Together with

Good Morning,

Trump is down to five candidates for Fed chair, US and China are close to a trade deal, the S&P is set for its best earnings season in four years, UBS applied for a national bank charter, Amazon plans to cut 10% of its corporate workforce, and CFB upsets are causing a wave of coach firings.

Fall season means it's time for a wardrobe overhaul. Check out our personal favorite Mizzen+Main for the most comfortable men's dress shirts in the game.

Let's dive in.

Before The Bell

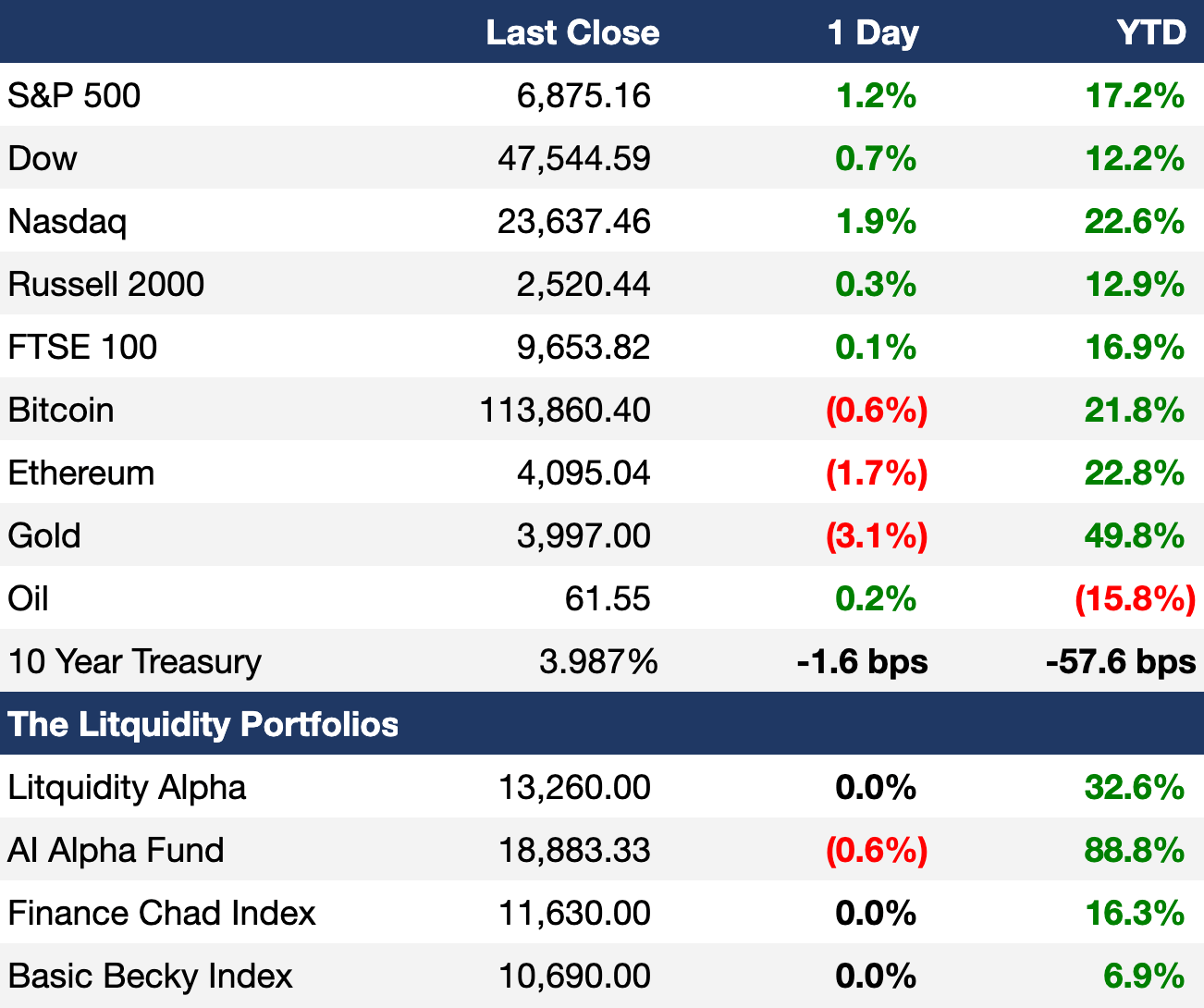

As of 10/27/2025 market close.

