Together with

Good Morning,

Lyft’s CEO is stepping down, the Fed is debating a pause in interest rate hikes, Sam Altman wants AI regulation, the IRS is testing a free e-filing system, homebuilder sentiment has rebounded from negative territory, and China’s recovery is losing steam.

Did you know there’s a way to invest in real estate while also helping local communities? If that sounds like an interesting opportunity to you, check out today’s sponsor, Roots.

Let’s dive in.

Before The Bell

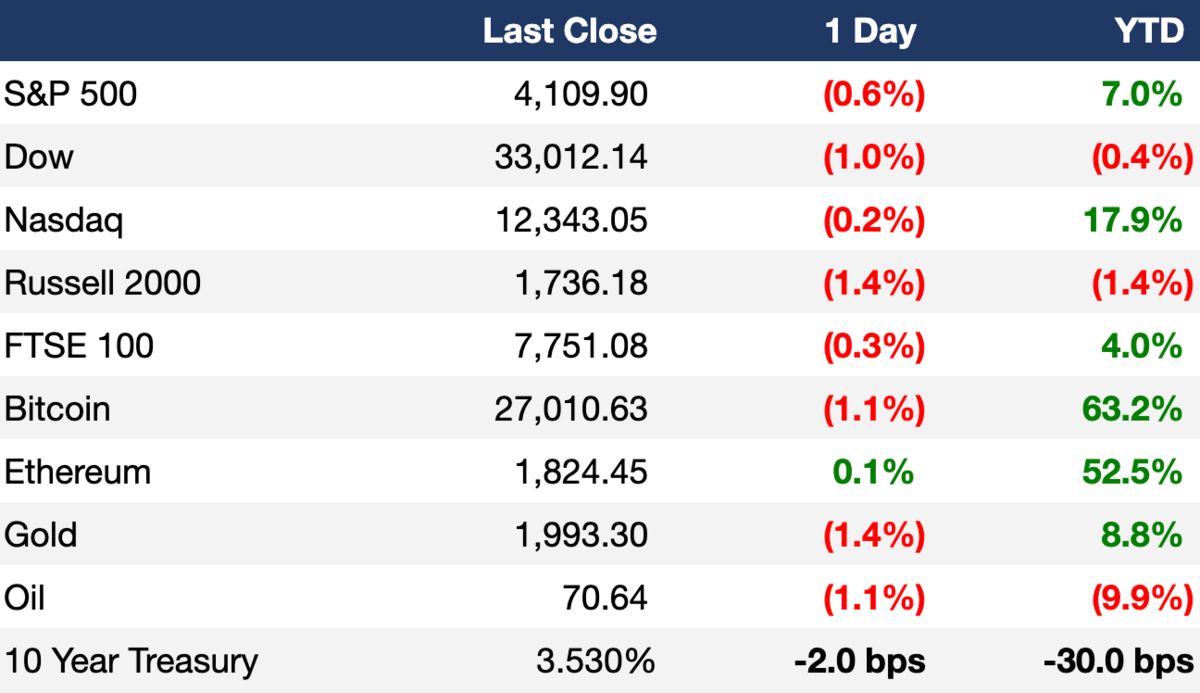

As of 5/16/2023 market close.

Markets

US stocks ended the session lower on Tuesday as investors digested fresh economic data and monitored possible updates concerning the debt-ceiling standoff

Japan’s stock index hit its highest level in 33 years

US 30Y yields hit highest level since the banking crisis

Earnings

Baidu beat Q1 expectations with revenue growing 10% YoY as Chinese businesses spent more on advertising with China reopening post-Covid (RT)

Home Depot missed Q1 revenue expectations as consumer spending on home improvement softened compared to during the pandemic boom (YF)

What we're watching this week:

Today: Take-Two Interactive, Target, Wix

Thursday: Walmart, Alibaba, Bath & Body Works, Canada Goose, Nio

Friday: Deere, Foot Locker

Full calendar here

Headline Roundup

Retail sales rose for the first time in three months in April (WSJ)

Investor pessimism over economy is at lowest level so far this year (BBG)

Homebuilder sentiment turned non-negative for first time in nearly a year (CNBC)

Senators blamed SVB and Signature bank management for banks’ failures (WSJ)

China’s recovery loses steam, signaling trouble for global economy (WSJ)

Fed officials reveal debate over whether to pause rate hike in June (BBG)

Fund managers cut commercial property exposure to lowest since 2008 (FT)

Record buyback spree is attracting shareholder complaints (FT)

UBS flags $17B hit from Credit Suisse takeover (RT)

Open AI CEO Sam Altman called for AI regulation (WP)

Morgan Stanley weighs cutting 7% of Asia IB jobs (RT)

Lyft CEO Paul to step down, will appoint replacement (YF)

A 32-year-old nears billionaire status by using AI to broker Japan mergers (BBG)

Rare pharma antitrust action seeks to block Amgen-Horizon deal (WSJ)

Connecticut’s $600M plan to narrow wealth gap: give kids trust funds (BBG)

A Message From Roots

A Real (Estate) Win-Win

Real estate investing has always felt like a zero-sum game: Either investors benefit and tenants don’t, or vice-versa… which, if you ask us, feels pretty outdated.

