Together with

Good Morning,

The Fed is set to double its economic growth forecast, Apple and Arm signed a chip deal that goes beyond 2040, China banned iPhone use for government officials at work, oil prices climbed on an expected US crude stock draw, and Roku’s stock jumped on layoff news.

This summer was a volatile season in financial markets, but today’s sponsor, Axios Pro, published a report covering the most important factors and trends you need to know across VC, PE, and M&A. Check it out here.

Let’s dive in.

Before The Bell

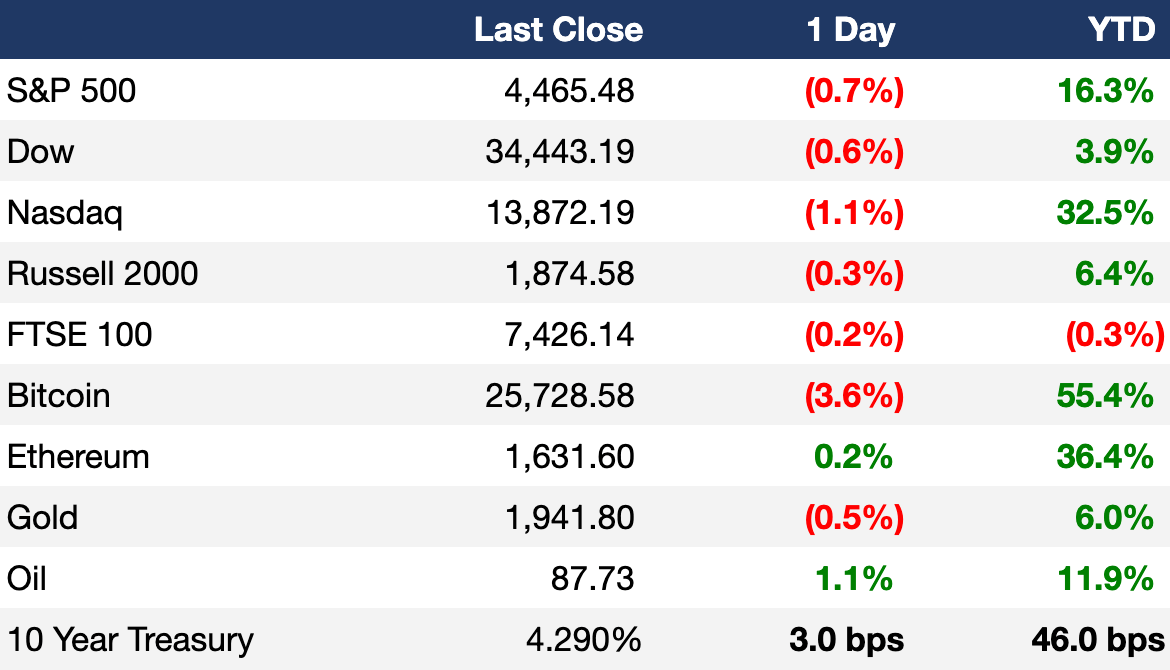

As of 9/6/2023 market close.

Markets

US stocks fell over concerns that the Fed may not be done hiking interest rates

The Nasdaq led indices with a 1.06% decline

Oil prices continued their climb upwards on anticipated US crude stock draw, with WTI crude closing at 87.73

US 2Y yields hit 5.03%

Earnings

GameStop shares rose ~6% after it posted a smaller-than-expected loss and beat revenue expectations thanks to strong video game demand (RT)

UiPath shares rose 5% after beating Q3 analyst earnings and revenue expectations (I)

C3.ai stock fell 7% despite reporting better-than-expected losses and revenue; it forecast a larger-than-expected full-year loss and withdrew its forecast of non-GAAP profitability by the end of fiscal 2024 (BRRN)

What we're watching this week:

Today: DocuSign

Friday: Kroger

Full calendar here

Headline Roundup

Fed set to double its economic growth forecast after strong US data (BBG)