Click here to learn more about the Litquidity portfolios and subscribe to the strategies on Autopilot.*

Markets

US stocks surged yesterday on US-China trade deal optimism

All three major indexes hit fresh ATHs

Europe's Stoxx 600 hit a fresh ATH

UK's FTSE 100 hit a fresh ATH

Spain's IBEX 35 hit an ATH for the first time in 18 years

Japan's Nikkei 225 rallied to a fresh ATH

Argentina bonds and currency surged after victory for Milei's party

Earnings

Bed Bath & Beyond reported mixed Q3 results with a smaller-than-expected loss as restructuring takes hold; the retailer guided for revenue growth next year (WSJ)

What we're watching this week:

Today: UnitedHealth, PayPal, UPS, Visa, Electronic Arts

Wednesday: Alphabet, Meta, Microsoft, Boeing, Starbucks, Verizon, CVS, Chipotle, Caterpillar, Carvana, Kraft Heinz

Thursday: Amazon, Apple, Coinbase, Eli Lilly, Comcast, Reddit, Blue Owl, Roblox

Friday: ExxonMobil, Chevron, AbbVie

Full calendar here

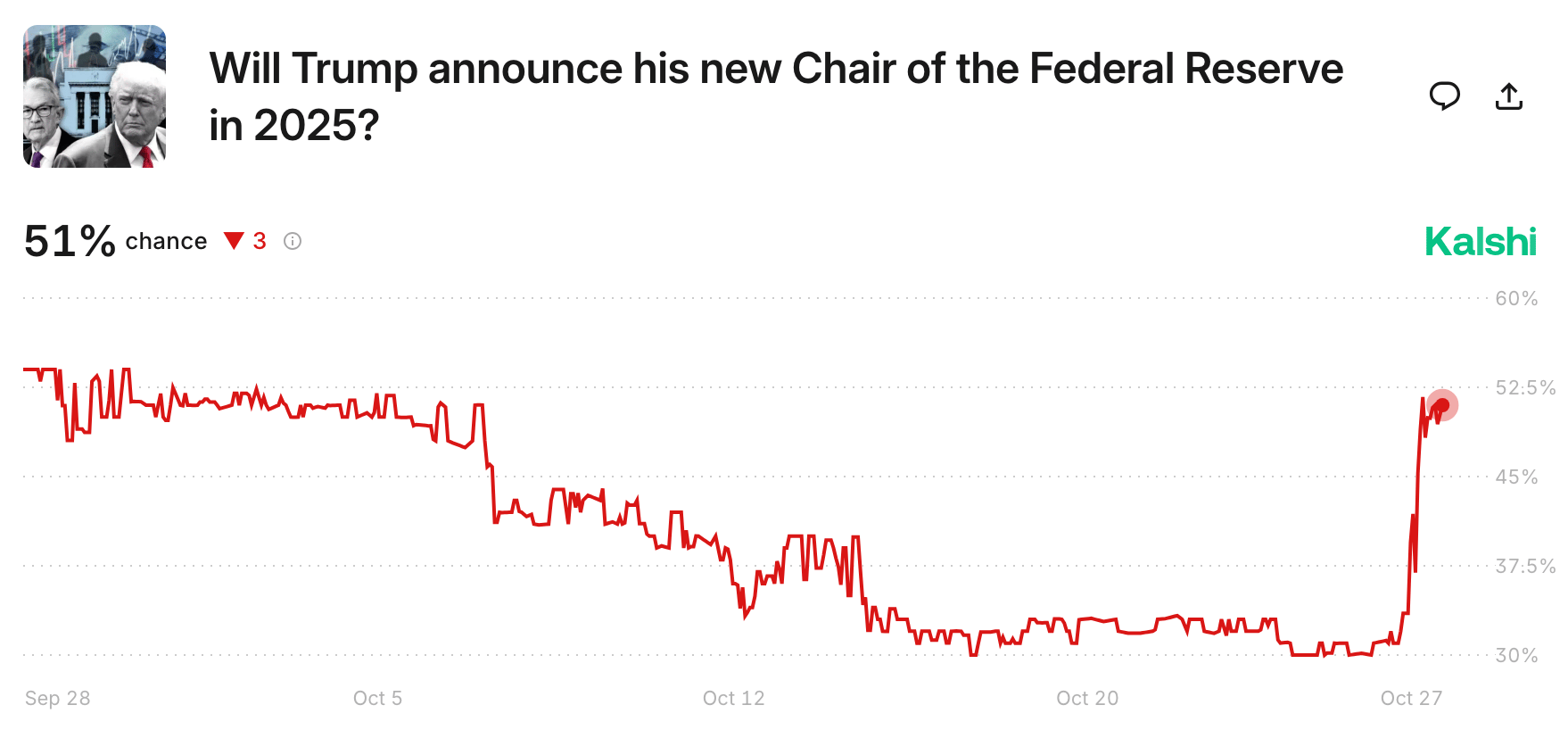

Prediction Markets

Not much J Pow criticism since the Fed cut rates last month.

