Together with

Good Morning,

An ex-McKinsey partner sued the firm for being scapegoated, big asset managers are resorting to 'vulture' tactics, Elliott built a stake in one of Buffett’s investments, and regulators seized and sold Republic First Bank…yes, exactly one year after First Republic Bank.

Summer around the corner means its your time to rejuvenate at the members club that’s good for you. Check out Bond Life Club, the newest private members club opening in East Hampton this summer, co-founded by Litquidity.

Let’s dive in.

Before The Bell

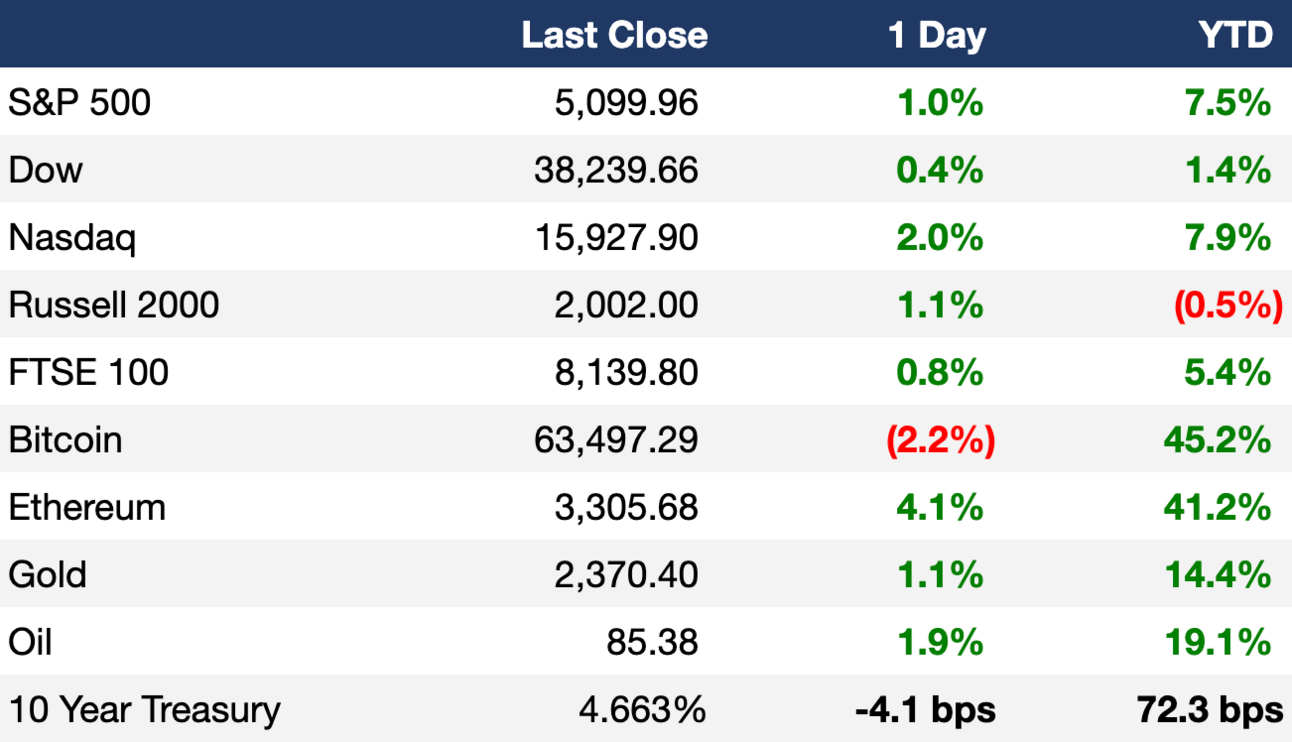

As of 04/26/2024 market close.

Markets

US stocks climbed on Friday on the back of Big Tech names that rallied on strong earnings

The S&P and Nasdaq snapped three and five-week losing streaks respectively to clinch their best weeks since November

Hong Kong’s Hang Seng Index is up 20% YTD, entering a bull market

Copper hit $10k/ton on supply concerns

Yen sunk to a new to 34-year low after BOJ held rates near zero

It’s a big week ahead with investors bracing for big name earnings, the Fed’s rate policy meeting, and a crucial employment report

Earnings

ExxonMobil shares fell ~3% after missing Q1 earnings estimates on eroding refining margins and declining natural gas prices (CNBC)

Chevron beat Q1 earnings estimates but posted a decline in YoY profit due to headwinds facing its refining and natural gas businesses (CNBC)

AbbVie shares fell ~5% due to disappointing Q1 sales from the company’s arthritis drug Humira which is facing heightened competition (YF)

What we're watching this week:

Today: Domino’s, Paramount, Sofi

Tuesday: Amazon, PayPal, AMD, Starbucks, Eli Lilly, McDonald’s, 3M, Coca-Cola

Wednesday: Mastercard, Qualcomm, Pfizer, CVS, KKR

Thursday: Apple, Block, Novo Nordisk, Coinbase, DraftKings, Apollo Global Management

Full calendar here

Headline Roundup

PCE index rose 2.7% YoY in March (FT)

Ex-McKinsey partner sues firm for being made opioids 'scapegoat' (RT)

Ban on non-compete agreements send shockwaves across Wall Street (FT)

Big asset managers adopt 'vulture' tactics in distressed debt fights (FT)

Japan’s oldest VC firm is eying a 200% gain (BBG)

Elliott built a 'large' take in Buffett-favored Sumitomo (BBG)

US executive pay jumped 9%, widening US-UK gap (FT)

Chinese bonds dodge global debt selloff as yield gap widens (BBG)

Troubled borrowers seen fighting for runway without rate cuts (BBG)

Commodity prices could keep inflation high (FT)

Chinese regulators warn against SVB-style meltdown (FT)

China firms go 'underground' on Russia payments as banks pull back (RT)

Lending and consumer data cements case for ECB rate cuts (RT)

Dutch kick-start European attempts at carbon capture (FT)

US/global equity funds see fourth-straight week of outflows (RT)

Google becomes fourth company to reach $2T market cap (TV)

US Treasury refunding set to offer relief from supply rises (RT)

Apple intensifies talks with OpenAI for iPhone generative AI features (BBG)

A Message From Bond Life Club

The members club that’s good for you.

