Together with

Good morning,

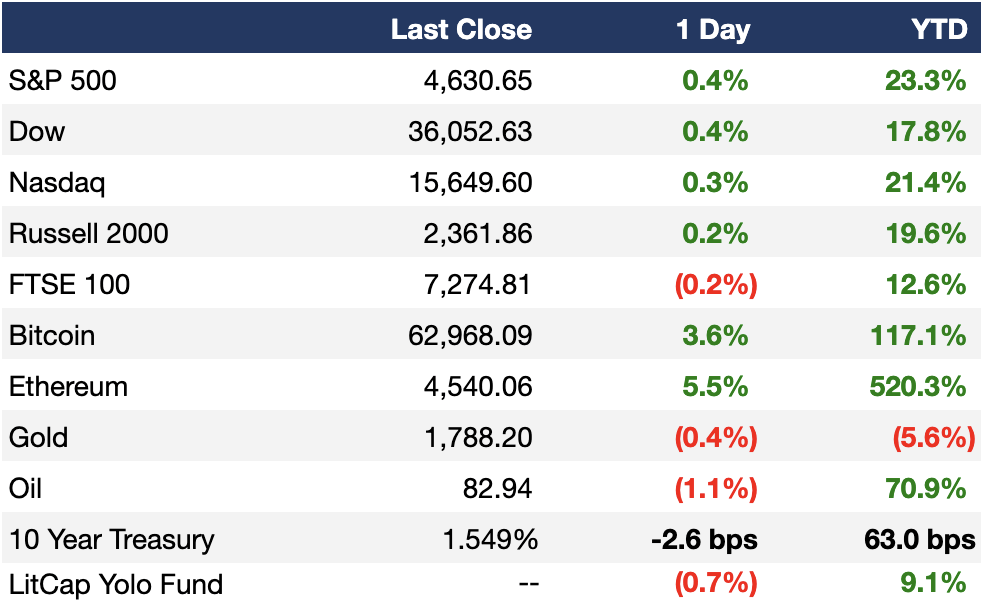

The US markets are at fresh ATHs yet again, earnings are strong af, Ethereum broke $4,600 for the first time, and things are feeling good overall rn.

If you're reading this email, you might see Exec Sum looks a bit different today. We're in the process of upgrading our home and the movers are still on their way. Still making some tweaks to the new template but we're happy with the new place. With that said, we'll be temporarily pausing our referral program for a few weeks to upgrade it and make things run smoother. In the meantime, we're offering 15% at our merch store to all our readers w/ code thx15 (good thru next Sunday).

Stay tuned for a yuge giveaway announcement and the buy side comp survey results before end of week. We're excited to see this community grow and want to continue giving back as much as we can. Thx for being a part of the Exec Sum fam. 🤝

And lastly, shoutout to today's sponsor, Motley Fool, they've got a report on their latest investment thesis here (more info below).

Let's dive in.

Forwarded email? Subscribe here.

Before The Bell

Click here to download the Iris Social Stock app and see the LitCap Yolo Fund's portfolio holdings.

If you want to learn more about crypto trading strategies, check out our Foot Guns newsletter.

Markets

This is getting repetitive, but the S&P, Dow Jones, and Nasdaq all closed at new ATHs for the third session in a row yesterday

The S&P closed at an ATH for the 61st time this year (only 8 more times for a really nice year)

Strong corporate earnings reports have continued to abate investors’ inflationary fears and push markets higher, as companies are repeatedly showing the ability to maintain profit margins and beat on EPS despite rising costs

Investors will be keeping a close eye on announcements coming today after the conclusion of the Fed’s two-day meeting which started today; JPow is expected to announce that the Fed will incrementally scale down its monthly bond purchases

Earnings

Pfizer shares popped 4%+ yesterday after reporting better-than-expected Q3 net profit driven by vaccine sales; the drugmaker also raised its 2021 EPS and revenue outlooks (Barrons)

BP reported Q3 earnings above analyst expectations, largely due to rising commodity prices, but shares fell yesterday which could have been due to the $2.5B headline loss the company reported due to ‘significant adverse fair value accounting effect’ (CNBC)

Under Armour shares jumped 16%+ yesterday after a beat-and-raise earnings report on the heels of progress in brand image improvement under CEO Patrik Frisk (CNBC)

What we’re watching today: CVS

Full calendar here

Headline Roundup

Car rental company Avis doubled in single day on plans to add more electric cars and huge earnings beat (BBG)

Facebook to shut down use of facial recognition technology (BBG)

Microsoft’s own metaverse is coming, and it will have PowerPoint and Excel (BBG)

Apple wants iPhones to detect car crashes, auto-dial 911 (WSJ)

DOJ sues to block publisher Penguin Random House from acquiring rival Simon & Schuster (WSJ)

Zillow terminates home-flipping business after citing inability to forecast prices (WSJ)

Goldman bumps up managing director class to biggest ever (BBG)

Eric Adams wins in NYC, capping ascent from cop to mayor-elect (BBG)

A Message From Motley Fool

Should you consider 5G stocks?

If you know much about us at the Motley Fool then you probably know how well we’ve done identifying massive technological trends and then finding stocks that can benefit in potentially explosive ways.

Like we did with:

Amazon and the e-commerce revolution, our recommendation up +21,454%* since we first recommended it September 6th, 2002

Or Netflix and the streaming trend, up +34,080%* since December 17th, 2004

Or Booking Holdings and the online travel explosion, up +10,428%* since we recommended it on May 21st, 2004

So what are we seeing today that might be the next big world-changing trend?

