Together with

Good Morning,

Credit market concerns are spurring M&A speculation, startup M&A hit a record high in Japan ahead of listing curbs, US tariffs are creating a surprise advantage for LME, and an AWS outage took down major websites around the world yesterday.

Columbia Business School Exec Ed and Wall Street Prep launched a comprehensive online program on AI for Business & Finance, covering everything from GenAI foundations to advanced ML, all while offering access to a global network of industry veterans. Learn more below.

Let's dive in.

Before The Bell

As of 10/20/2025 market close.

Click here to learn more about the Litquidity portfolios and subscribe to the strategies on Autopilot.*

Markets

US stocks rallied yesterday as investors looked past the government shutdown and trade tensions to prepare for the start of Q3 earnings

S&P had its best two-day advance since June

Japan's Nikkei 225 surged 3.4% to a new ATH on political optimism

MSCI EM index surged 1.6%

Earnings

What we're watching this week:

Today: Coca-Cola, Netflix, Capital One, GM, RTX, Lockheed Martin, 3M

Wednesday: Tesla, AT&T

Thursday: Intel, American Airlines

Friday: Procter & Gamble, Booz Allen Hamilton, General Dynamics

Full calendar here

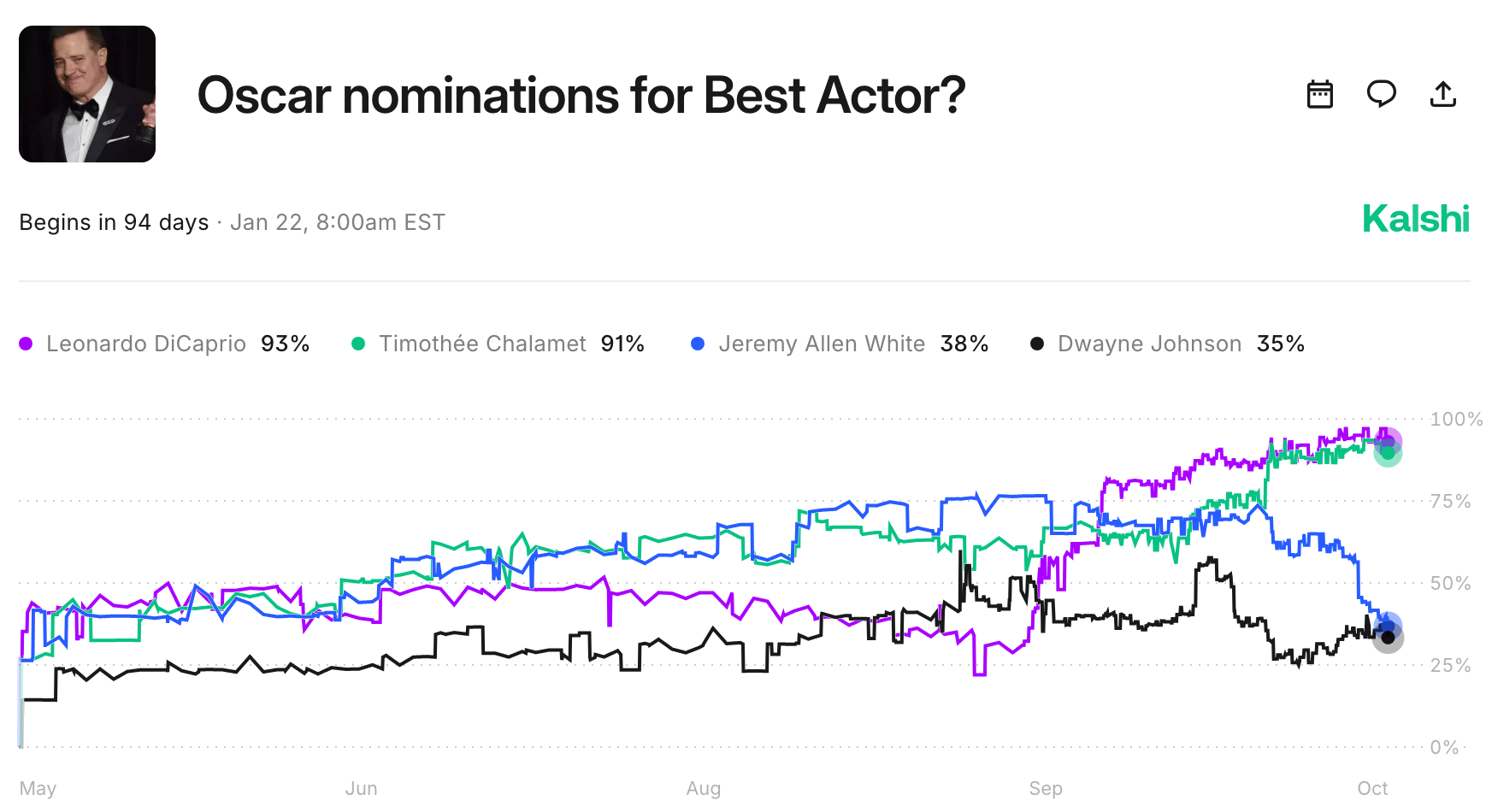

Prediction Markets

The Rock is getting some Oscar buzz for the first time ever.

Headline Roundup

Shutdown stalemate brings US IPO holdouts off the sidelines (BBG)

US bank rout prompts M&A speculation as credit worries loom (RT)

JPMorgan warns First Brands fallout is driving up banks' funding costs (FT)

CLO ETFs saw the biggest outflows since April (BBG)

SCOTUS will hear case on tariffs in two weeks (BBG)

US signed a rare earths agreement with Australia (BBG)

Cboe is seeking to extend options hours into overnight (BBG)

China ETFs see outflows as US-China tensions trigger volatility (BBG)

Canada tells Maple 8 to invest at home in age of 'economic nationalism' (FT)

Hedge funds have returned to Hong Kong listings (FT)

US tariffs hand surprise win to London Metal Exchange over Comex (FT)

Startup M&A hit a record high in Japan ahead of listing curbs (BBG)

Twelve-hour stock trading explodes activity in $2.4T Korea market (BBG)

Brazil hedge funds outperform benchmark as bullish bets pay off (BBG)

KKR launched a maritime leasing platform (BBG)

Glass Lewis also urged shareholders to reject Musk's $1T pay (RT)