Headline Roundup

US and China are close to a trade deal (CNBC)

Good vibes are back on Wall Street (WSJ)

US M&A topped $80B in 24 hours (FT)

Trump met with Japan's new PM Takaichi for defense and trade talks (BBG)

S&P 500 hedging costs rise ahead of earnings, trade talks, and Fed (BBG)

Fed chair race is down to five candidates (CNBC)

PBOC will resume government bond trading (BBG)

S&P 500 is on course for its best earnings in over four years (BBG)

JPMorgan offers staff AI chatbot to help write performance reviews (FT)

Hedge funds rekindle appetite for tech VC (II)

Private credit ratings may be 'systematically' inflated (FT)

UBS applied for a national bank charter in US (BBG)

Blackstone hired Apollo's Michele Raba as head of European PE (RT)

Australia bond sales are set to hit a record high (BBG)

UK will stop disclosing identity of short sellers (FT)

Tesla risks losing Musk as CEO if $1T pay package isn't approved (CNBC)

Amazon plans to cut 30k jobs in corporate (BBG)

Barclays re-entered Saudi Arabia 11 years after exiting business (BBG)

EY UK partner pay rose 9% to £787k (FT)

Face of LIBOR scandal Tom Hayes sued UBS for malicious prosecution (BBG)

Meta appointed ex-metaverse exec to boost AI efforts (FT)

Football coaches are getting fired across the board (WSJ)

A Message from Mizzen+Main

"I legit love my Mizzen+Main shirts." – Hank, CEO of Litquidity

Fall szn means it's time to consider a wardrobe overhaul, but it's hard to find a shirt that meets all our needs. Don't stress, Mizzen+Main has your back.

With their Leeward No Tuck Dress Shirt, you can have all the comfort of your favorite homey T-shirt with the style of that dress shirt you can wear to the office every day. This shirt is made from machine washable performance fabric that's quick drying and wrinkle resistant – so you'll never have to worry about looking your best.

Stop sacrificing comfort for style, because you can have both in your Mizzen+Main's Leeward dress shirt. Use code EXECSUM and take $35 off any order of $125+ today.

Deal Flow

M&A / Investments

American Water Works agreed to buy Essential Utilities in a ~$13B all-stock deal, including debt

Regional lender Huntington Bancshares will acquire smaller rival Cadence Bank in $7.4B all-stock deal

Activist hedge fund Trian and tech investor General Catalyst submitted a $7.2B take-private offer for asset manager Janus Henderson

French media company Banijay is in advanced talks to acquire German sports-betting business Tipico from CVC for $5.2B

European PE firm Cinven is considering a sale of German software company think-cell at a $3.5B valuation

European PE firm EQT offered to acquire Australian insurance firm AUB Group for $3.4B

$3.3B-listed financial software firm BlackLine rejected a takeover offer from German software giant SAP earlier this year

Vista Equity Partners acquired a majority stake in Swiss-American software company Nexthink from UK PE firm Permira at a $3B valuation

Regional lender FirstSun Capital will buy peer First Foundation in a $785M all-stock deal

Canadian financial services firm Wealthsimple Financial. raised $536M at a $7.1B valuation co-led by Dragoneer and GIC

KPS Capital Partners agreed to acquire a controlling stake in chemicals firm Albemarle's Ketjen refining catalyst unit for $660M

South African lender FirstRand acquired a 20.1% stake in AI fintech firm Optasia for $277M ahead of its IPO

Nordic Capital agreed to acquire historical capital markets data provider BMLL for $250M

Abu Dhabi state-owned oil giant ADNOC's overseas unit XRG is in talk to invest in Argentinian LNG firm YPF

Chinese PE firms HSG and CPE are vying for a controlling stake in Burger King's China business

Russia's second-largest oil producer Lukoil plans to sell its international assets amid sanctions

VC

AI-model training startup Mercor is set to raise $350M at a $10B valuation led by Felicis

AI for finance startup Rogo Technologies raised funding at a $750M valuation from Sequoia

Financial wellness and growth solutions startup SavvyMoney raised a $225M funding round led by PSG and Canapi Ventures

Wealth technology platform Endowus raised $70M in funding led by Illuminate Financial

CoreStack, a multi-cloud governance and automation platform, raised a $50M round led by Post Road Group

Fintech startup Hyperlayer raised a $40M round led by CDAM

Pave Bank, a programmable bank, raised a $39M round led by Accel

Onfire, an Israeli startup that monitors public forums to identify what tools devs are discussing, raised a $14M Series A led by Grove Ventures and TLV Partners

Media technology company Steven.com raised over $10M at a $425M valuation led by Slow Ventures and Apeiron Investment Group

PodPlay Technologies, a vertical SaaS platform for participatory sports venues, raised an $8M Series A led by Frontier Growth

Turtle, a protocol focused on on-chain liquidity distribution, raised a $5.5M round led by Bitscale VC, Theia, Trident Digital, and more

AI-driven contract management platform Hubble raised a $5.2M Series B from Vertex Ventures

Sequoia and a16z recently announced historic fundraising plans. Stay up-to-date on the entire VC ecosystem here.