Roots agrees, which is why they’re changing all that with their community-focused real estate investing platform. Just check the blueprint:

Roots buys properties, fixes them up, and finds renters

Renters get invested in the fund for paying their rent on time, being good neighbors and taking care of the property.

Here’s the craziest part… this approach actually works.

The Roots Fund grew 16% last year (in a down market, no less), while tenant investors stockpiled a cool $175,000.

Want to invest wisely AND do good for the community all in one fell swoop? Then check out Roots right here.

Deal Flow

M&A / Investments

Disney will likely acquire the remaining 33% stake it doesn't already own in streaming service Hulu from telecoms giant Comcast at a $27.5B+ valuation by Q1’24 (CNBC)

Deutsche Bahn is open to selling its DB Schenker logistics unit to a strategic buyer at a valuation of up to $21.3B (BBG)

Qatar’s Sheikh Jassim made a final improved $6.31B offer for total ownership of Manchester United (RT)

Partners Group is mulling a potential sale of UK software company Civica for $2B (BBG)

Advent International, Blackstone, CVC Capital Partners, and EQT AB have each bid ~$2B for a 12.5% stake in the media rights business of the Bundesliga, Germany’s main football competition (BBG)

French voucher provider Edenred acquired Reward Getaway, a British company whose software aids companies reward their employees, for an EV of $1.45B (RT)

Ajit Prahbu, the co-founder of Quest Global Services, and Carlyle are in separate talks to acquire minority stakes in the engineering services firm Quest Global Services for a combined value of $640M (BBG)

Elon Musk’s X Corp., the parent company of Twitter, acquired tech talent recruiting service Laskie (BBG)

A group of investors led by French telecom billionaire Xavier Niel and hedge fund veteran Albert Saporta are building a stake in Swiss asset manager GAM Holding after a takeover bid by Liontrust Asset Management (BBG)

AlTi Global agreed to buy Singaporean wealth manager AL Wealth Partners (BBG)

VC

IBS Software, a Singapore-based provider of SaaS solutions for the travel and logistics industry, received a $450M investment from Apax Partners (FN)

Property insurance provider SageSure raised $250M in financing from Amwins and Flexpoint Ford (BW)

Ray Therapeutics, a optogenetics startup, raised a $100M Series A led by Novo Holdings (FN)

Boundless Bio, a clinical-stage oncology company, raised a $100M Series C led by Leaps and RA Capital Management (FN)

Huntress, a managed security platform for SMBs, raised a $60M Series C led by Sapphire Ventures (FN)

ANYbotics, a Swiss robotics startup, raised a $50M Series B led by Walden Catalyst and NGP Capital (BW)

Ensoma, a startup developing in vivo treatments for cells in the hematopoietic system, raised a $50M Series B extension led by Kite, Bioluminescence Ventures, and Delos Capital (BW)

Metaphore Biotechnologies, a startup specializing in biomimicry and ML for molecular mimics, raised $50M in funding from Flagship (FN)

Hippocratic AI, a startup building AI models for the healthcare industry, raised $50M in a funding round led by General Catalyst and Andreessen Horowitz (RT)

Spiff, a Salt Lake City-based provider of sales commission software, raised a $50M Series C led by Salesforce Ventures (FN)

NewLimit, a company that aims to increase the number of healthy years each person lives, raised a $40M Series A from Dimension, Kleiner Perkins, Founders Fund, and others (TC)

Aki Network, a Tokyo-based web3 growth stack provider, raised a $40M seed round led by Akatsukis Web3 Fund and Mask Network (FN)

River, a Bitcoin technology and financial services startup, raised a $35M Series B led by Kingsway Capital (PRN)

Cormint, a Bitcoin miner, raised a $30M Series A led by Jamie McAvity and Nav Sooch of Silicon Labs (BW)

Drug Farm, a startup using genetics and AI to discover immune-modulating therapies, raised a $27M Series C led by YD Capital (BW)

Together, a startup developing open-source generative AI, raised a $20M funding round led by Lux Capital (TC)

Skin Pharm, an aesthetic skincare clinic, received a $15M investment from Prelude Growth Partners (BW)

Quilt, a startup building a ductless heat pump system, raised a $9M seed round led by Lowercarbon Capital and Gradient Ventures (BW)