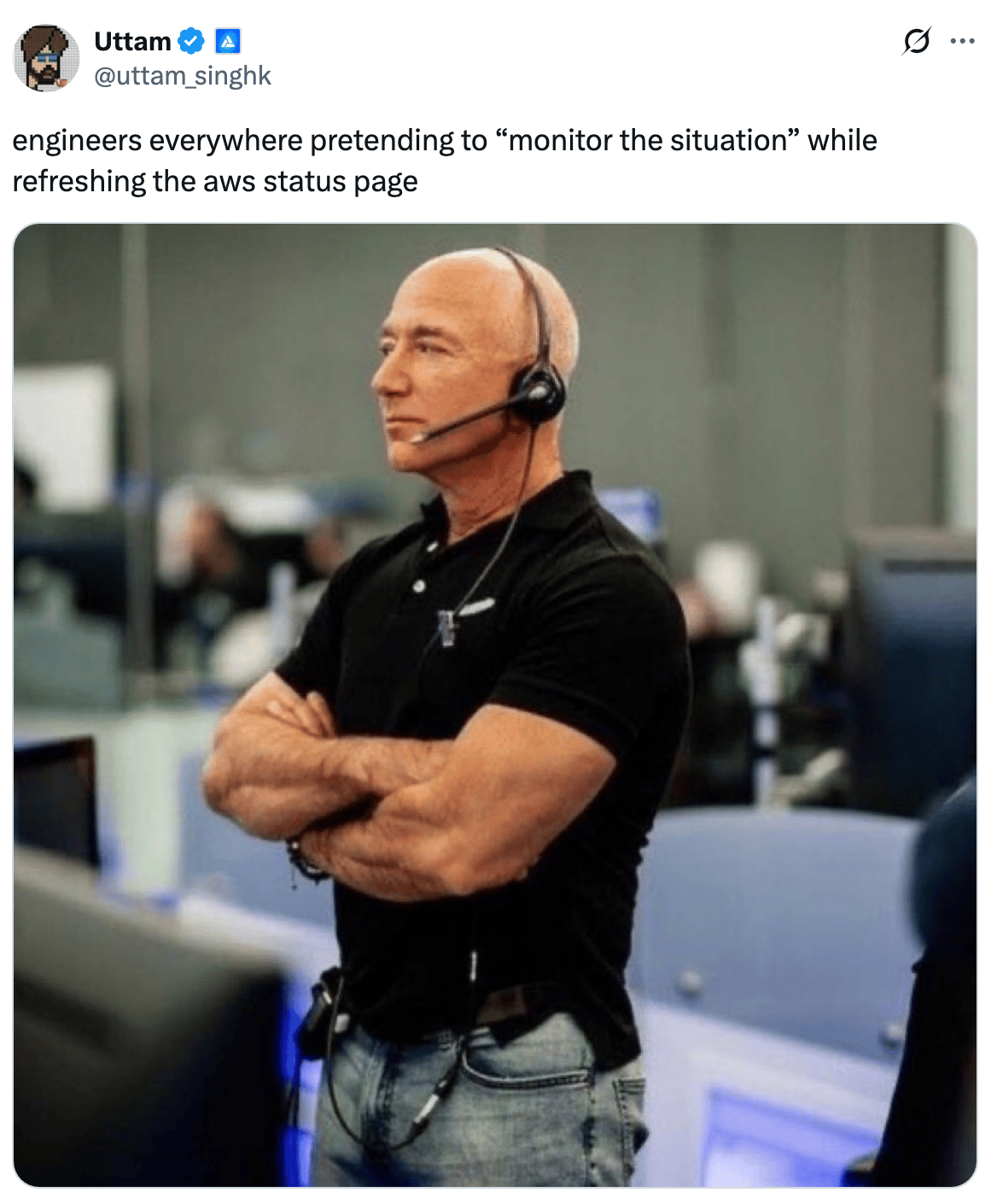

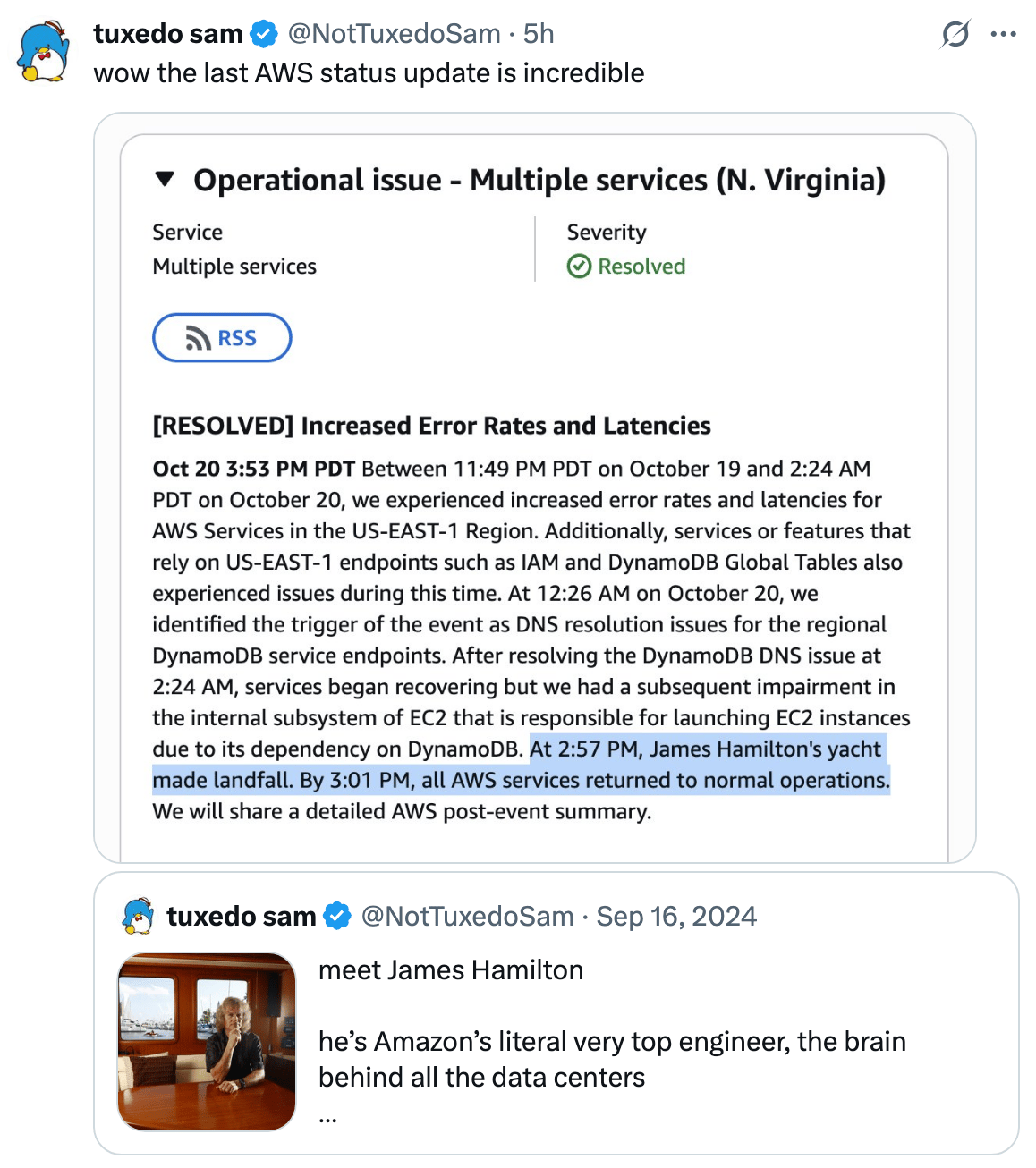

Amazon Web Services took down major websites in global outage (CNBC)

SEC banned three Mexican financial firms for helping cartels launder (BBG)

Paramount Skydance will cut 2k jobs (RT)

A Message from Columbia Business School Exec Ed

Learn AI for Business. Network Like an MBA.

In finance, AI fluency means turning buzzwords into bottom-line impact. The AI for Business & Finance Certificate Program makes that concrete:

8 weeks of hands-on, real-world use cases

Live office hours with Columbia Business School Exec Ed faculty

A global network that exposes you to new ideas and opportunities

Don't just follow AI trends. Elevate your career with AI skills that actually make a difference.

Enroll today using code LITQUIDITY and save $300. Program starts Nov. 10

Deal Flow

M&A / Investments

UK PE firm Permira is weighing a sale of financial data group Octus at an over $4B valuation

Swiss building materials supplier Holcim agreed to acquire German walling company Xella for $2.2B

Investment company Plantro withdrew its $500M offer to acquire Canadian legal software form Dye & Durham

European PE firm EQT is in talks with secondaries investors Coller Capital, HarbourVest Partners, and Pantheon over a potential acquisition

