Together with

Good Morning,

US is at risk of a debt default in July, fintech startups have been on the decline with rates rising, Goldman sacked its idea for a D2C credit card, DOJ is stepping up its antitrust investigation into Apple, Musk will likely bring on a new Twitter CEO by end of year, and worker burnout is at a pandemic high.

Looking to overhaul your math, data, and computer science skills to be more competitive in the job market? Check out today's sponsor, Brilliant.

Let's dive in.

Before The Bell

Markets

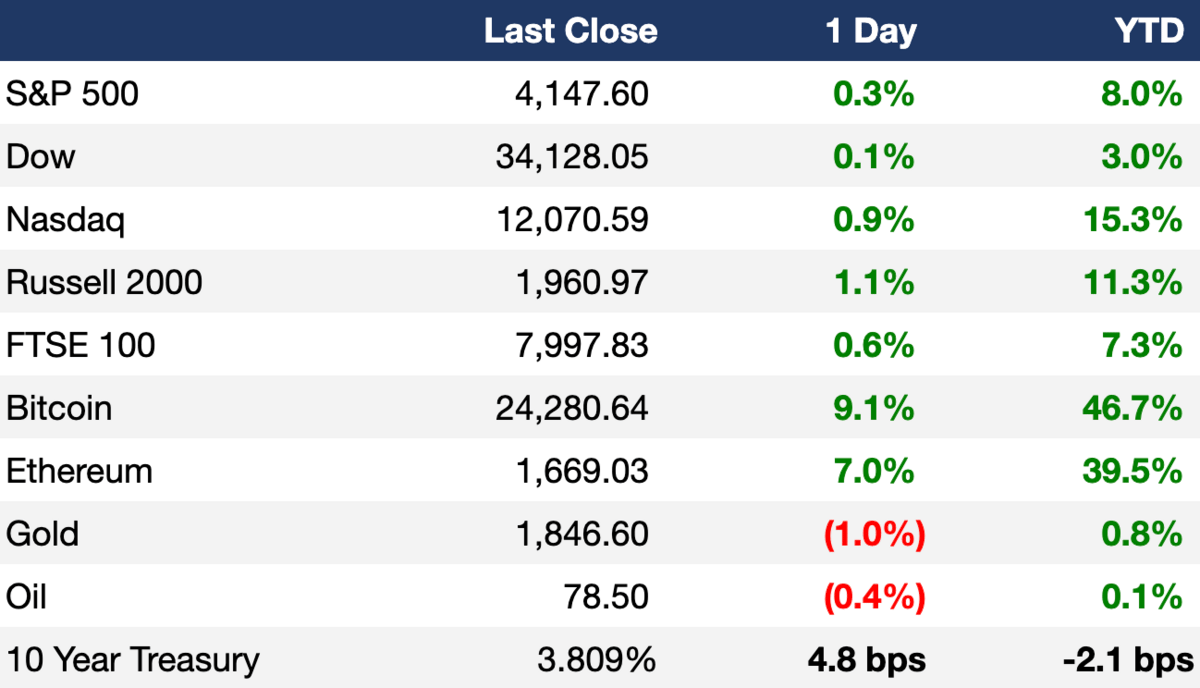

US stocks reversed losses to finish green yesterday on strong economic data such as retail sales that hinted at a resilient economy

The Nasdaq notched a 3-day win streak

UK's FTSE 100 topped 8,000 for the first time

The dollar index rose 0.6% to a six-week high

Bitcoin surged ~10% on no apparent news

Earnings

Barclays missed Q4 EPS estimates on a 14% fall in FY pretax profit due to surging costs, a collapse in deal fees, and multi-million dollar fines; their stock slumped 8.3% (RT)

Cisco beat Q2 EPS and revenue estimates on a 14% growth in their core Secure segment and raised FY guidance on resilient tech infrastructure demand and improving supply chains; their stock gained 6%+ (CNBC)

Shopify beat Q4 EPS and revenue estimates on a surprise profit driven by a holiday demand surge but forecast slowing Q1 revenue growth despite price hikes and new product launches; their stock fell 6.5% AH to reverse the day's gains (INV)

Zillow beat Q4 EPS and revenue estimates on resilient traffic and growth in multifamily properties despite a slowing housing market; the firm is focused on building a 'housing super app' after exiting the home-buying business (CNBC)

What we're watching this week:

Today: DraftKings, WeWork

Full calendar here

Headline Roundup

US is at risk of debt default as soon as July (AX)

UK CPI fell for third straight month to 10.1% (GU)

Retail sales rose 3% in January, smashing expectations (CNBC)

Emerging market inflows in January were largest in two years (RT)

US law firm demand fell 3.9% in Q4 (RT)

Fintech threat to big banks fizzled in 2022 on rising rates (RT)

Goldman Sachs scrapped idea for a D2C credit card (CNBC)

US asset manager Van Eck will terminate its Chinese mutual fund plan (RT)

DOJ is stepping up its antitrust investigation into Apple (WSJ)

Commodity trader Glencore posted a record $34B annual profit (FT)

Musk likely to bring in a new Twitter CEO by year end (WSJ)

Apple will scrutinize customer history in new ‘buy now, pay later’ service (BBG)

Tesla will open its charging network to other EVs (AX)

KPMG laid off 5% of its advisory in Big Four first (FT)

Neiman Marcus will cut ~5% of its workforce (RT)

AMC Networks' owner named his wife Kristin Dolan as new CEO (WSJ)

Twitter will allow cannabis ads in social media first (RT)

Musk donated $1.95B in Tesla shares to charity last year (RT)

David Malpass will step down as World Bank head (AX)

Worker burnout is at a pandemic-era high (BBG)

62% of Americans think college admissions should not consider race (RT)

A Message From Brilliant

For investors, business leaders, and anyone looking for an edge, Brilliant sharpens your analytical thinking with bite-size lessons in math, data, and computer science.

