Together with

Good morning,

Back in NYC following an epic week down in Miami. Met some awesome folks, got Karl blackout at the club, was appropriately sauced while crypto crashed late Friday night, and managed to get the newsletter out in time every morning.

In case you missed it, we circulated an exclusive investment opportunity to select folks who filled out our survey and are in the process of filling up the first LitVentures special purpose vehicle. 2022 bout to go hard as a mf. We're just getting started.

Let's dive in.

Before The Bell

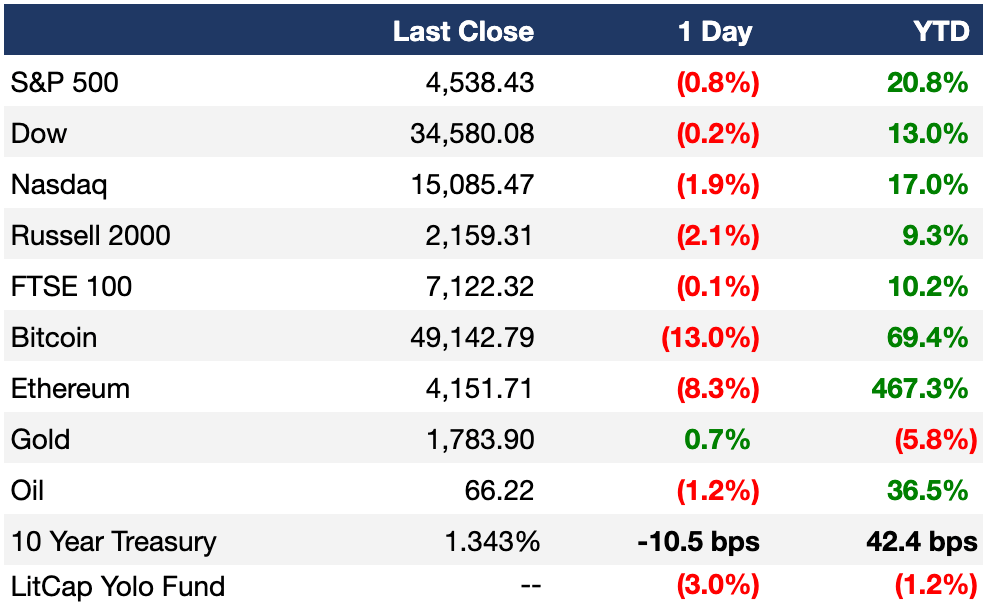

As of 12/05/2021 market close.

To see the LitCap Yolo Fund's portfolio holdings, download the Iris Social Stock app here and give Litquidity a follow. If you want to learn more about crypto trading strategies and the world of DeFi, check out our Foot Guns newsletter.

Markets

Equities swung back into the red on Friday, as all three major indexes posted losses, with the tech-heavy Nasdaq losing 1.9%

Along with omicron concerns, a disappointing November jobs report helped to push markets down

Nonfarm payrolls increased by just 210K in November, considerably lower than the economists’ expectations of 573K

In better news from the report, the unemployment rate fell to 4.2%, below consensus estimates of 4.5%

Investors will be continuing to keep an eye on the two major trends moving markets right now: developments with the omicron variant and the timeline of the Fed’s tapering plan

Bitcoin and the broader crypto markets got absolutely rekt Friday evening, with billions worth of crypto being liquidated. If you were in Art Basel, every party had crypto holders staring at their phones in shock

Earnings

What we're watching this week:

Mon: Coupa

Weds: GameStop

Thurs: Chewy, Oracle

Full calendar here

Headline Roundup

Gilead recalls 55,000 vials of Covid drug due to glass shards (BBG)

UAE buys 80 French Rafale fighter jets in $19B deal (BBG)

Republican leader and former US senator Bob Dole passed away at 98 (CNBC)

Bitcoin holds steady just below $50K after tanking 17%+ on Friday night and into Saturday (CNBC)

CDC chief says omicron likely already in 15 states and cases likely to rise (CNBC)

Crypto exchange BitMart confirms it was hacked and lost $150M in crypto (TBC)

China seeks first military base on Africa’s Atlantic Coast, US intelligence finds (WSJ)

A Message From Skillful

How many times have you told yourself that you’re finally going to learn SQL? Tableau? Or even product frameworks and KPIs? And it never ends up happening?

Us too. Until we heard of Skillful.

Skillful runs immersive cohort-based programs for business careers in the tech industry. Think roles like Strategy & Operations, Product and Growth.

Basically the kind of work you’d do as someone who reads smart business & tech newsletters like, I don’t know, this one.

At Skillful, you’ll get access to programs that are built + led by operators from places like Netflix, Instacart and DoorDash.

And you’ll join a strong community of Skillful grads who have been hired by companies like Stripe, TikTok, Uber and many more.