Hey everyone, it’s Hank from Litquidity again.

I am excited to introduce Bond Life Club, the newest private members club I co-founded that will open in the Hamptons this summer.

Situated in the heart of East Hampton, Bond Life Club will cater to those looking for a break from stuffy country clubs and are seeking a modern, vibrant "third place" to gather, work, exercise, dine and socialize.

Our inaugural club will include a diverse mix of amenities including a diverse range of racquet sports, saunas, cold plunges, gym, wellness / recovery, full service dining, weekly programming, events, tournaments and more.

Memberships are now live and we are curating an exclusive cohort of founding members (early members include notable celebrities, athletes, investors, and entrepreneurs).

As members of the Exec Sum community, we are offering you all the opportunity for priority review when you mention "Litquidity" in the application. Click the button below to apply and learn more.

Deal Flow

M&A / Investments

FDIC seized Republic First Bank, which was consequently acquired by Fulton Bank (RT)

BHP Group is considering making an improved proposal for Anglo American after the London-listed miner rejected its $39B takeover offer as significantly undervalued (BBG)

L’Occitane International billionaire owner Reinold Geiger is close to making a take-private offer that would value the skincare company at ~$7B, including debt (BBG)

Tech-focused PE firm Thoma Bravo agreed to acquire UK cybersecurity company Darktrace at an equity value of ~$5.3B (BBG)

Carlyle Group and the family owners of Tamko Building Products are considering a sale that could value the roof shingles maker at over $3.5B (BBG)

Apollo Global Management, KKR, and Stonepeak may inject billions of dollars into a JV that will help fund Intel’s semiconductor fabrication facility in Ireland (BBG)

Food giant General Mills is exploring a sale of its North America yogurt business including its Yoplait brand in a deal that could be worth over $2B (RT)

Blackstone is finalizing a revised offer to buy Hipgnosis Songs Fund that will be a significant improvement on the $1.5B bid made by Concord (BBG)

UMB Financial is in talks to acquire rival Heartland Financial USA, which has a $1.5B market cap, in what could be the largest regional bank merger this year (BBG)

Apollo Global Management will acquire frac-sand provider US Silica Holdings in a $1.2B cash deal (BBG)

Czech billionaire Daniel Křetínský will acquire a 20% stake in German conglomerate Thyssenkrupp’s steel business at an estimated ~$749M equity value (FT)

KKR-backed French media group Mediawan agreed to acquire KKR-owned German rival Leonine in a $536M all-share deal (FT)

Billionaire Lawrence Stroll is in early talks to sell up to a 25% stake in his Aston Martin F1 team (BBG)

Agricultural commodities trader Louis Dreyfus sweetened its offer for Namoi Cotton to $81M (BBG)

UAE-backed RedBird IMI is set to walk away from its takeover of The Telegraph, which will likely trigger another bidding war for the UK newspaper group (BBG)

VC

Amae Health, a mental health care startup, raised a $15M Series A led by Quiet Capital (PRN)

WEE Marketplace, a Dubai-based product delivery marketplace, raised a $10M pre-Series A round led by Sig Investment (FN)

Edia Learning, an AI platform helping students succeed at math, raised a $9.4M round led by Felicis (FN)

Yoneda Labs, a startup building a foundation model for chemists working in drug discovery, raised a $4M seed round led by Khosla Ventures (BW)

Neowrk, an AI startup optimizing workplace management, raised a ~$2.2M round led by Indicator Capital (PRN)

IPO / Direct Listings / Issuances / Block Trades

SPAC

American Rare Earths rejected a $400M SPAC offer for its Wyoming Rare subsidiary (MN)

Debt

Banks including Morgan Stanley and Goldman Sachs are lining up ~$1.1B of debt to allow CVC Capital Partners' to hold on to Italian university group Multiversity (BBG)

TGI Fridays is working with Guggenheim Partners to explore ways to address its debt and has considered a new private loan that would refinance $375M of bonds (BBG)

Bankruptcy / Restructuring

Adam Neumann asked a bankruptcy court not to advance WeWork’s proposal to turn its business over to top lenders after it rejected his attempts to regain control of the company (WSJ)

Casa Systems, a software maker for cable TV companies, won court approval to sell its cloud-based unit for $32M to Lumine Group US to fund its bankruptcy case (BBG)

Fundraising

General Catalyst is close to raising $6B to invest in tech start-ups (FT)

Oaktree Capital Management is spinning out its transportation-infrastructure group with $3.7B in assets into a new firm called Duration Capital Partners (WSJ)

Ex-Carlyle Japan exec led Newton Investment Partners raised $960M from for a new fund to invest in local companies (BBG)

Hong Kong-based alternative credit manager Tor Investment Management raised $370M for its third Asia opportunistic private credit fund (BBG)

Crypto Corner

Swiss National Bank sees 'good reasons' to avoid crypto investments (BBG)

Exec’s Picks

WSJ published an interesting piece observing how the thrill factor is back for retail investors.

Litney Partners - Financial Recruiting 💼💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

Meme Cleanser

Advertise with us // Visit our merch store // Invest alongside Lit Ventures // Book a call with Lit // Launch your own newsletter