Together with

Good Morning,

Bank runs have started in Russia while US citizens are advised to leave the country (shocker), Lucid tanked after investors realized a company shouldn't be worth $500M per car delivered, TikTok is introducing longer videos, Russia destroyed the world's biggest plane (RIP), and Shell is dumping its Russian oil stakes.

If you want to take a break from doom-scrolling through social media, check out today's BSD podcast. Lit and Mark pull from their own experiences to discuss how to work smarter, not harder. Listen to the latest episode on Spotify and Apple Podcasts.

Let's dive in.

Before The Bell

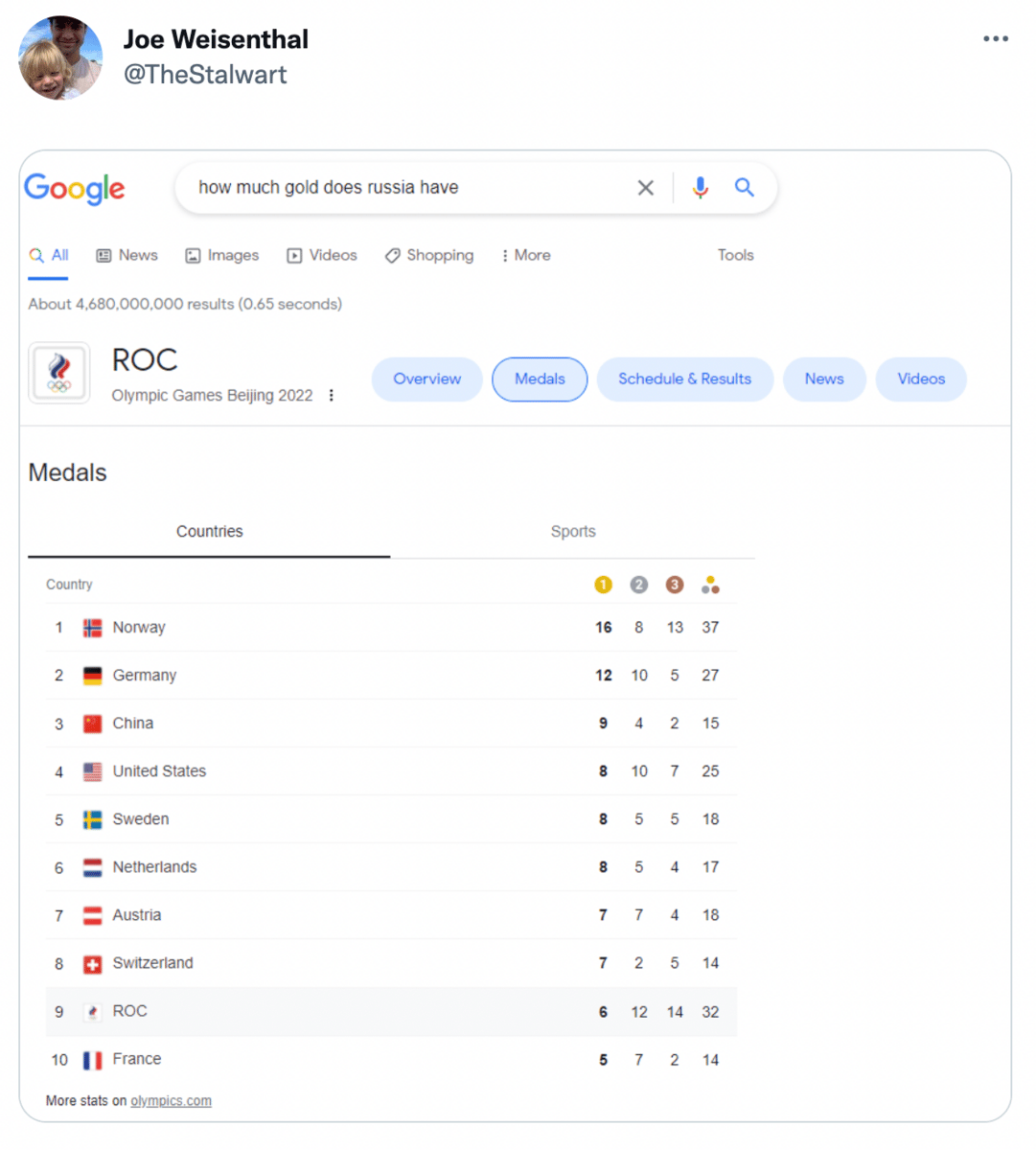

As of 2/28/2022 market close.

