Together with

Good Morning,

Hedge funds are hurting from lack of PE exits, Bill Gross thinks Trump would be worse for bond markets, more high-grade borrowers are at risk of downgrade, and Google botched its AI push again.

Looking to diversify into a range of private credit opportunities? Check out Percent, a highly democratized private credit market for exclusive private credit deals.

Let’s dive in.

Before The Bell

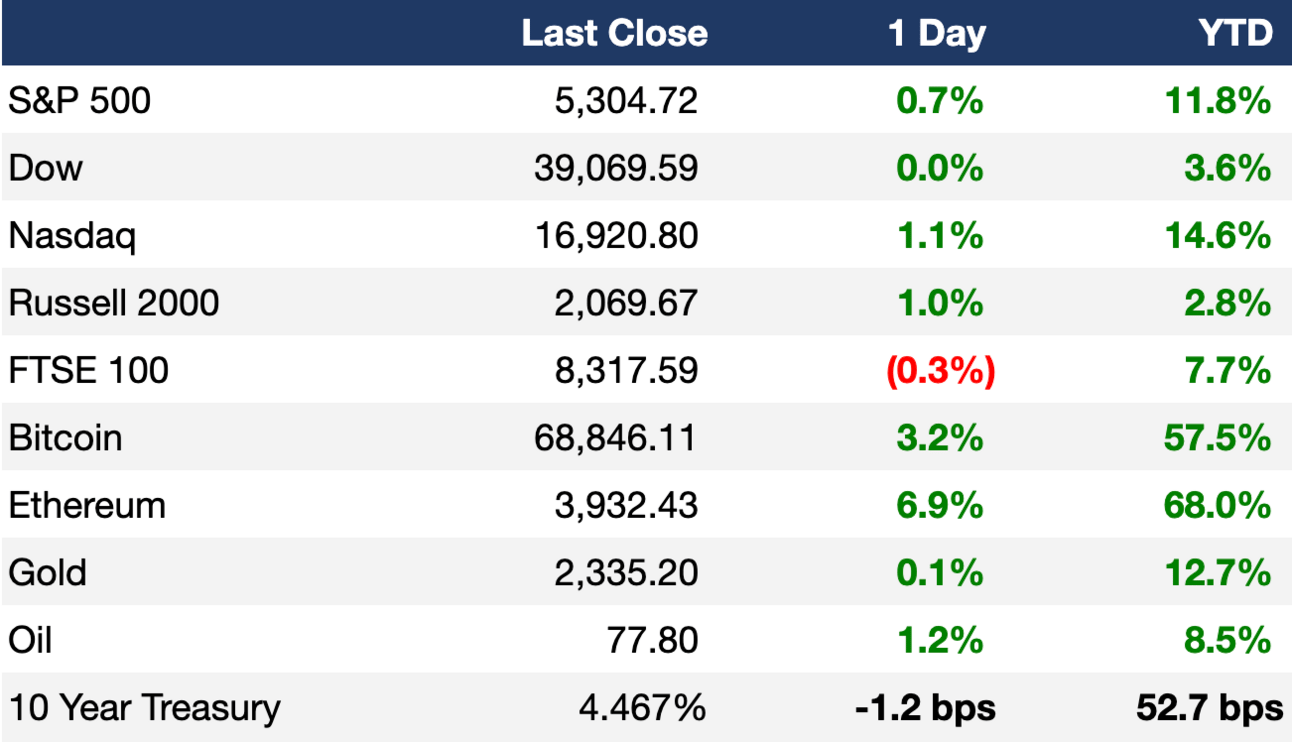

As of 05/24/2024 market close.

Markets

US and UK stock markets were closed yesterday in observance of regional holidays

US stocks rebounded on Friday on news of improving consumer outlook on inflation

The Nasdaq rose for a fifth-straight week to an ATH

The Dow snapped a five-week win streak

Markets are now pricing one rate cut in 2024, down from six earlier this year

Earnings

What we're watching this week:

Today: CAVA

Wednesday: Salesforce, HP

Thursday: Costco, Dell, Dollar General, Kohl's

Full calendar here

Headline Roundup

Hedge funds hit by lack of PE exits (FT)

Swedish insider trading probe involves PE employees (BBG)

Bill Gross says Trump would be worse for bond markets than Biden (FT)

Janet Yellen expressed concerns over rising living costs (FT)

More US high-grade borrowers at risk of downgrade as economy slows (FT)

Google's AI search is producing embarrassingly wrong results (TV)

UK life insurers tripled use of controversial reinsurance deals (FT)

Trafigura faces off with aluminum bulls over huge metal stash (BBG)

Most UK-focused pension funds severely lag index tracker (FT)

US municipalities pile into Israel’s wartime debt (FT)

UBS successor to CEO Ermotti to come from within bank (FT)

Equity funds see massive weekly inflows on rate cut hopes (RT)

'Asset famine' in China curbs central bank's bond trading ambitions (RT)

China's property stimulus raises risks for banks in smaller cities (RT)

Citigroup asked 600 staffers to RTO full-time (RT)

Boeing sees six-fold rise in employee concerns on safety and quality (RT)

A Message From Percent

Up To 20% APY Returns? No, It’s Not Bitcoin Or AI…

Private credit was a $500 billion asset class in 2015 - it’s projected to grow to $2.5 trillion by 2027.