We’re letting Exec Sum readers find out early.

*Returns as of 10/15/21. Past performance is not a guarantee of future results.

Deal Flow

M&A

Industrial materials maker DuPont agreed to buy engineering materials technology maker Rogers for ~$5.2B (RT)

Platinum Equity is planning to transfer portable toilets company United Site Services from one of its funds to another at a $4B valuation; the plan will allow existing investors to cash out (BBG)

Baring PE Asia agreed to buy business expansion specialist Tricor from Permira in a $2.76B deal (RT)

PE firm Atlas Holdings is nearing a deal to acquire commercial-printing company RR Donnelley for $2B+ (WSJ)

CMA CGM, one of the world’s largest shipping companies, is nearing a deal to buy Fenix Marine Services, which operates a container terminal in the Port of LA at a ~$2B valuation; CMA CGM currently owns a 10% stake and will acquire the remaining 90% from EQT (BBG)

Siam Commercial Bank, Thailand’s oldest lender, agreed to buy a 51% stake in local digital asset exchange Bitkub for $537M (RT)

Hong Kong-based lingerie & swimwear maker Hop Lun is reviving a sale that was halted due to the pandemic and is seeking a $500M+ valuation (BBG)

SoftBank is considering a sale of asset manager Fortress Investment Group, which it acquired for $3B+ over four years ago (BBG)

American Eagle Outfitters agreed to buy Quiet Logistics, a supply chain partner utilizing state-of-the-art tech and robotics for cost-effective fulfillment services, for $350M (AE)

Fat Brands agreed to buy restaurant chain Fazoli’s in a $130M deal (BBG)

Freelance platform Fiverr agreed to buy Stoke Talent, which lets companies manage their freelance teams, for $95M (TC)

Brazilian airline Azul is interested in acquiring Chile’s bankrupt LATAM Airlines and is ready to make an offer if creditors fail to agree on a restructuring plan (RT)

A consortium that includes ‘at least one government-backed buyer’ is in advanced talks to buy Huawei Technologies’ x86 server business, after the US blacklisting of the company made it difficult to secure processors from Intel (BBG)

Cross River Bank agreed to buy fintech company Betterfin (BBG)

US antitrust officials sued to block book publisher Penguin Random House’s $2.18B merger with its rival Simon & Schuster (BBG)

VC

Autonomous delivery startup Nuro raised a $600M round at an ~$8.6B valuation led by Tiger Global (TC)

137 Ventures, which loans to private company shareholders, closed its fifth fund with $350M (TC)

Carsome, an online used-car marketplace in Southeast Asia, is seeking to raise a ~$200M pre-IPO round (BBG)

African cross-border payments startup Chipper Cash raised a $150M Series C extension led by FTX (TC)

Chinese HR tech startup Moka raised a $100M Series C led by Tiger Global (TC)

Korean autonomous startup 42dot raised an $88.5M Series A at a $425M valuation from Shinhan Financial Group, Lotte Rental, and more (TC)

Cloud-native application monitoring platform Lumigo raised a $29M Series A led by Redline Capital, Wing Venture Capital, and Vertex Ventures US (TC)

Hone, a human-powered platform for leadership training, raised a $16M Series A led by F-Prime Capital (TC)

EV conversion startup Opibus raised a $7.5M pre-Series A led by At One Ventures (TC)

Post-sales orchestration platform Magnify raised a $6M seed round led by Madrona Venture Group (TC)

Vivoo, a urine-testing wellness tracker, raised a $6M Series A led by Draper Associates’ Tim Draper (TC)

AI app-centric streaming database Activeloop raised a $5M seed round led by 468 Capital and CM Ventures (TC)

Martie, a startup diverting shelf-stable food items from landfills, raised a $3M round from Upfront Ventures (TC)

IPO / Direct Listings / Issuances / Block Trades

Brazilian digital bank Nubank is seeking a ~$50B valuation in its IPO (BBG)

Dubai plans to list its Dubai Electricity & Water Authority in an IPO at a $25B+ valuation (BBG)

Shoemaker Allbirds priced its IPO above a marketed range to raise $303M at a $2.4B fully diluted valuation (BBG)

BlackRock, Canada’s PPIB, and sovereign wealth funds are among bidders for the $1.1B of shares of digital payments company Paytm is looking to sell to institutional investors as part of its IPO (BBG)

Indian logistics startup Delhivery is seeking to raise ~$998M in its IPO (TC)

Rubix, a provider of maintenance and repair parts for industrial firms, scrapped their London IPO that was looking to raise $984M (BBG)

Precision medicine startup Tempus Labs is exploring a US IPO (BBG)

SPAC

Black Rifle Coffee, a coffee seller focused on military veterans, agreed to merge with SilverBox Engaged Merger Corp. I in a $1.7B deal (WSJ)

Exec's Picks

La Aurora, the original Dominican Cigar since 1903. Check out La Aurora's new premium online marketplace to discover and buy the best cigars the brand has to offer, with shipping available in 35 states. Must be 21+ to purchase

The Hiring Block

If you're looking to break into finance, lateral, or move out, check out our Litquidity Search Partners job board right here. We've got 80+ jobs spanning IB, S&T, VC, tech, private equity, DeFi, CorpDev and more.

If you're looking to hire candidates and want to post a job, all you have to do is hit submit on the job board.