Together with

Good Morning,

New York City currently looks like an apocalypse movie, Messi is taking his talents to South Beach, Bank of Canada raised rates to a 22-year high, US labor markets were resilient in May, Microsoft is offering OpenAI’s GPT models to government cloud customers, Manhattan apartment prices are through the roof, and Amazon is planning an ad tier for Prime.

Let’s dive in.

Before The Bell

As of 6/7/2023 market close.

Markets

US stocks wavered after an unexpected interest rate hike from Canada and a surprise drop in Chinese exports stoked fresh concerns about global growth

Both the S&P 500 and Nasdaq closed in negative territory

The 2Y US Treasury yield and benchmark 10Y yield increased after the Bank of Canada raised interest rates, adding to investor jitters about the Fed’s next move

US inflation data is expected to show consumer prices eased slightly MoM while core prices remained elevated

Earnings

GameStop missed Q1 expectations after revenue declined YoY, and CEO Matthew Furlong was fired while Ryan Cohen was appointed as Executive Chairman; shares dropped 20% AH (CNBC)

Campbell Soup reported mixed Q1 results as the CEO remains confident about Campbell’s condensed products offerings with their broader customer base, but questioned condensed soup’s relevance among younger customers (CNBC)

What we're watching this week:

Today: DocuSign, Vail Resorts

Friday: NIO

Full calendar here

Headline Roundup

Bank of Canada lifts rates to 22-year high, ending four-month pause (WSJ)

US east coast blanketed in eerie veil of smoke from Canada fires (RT)

China's exports tumble in May as global demand falters (RT)

US labor market shows resilience with strong May hiring (WSJ)

US trade deficit widens to 6-month high, expected to dent economic growth (RT)

PSG star Lionel Messi plans to sign with Inter Miami (AP)

US-China chip war could hurt South Korea’s tech giants — but not for long (CNBC)

Microsoft to offer OpenAI's GPT models to government cloud customers (RT)

TikTok seeks up to $20B in e-commerce business this year (BBG)

Manhattan apartments are leasing in a flash ahead of summer frenzy (BBG)

Boeing sued for allegedly stealing IP, counterfeiting tools for NASA projects (CNBC)

Boeing warns new defect on 787 Dreamliners will slow deliveries (CNBC)

Amazon plans ad tier for Prime video streaming service (WSJ)

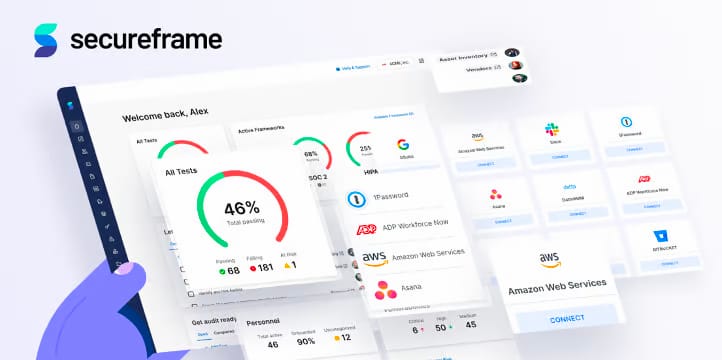

A Message From Secureframe

Get SOC 2 in weeks not months.

Let Secureframe unblock opportunities and accelerate your sales cycle without the need to invest in new resources or overburden your team.

From comprehensive compliance policy templates to over 150 integrations with your core technology services, the Secureframe platform significantly increases the speed with which organizations can confidently begin a SOC 2 audit, without increasing overhead or slowing your team down.

Deal Flow

M&A / Investments

Vodafone and CK Hutchinson are in the final stages of an agreement to merge their British mobile operations to create an $18.6B entity as soon as Friday (RT)

Qatar’s Sheikh Jassim submitted his fifth takeover offer for the Glazer Family’s Manchester United and is open to negotiating until Friday; the Glazers value the club at $7.5B (BBG)

Chinese data center operator Chindata Group received a $2.9B take-private offer from Bain Capital (RT)

Goldman Sachs is weighing the sale of Ireland’s largest shopping mall for $695M, which would be less what they paid to acquire the property (BBG)

Australian aged care provider Estia Health intends to back Bain Capital’s sweetened takeover offer of $552M (RT)

Franchise operator Flynn Restaurant Group is acquiring Pizza Hut Australia from PE firm Allegro Funds, adding 260 restaurants to the company (BBG)

Investec Bank has acquired a majority stake in European adviser Capitalmind Group after a purchase of an additional 30% stake in the boutique firm (BBG)

Carlyle Group is looking to purchase Italian football league Serie A’s media rights (RT)

