Together with

Good morning,

Or should we say "gm". It's Friday, Mariah Carey has appeared from the woodwork again, Miami's streets are clogged with crypto / NFT / tech nerds, and the November jobs report is set to drop this morning.

With the holidays fast approaching, we've got some treats in store for the Exec Sum fam. Stay tuned for more next week. For now, the team will be getting lit af at Art Basel events. Le

Have a great weekend, all.

Before The Bell

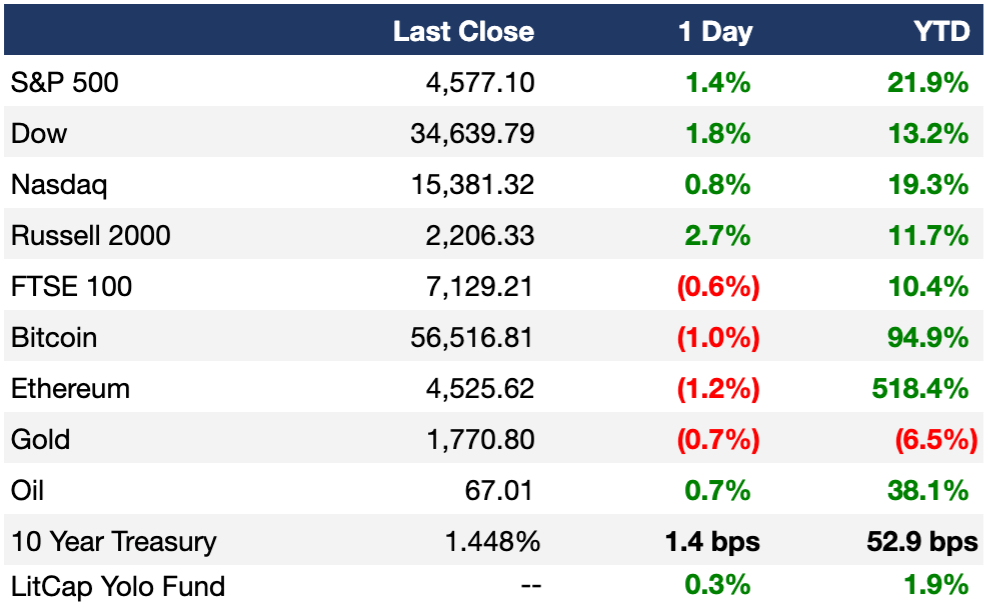

As of 12/02/2021 market close.

To see the LitCap Yolo Fund's portfolio holdings, download the Iris Social Stock app here and give Litquidity a follow. If you want to learn more about crypto trading strategies and the world of DeFi, check out our Foot Guns newsletter.

Markets

The three major US indexes rebounded yesterday after cyclical stocks tied to economic recovery recovered back their recent losses

First time jobless claims for last week came in at 222K, beating 240k that economists estimated

Be on the lookout for the November jobs report this morning; economists are expecting 581K jobs added

Earnings

Dollar General posted a beat-and-raise Q3 report as shoppers move to discounted retailers amid the highest levels of inflation in 30 years (TS)

DocuSign fell 30% in extended trading after reporting EPS and revenue that exceeded expectations, but a discounted Q4 forecast which came in well below expectations (CNBC)

TD reported better-than-expected earnings numbers but a cautious future outlook due to inflation and the end of stimulus measures (RT)

What we’re watching today: BMO

Full calendar here

Headline Roundup

Facebook parent Meta expands advertising options for crypto (BBG)

GlaxoSmithKline says its Covid antibody drug is likely effective against omicron (WSJ)

MLB owners lock out players in battle over the game’s economics (WSJ)

US tightens travel testing requirements, mask mandates as part of broader plan to fight Covid (CNBC)

Jobless claims less than expected as labor market returns to pre-pandemic self (CNBC)

Omicron will likely ‘dominate and overwhelm’ world in 3-6 months, doctor says (CNBC)

Blackstone’s executive vice chairman, Tony James, to retire (WSJ)

Suburban NYC home sales plunge because there’s nothing to buy (BBG)

Italy to shield strategic assets if KKR bids for Telecom Italia (BBG)

BuzzFeed workers walk off the job to protest contract talks (BBG)

New York officials confirm 5 cases of omicron Covid variant across state (CNBC)

Dollar General will open 1,000 Popshelf stores, aimed at wealthier shoppers (CNBC)

Google workers in US won’t return to office as expected on Jan. 10 (CNBC)

FTC sues to block Nvidia’s $40B acquisition of Arm (CNBC)

A Message From Capital Allocators

I’ve been writing about Capital Allocators for a few weeks now, and if you haven’t checked out the pod, I’m telling you – it slaps. The guest library is seriously deeper than the 2018 Gold State Warriors with some of the biggest name in institutional investing. Subscribe on Apple, Spotify, or wherever you listen to podcasts.

Today I want to tell you about Capital Allocators University – a live, online cohort for senior investment professionals. CAU is an opportunity for like-minded peers in institutional investing to learn from subject matter experts and connect to compound relationships.

Ted Seides and past podcasts guests teach frameworks to help generate internal alpha – like Annie Duke teaching best-practices in decision making and the CIO from the New Zealand Super Fund and former Notre Dame CIO teaching modern investment frameworks.

Registration for the April 2022 cohort will open in January. Space is limited, so join the waitlist today.