If you want to learn more about crypto trading strategies and the world of DeFi, check out our Foot Guns newsletter.

Markets

Stocks rallied into the close yesterday after opening sharply down

The Dow and S&P both booked small losses while the Nasdaq closed in the green

Investors will continue monitoring the effects of the Russia-Ukraine conflict

Currency fluctuations from Russia’s interest rate hike and economic sanctions such as the barring of Russian banks from SWIFT could increase volatility

Putin announced counter-sanctions, while officials also introduced some capital controls to try and stop the ruble plunge

There's now a risk that Russia's stocks and bonds could be kicked out of major investment benchmarks as they become increasingly hard to trade

Oil pushed higher as traders balanced the possible release of emergency stockpiles against fears of disruption to Russian energy exports

Earnings

Berkshire Hathaway shares were up 1%+ AH after their earnings report showed a surge in operating earnings as well as $27B in share buybacks in 2021 (CNBC)

Lucid shares dropped 14%+ after hours after the EV startup cited supply chain constraints as reasoning for slashing its 2022 vehicle production forecast (CNBC)

Lordstown Motors shares fell yesterday after reporting increasing losses and announcing they would need to raise more funding to launch sales and production of their first electric pickup truck later this year (WSJ)

Zoom shares tanked as much as 13% in extended trading after beating on quarterly EPS and revenue but posting a worse-than-expected revenue forecast (CNBC)

What we’re watching today: Target, SoFi, AMC, Salesforce, Nordstrom

Full calendar here

Headline Roundup

Russia hikes rates to highest level since 2003, adds capital controls (BBG)

The list of foreign companies pulling out of Russia keeps growing (BBG)

New York to drop virus restrictions in city and around state (BBG)

US advises citizens to consider leaving Russia immediately (BBG)

World’s biggest plane destroyed in Russian attack on airfield (BBG)

India cabinet said to allow 20% foreign direct investment in LIC (BBG)

Sanctions sink European arm of Russia’s Sberbank (WSJ)

TikTok expands max video length to 10 minutes, up from 3 minutes (TC)

Russian planes barred from airspace over Europe, Canada (WSJ)

Ukraine hospitals could run out of oxygen supplies in 24 hours as war disrupts health services, WHO says (CNBC)

Reface, a viral face-swap app from Ukraine, adds anti-war push notifications (TC)

Fed’s Bostic says half-point move possible if inflation persists (BBG)

IOC recommends banning Russian athletes from international competition as FIFA bars soccer team (WSJ)

Derek Jeter exits as Miami Marlins’ chief executive (WSJ)

Long lines at Russian ATMs as bank runs begin (CNBC)

Pentagon awards $1.8B in contracts to build out its military satellite internet (CNBC)

JPMorgan, Danske Bank freeze funds exposed to Russian assets (BBG)

A Message From Ledger

Skip The Wait List For This Crypto Credit Card

If you’ve ever walked up to the club, fist-bumped the bouncer (Terry, your cousin’s roommate who you crushed beers with back in ‘08), and proceeded to cut the 30+ other people waiting, you know that nothing feels better than skipping a line.

Well, we’ve got good news – now you can do that with the new CL Card, powered by Ledger and operated by London-based fintech Baanx.

This card will allow you to convert your crypto to fiat when making a purchase, receive your paycheck in crypto, spend digital currency without selling, manage your balance... and more.