UK newspaper group, Telegraph Media Group, will be put up for sale after the publisher’s owners failed to repay loans from the Bank of Scotland (RT)

VC

Alkeus Pharmaceuticals, a biopharmaceutical company focused on eye diseases, raised a $150M Series B led by Bain Capital Life Sciences (FN)

Digibee, an integration platform as a service (iPaaS) company, raised a $60M Series B led by Goldman Sachs Asset Management (BW)

Upperline Health, a provider network dedicated to specialty value-based care, raised $58.4M in financing led by Crestline Investors (BW)

GetHarley, a skincare telehealth and consultation platform, raised a $52M round led by Index Ventures (TC)

Forge Nano, a precision nano-coating technology company, raised $50M+ in funding led by Korea's Hanwha Corporate Venture Capital (FN)

Instabase, a startup providing an ‘apps platform’ to analyze ‘unstructured’ data, raised a $45M Series C at a $2B valuation led by Tribe Capital (TC)

EliseAI, an AI platform for real estate, raised a $35M Series C led by Point72 Private Investments (BW)

Financial planning and analysis platform Mosaic raised a $26M Series C led by OMERS Ventures (TC)

Vertos Medical, a startup developing minimally invasive treatments for lumbar spinal stenosis, raised a $26M Series C led by Norwest Venture Partners (PRN)

Mozart Therapeutics, a developer of CD8 Treg modulators, raised a $25M Series A extension led by Pfizer Ventures, AbbVie Ventures, Ono Venture Investment, and UPMC Enterprises (PRN)

Hopewell Therapeutics, a biotech startup with a lipid nanoparticle platform, raised a $25M seed round from Mass Ave Capital, 5Y Capital, and others (PRN)

Cellusion, a Japanese startup building iPS cell-derived corneal endothelial cell substitutes, raised a $21M Series C from JIC Venture Growth Investments, NISSAY Capital, and more (BW)

Yuvo Health, an administrative and managed care solution for community health centers, raised a $20.2M Series A led by Mastry Ventures (PRN)

Onfly, a Brazilian travel technology company, raised a $16M Series A led by Left Lane Capital and Cloud9 Capital (PRN)

Blumira, a provider of detection and response technology, raised a $15M Series B led by Ten Eleven Ventures (PRN)

Enterprise payments startup Payrails raised a $14.4M seed extension led by EQT Ventures (TC)

Griffin, a London-based provider of a full-stack banking service, raised a $13M Series A led by MassMutual Ventures (FN)

Significo, a provider of secure and reliable digital health solutions, raised a $12M Series A led by Doug Blough (PRN)

MatrixSpace, an AI collaborative sensing solutions company, raised a $10M Series A led by the Raptor Group (PRN)

Onebeat, an Israeli AI-enabled retail tech startup, raised $10M in additional funding led by Magenta Venture Partners (FN)

Conversational marketing platform Spectrm raised a $6.5M round led by 3TS Capital Partners (FN)

IPO / Direct Listings / Issuances / Block Trades

Natural soda ash producer WE Soda confirmed its intentions to IPO in London and will raise up to $800M at a ~$7.5B valuation (BBG)

Hamilton Insurance Group is mulling strategic options, which include a potential IPO that would value the company at over $2B (RT)

Russian lender VTB will raise $1.2B in a secondary public offering (RT)

Debt

AviLease, a Saudi PIF-backed jet lessor, received a $1.1B unsecured five-year loan for general corporate use (RT)

Bankruptcy / Restructuring / Distressed

Mattress maker Serta Simmons Bedding’s reorganization plan to reduce its debt from $1.9B to $315M was confirmed by bankruptcy court (RT)

Fundraising

Startup incubator and VC Antler is raising a $285M Elevate fund to invest in later-stage startups (TC)

Crypto Corner

SEC alleged that Merit Peak, an offshore trading company controlled by Binance CEO 'CZ,' received $11B in customer deposits (RT)

Coinbase CEO hits back at SEC chair after lawsuit, says user funds are safe (RT)

A mystery trader purchased thousands of Coinbase puts less than half an hour before the SEC announced their lawsuit against the exchange, netting them up to $2.6M (BBG)

Cathie Wood’s funds have boosted their stakes in Coinbase after the SEC sued the company (BBG)

Lawyers representing Binance accused SEC chair Gary Gensler of offering to serve as an advisor to Binance in 2019 (CT)

Exec’s Picks

Marc Andreessen wrote a detailed piece explaining Why AI Will Save the World.

The Atlantic's Dror Poleg covered why The Next Crisis Will Start with Empty Office Buildings.

Litney Partners - Financial Recruiting 💼💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

Meme Cleanser

Advertise with us // Visit our merch store // Invest alongside Lit Ventures // Book a call with Lit // Launch your own newsletter