Together with

Good Morning,

Aston Martin is getting short-squeezed, global supply chains "returned to normal" according to the NY Fed, 70+ SPACs are facing liquidation risk, Chinese firms are ditching the US and UK for Swiss listings, hedge funds are suing the LME for its decision to cancel billions in nickel trades last year, and Alameda Research is suing Grayscale.

Looking to overhaul your math, data, and computer science skills to be more competitive in the job market? Check out today's sponsor, Brilliant.

Let's dive in.

Before The Bell

Markets

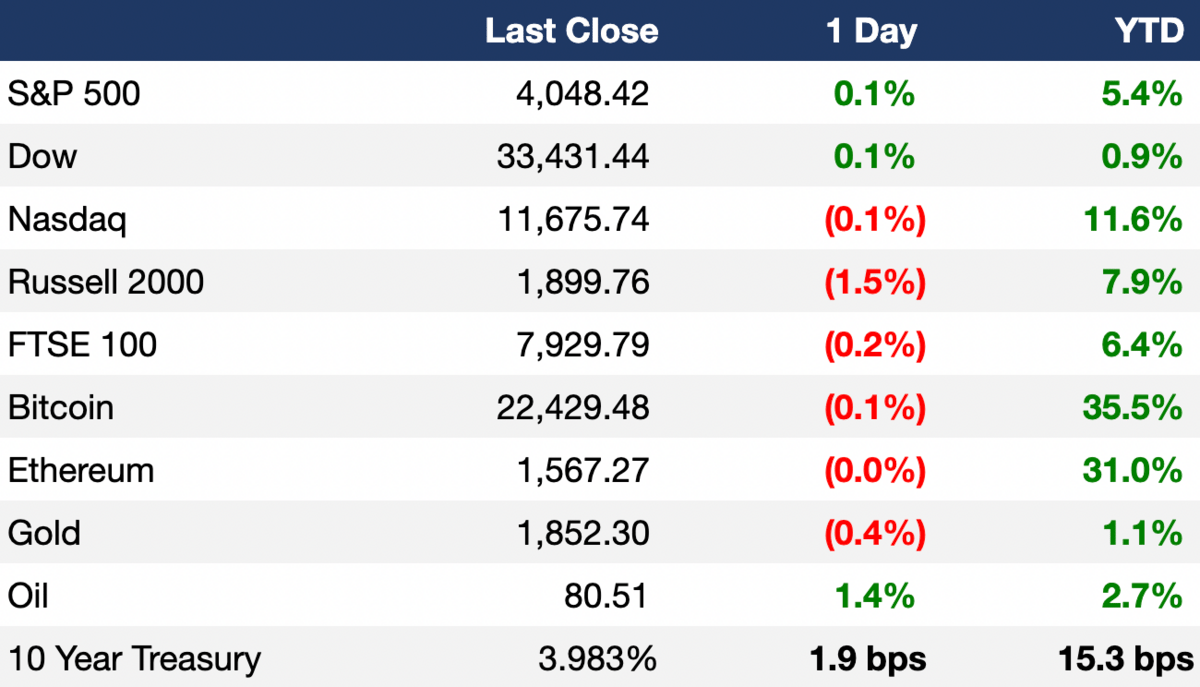

US stocks gave back early gains to end flat yesterday as investors await both J Pow's congressional testimony and important labor market data this week

The Dow scored a four-day win streak on Monday

Gold prices dipped in anticipation of this week’s Fed commentary

Earnings

What we're watching this week:

Today: Dick's Sporting Goods, Dole

Thursday: Oracle, JD.com, Ulta Beauty

Full calendar here

Headline Roundup

US mortgage rates rose for a fourth straight week to 6.65% (WSJ)

Global supply chains have 'returned to normal,' according to NY Fed (RT)

Iran discovered the world’s second-largest lithium deposit (CNBC)

Over 70 SPACs with $18B cash in total are at risk of liquidation (BBG)

Fear of ratings downgrades puts companies off debt-driven deals (FT)

NYSE, Charles Schwab and Citadel Securities pushed back against SEC's proposed stock market rules (RT)

Chinese firms are ditching US/UK for Switzerland to raise money overseas (FT)

Firms are disclosing actual CEO compensation amid a new SEC rule (WSJ)

India is expanding trade ties with the West amid China risks (WSJ)

Saudi Arabia deposited $5B in Turkey's central bank (RT)

Ten HFs including AQR sued London Metal Exchange over its decision to cancel nickel trades worth billions last year (BBG)

General Atlantic, International Holding Company, and Abu Dhabi-backed ADQ will partner to create MENA's largest investment manager (FT)

UBS cut bonus pool while increasing CEO pay (BBG)

Chevron CEO believes Ukraine war fundamentally changed natural gas markets (RT)

TikTok rolled out 'Project Clover' to assure Europeans on data (WSJ)

Tesla slashed prices for the second time this year (BBG)

Top Goldman Sachs trader Joe Montesano will depart (FT)

Boomers are leading the consumer spending boost (AX)

Hospitality sector employment is booming (WSJ)

Aston Martin stock surged 25% as 2023 F1 success amplifies short squeeze (BBG)

A Message From Brilliant

The best time to learn more about AI was yesterday. The second best time? Right now.

With Brilliant, you can level up on the concepts behind AI and artificial neural networks in minutes a day. Brilliant is an interactive learning tool that gets you hands-on with core concepts in math, data, and computer science. Interactive learning is proven to be six times more effective than lectures. With thousands of bite-sized lessons, it's easy to fit into your busy life.