IPO / Direct Listings / Issuances / Block Trades

EQT, SWF ADIA, and Auba Investment are looking to sell an 8.4% stake in Swiss skincare company Galderma for $3.5B

$27B-listed Chinese heavy machinery company Sany Heavy Industry is set to begin trading in Hong Kong after raising $1.6B

LVMH chair Bernard Arnault acquired $1.6B in LVMH shares

SoftBank-backed Indian eyewear retailer Lenskart Solutions is seeking to raise $830M in an India IPO

AI analytics company Fractal Analytics is seeking to raise $555M at a $3B valuation in an India IPO

JPMorgan invested $75M for a 3% stake in gold miner Perpetua Resources for its $1.5T security fund's first investment

Digital token marketplace operator tZero plans to IPO next year

$36B-listed Chinese automotive firm Seres group is taking investor orders for a Hong Kong listing that may raise $1.7B

Debt

Keurig Dr Pepper raised $7B in private credit from Apollo and KKR to help finance its $18B acquisition of European coffee company JDE Peet's

Philip Morris International launched a $3.5B investment grade bond sale

Chinese e-commerce firm Meituan plans to raise $3B in a dollar and offshore yuan bond sale

Blackstone is leading a private credit deal for life-sciences company Signant Health to replace over $1B in leveraged loans

Crypto and data center firm Galaxy Digital is seeking to raise $1B in an exchangeable bonds sale

Turkey is selling dollar bonds as EM optimism grows

Bankruptcy / Restructuring / Distressed

German battery maker BMZ filed for insolvency for some of its key units

UK oilfield services group Petrofac applied to enter administration

Fundraising / Secondaries

Goldman Sachs Asset Management is in talks to secure a $10B mandate from SWF Kuwait Investment Authority

VC a16z plans to raise $10B across funds focused on mature companies, AI applications and infrastructure, and 'American Dynamism' defense and manufacturing

Canadian investment firm Dawson Partners acquired $1B worth of PE LP stakes including in Blackstone from the Hong Kong Jockey Club's portfolio

Singapore SWF GIC is seeking to sell $1B worth of its PE LP stakes including in Blackstone, Apollo, and TDR Capital

VC Sequoia plans to raise $950M across a Series A and seed fund

Growth equity investor Insignia Capital raised $500M for its newest fund

Energy credit investor Breakwall Capital raised $125M for a targeted $500M infrastructure-focused fund

Crypto Sum Snapshot

Nigeria capital markets suffer as crypto and gambling outpaces investing

Canary Capital and Bitwise will launch the first US altcoin ETFs despite shutdown

IBM launched a platform for enterprises to launch blockchain-based services

Ethereum scaling network MegaETH raised $350M in an ICO at a $7B valuation

Big banks enter stablecoin era by taking Zelle international

Crypto Sum compiles the most important stories on everything crypto. Read it here.

Exec’s Picks

Check out Bloomberg's profile on Evercore exec Nigel Dawn: the man behind the booming PE secondaries market.

Is the AI bubble more dangerous than tight credit spreads? Read Allison Schrager's opinion on the actual biggest market risk right now.

Finance & Startup Recruiting 💼

Litney Partners

If you're a junior banker looking for your next career move, check out Litney Partners, a recruiting venture between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm), Litney Partners places talent at leading firms in PE, hedge funds, VC, growth, credit, IB, and fintech and is currently recruiting for some incredible roles. Head over to our website to drop your resume and we'd love to get in touch!

Next Play

If you're down bad, realizing finance isn't for you, and want to explore the world of startups (BizOps, chief of staff, strategic finance, etc.), fill out this form. Next Play will reach out to schedule a 1:1 video call if they think they can help as your own, personal startup matchmaker. They've grown their community to over 50k talented professionals and have deep relationships across the tech ecosystem.

Meme Cleanser

🛒 Merch Store: Visit our merch store to shop our latest apparel, shoes, bags, accessories and more.

💵 Litquidity Ventures: Accredited investors & qualified purchasers within the Litquidity community can gain access to alternative investments such as venture, late-stage growth, and private equity through Litquidity Ventures. Interested? Fill out this form.

☎️ Book a call with Lit: Want to pick Litquidity's brain on business advice, insights, or just chat to say what's up? Buy his time here.

📧 Launch your own newsletter: Have great content ideas and looking to launch your own publication? We highly recommend beehiiv to get started.

*DISCLAIMER: Investment advice provided by Autopilot Advisers, LLC ("Autopilot"), an SEC-registered investment adviser. Past performance does not guarantee future results. Investing carries risks, including loss of principal. As always, be smart out there. Litquidity is compensated to promote AutoPilot. Compensation details available upon request.