Apple and Arm sign deal for chip technology that goes beyond 2040 (CNBC)

China’s credit wreck exposes governance failings to world (BBG)

China bans iPhone use for government officials at work (WSJ)

US lawmaker calls for ending Huawei, SMIC exports after chip breakthrough (RT)

Oil prices edge up on anticipated US crude stock draw (RT)

Oaktree’s Howard Marks expects more companies to default on debt (BBG)

Google reaches antitrust settlement with state over app store practices (WSJ)

US service gauge rises to six-month high, topping all forecasts (BBG)

Texas teeters on edge of blackouts as demand squeezes grid (BBG)

Warner Bros. Discovery CEO Zaslav says writers, actors strikes need to end (CNBC)

US to cancel Alaska oil, gas leases issued under Trump (RT)

ECB’s Knot says market risk underplaying hiking chances (BBG)

Roku stock jumps after company says it will lay off 10% of workforce (CNBC)

Sluggish Canadian banks face stock sales to meet capital rules (BBG)

McConnell vows to finish Senate term, despite health scares (CNBC)

A Message From Axios Pro

VCs are sitting on hundreds of billions of dollars of dry powder. To prepare you for what’s next across the dealmaking world, Axios Pro analyzed thousands of data points to uncover the factors that matter most right now.

Why it matters: Boasting decades of combined experience, the Axios Pro newsroom brings together the smartest journalists covering VC, PE and M&A today. Each day, we guide our readers with industry-specific coverage of companies, trends and funding rounds that other outlets just miss.

Deal Flow

M&A / Investments

Paper company WestRock is nearing a deal to merge with Europe’s Smurfit Kappa to create a $20B global paper and packaging powerhouse (WSJ)

Tata Group's consumer unit is in talks to buy at least a 51% stake in popular Indian snack food maker Haldiram's, which is seeking a $10B valuation (RT)

Great Wall Motor is exploring options including a stake sale in its $6B battery unit Svolt Energy Technology due to possible IPO delay (BBG)

An investor consortium that includes Blackstone and Thomson Reuters are looking to sell $2.9B worth of stock in London Stock Exchange Group (BBG)

Data analytics software company Alteryx, which has a market cap of $2.2B, is exploring a potential sale after attracting takeover interest (RT)

C&S Wholesale Grocers is nearing a $2B deal to acquire 400 grocery stores from Kroger and Albertsons Cos, who are hoping to secure regulatory approval for their $24.5B deal (RT)

PE firm Thoma Bravo will acquire health-records software company NextGen Healthcare in a $1.8B deal (BBG)

Chinese auto chipmaker GTA Semiconductor raised $1.8B through a largely state-led financing round (RT)

Morgan Stanley Infrastructure Partners is in talks to acquire indebted cable and telecoms group Altice’s French data centers for an estimated $1.1B (RT)

Alternative asset fund manager Bridgepoint will acquire Energy Capital Partners for $1.1B, including debt, to boost its mid-market asset investing presence (RT)

Nestle agreed to acquire Brazilian chocolate maker Kopenhagen for $600M-$900M (RT)

Canadian natural gas firm Peyto Exploration & Development agreed to acquire Spanish energy company Repsol's Canadian unit for $468M (RT)

Jared Kushner’s PE firm Affinity Partners is acquiring a $150M minority stake in Israeli car maker S Shlomo Holdings (BBG)

VC

PayJoy, a smartphone-based finance solutions startup, raised $360M: a $150M Series C led by Warburg Pincus and $210M in debt led by Citi (FN)

Boston Metal, a metals technology solutions company, raised a $262M Series C from Aramco Ventures, M&G Investments, Goehring & Rozencwajg, and others (BW)

Nimbus Therapeutics, a clinical-stage drug discovery startup, raised a $210M private financing round led by GV and existing investors SR One and Atlas Venture (BW)