If you want crypto to be fully part of your daily life, you can join the hefty waitlist for the CL Card right here…

or, you can flex those line-skipping muscles and jump to the front by referring others.

See you in the club, nerds.

Buy, exchange, lend, and other crypto transaction services are provided by third-party partners. Ledger provides no advice or recommendations on use of these third-party services.

Deal Flow

M&A / Investments

Healthcare Realty Trust agreed to buy Healthcare Trust of America in a ~$17.6B deal (BBG)

TD Bank agreed to buy bank First Horizon for $13.4B in their largest acquisition ever (BBG)

KPS Capital Partners is nearing a deal to buy building materials company CRH’s Oldcastle Building Envelope unit for ~$3.8B (BBG)

Biocon Biologics agreed to buy Viatris’ Biosimilars assets for up to $3.3B (BBG)

Shell said it would exit its $3B JV with Russian energy giant Gazprom (WSJ)

REIT WP Carey agreed to buy self-storage asset manager Corporate Property Associates in a $2.7B deal (RT)

British electrical engineering firm Spectris is in talks to buy technology firm Oxford Instruments in a $2.4B deal (RT)

Cinven is nearing a deal to buy Bayer’s pest control business in a potential $2.3B deal (BBG)

Brookfield Asset Management agreed to buy 60% of the payments business of First Abu Dhabi Bank at a $1.15B valuation (BBG)

Wallaby Medical, a firm that develops devices to treat strokes, is in advanced talks to buy Germany’s Phenox, which develops technologies to treat neuro vascular diseases, in a potential ~$558M deal (BBG)

Seritage Growth Partners, a REIT that emerged from the Sears bankruptcy, is exploring strategic alternatives including a sale (BBG)

Universal Music Group agreed to buy singer Neil Diamond’s song catalog and recording rights (WSJ)

VC

Ethnic e-grocer Weee! raised a $425M Series E led by Softbank Vision Fund II (PRN)

Aurora Solar, a software platform for solar sales and design, raised a $200M Series D co-led by Coatue and Energize Ventures (PRN)

Blueprint Equity, a growth equity firm, raised $175M for its second fund (PRN)

Qventus, a provider of AI-aided software for healthcare operations, raised $50M in funding from Thomas H. Lee Partners (BW)

Supira Medical, a company developing a ‘temporary mechanical circulatory support’ solution, raised a $30M Series C led by Cormorant Asset Management and The Capital Partnership (PRN)

Flashfood, a mobile marketplace providing customers with access to discounted food nearing its best by date, raised a $12.3M Series A led by S2G Ventures (TC)

Appili Therapeutics, a biotech company focused on drug development for infectious diseases, raised $10M in funding from the US Department of Defense (BW)

Ex Parte, a startup using AI to predict litigation outcomes, raised a $7.5M Series A led by R8 Capital (BW)

HearHere, a startup building an audio entertainment and immersive storytelling app, raised a $3.2M seed round led by Camping World (TC)

IPO / Direct Listings / Issuances / Block Trades

Nahdi Medical Co, Saudi Arabia's largest pharmacy retail chain, is seeking to raise as much as ~$1.4B from an IPO (the biggest IPO in the kingdom since Aramco) (BBG)

Chinese EV maker Nio will start trading in Hong Kong next week, choosing a path to listing that doesn’t involve selling new shares or raising any money (BBG)

EQT is preparing skincare business Galderma for one of Europe’s largest IPO’s this year (BBG)

Chinese education platform Fenbi.com is considering filing for a Hong Kong IPO that could raise ~$300M (BBG)

Crypto Corner

Coinbase and Binance decline Ukraine request to block Russian crypto users (Decrypt)

Ledger, today's sponsor, helps protect crypto holders from having their assets seized with their hardware wallets. Be wary of keeping your crypto in centralized exchanges these days

FTX pledges up to $1B for philanthropic fund to improve humanity (Decrypt)

KPMG in Canada buys World of Women NFTs (TBC)

