Together with

Good Morning,

Amazon will soon allow auto dealers to sell cars on their site, Congress wants to expel George Santos after a House Ethics report, Cruise suspended their employee share program, Alphabet’s Pichai says China will be at the forefront of AI, and Jim Harbaugh accepted the Big Ten’s sign stealing suspension.

Is your old mattress lumpy, uncomfortable, and ready to bite the dust? Upgrade your sleep with today's sponsor, Eight Sleep.

Let’s dive in.

Before The Bell

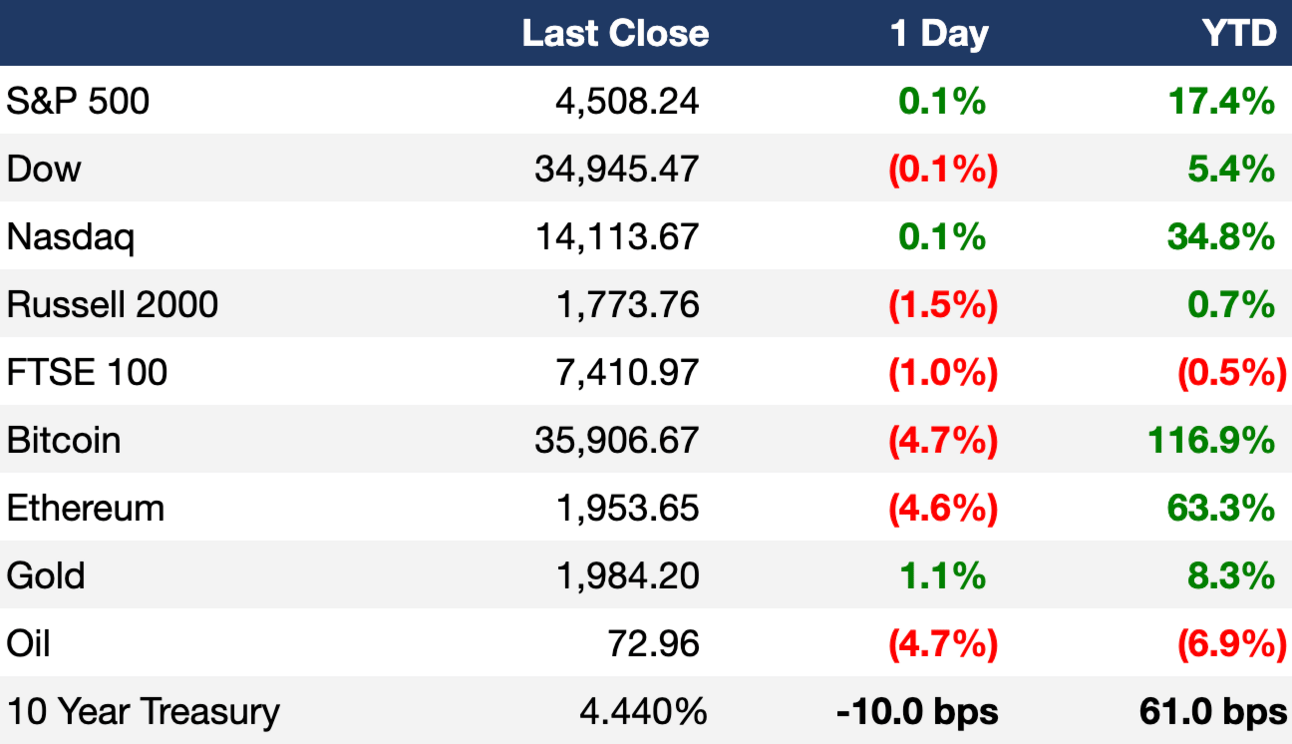

As of 11/16/2023 market close.