Deal Flow

M&A

Telecom Italia is close to picking banks to advise it on a $37B buyout offer approach from KKR (RT)

Apollo and EQT are exploring the sale of Direct ChassisLink, the largest US provider of chassis for marine and domestic containers, in a $4.5B deal (BBG)

AstraZeneca blocked a $7.6B takeover by Advent International of drugmaker Swedish Orphan Biovitrum by withholding its 8% stake (BBG)

CVC, Silver Lake, and Thoma Bravo are among PE firms weighing bids for Germany’s Software AG, which has a current market value of $3.3B (BBG)

Credit Agricole agreed to buy a 49% stake in the renewables business of Italian energy group Edison valuing the unit at $2.3B+ (RT)

Carlyle agreed to buy a 50% stake in medical-device manufacturer Resonetics at a $2.25B valuation (BBG)

Korea’s National Pension Service and LaSalle Investment Management for ~$1.7B (BBG)

Diversified industrials company Fortive agreed to buy health-care software maker Provation Medical for $1.4B+ (BBG)

APM Holding, which invests the wealth of the billionaire Maersk family, agreed to buy Covid-19 test maker and diagnostics company Unilabs (BBG)

Israel’s Property and Building Corp. agreed to sell the HSBC Tower building in New York City for $855M to an unidentified third party (BBG)

Macquarie is exploring a sale of Centerline Logistics, a provider of marine petroleum transportation services, that could fetch ~$600M (BBG)

Activist investor Engine Capital is urging department-store chain Kohl’s to consider a sale of the company or a separation of its e-commerce business (WSJ)

Walgreens is exploring a sale of UK drugstore chain Boots (BBG)

French hotel group Accor agreed to buy Le Lido, an iconic cabaret on the Champs-Elysees avenue in Paris (BBG)

Kazakhstani brokerage Freedom Holding agreed to buy equities research and trading boutique MKM Partners for ~$50M (BBG)

VC

Crypto exchange FTX and its US affiliate are seeking to raise $1.5B in total funding at a combined $40B valuation (TI)

HR tech startup Sense raised a $50M Series D at a $500M valuation led by SoftBank Vision Fund 2 (TC)

Umamicart, a startup aiming to be an all-in-one ingredient supplier, raised a $6M seed round led by M13 and FJ Labs (TC)

London-based digital health startup Vinehealth raised a $5.5M seed round led by Talis Capital (TC)

IPO / Direct Listings / Issuances / Block Trades

Vietnamese conglomerate Vingroup is restructuring its automobile unit VinFast ahead of a planned 2022 IPO that could raise up to $3B (BBG)

Saudi Arabia’s Public Investment Fund is set to raise up to $3.1B in a 5% stake sale in Saudi Telecom (BBG)

Chinese drug manufacturer Asymchem Laboratories is planning to raise $917M in its Hong Kong IPO (BBG)

MTN Group, Africa’s largest wireless carrier, raised $150.2M in the IPO of is Ugandan unit (BBG)

UK pharmaceutical company AstraZeneca is studying options including a potential listing of its newly-created vaccines division (BBG)

SPAC

Exec's Picks

Keep Your 2021 Gains (Even on Crypto)

If you are facing hefty U.S. taxes on cap gains from the sale of a business, stock, BTC, real estate, or other investments…

Unlock tax incentives and put your gains to work making an impact in up-and-coming areas.

Other Picks:

Getting close to the cutoff for getting some LitCap merch ahead of the holidays. We've got ugly christmas sweaters and new NFT-related merch (inspired by the JPEG contingent down at Art Basel)

If you got smoked in crypto and didn't see this coming, you should sign up for the Foot Guns crypto trading newsletter to stay up to speed on technicals. Avoid shooting yourself in the foot with degen trading strategies.

Gift a copy of the all-time finance classic book "The Intelligent Investor" to a boomer in your life (or maybe the same degen crypto trader who got smoked over the weekend). You can get 'em for less than $20 on Amazon.

The Hiring Block

If you're looking to break into finance, lateral, or move out, check out our job board on Pallet, where we curate highly relevant roles for you. We've got 100+ jobs spanning IB, S&T, VC, tech, private equity, DeFi, crypto, CorpDev and more. We sift through all the noise on LinkedIn, Indeed, Monster, etc. so you don't have to.

If you're looking to hire candidates and want to post a job, all you have to do is hit "+ Hire Talent" on the top right of the job board.

Featured role: Pantera Capital, the first institutional firm focused exclusively on blockchain / digital assets with over $5B in AUM, is looking to hire a Capital Formation Associate in NYC. Ideal for someone w/ 2+ yrs of experience in IB, Capital Markets, Equity Research, or Investor Relations. Apply here.

To Candidates: We've also partnered up with Portal Jobs for a more hands-on approach to matching talent with relevant jobs. Fill out the form here and we'll get to work on placing you in a relevant gig 🤝