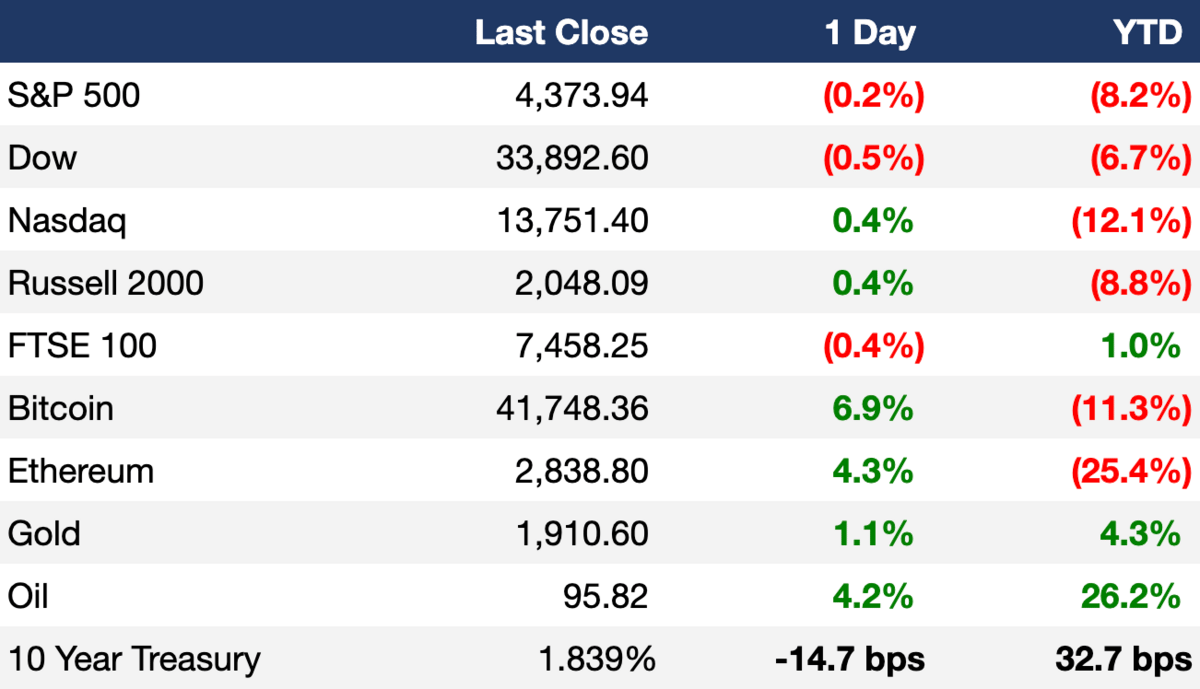

Ruble-denominated Bitcoin volume surges to 9-month high (CD)

Japan's e-commerce giant Rakuten launches NFT marketplace (BW)

