Together with

Good Morning,

Lazard's CEO called long work hours a 'trade-off' for juniors, markets are suddenly bracing for an upsized rate cut, Amazon is ending all WFH, and Apollo is pushing into investment-grade debt.

With over 80% of lenders now looking past credit scores, Plaid released some quick insights on four trends shaping the future of finance.

Let's dive in.

Before The Bell

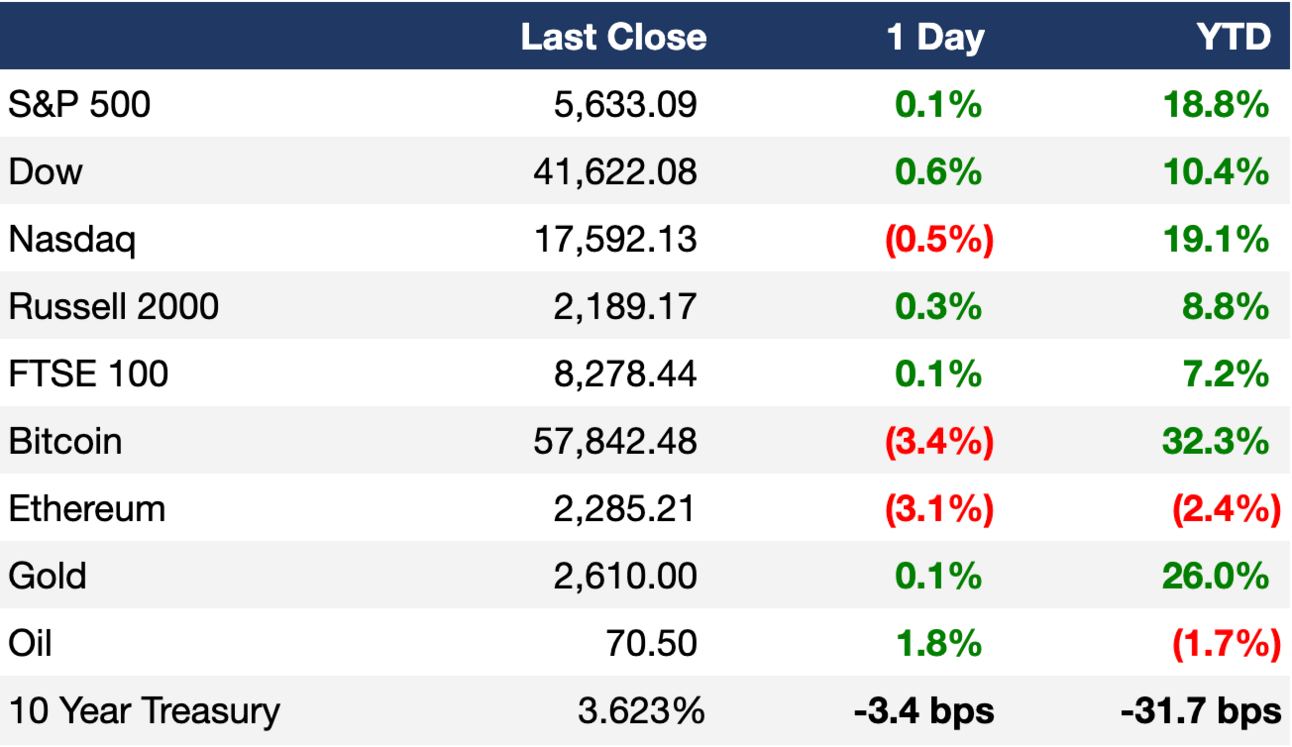

As of 09/16/2024 market close.

Markets

US stocks closed mixed as investors braced for the Fed’s rate decision this week

Dow closed at a new ATH

Equal-weighted S&P 500 hit an ATH

Markets further raised odds of a bigger 50 bps rate cut to 60%

Short oil bets hit a record high last week on global demand woes

Yen strengthened past 140 versus dollar for the first time since July 2023

Earnings

What we're watching this week:

Wednesday: General Mills

Thursday: FedEx

Full calendar here

Headline Roundup

Lazard CEO says long hours a Wall St trade-off for junior bankers (BBG)

Hedge funds bought banks, insurance stocks at fastest pace since mid-2023 (RT)

Foreigners plough into EM portfolios with Fed rate cut in sight (RT)