Unitea, an engage-to-earn music platform, raised a $7M seed round led by 1st Class Guernsey, Chaos Capital, TokenSociety, and Fuel Venture Capital (PRN)

Visual Layer, a visual data management platform, raised a $7M seed round Madrona and Insight Partners (FN)

IPO / Direct Listings / Issuances / Block Trades

Rakuten Group plans to issue new shares to raise up to $2.4B to shore up capital (BBG)

Saudi Arabia is studying another multi-billion dollar Aramco stock offering (RT)

Abu Dhabi National Oil is looking to raise $607M in its IPO at an equity valuation of up to ~$4.1B (RT)

Dongfang Jingyuan Electron, a Chinese chip firm looking to rival ASML, is weighing an IPO in China as soon as next year (BBG)

Debt

Bankruptcy / Restructuring

Fundraising

Illumen Capital, an Oakland-based impact fund, raised a $168M Fund II led by Ford Foundation, and W.K. Kellogg Foundation (FN)

Web3 VC firm Red Beard Ventures closed a $25M funding round with investment from prominent Web3 players including a16z's Marc Andreessen and Chris Dixon, Animoca Brands, among others (CD)

Crypto Corner

Exec’s Picks

For investors, business leaders, and anyone looking for an edge—Brilliant sharpens your analytical thinking with bite-size lessons in math, logic, data science, and more. Get hands-on with everything from foundational math to cutting-edge topics like AI and neural networks. Join 10M+ people around the world taking their skills to the next level and start your 30-day free trial today. Plus, Exec Sum readers can get 20% off an annual premium subscription.

Financial Times covered how Vice’s previous fundraising ultimately accelerated its bankruptcy.

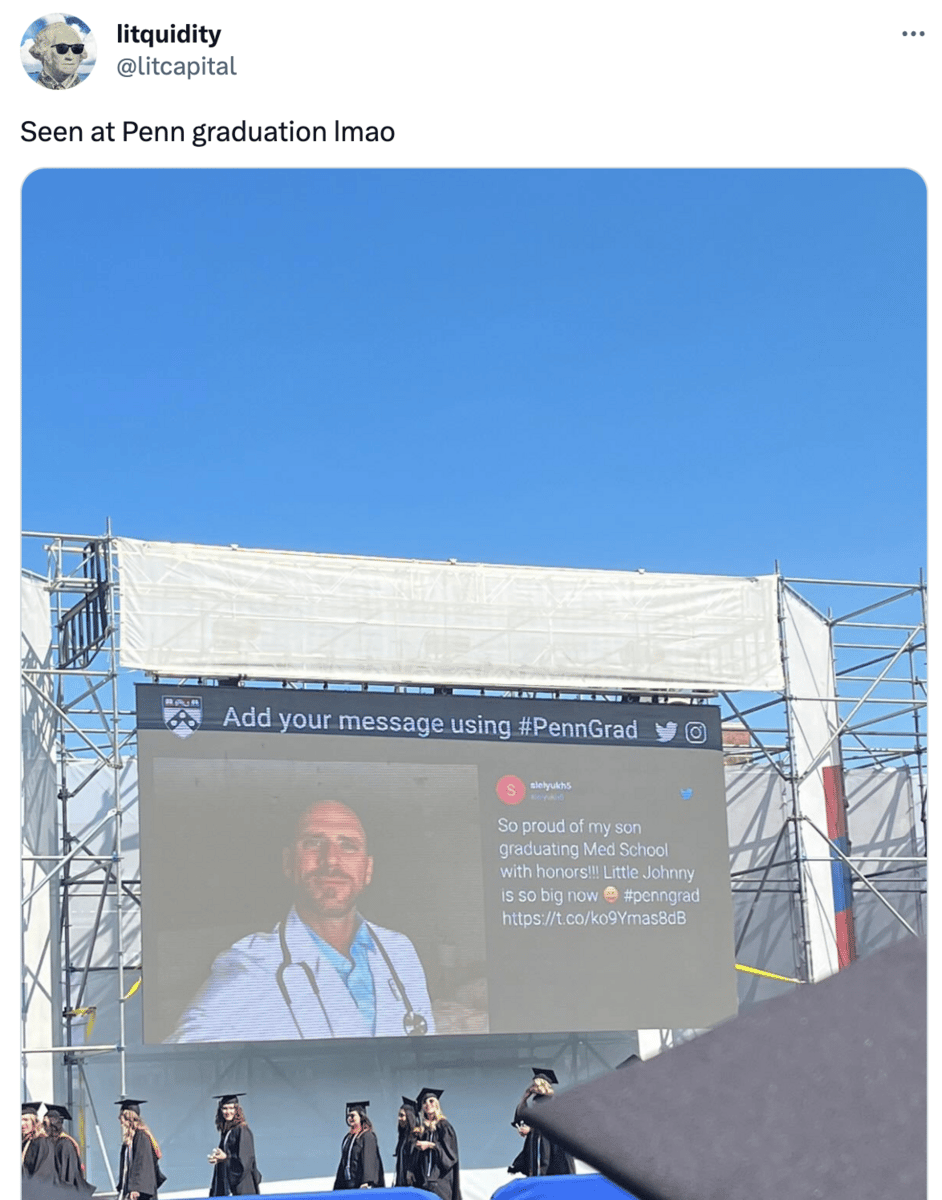

Litney Partners - Financial Recruiting 💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