Ari Emanuel's events company MARI acquired TodayTix Group

House of Doge, the commercial arm of Dogecoin Foundation, acquired a controlling stake in Italian soccer club US Triestina Calcio 1918

Top VC picks by Fundable

UK neobank fintech Revolut is raising a $3B round at a $75B valuation

OpenEvidence, a 'ChatGPT for doctors', raised a $200M round at a $6B valuation led by GV

CoMind, a UK brain monitoring startup, raised a $60M Series A led by Plural

Hyperlayer, UK embedded fintech products company, raised $40m led by CDAM

Safe Pro Group, an AI-based defense and security technology startup, raised a $14M round led by Ondas Holdings

Magic, a startup building AI for real-world experiences, raised a $10M seed round led by Lerer Hippeau

1001 AI, a startup creating AI infrastructure for critical industries in MENA, raised a $9M seed round led by CIV, General Catalyst, and Lux Capital

Provision, a startup building an AI assistant for construction estimators, raised a $7M seed round led by Cercano Management

Milvus Advanced, a startup creating rare metal alternatives, raised a $6.9M seed round led by Hoxton Ventures

Logic, a decision automation platform, raised a $4.3M seed round from Founders' Co-op, Audacious, Neo, and others

Hard to miss the wave of deep tech startup raises. Track any startup sector or theme on Fundable.

