Together with

Good Morning,

Oracle debt is suddenly trading like junk, regulators are forcing Koreans to watch training videos before trading, Trump narrowed his Fed chair pick to Hassett and Warsh, SpaceX is interviewing banks for a blockbuster IPO, and fund managers view India stocks as a top hedge against AI risks.

Spreadwise is revolutionizing liquidity for HNWIs by offering fixed-rate liquidity at sub-4% rates. This is a game-changer for investors who want to access credit without disrupting their portfolios. If you manage high net-worth wealth for yourself or your clients, you must check 'em out.

Let's dive in.

Before The Bell

As of 12/12/2025 market close.

Learn more about the Litquidity portfolios and subscribe to the strategies on Autopilot.*

Markets

US stocks slumped on Friday as the tech selloff resumed

S&P pulled back from an ATH

S&P and Nasdaq ended the week in red

Small-caps Russell 2000 hit a fresh ATH before closing lower

US 30Y yield rose to 4.85% to its highest since September

Volumes in Big Tech CDSs climbed 90% since September as investors seek protection against AI debt

Earnings

What we're watching this week:

Wednesday: Micron, General Mills

Thursday: Accenture, Nike, FedEx, CarMax, Darden Restaurants

Friday: Carnival

Full calendar here

Prediction Markets

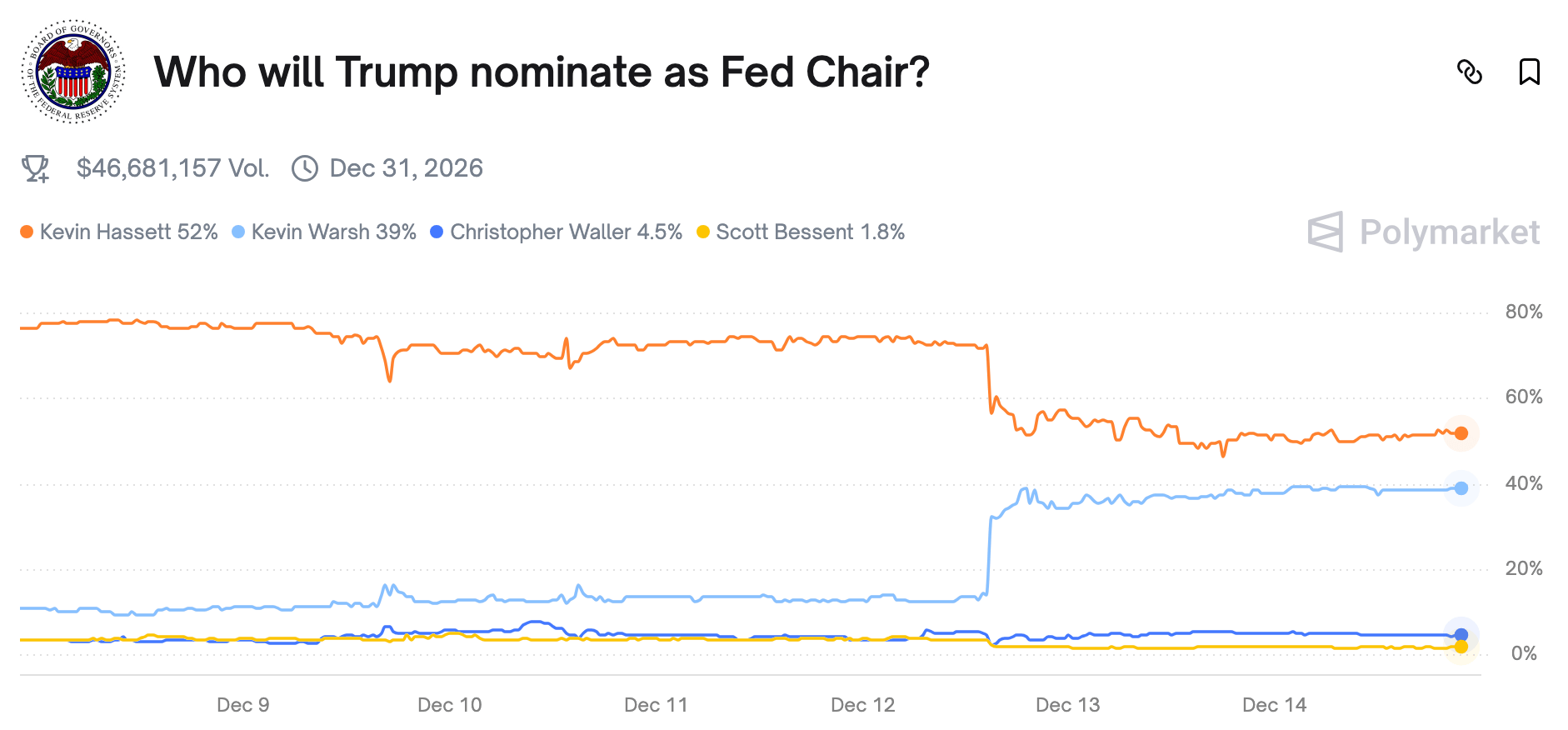

Trump narrowed his Fed chair pick to Hassett and Warsh, lifting Warsh's odds in the race. Also, Jamie Dimon expressed support for Warsh