Why? Private credit are loans negotiated privately and not by banks - meaning they’re typically less correlated to public markets and can protect against volatility.

With Percent, everyday accredited investors can access these deals alongside institutional investors, unlocking the potential for higher returns and diversification.

New to private credit? Earn up to a $500 bonus on your first investment with Percent here.

Percent offers investors:

High APYs: Percent’s average APY is 18.1% as of Mar 31, 2024.

Low minimums: Invest as little as $500 to start.

Shorter terms: Deals range from 6-36 months.

Diversification: Access to multiple types of lending through both domestic and international deals.

Deal Flow

M&A / Investments

KKR is set to receive EU approval for its $23.9B deal to acquire Telecom Italia's fixed-line network (RT)

PE firm PAG is considering buying Chinese conglomerate Dalian Wanda Group’s shopping mall properties, which could fetch a $13.8B valuation (BBG)

EQT is exploring strategic options including a minority stake sale for Reworld that could value the waste management firm at over $8B, including debt (BBG)

$4.8B waste disposal firm Stericycle is considering a potential sale after receiving takeover interest (BBG)

PE firm Advent International is nearing a deal to acquire a stake in industrial software firm Prometheus at an over $4B valuation, including debt (BBG)

Carlyle is planning a sale of Italian aerospace-focused manufacturer Forgital at a $2.7B EV (RT)

UK engineering firm John Wood Group rejected a third ~$2B takeover proposal from Dubai-based Sidara (RT)

UK homebuilding giant Persimmon is exploring a $1.3B takeover bid for rival Cala (BBG)

UK financial services company Coventry Building Society will acquire Co-operative Bank for $990M cash (RT)

ADNOC and Aramco are among firms weighing bids for Shell's downstream assets in South Africa, which could be valued at over $800M (BBG)

Swiss private bank Julius Baer is reportedly exploring a potential acquisition of rival EFG International (BBG)

VC

Musk's xAI raised a $6B Series B at a $24B valuation from investors including Sequoia and a16z (WSJ)

Indian e-commerce firm Flipkart is raising a $1B round at a $36B valuation led by Walmart and with significant participation from Google (TC)

German AI defense startup Helsing AI is in talks to raise a $400M Series C at a $4B valuation led by General Catalyst (EU)

CBiGroup, a financial services platform for businesses, raised a $15M Series A led by Alpol Capital Family Office (FN)

Cloud-based spreadsheet app Rows raised an $8.4M seed round led by Indico Capital Partners (EU)

5thScape, a startup developing products for VR, raised a $6M seed round (FN)

ThinkLabs AI, a startup developing technology to enhance grid planning, raised a $5M seed round led by Powerhouse Ventures and Active Impact Investments (FN)

IPO / Direct Listings / Issuances / Block Trades

Saudi Arabia is planning a ~$10B share sale in state-owned energy giant Aramco (RT)

India's Adani Energy Solutions secured board approval to raise as much as $1.5B (BBG)

Indian miner Vedanta is considering a share sale that could raise up to $1B (BBG)

Healthcare payments software firm Waystar is moving ahead with plans for a $950M IPO (BBG)

GameStop raised $933M from an at-the-market equity offering (RT)

The IPO valuing Mauritian telecoms firm Emtel at $222M made it Mauritius' fifth-most valuable firm (BBG)

Luxury sneaker brand Golden Goose is planning a Milan IPO as soon as this week (BBG)

French energy giant TotalEnergies is exploring a cross-listing in US, while keeping its shares on Euronext (RT)

Debt

Brazilian paper/pulp giant Suzano is in talks with Asian banks including Mizuho Financial, Nomura, and Mitsubishi UFJ, on financing a potential bid for $15.8B US rival International Paper (BBG)

French battery startup Verkor secured $1.4B in green loans (BBG)

Italian financial services specialist DoValue is nearing a $489M financing deal with a group of banks for its combination with Elliott's Gardant servicing unit (BBG)

Bankruptcy / Restructuring / Distressed

Brazilian airline Gol expects to exit Chapter 11 bankruptcy with a $1.5B equity injection and a $2B debt refinancing (RT)

Struggling landlord SBB struck a second financing deal with investment firm Castlelake, to provide a $535M cash injection (BBG)

Rite Aid is nearing a deal on a post-bankruptcy financing package that would eliminate $2B in debt (RT)

Troubled German landlord Adler struck a deal with creditors to refinance debt and inject liquidity in its second debt overhaul in the last two years (BBG)

Italian fashion brand Benetton is planning a restructuring as losses mount (RT)

Fundraising

China set up its third state-backed fund with $47.5B to back its semiconductor industry (RT)

Crypto Corner

A UK woman was sentenced to six years over a $5.6B China Bitcoin fraud (BBG)

Exec’s Picks

Considering investments in private markets but not sure how to access them? Check out Nomuscapital for solutions tailored to a range of investment needs, including entity formation, legal and accounting, cap table management…and everything you need to launch your investment fund today.

The Information's founder Jessica Lessin gave an interesting take on how media companies are making a huge mistake with AI.

Litney Partners - Financial Recruiting 💼💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

Meme Cleanser

Advertise with us // Visit our merch store // Invest alongside Lit Ventures // Book a call with Lit // Launch your own newsletter