Markets

US stocks closed relatively unchanged

The Dow fell 0.13%, while the S&P rose 0.12%

Oil prices slumped ~5% due to investor concerns over global oil demand

European stocks fell as positivity around cooling inflation wore off

Earnings

Walmart shares fell 8% despite beating Q3 earnings and revenue expectations due to the company’s cautious outlook on consumer spending (CNBC)

Macy’s shares rallied 6% after beating Q3 earnings and revenue expectations thanks to inventory and margin improvement offsetting a 7% YoY decline in sales (CNBC)

What we're watching this week:

Today: BJ’s

Full calendar here

Headline Roundup

Amazon will allow auto dealers to sell cars on its site, starting with Hyundai (CNBC)

Momentum builds to expel George Santos after House Ethics report (AX)

Fed’s Mester wants ‘much more evidence’ that inflation has been defeated (CNBC)

US yields underestimate ‘adverse fiscal dynamics,’ Barclays says (BBG)

Cruise suspends employee share program, citing need to revalue business (WSJ)

US continuing jobless claims rise to highest in almost two years (BBG)

YouTube debuts AI tool that mimics vocals of artists like John Legend, Demi Lovato (CNBC)

China will be at the forefront of AI, Alphabet’s Pichai says (BBG)

Apple’s effort to replace Qualcomm chip in iPhone falls further behind (BBG)

Brigade, Sculptor among now-bankrupt WeWork’s biggest creditors (BBG)

Japan firms exit Taiwan offshore wind projects, deepening industry crisis (BBG)

Wall Street loves Washington’s new debt approach - for now (WSJ)

Microsoft is bringing its Copilot chatbot to Windows 10 (CNBC)

Applied Materials under US probe for shipment to Chinese chipmaker SMIC (RT)

Americanas fraud was $1B more than previously suspected (BBG)

Argentina running out of soy adds to next president’s economic woes (BBG)

Jim Harbaugh accepts the Big Ten’s sign stealing suspension (WSJ)

A Message From Eight Sleep

Invest in your sleep.

Humans spend roughly one-third of their lives sleeping. A good night’s sleep is vital for every human to survive. So why not get the best out there? Enter Eight Sleep.

Eight Sleep is a high-tech smart bed system that has taken Silicon Valley by storm. With built-in heating and cooling system, multiple foam layers to deliver comfort, and analytics tracking to help you optimize your sleep and recovery, Eight Sleep is the complete package.

Eight Sleep has also given the Litquidity community the best offer on the market for their products. Just use code "LIT" at checkout to apply the discount, and you'll get a nice discount.

So what are you waiting for? Order your Eight Sleep today by clicking below 👇🏼

Deal Flow

M&A / Investments

Alternative credit manager Kennedy Lewis Investment Management, which has ~$14B AUM, is exploring strategic options including an outright sale (BBG)

Canadian PE group Brookfield canceled plans to sell holiday resort group Center Parcs after failing to secure bids at its $5B price (FT)

Engineering consultant Jacobs Solutions is in advanced talks to merge its government consulting arm at a valuation of over $4B with PE-owned Amentum Services (RT)

QuidelOrtho is considering a sale of its transfusion medicine unit, which could be valued at $1.5B-$2B (BBG)

Greece sold a 22% stake in its second-largest lender by market value, National Bank of Greece, raising over $1.1B; the sale was oversubscribed by eight times (RT)

US PE firm Arctos Partners acquired a minority stake in the Aston Martin F1 team at a $1.1B valuation from Canadian billionaire Lawrence Stroll (BBG)

Pet food and confectionery giant Mars will acquire UK chocolate business Hotel Chocolat in a $663M deal (FT)

Spanish train maker Talgo, which had a market value of $537M, received a preliminary proposal from an unidentified Hungarian business group to acquire all its shares (RT)

Advent International will acquire payments firm myPOS at a valuation of over $500M in the PE investor’s latest push into digital payments (RT)

Premier wine group The Duckhorn Portfolio will acquire Sonoma-Cutrer Vineyards from spirits and wines business Brown-Forman in a $400M cash-and-stock deal (BW)

Amancio Ortega, the billionaire founder of Inditex Zara clothing chain, agreed to buy a 49% stake in a Spanish clean energy portfolio from Repsol for $395M (BBG)

British pub Young & Co’s Brewery will acquire smaller rival City Pub Group for $201M as British pubs struggle (BBG)