Trade your prediction on the next Fed chair on Polymarket

Headline Roundup

Regulators force Koreans to watch training videos before trading (FT)

Wall Street's AI adoption is set to drive hiring boom (BBG)

Trump named Warsh and Hassett as top Fed chair contenders (WSJ)

Jamie Dimon supports Kevin Warsh for next Fed chair (FT)

Bond market rate-cut debate to heat up with busy data week (BBG)

BOJ will pledge more rate hikes in policy meeting this week (RT)

Equity funds saw the largest weekly inflow in five weeks (RT)

Wall Street ditches Big Tech for old school names for growth in 2026 (BBG)

Oracle debt is trading like junk amid data center delays (BBG)

OpenAI ends six-month 'vesting cliff' in AI talent race (WSJ)

Asset managers view India stocks as top hedge against AI risks (BBG)

Hedge funds pile into commodities in search of alpha (FT)

Carry trade revival that electrified EM spurs optimism for 2026 (BBG)

China IPO mania gives investors just a 0.02% shot at stock (BBG)

Swiss dealmaking surges to record highs despite strong franc (FT)

VC seed funding check sizes broke records this year (CB)

Nasdaq will block IPOs that are vulnerable to market manipulation (RT)

Hedge fund Peconic gained 79% YTD in concentrated three-stock bet (BBG)

RenTech explores tweak to trading models after meme-stock volatility (WSJ)

Banco Sabadell banned Cerberus from buying its non-performing loans (BBG)

Kirkland & Ellis faces blowback over credit-market monopoly lawsuit (WSJ)

Hong Kong and India fuel blockbuster year for Asia fundraising (BBG)

India banks seek to double cap on M&A finance as deals soar (BBG)

Wells Fargo hiring spree fuels IB ambitions (RT)

Brown University canceled finals after deadly shooting (BBG)

Ex-JPMorgan banker took 50% pay cut to join MrBeast (ET)

A Message from Spreadwise

Borrow Against Your Portfolio – Smarter

Most investors use margin or portfolio lines of credit and end up paying 6%-12% interest with no tax benefit. Spreadwise lets you access the same liquidity at lower rates (under 4%) and treat the cost as capital losses, not interest expense.

Spreadwise works through a fully collateralized SPX box spread options strategy, giving you fixed-rate, fixed-term financing without selling your investments or making monthly interest payments.

The result: lower effective borrowing costs, more flexibility, and real tax advantages, all while keeping your portfolio exactly where it is.

If you're a high-net-worth investor or manage concentrated stock positions, Spreadwise can help you unlock cash without the usual drag.

Deal Flow

M&A / Investments

Tech-focused PE firm Thoma Bravo is in talks to merge shipping software firm Auctane with third-party logistics provider WWEX Group and inject $500M of new equity to form a $12B entity

AI workflow automation platform ServiceNow is in advanced talks to buy cybersecurity startup Armis for $7B

SK Capital is nearing a deal to acquire Swiss drug distribution company Swixx Biopharma at a $1.8B valuation

Intel is in advanced talks to acquire AI chip startup SambaNova for $1.6B, including debt

Chinese mining firm Jiangxi Copper sweetened its takeover bid for UK's SolGold to $1.13B

Crypto giant Tether submitted a binding all-cash offer for a 65.4% stake in Italian soccer club Juventus FC from Italian family office Exor for $634M

NCAA D1 athletic conference Big 12 is finalizing a deal with RedBird Capital Partners and Weatherford Capital to unlock $500M of funding for member colleges

Harbour Energy agreed to acquire all the subsidiaries of Waldorf Energy and Waldorf Production in the UK North Sea fields for $170M

First Eagle Investments agreed to acquire Diamond Hill Investment Group in an all-cash deal at a $473M valuation, representing a 49% premium

Moroccan conglomerate Holmarcom is in talks to acquire a 67% stake in Moroccan bank BMCI from French lender BNP Paribas

Australian mining firm Ioneer is interested in bidding on a bundle of Rio Tinto's US boron assets

Germany is in early talks to acquire a majority stake in Dutch state-owned utility TenneT's German power grid

Tether-backed farming company Adecoagro offered to acquire 50% stake in nitrogen fertilizer manufacturer Profertil from Argentina's state-owned oil company YPF

PE firm TDR's $1.3B acquisition of UK coffee chain Costa Coffee from Coca-Cola is at risk of collapsing over valuation concerns

VC

Musk's SpaceX is selling secondary shares at an $800B valuation

AI no-code startup Emergent is set to raise a $60M round led by Khosla Ventures

PsiThera, a computational drug-discovery startup, raised a $47.5M Series A led by Samsara Biocapital and Lightstone Ventures

The Owl AI, an AI-driven sports officiating startup, raised an $11M seed round led by S32

Worktrace AI, an AI workflow-automation startup, raised a $9.3M seed round co-led by Conviction and 8VC

AI-based blockchain security startup TestMachine raised a $6.5M round led by Blockchange Ventures, Decasonic, Delphi Ventures, and New Form Capital

Privacy-preserving data protocol ORO AI raised a $6M seed round led by a16z Crypto and Delphi Ventures

Get real-time updates on any startup, VC, or sector. Try Fundable.

