hits! Use code EXEC60 today to get an exclusive 60% discount for Exec Sum readers and get your data off 180+ data brokers and people search sites automatically with Incogni.

Worried you won’t see the results? There’s no better time to test it out than during the marketing frenzy that is Black Friday. If you don’t find peace from spam within 30 days they offer a full refund.

Deal Flow

M&A / Investments

Telecom Italia’s board approved the sale of its landline network to KKR in a $23.6B deal backed by the Italian government (BBG)

British regulators cleared Cameco and Brookfield Renewable Partners' $7.9B acquisition of nuclear power plant equipment maker Westinghouse Electric (RT)

Saudi Arabia expressed interest in investing up to $5B for a stake in $30B Indian Premier League, international cricket’s most lucrative event (BBG)

PE firm Platinum Equity is in advanced talks to purchase Kohler’s generators division for over $3B (BBG)

Polywood, a maker of recycled plastic outdoor furniture, is exploring options including a sale that could value the PE-backed company at ~$1B (RT)

Buyout firm The Jordan Company is in exclusive negotiations to acquire medical equipment maker Tidi Products from Roundtable Healthcare Partners for at least $900M (RT)

Ineos CEO Jim Ratcliffe is looking to invest $300M in Manchester United's infrastructure in addition to a $1.5B+ offer to acquire a 25% stake in the football club (RT)

Greece's biggest power utility Public Power will acquire retailer Kotsovolos from British electrical retailer Currys in a $215M deal (RT)

Investment bank Houlihan Lokey is in talks to acquire Triago, a placement agent best known for assisting private equity firms with fundraising (BBG)

RidgeLake Partners will acquire a minority stake in middle-market buyout firm Gridiron Capital from the firm (BBG)

VC

Gynesonics, a minimally invasive solutions startup for uterine fibroids, raised a $42.5M round led by Amzak Health, Endeavor Vision, Kaiser Permanente Ventures, and Runway Growth Capital (FN)

Cyber defense startup Wraithwatch raised an $8M seed round led by Founders Fund (FN)

Ambercycle, a molecular regeneration technology company for the fashion industry, raised $5M in funding led by Drive Catalyst (FN)

HeartBeat.bio, a biotech startup providing a human organoid and AI-supported drug discovery platform for heart disease, raised a $4.8M pre-series A led by i&i Biotech Fund, Invest AG, and Tensor Ventures (FN)

Carepatron, a healthcare management platform, raised a $4M seed round from Blackbird and TQ Ventures (TC)

Ophthalmic medical device startup Pantheon Vision raised a $2.5M seed round led by KeraLink International (FN)

GlassFlow, a Berlin-based data streaming platform, raised a $1.1M pre-seed round led by High-Tech Gründerfonds, TinyVC, Roosh Ventures, and others (FN)

IPO / Direct Listings / Issuances / Block Trades

Chinese electric truck maker Windrose Technology is seeking to raise at least $200M in a 2024 US IPO (BBG)

SPAC

Chip designer and supplier GCT Semiconductor will merge with Concord Acquisition Corp III in a $461M deal (BW)

Debt

Indian mining conglomerate Vedanta Group is in advanced talks to raise a $1.3B private loan with an interest rate of 18-20% to overhaul its debt (BBG)

Bankruptcy / Restructuring

Fundraising

Pan-African VC Norrsken22 closed its debut fund, Norrsken22 African Tech Growth Fund, at $205M (TC)

Crypto Corner

The US Supreme Court agreed to hear a dispute over Coinbase's effort to move a dispute with users of the cryptocurrency exchange out of courts and into private arbitration (RT)

Exec’s Picks

Number Go Up author and Bloomberg investigative reporter Zeke Faux joined Barry Ritholtz to discuss his journey down the crypto rabbit hole that led to his book.

Barron’s published a cool highlight on Kyla Scanlon, explaining how she became the face of Gen Z financial content.

Litney Partners - Financial Recruiting 💼💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

Meme Cleanser

Advertise with us // Visit our merch store // Invest alongside Lit Ventures // Book a call with Lit // Launch your own newsletter