Chinese delivery giant Meituan is exploring a potential acquisition of Delivery Hero’s Southeast Asian business (BBG)

VC

T-Therapeutics, a biotech company developing TCR therapeutics, raised a $59.5M Series A led by Sofinnova Partners, F-Prime Capital, Digitalis Ventures, and Cambridge Innovation Capital (FN)

Deep Sky, a Montreal-based carbon removal project developer, raised a $57.5M Series A co-led by Brightspark Ventures and Whitecap Venture Partners (PRN)

Vulcan Cyber, a company developing software to help enterprises detect vulnerabilities in their software stack, raised $55M in equity financing led by Maor Investments and Ten Eleven Ventures (TC)

NTx, a life sciences company building biomanufacturing platforms, raised a $47.5M Series B led by RA Capital Management (BW)

SGNL.ai, a Continuous Access Management company, raised $36M from Cisco Investments, Costanoa Ventures, and Fika Ventures (PRN)

Cloud-based platform Ninety raised a $35M Series B led by Blue Cloud Ventures (PRN)

On Target Laboratories, a startup developing intraoperative molecular imaging agents, raised a $30M Series C led by H.I.G. Capital, The Hurvis Group, and others (VC)

Silicon photonics startup SiLC raised $25M in funding from Hokuyo Automatic, Hankook & Company, and ROHM Semiconductor (VC)

The Cumulus Coffee Company, a startup developing a cold brew machine for home use, raised a $20.3M seed round led by Valor Siren Ventures and Valor Equity Partners (PRN)

Lynx, a Madrid-based provider of AI software that detects and prevents fraud and financial crimes, raised an $18.5M Series A led by Forgepoint Capital (FN)

Codegen, a startup automating software engineering tasks, raised a $16M seed round led by Thrive Capital (TC)

Inclusively, the workforce inclusion platform, raised a $13M Series A led by Firework Ventures (BW)

Bezi, a collaborative 3D design tool, raised a $13M Series A led by Benchmark (FN)

SwiftConnect, a provider of connected access enablement solutions, raised a $10M round led by Quadri Ventures (FN)

Switch Maritime, a startup developing hydrogen fuel cell and battery electric zero-carbon ferries, raised a $10M Series A led by Nexus Development Capital (FN)

CFX Labs, a startup aiming to monetize the payments market, raised a $9.5M seed round led by Shima Capital, Decasonic, Antalpha, and more (VC)

Optiwatt, a consumer energy optimization app and operating system, raised a $7M Series A led by Navitas Capital (FN)

Ediphi, a cloud-based estimating solution, raised a $6.5M seed round from Suffolk Technologies (PRN)

Tactical collectible card game Shardbound raised a $5M round led by BITKRAFT Ventures (TC)

OCOchem, a startup commercializing technology to electrochemically convert carbon dioxide and water into sustainable platform molecules, raised a $5M seed round led by TO Ventures (VC)

Morf Health, a startup helping healthcare providers sync patient data, raised a $3M seed round led by Kindred Ventures (FN)

IPO / Direct Listings / Issuances / Block Trades

India's Tata Technologies set its IPO valuation at ~$2.5B (RT)

Elon Musk denied a report that his rocket company SpaceX was discussing an IPO of its satellite business as soon as 2024 (RT)

Alibaba shares plunged 9% after the Chinese e-commerce giant canceled its spinoff of its cloud computing unit due to US chip export restrictions on China (CNBC)

Debt

Fundraising

Crypto Corner

A JV between Binance Holdings and Gulf Energy Development plan to launch a crypto exchange in Thailand next year after winning a license from the country’s regulator (BBG)

CoinShares, one of Europe’s largest cryptocurrency asset managers, is looking to buy ETFs from rival Valkyrie, which has a spot Bitcoin ETF awaiting regulatory approval (BBG)

Exec’s Picks

Google’s newest advanced AI music generation model, Lyria, is one of the cooler recent breakthroughs in artificial intelligence.

Litney Partners - Financial Recruiting 💼💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

Meme Cleanser

Advertise with us // Visit our merch store // Invest alongside Lit Ventures // Book a call with Lit // Launch your own newsletter