IPO / Direct Listings / Issuances / Block Trades

SpaceX started a bake-off for the biggest-planned IPO ever

Chinese humanoid robot maker Galbot is considering a Hong Kong IPO at a $3B-$4B valuation

Blackstone-backed Indian warehouse/logistics giant Horizon Industrial Parks is preparing to file for a $500M India IPO

Wealth management fintech Wealthfront raised $485M at a $2.6B valuation in its IPO

Warburg Pincus-backed India shadow lender Truhome Finance is seeking to raise $300M at a $1.5B valuation in an India IPO

Debt

Apollo shorted loans of software firms including Internet Brands, SonicWall, and Perforce on AI-related concerns before closing positions

Thoma Bravo is in talks to raise $5B in private credit from lenders including Blackstone to finance its merger of Auctane with WWEX Group

Bankruptcy / Restructuring / Distressed

Brazilian airline Azul won US court permission to exit Chapter 11 and implement a creditor-backed restructuring that cuts $2.6B in debt and raises $950M in new equity from United Airlines and American Airlines

Investors holding $2.8B in products sold through Chinese shadow bank Zhejiang Zhejin Asset Operation and backed by debt claims of property developers affiliated with Sunriver Holding failed to receive payments

First Brands is requesting court approval to access $250M in receivables to supplement rescue financing after its $1.1B DIP loan collapsed

TPG exited most of its stake in cosmetics firm Anastasia Beverly Hills as part of a restructuring that wiped out 85% of its $600M minority investment

Troubled Chinese developer Vanke faces imminent debt failure after creditors rejected its plan to delay a $283M bond payment

Luxury retailer Saks' subordinated debt fell to 12¢ ahead of an over $100M payment due month-end amid declining sales and strained vendor relationships

Roomba maker iRobot filed for Chapter 11 bankruptcy and will cede control to main supplier and lender Shenzhen PICEA Robotics and Santrum under a restructuring agreement

A group of creditors to collapsed subprime auto-lender Tricolor is seeking investigations into what JPMorgan and Fifth Third Bank knew about the fraud before the collapse

Fundraising / Secondaries

UK hedge fund Fulcrum Asset Management raised $2.8B from Millennium for its equities-focused strategy

UK hedge fund Armar Capital raised $850M from Millennium

UK asset manager Aberdeen will acquire $2B of US closed-fund assets from investment manager MFS

MM PE firm MML Capital raised over $740M for a new continuation fund for two PortCos

Crypto Sum Snapshot

Terraform Labs-founder Do Kwon was sentenced to 15 years over $40B crypto collapse

Interactive Brokers will allow retail clients to fund brokerage accounts with stablecoins

Strategy will remain in Nasdaq 100 index

Circle, Ripple, BitGo, Paxos, and Fidelity Digital Assets won regulatory approval for national trust bank charters

Crypto Sum compiles the most important stories on everything crypto. Read it here.

Exec’s Picks

Has AI reduced the workload in M&A – or just moved it around?

Read UpSlides's The AI Paradox in M&A report to discover the truth from M&A professionals across the US and UK.

Josh Brown wrote an interesting piece explaining how market concentration in a bull market is not a bug, but a feature.

Financial Services Recruiting 💼

If you're a junior banker looking for your next career move, check out Litney Partners, a recruiting firm established by Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates across private equity, hedge funds, venture capital, growth equity, credit, and investment banking.

We're currently seeking talent for some incredible roles. Head over to Litney Partners to drop your resume / create your profile and we'd love to get in touch!

Meme Cleanser

🛒 Merch Store: Visit our merch store to shop our latest apparel, shoes, bags, accessories and more.

💵 Litquidity Ventures: Accredited investors & qualified purchasers within the Litquidity community can gain access to alternative investments such as venture, late-stage growth, and private equity through Litquidity Ventures. Interested? Fill out this form.

☎️ Book a call with Lit: Want to pick Litquidity's brain on business advice, insights, or just chat to say what's up? Buy his time here.

📧 Launch your own newsletter: Have great content ideas and looking to launch your own publication? We highly recommend beehiiv to get started.

*DISCLAIMER: Investment advice provided by Autopilot Advisers, LLC ("Autopilot"), an SEC-registered investment adviser. Past performance does not guarantee future results. Investing carries risks, including loss of principal. As always, be smart out there. Litquidity is compensated to promote AutoPilot. Compensation details available upon request.