You can get hands-on with core concepts on everything from data analysis and AI to neural networks, quantum computing, and beyond. Brilliant makes it so easy and intuitive, you can master even advanced concepts in just minutes a day.

Join over 10 million people around the globe taking their skills to the next level and start your 30-day free trial today. Plus, Exec Sum readers can get 20% off an annual premium membership.

Deal Flow

M&A / Investments

Australian gold miner Newcrest rejected an initial $17B takeover bid by American rival Newmont (BBG)

A consortium led by MSP Sports Capital will launch $3.75B takeover bid for Premier League team Tottenham Hotspur (FT)

Chinese conglomerate Sinochem is considering selling its ~$1.85B, 37% stake in Italian tiremaker Pirelli; it initially bought the firm for ~$8B in 2015 (BBG)

Amazon is in talks with regulators on its $1.7B bid for iRobot, maker of the robotic vacuum cleaner Roomba (RT)

Credit Suisse will exit distressed debt trading and sell its $250M related portfolio (BBG)

Indonesian telecom infrastructure company Mitratel agreed to buy a portfolio of telecommunication towers from Indonesian carrier Indosat for ~$109M (BBG)

Moet Hennessy, the wine and spirits division of luxury house LVMH, agreed to buy a majority share in rose wine maker Chateau Minuty (BBG)

Eminence Capital, a shareholder in Ritchie Bros Auctioneers, has come out against the company’s planned acquisition of US auto retailer IAA (RT)

Gold miner Barrick Gold told peer Newmont it would be open to acquiring its minority stake in Nevada Gold Mines, a JV between the two majority-owned by Barrick (RT)

Ryan Reynolds partnered with Canadian real estate developer Remington Group in a bid for NHL team Ottawa Senators (YH)

VC

SandboxAQ, a startup using AI and quantum tech to help companies transition to post-RSA security, raised a $500M round from Breyer Capital, T. Rowe Price, TIME Ventures and ex-Google CEO Eric Schmidt (RT)

Deepwatch, a managed detection and response security startup, raised $180M in funding from Springcoast Capital Partners, Splunk Ventures, and Vista Credit Partners (BW)

Passwordless authentication startup Descope raised a $53M seed round led by Lightspeed Venture Partners and GGV Capital (TC)

Apkudo, a startup developing a platform to manage, sell, and test connected devices, raised a $37.5M Series C led by Closed Loop Partners and Piper Sandler Merchant Banking (TC)

Spiffy, an on demand car care, technology, and services company, raised a $30M Series C led by Edison Partners (BW)

Oligo Security, a runtime application security / observability startup, raised a $28M Series A from TLV Partners, Lightspeed Venture Partners, Ballistic Ventures, and more (TC)

Codagenix, a virus design platform, raised a $25M Series B extension from Serum Institute of India, Euclidean Capital, and Adjuvant Capital (PRN)

Superplastic, a startup creating and developing ‘synthetic’ influencers, raised a $20M Series A-4 led by Amazon’s Alexa Fund (TC)

Smile Identity, a provider of ID verification and KYC compliance for African faces / identities, raised a $20M Series B led by Costanoa Ventures and Norrsken22 (TC)

South African insurtech Naked raised a $17M Series B led by the International Finance Corporation (TC)

Crypto index platform Alongside raised an $11M seed round led by a16z (TC)

Smartrr, a subscription platform for Shopify stores, raised a $10M Series A led by Canvas Ventures (BW)

German battery recycling startup Cylib raised an $8.55M seed extension round led by World Fund, bringing the total seed round to $12.6M (TC)

Morphoceuticals, a biotech startup developing AI-guided electroceuticals to regenerate limbs / organs / tissues, raised an $8M seed-2 round led by Prime Movers (PRN)

Hippo Video, an interactive video platform for increasing sales engagement, raised an $8M round led by Dallas Venture Capital (BW)

Robigo, a startup biomanufacturing precision crop protection solutions, raised a $6.85M seed round led by Congruent Ventures (BW)

Thatch, a platform simplifying health benefits for startups and their employees, raised a $5.6M seed round led by a16z and GV (TC)

Aura Network, a startup building an ecosystem to accelerate global NFT adoption, raised a $4M pre-Series A led by Hashed and Coin98 Ventures (BW)

Funga, a startup using fungus to capture carbon, raised a $4M seed round led by Azolla Ventures (TC)

Debt

Pharmaceutical company Amgen sold a $24B investment-grade bond to help fund its purchase of Horizon Therapeutics (BBG)

Bankruptcy / Restructuring

Fundraising

Crypto Corner

An ex-Stanford Law dean and a Stanford comp sci researcher cosigned SBF's bond (RT)

SEC proposed changing crypto custody rules (CNBC)

Binance endured over $830M of outflows on Monday in worst day since December (TT)

FTX is negotiating the return of $400M from obscure HF Modulo Capital (NYT)

A US judge denied an independent examiner for FTX's bankruptcy (AX)

Exec's Picks

Top-tier private market fund managers outperform public markets, but access has been almost impossible (unless you have at least $50M in capital to deploy). Gridline users gain access to a curated selection of rigorously vetted managers and up-to-date information about the most compelling investment opportunities. Membership to the platform is free and access is instant. Upgrade your portfolio with Gridline now.

This Platformer piece breaks down how Musk tweaked the algorithm to make his tweets appear more.

Bloomberg's Matthew Boyle covered how Shopify managed to cull 320,000 hours of meetings.

Litney Partners - Financial Recruiting 💼💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

Meme Cleanser

Thinking of starting your own newsletter? Beehiiv is the best platform for creators, period. Click here to get started building your own audience.