Apollo pushes into investment-grade debt long dominated by banks (FT)

Firms jostle to sell alternative assets to wealthy investors (FT)

Warren Buffett is buying less of his own Berkshire Hathaway stock (WSJ)

Amazon is ending all hybrid/WFH (CNBC)

Intel unveiled a cost-cutting and restructuring plan (WSJ)

Boeing freezes hiring as strike worsens finances (WSJ)

Microsoft announced a $60B buyback and 10% dividend hike (WSJ)

Starbucks North America CEO will retire after eight months on the job (WSJ)

A Message From Plaid

4 Trends Driving The Future of Finance and How they Affect Your Business

The world of finance can be a fickle one. Today’s innovative ideas can be tomorrow’s security concerns, and vice versa – exactly why it’s important to stay informed on what’s trending.

Lucky for you, Plaid has it covered. Their latest report on the Top Trends Driving The Future Of Finance breaks down what’s moving and shaking finance today, how these trends are shaping the next era of the industry, and why they should matter to you.

This quick guide peels back the curtain on the 4 biggest trends in finance, and walks you through some actionable insights into…

How pay by bank can cut payment costs by 20-70%

Why 83% of lenders are ready to look beyond credit scores

How almost half of all fraud attempts now incorporate AI

And more

Deal Flow

M&A / Investments

Vista Equity Partners and Blackstone are nearing a deal to take private workplace collaboration software Smartsheet in at $8B cash deal (RT)

Flutter Entertainment is nearing a $2.6B acquisition of gambling technology group Playtech's consumer operations (SKY)

BP plans to sell its ~$2B US onshore wind energy business (FT)

National security IT company CACI International will acquire RF electronics firm Azure Summit Technology for $1.3B cash (BW)

Central Pacific Financial is in talks to raise $1B from Warburg Pincus, Centerbridge, and Atlas Merchant Capital to buy rival American Savings Bank from struggling Hawaiian Electric Industries (BBG)

Apollo will acquire a stake in a Caspian gas pipeline from BP for $1B (BBG)

Brookfield is exploring a sale of the retail space of NYC's 685 5th Ave that may be worth $300M (BBG)

Carlyle is buying a minority stake in landlord-focused private credit firm North Bridge ESG (BBG)

Billionaire Dan Friedkin reignited plans to buy Premier League club Everton FC (BBG)

VC

Akur8, a ML-powered insurance pricing platform, raised a $120M Series C led by One Peak (EU)

Peratech, a UK startup developing next-gen touch/force-sensing solutions, raised a $31.5M round led by Dark Matter Partners (TFN)

Estate planning platform Wealth.com raised a $30M Series A led by GV (BW)

TeamBridge, an HR software for wage workers, raised a $28M Series B led by Mayfield (TC)

AI bots for process automation startup 11xAI raised a $24M Series A led by Benchmark (TC)

Email security firm EasyDMARC raised a $20M Series A led by Radian Capital (EU)

AI coding assistant Supermaven raised a $12M round led by Bessemer Venture Partners (TC)

Smalt, an energy transition labor-supply engine, raised an $8.6M seed round led by noa (EUS)

AI digital twin solution Samp raised a $6.5M round led by Promus Ventures (EU)

IPO / Direct Listings / Issuances / Block Trades

Debt

Oak Hill Advisors provided a $775M private credit loan to help fund Carlyle's acquisition of auto parts distributor Worldpac (BBG)

Bankruptcy / Restructuring / Distressed

Fundraising

Crypto Corner

Exec’s Picks

Diversify your portfolio with private credit deals with up to 20% APY. Get a bonus of up to $500 with your first investment on Percent.

Callie Cox explored the wide gap among index stocks that continue to persist amid a raging bull market. A great piece in light of the equal-weight S&P 500 hitting an ATH…

Investment Banking Opportunity

Cascadia Capital - Investment Banking Analysts & Associates

Independent middle market advisory is hiring experienced IB associates and analysts in Austin, Minneapolis and Seattle

The firm is expanding after a significant investment from ex-Barclays CEO Bob Diamond and several senior banker hires.

Seeking associates and analysts across technology, industrials, consumer, and business services coverage, and analysts in capital markets and generalist roles

Immediate start, competitive comp packages

Meme Cleanser

Advertise with us // Visit our merch store // Invest alongside Lit Ventures // Book a call with Lit // Launch your own newsletter