Join over 10 million people and start your 30-day free trial now. Plus, get 20% off an annual premium subscription.

Deal Flow

M&A / Investments

PE firm Silver Lake and Canada Pension Plan Investment Board offered to buy software maker Qualtrics in a $12.4B go-private offer, a ~6% premium to the stock's last closing price (RT)

US energy company Vistra agreed to buy nuclear power producer Energy Harbor in a $3.43B deal (RT)

Marlboro maker Altria agreed to buy e-cigarette startup NJOY for ~$2.75B, after losing billions through its investment in Juul (RT)

British retailer EG Group raised $1.5B through a sale and leaseback of 415 US sites (BL)

Malaysian conglomerate Westar Group agreed to buy KKR’s 21% stake in its subsidiary helicopter services company Westar Aviation Services (BBG)

Abu Dhabi National Oil Company’s potential acquisition of energy trading house Gunvor hit an impasse amid deal size disagreements (FT)

Actor and producer Tyler Perry expressed interest in buying a majority stake in BET Media Group, the owner of the BET and VH1 cable network and streaming service BET+, from media company Paramount Global (WSJ)

Swiss fund manager GAM is scrambling to find a buyer ahead of the release of its annual results, which it has delayed by two months (FT)

VC

Open banking startup Abound raised a $601M hybrid round with debt from Citi and Waterfall Asset Management and equity from K3 Ventures, GSR Ventures, and Hambro Perks (TC)

Residential energy retrofit platform BlocPower raised a $155M Series B ($130M in debt / $25M in equity) led by VoLo Earth Ventures (TC)

Palmetto, a technology enabled clean energy platform, raised $150M in funding from TPG Rise Climate (FN)

Bicara Therapeutics, a clinical stage biotech company developing biologics to elicit an anti-tumor response, raised a $108M Series B led by Red Tree Venture Capital and RA Capital Management (BW)

Effect Photonics, a Dutch-based developer of integrated optical solutions, raised a $40M round led by Invest-NL and Innovation Industries (FN)

N2F, a provider of expense management software, received a $25.6M investment from PSG Equity (FN)

RangeForce, a provider of cloud-based cyber defense upskilling solutions, raised a $20M round led by Energy Impact Partners and the Paladin Capital Group (FN)

Geothermal energy startup XGS Energy raised $19M in financing which included a $14M Series A led by Anzu Partners (BW)

Congruence Therapeutics, a biotechnology startup working on an interface between computational and experimental drug discovery, raised a $15M Series A extension led by BDC Capital’s Thrive Venture Fund (FN)

Chromologics, a Danish biotech startup producing natural food colors, raised a $7.6M seed round led by Novo Holdings, Nordic Foodtech VC, Danmarks, and others (FN)

Odyssey Wellness, the maker of an energy drink infused with mushroom extracts, raised a $6.3M Series A (BW)

Lonestar, a startup looking to build mission critical data services and communications on the Moon, raised a $5M seed round led by Scout Ventures (PRN)

SteadyPay, a London-based progressive lending platform, raised a $3M seed round led by N1 (FN)

Chimi, a Stockholm-based fashion house, raised a $1.9M seed round led by the Redgert Group, Bianca Ingrosso, and Ben Eliass (FN)

Over C, a Caribbean-based property management platform, raised $1.2M in funding from Ayre Ventures (FN)

UK-based data provider platform DiffusionData raised a $1M round from The North East Development Capital Fund (FN)

IPO / Direct Listings / Issuances / Block Trades

Debt

Argentina will swap investors' local debt into new bonds to ease fears of default on $35B of local debt due in Q2 (BBG)

Fundraising

Bridgewater raised $836M for two 'Defensive Alpha' strategy funds which intend limited exposure to equities (RT)

Indiana Public Retirement System committed $450M to two PE firms: $300M to HarbourVest Partners and $150M to Hellman & Friedman (PEI)

Upload Ventures, a SoftBank LatAm spinout, is seeking to raise a $250M fund (TC)

London-based investment firm Infodriver Capital launched a $10M fund aimed at supporting DeFi, GameFi, and AI startups across the UK, UAE, USA, and Europe (FN)

Crypto Corner

Alameda Research sued crypto asset manager Grayscale for imposing a redemption ban that could realize over $250M of asset value for FTX customers (RT)

Bybit suspended US dollar deposits (CD)

Crypto banking firm BCB is preparing US dollar payments to plug Silvergate gap (CD)

Bitcoin ATM firm Bitcoin of America allegedly profited from crypto scams via unlicensed kiosks (CT)

French luxury house Hermes asked a US court to block artist Mason Rothschild from promoting/owning his MetaBirkin NFTs (RT)

Exec's Picks

How to Invest is a master class on investing featuring conversations with the biggest names in finance, from the legendary cofounder of The Carlyle Group, David M. Rubenstein. Check out his latest book here.

Janelle Teng covered the issues with stock-based compensation as both an incentive tool and a smoke screen to hide poor financials.

Financial Times' Laurence Fletcher shared how Citadel used weather forecasts to help it outperform in 2022.

Litney Partners - Financial Recruiting 💼💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

Meme Cleanser

Thinking of starting your own newsletter? Beehiiv is the best platform for creators, period. Click here to get started building your own audience.