Exec's Picks

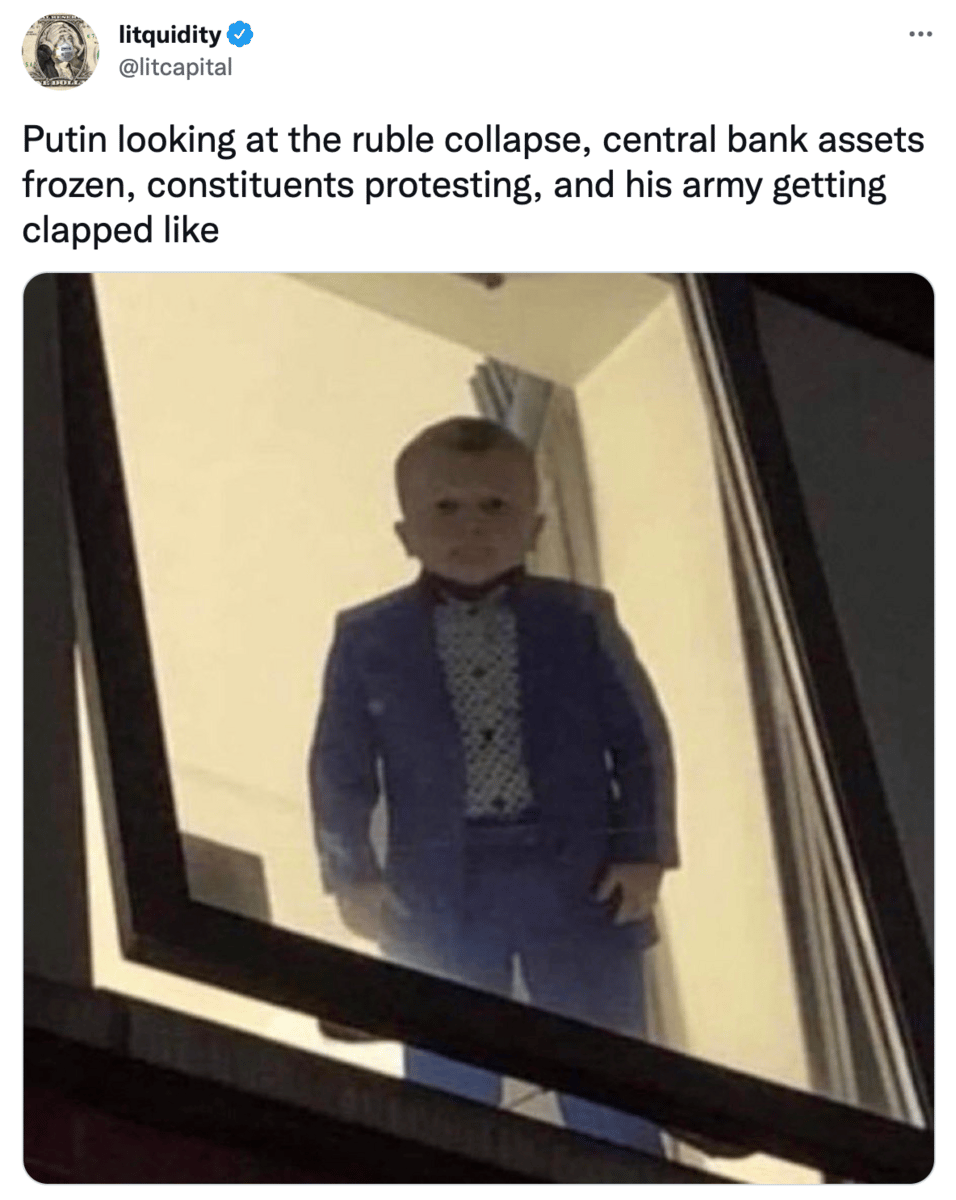

Thanks to social media, Russia's invasion of Ukraine is the first major armed conflict where we are receiving live updates of events as they take place. Trung Phan explains the significance of war in the digital age here.

Like yesterday, scroll through the comments on this post if you're looking for ways to donate to Ukrainian charities.

Big Swinging Decks Podcast

🚨NEW EPISODE OF BSD DROPPED LAST NIGHT🚨

Today's episode: Lessons Learned in the Bullpen: A Case Study on Working Smarter, Not Harder.

This week, Lit and Mark share their tips of the trade gained through hours and hours of time spent on Microsoft Excel and eating Seamless in a cubicle. So pop your F1 key off, chug a red bull, and enjoy the advice of the bullpen’s two most infamous alums.

Check out Big Swinging Decks on Spotify and Apple Podcasts. Sponsored by CoinFLEX.US. Sign up for the waitlist of their US launch here.

The Hiring Block

If you're looking to break into finance, lateral, or move out, check out our job board on Pallet, where we curate highly relevant roles for you. We've got 40+ jobs spanning IB, S&T, VC, tech, private equity, DeFi, crypto, CorpDev and more. We sift through all the noise on LinkedIn, Indeed, Monster, etc. so you don't have to.