Shop Circle, a London-based e-commerce software provider, raised a $120M Series A led by 645 Ventures and 3VC (FN)

d-Matrix, a startup building a generative AI compute platform for data centers, raised a $110M Series B led by Temasek (BW)

SaaS management platform Josys raised a $93M Series B led by Global Brain and Globis Capital Partners (TC)

Ibex Medical Analytics, a startup using AI to improve cancer diagnostics, raised a $55M Series C led by 83North (FN)

Story Protocol, an open infrastructure platform for the creation and distribution of IP, raised $54M in funding led by a16z crypto (BW)

Tentarix Biotherapeutics, a biotech startup focused on developing multi-functional, conditional protein therapeutics, raised a $35M Series B led by Amplitude Ventures (BW)

Nuventura, a Berlin-based provider of SF6-free MV gas-insulated switchgear technologies, raised a $26.8M Series A led by Mirova (FN)

Arduino, a microcontroller manufacturer, extended its Series B by $22M with a $32M Series B led by CDP Venture Capital and Anzu Partners (TC)

Momnt, a fintech startup providing real-time lending and payment solutions for businesses, raised $15M in funding led by TruStage Ventures (BW)

Vehicle-to-everything startup Commsignia raised a $15M Series B led by PortfoLion Capital Partners, Inventure, Day One Capital, and Inference Partners (FN)

SaaS workplace management startup deskbird raised a $13M Series A led by Alstin Capital and AVP (FN)

Snack company SkinnyDipped raised a $12M Series A led by hospitality entrepreneur David Grutman (TC)

Lydian, a CO2-derived fuels and chemicals startup, raised a $12M seed round led by Congruent Ventures and Galvanize Climate Solutions (FN)

Rejuvenation Technologies, a startup developing mRNA-based therapeutics to address mechanisms of aging, raised a $10.6M seed round led by Khosla Ventures (BW)

API security startup Pynt raised a $6M seed round led by Joule Ventures (TC)

Treon, a startup building intelligent edge products for the IoT, raised a $5.9M Series A led by Ventech (FN)

Fine art-focused tech startup TRLab raised a $5M seed round led by Hivemind Capital (FN)

IPO / Direct Listings / Issuances / Block Trades

Amer Sports confidentially filed for an IPO that could value the the maker of Wilson tennis rackets at as much as $10B; Amer is seeking to raise as much as $3B (RT)

Online grocery delivery platform Instacart is preparing to set its IPO price range and begin its investor road show as soon as Monday (BBG)

German glassmaker Schott is looking to sell $859M worth of shares in its medical division’s IPO (RT)

SPAC

AI startup Zapata AI will merge with Andretti Acquisition Corp. in a $200M deal (BBG)

Debt

Restaurant Brands International is selling a $4.2B leveraged loan in one of the largest refinancing deals to hit the market this year (BBG)

CBA, Australia’s largest bank by market cap, raised $3.3B through US dollar bond markets with three issuances (RT)

DBS Group, Singapore’s largest bank, raised $1.5B through dollar bond markets (RT)

Bankruptcy / Restructuring

Fundraising

Crypto Corner

Cathie Wood's Ark Invest and crypto investment firm 21Shares filed for spot-ether ETFs (RT)

Bankrupt cryptocurrency lender Genesis Global Holdco sued its parent company Digital Currency Group over $620M in outstanding loans (BBG)

FTX founder SBF lost his bid to be freed from Brooklyn jail to prepare better for his trial (RT)

Exec’s Picks

Zeke Faux wrote an excellent piece on the downfall of Sam Bankman-Fried and the broader decline of crypto.

Matt Levine covered how Elon Musk borrowed ~$1B from SpaceX when he was purchasing Twitter.

Litney Partners - Financial Recruiting 💼💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

Meme Cleanser

Advertise with us // Visit our merch store // Invest alongside Lit Ventures // Book a call with Lit // Launch your own newsletter