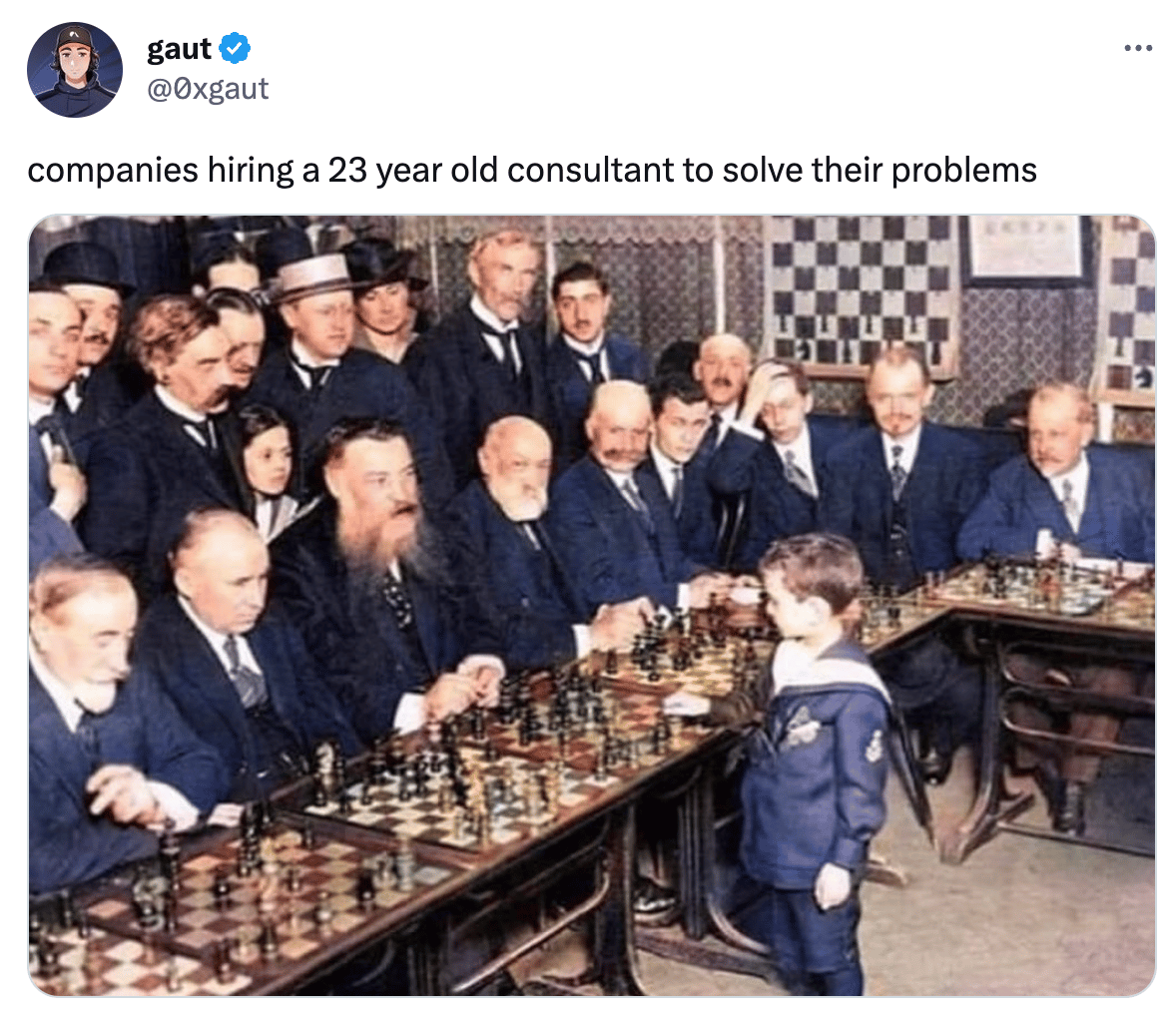

Meme Cleanser

Want to chat social media growth, newsletter strategy, angel investing, Wall Street careers, or something else? Book a call with Litquidity here.

Thinking of starting your own newsletter? Beehiiv is the best platform for creators, period. Click here to get started building your own audience.