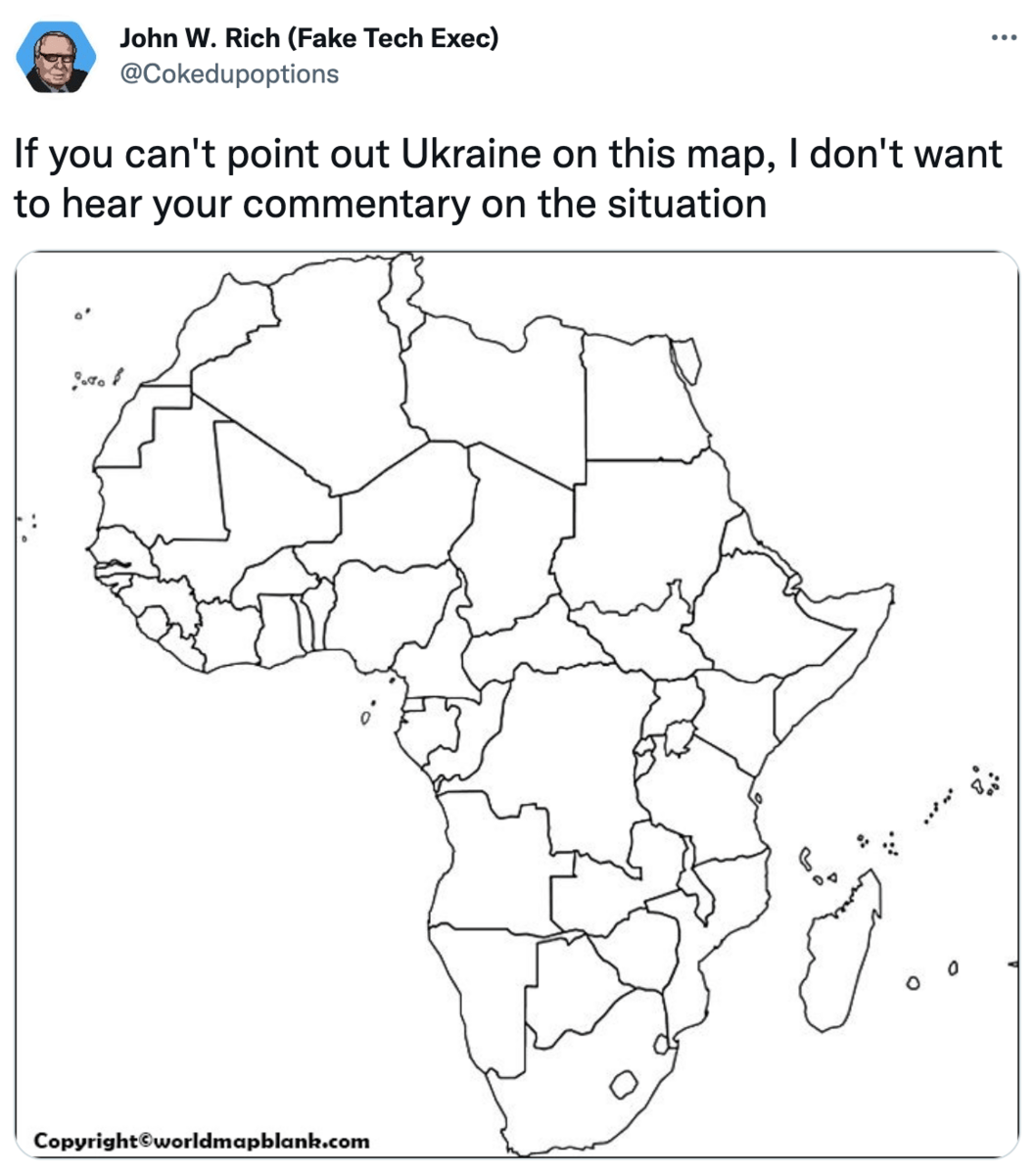

Meme Cleanser

Catch the latest episode of our Big Swinging Decks podcast on Spotify and Apple Music 🤝