Lean more and join the waitlist for Capital Allocators University

Deal Flow

M&A

Australian biotech company CSL is in talks to buy Swiss drugmaker Vifor in a potential $8.6B deal (BBG)

British asset manager Abrdn agreed to buy investment platform Interactive Investor for $1.98B (RT)

Triton Investment Management is in advanced talks to buy UK specialty pharmaceutical company Clinigen, which has a current market value of ~$1.3B (BBG)

Lone Star Funds is considering a sale of its Chinese gas company Sino Gas & Energy that could fetch ~$1B (BBG)

Australian grocer Woolworths made a $613M offer for drugstore chain Australian Pharmaceutical Industries (RT)

Bank of East Asia is considering a sale of its general insurance business Blue Cross that could fetch $300-400M (BBG)

Thai conglomerate Central Group agreed to buy British department store operator Selfridges & Co. from The Weston Family (BBG)

Churchill Downs is exploring options including a sale of TwinSpires Racing, the official betting partner of the Kentucky derby, that could fetch $1.5B (BBG)

Bass Pro Shops owner, Great Outdoors Group, has terminated its merger with outdoor equipment retailer Sportsman’s Warehouse and will pay a $55M fee (BBG)

A group led by publishing veteran David Steinberger agreed to buy Open Road, one of the country’s first independent ebook publishers, for $60-80M (WSJ)

Daily Mail chairman, Lord Rothermere, raised his offer for the newspaper company by 5.9% and lowered the shareholder acceptances to clinch the deal to 50% from 90% after major investors called the first offer unfair (BBG)

VC

Express grocery delivery service Instamart raised $700M in funding from Swiggy (TC)

Logistics startup Mesh Korea is looking to raise $200-300M at a $850M valuation (BBG)

Smartling, a cloud translation platform company, raised $160M in funding led by Battery Ventures (BW)

Rapid grocery delivery service Jokr raised $260M at a $1.2B valuation from existing investors, including Tiger Global (BBG)

Singaporean-based edtech company LingoAce raised a $105M Series C led by Sequoia Capital India (BW)

“Buy Now, Pay Later” platform Kueski raised $102M in funding led by StepStone Group and $100M in debt led by Victory Park Capital (TC)

Labor management platform Shiftsmart raised a $95M Series B led by D1 Capital (BW)

Lodging performance network Hotel Engine raised a $65M Series B at a $1.3B valuation led by Telescope Partners (PRN)

Corporate spend management platform Mendel raised a $15M Series A as well as $20M in debt after participating in Y-Combinators Winter 2021 cohort (TC)

All in one hotel operations platform Life House raised a $60M Series C led by KAYAK and Inovia Capital (PRN)

Gaming organization 100 Thieves raised a $60M Series C at a $460M valuation led by Green Bay Ventures (BW)

Mobility-as-a-Service startup Kakoa Mobility raised $55M in funding at a $4.2B valuation from strategic investor GS Retail (TC)

Clarity AI, a sustainability technology startup, raised $50M in funding at $450M valuation led by SoftBank (BW)

Glorify, an app to help Christians strengthen their daily connection to God, raised a $40M Series A led by a16z (PRN)

Uniform, a headless composable digital experience platform, raised a $28M Series A led by Insight Partners (PRN)

Visual effects startup Monsters Aliens Robots Zombies raised a $5.3M Series A led by Round13 Capital (TC)

IPO / Direct Listings / Issuances / Block Trades

SPAC

Shares of ride-hailing and delivery firm Grab rose 18% in US debut yesterday after their $40B SPAC merger (RT)

BuzzFeed will raise $16M from its public listing, after the SPAC it merged with suffered a wave of investor withdrawals (~94% of the $287.5M it had raised) (WSJ)

Singapore’s Vertex Holdings and European asset manager Tikehau Capital are preparing to file preliminary prospectuses for a SPAC listing in the city-state (BBG)

Debt

Lenders are postponing the $8.5B debt package to finance CD&R’s buyout of UK grocer Morrison amid market volatility (BBG)

Barclays and Deutsche Bank are prepping a ~$3.5B debt sale to help fund Brookfield Business Partners’ purchase of global lottery services and technology business Scientific Games (BBG)

Exec's Picks

Straight cash (back), homie. This new credit card is a spender’s dream, offering unlimited 2% cash rewards on purchases (no more tracking categories) and a generous sign-up bonus. The Ascent's independent team of experts is calling it one of best all-around cards. Learn more now.

In case you missed it last week, we're launching a Student Athlete program in partnership with OfficeHours. Litquidity Student Athletes will have access to exclusive merch, career coaching, interview prep, and access to the Litquidity team. Applications close Dec 10th. Apply here.

Crypto, Web3, NFTs, etc. are all the rage at the moment and we've got some new JPEG Morgan and DAO Jones hats available for the DeFi enthusiasts out there. Scoop em up now ahead of the holidays.

The Hiring Block

If you're looking to break into finance, lateral, or move out, check out our job board on Pallet, where we curate highly relevant roles for you. We've got 100+ jobs spanning IB, S&T, VC, tech, private equity, DeFi, crypto, CorpDev and more. We sift through all the noise on LinkedIn, Indeed, Monster, etc. so you don't have to.

If you're looking to hire candidates and want to post a job, all you have to do is hit "+ Hire Talent" on the top right of the job board.

To Candidates: We've also partnered up with Portal Jobs for a more hands-on approach to matching talent with relevant jobs. Fill out the form here and we'll get to work on placing you in a relevant gig 🤝