IPO / Direct Listings / Issuances / Block Trades

Activist hedge fund Jana Partners built a stake in $15B-listed medtech Cooper and is pushing for a merger of its contact lens unit with rival Bausch + Lomb

Activist hedge fund Starboard Value took a 5% stake in $8B-listed engineering and construction firm Fluor

Activist HoldCo Asset Management took a 3.8% stake in $3.3B-listed regional lender First Interstate Bank

Philippine's Maynilad Water Services raised $428M in an IPO priced at the top of a range in the counry's largest listing since 2021

Penta Investments-backed Polish music and books retailer Empik is seeking to raise $235M in a Poland IPO next year

CVC-backed Japanese personal-care business FineToday canceled Japan IPO plans for a second time

SPAC / SPV

Evernorth, a crypto treasury firm backed by Ripple, will merge with Armada Acquisition Corp II in a $1B deal to acquire XRP

Debt

Ethiopia is in talks to convert some of the $5.4B it owes to China into yuan-denominated loans

Truist Financial raised $2.5B in investment grade debt despite regional bank worries

Costa Rica plans to raise $1.5B in its first global bond sale since 2023

Italian lender UniCredit is planning a SRT to $1.4B of loans originated by its Austrian unit

A unit of Indian conglomerate Godrej is set to raise $230M in its third debt sale in three months

NYC's MTA is seeking to raise $230M in short-term debt

Bankruptcy / Restructuring / Distressed

Auto parts supplier First Brands tried to refinance $6B of debt with Banco Santander and Jefferies months before its collapse

Gambling firm Bally's Corp. shelved plans to amend part of a $1.9B debt package after creditor pushback

Blood glucose monitor maker LifeScan is set to receive bankruptcy court approval for its Chapter 11 deal to cut over $1B of debt

Banc of California, Enterprise Bank, and Nano Banc are exposed to $270M of troubled debt, which includes the fraud-linked debt that Zions and Western Alliance revealed

Fundraising / Secondaries

UK growth investor BGF plans to raise $675M in its first external fundraise

EA Private Debt raised a $500M private credit continuation vehicle led by Carlyle's FOF arm AlpInvest

Africa-focused hedge fund Enko Capital raised $100M for a targeted $200M private credit strategy

Robinhood filed to launch Robinhood Ventures Fund I, a closed-end fund to buy stakes in private companies and hold them through IPO and beyond

Crypto Sum Snapshot

August co-CEO says crypto exchanges need more coordination

British Columbia will limit AI power use and ban crypto mining

xAI, DeepSeek, and Anthropic are rattling Wall Street with serious gains in AI crypto trading test

Crypto Sum compiles the most important stories on everything crypto. Read it here.

Exec’s Picks

Join Weil Private Equity and 100+ industry peers on October 30th for Weil PE Bootcamp, an afternoon of high-level training for junior and mid-level deal professionals, followed by Burgers & Brunello, one of NYC's premier gatherings of dealmakers tasting the best vintages of Brunello with NYC's oldest wine shop, Acker Wines. Come learn, toast, and walk away with the edge to crush your deals. Click here to request a complimentary ticket.

San Francisco has resurrected from the dust. Thanks to AI.

Gold is on a three-year bender. But while gold is rallying today, there's been periods where it did nothing. Read Ben Carlson's analysis here.

Finance & Startup Recruiting 💼

Litney Partners

If you're a junior banker looking for your next career move, check out Litney Partners, a recruiting venture between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm), Litney Partners places talent at leading firms in PE, hedge funds, VC, growth, credit, IB, and fintech and is currently recruiting for some incredible roles. Head over to our website to drop your resume and we'd love to get in touch!

Next Play

If you're down bad, realizing finance isn't for you, and want to explore the world of startups (BizOps, chief of staff, strategic finance, etc.), fill out this form. Next Play will reach out to schedule a 1:1 video call if they think they can help as your own, personal startup matchmaker. They've grown their community to over 50k talented professionals and have deep relationships across the tech ecosystem.

Meme Cleanser

🛒 Merch Store: Visit our merch store to shop our latest apparel, shoes, bags, accessories and more.

💵 Litquidity Ventures: Accredited investors & qualified purchasers within the Litquidity community can gain access to alternative investments such as venture, late-stage growth, and private equity through Litquidity Ventures. Interested? Fill out this form.

☎️ Book a call with Lit: Want to pick Litquidity's brain on business advice, insights, or just chat to say what's up? Buy his time here.

📧 Launch your own newsletter: Have great content ideas and looking to launch your own publication? We highly recommend Beehiiv to get started.

*DISCLAIMER: Investment advice provided by Autopilot Advisers, LLC ("Autopilot"), an SEC-registered investment adviser. Past performance does not guarantee future results. Investing carries risks, including loss of principal. As always, be smart out there. Litquidity is compensated to promote AutoPilot. Compensation details available upon request.