Together with

Good Morning,

Stocks got rekt, Airbnb issued a permanent party ban, some EY auditors cheated on their ethics exams (lol), Ghislaine Maxwell got 20 years in prison, and Turkey supports Sweden and Finland joining NATO.

If you want to use this bear market as an opportunity to diversify your portfolio by adding real estate, check out today's sponsor: Cadre!

Let's dive in.

Before The Bell

As of 6/28/2022 market close.

If you want to learn more about crypto trading strategies and the world of DeFi, check out our Foot Guns newsletter.

Markets

Stocks opened green, but those early gains were quickly erased with all three major indexes closing in the red

The decline was partly driven by data from the Conference Board which showed that consumers’ short-term outlook for the US economy dropped to its lowest point in nearly a decade

The S&P 500 is on track for its worst first-half performance since 1970

Oil prices rose after China said it would loosen quarantine requirements for international travelers, signaling a potential turnaround for the world’s second largest economy

Earnings

What we’re watching this week:

Today: Bed Bath & Beyond, General Mills

Thursday: Walgreens Boots Alliance, Micron Technologies

Full calendar here

Headline Roundup

Home-price growth slowed slightly in April as competition for homes remained fierce despite rising mortgage-interest rates (WSJ)

European Central Bank President Christine Lagarde said the bank will raise interest rates gradually instead of rapidly over the coming months (WSJ)

Turkey has agreed to support NATO membership for Sweden and Finland, paving the way for the alliance’s expansion (WSJ)

Ghislaine Maxwell was sentenced to 20 years in prison for aiding Jeffrey Epstein in sex trafficking (AX)

India saw a record $82.3B in pending and completed M&A deals in Q2, defying the global dealmaking slump (BBG)

Ernst & Young was fined $100M after some of its auditors cheated on required ethics exams in recent years (WSJ)

New vehicle quality declined by 11% this year amid persistent supply chain issues (CNBC)

The US will deploy ~300K monkeypox vaccine doses in the coming weeks to address the virus outbreak (CNBC)

China slashes quarantine restrictions as covid cases fall (BBG)

Former Toys ‘R’ Us executives will face trial over the company's botched chapter 11 restructuring (WSJ)

The US Supreme Court will review Mall of America’s challenge to Sears' bankruptcy sale (WSJ)

Airbnb has made its party ban permanent (WSJ)

Disney’s board has voted to renew CEO Bob Chapek’s contract for another 3 years (WSJ)

A Message From Cadre

Traditional real estate investing has needed a transformation...

Cadre uses their proprietary technology to decrease overall costs for investors, bring clarity to a traditionally murky experience, and open participation for a historically opaque and illiquid asset class.

There is no better time than now to diversify1 your portfolio with expertly curated commercial real estate assets. Cadre’s deals are vetted by an investment committee which each average over 25 years of experience in the industry (Goldman Sachs, Blackstone, Four Seasons Hotels etc.) Since Cadre’s founding, Cadre has closed more than $4.5 billion in real estate transactions across 24 U.S. markets.

Why choose Cadre to diversify your portfolio?

Potential for liquidity - option to pull capital out of deals in secondary windows

Transparency - Insight into the why on each investment with quarterly updates and ongoing reporting

With low correlation to the stock market, commercial real estate is a vital part of a long term portfolio to grow wealth.

Cadre is the vehicle to make it happen.

Deal Flow

M&A / Investments

Spirit Airlines rejected JetBlue Airways sweetened takeover offer and asked its shareholders to vote for a merger with Frontier Airlines amid antitrust concerns (RT)

World’s biggest duty-free operator Dufry and multinational catering company Autogrill are in advanced discussions to merge and become a leading player in travel retail valued at $6B+ (BBG)

German conglomerate Siemens will buy US software solutions company Brightly Software for $1.58B (BBG)

Britain’s CareTech agreed to be bought out by a consortium led by the co-founders of the residential care company for ~$1.1B (RT)

PE firm BC Partners is exploring a sale of dental product manufacturer Zest Anchors for over $1B including debt (RT)

Intersect Power, a clean energy provider, announced a $750M growth equity investment led by TPG Rise Climate (PRN)

Energy companies SSE and Equinor together acquired three UK electricity plants from power generating company Triton Power in a $418M deal (RT)

American home appliance manufacturer Whirlpool agreed to sell all of its Russian operations to Turkish household appliances manufacturer Arcelik for deferred payments of ~$233M over 10 years (BBG)

VC

Gloat, an internal marketplace for corporate talent, raised a $90M Series D led by Generation Investment Management (TC)

Blockchain fintech firm PolySign raised $78M in funding: a $53M Series C from Cowen Digital, Brevan Howard, and others, and a $25M credit facility from PE firm Boathouse Capital (CD)

Shop Circle, a technology company that acquires and grows e-commerce software, raised a $65M funding round led by NFX and QED Investors (PRN)

Customer communication software maker FrontApp received $65M in financing led by Salesforce Ventures and Battery Ventures (BBG)

Speechmatics, an AI platform that translates speech to text, raised a $62M Series B led by Susquehanna Growth Equity (TC)

Lightbits Labs, a data storage platform, raised a $42M funding round led by Atreides Management (TC)

Progcap, an Indian startup that provides working capital to small and medium-sized businesses, raised a $40M Series C led by Creation Investments and Tiger Global (TC)

Eclipse Foods, a producer of sustainable and plant-based dairy products, closed a $40M Series B led by Sozo Ventures (PRN)

Sharebite, a startup that partners with restaurants to deliver food to corporate clients, raised a $39M Series B led by Prosus (TC)

Opaque Systems, a startup developing AI for confidential computing, closed a $22M Series A led by Walden Catalyst Partners (TC)

Industrial Next, an EV manufacturing startup led by two former Tesla employees, raised a $12M pre-Series A led by Lenovo Capital (TC)

Heyday, an automated software platform that helps users retrieve closed web pages, raised a $6.5M seed round led by Spark Capital (TC)

OpenReplay, a software troubleshooting platform, raised a $4.7M seed round led by Runa Capital (TC)

IPO / Direct Listings / Issuances / Block Trades

Chinese electric vehicle maker Li Auto plans to raise $2B from US investors through an “at-the-market” stock offering (CNBC)

Italian clean water technology company Industrie De Nora raised $501M in an Italy IPO, bringing the company to a ~$2.8B valuation (BBG)

Mining company Ivanhoe Electric fell 8.1% in its trading debut after it raised $169M in the US's biggest IPO since May (BBG)

American conglomerate Berkshire Hathaway purchased ~794K shares of Texas-based oil company Occidental Petroleum, increasing their stake in the company to ~16.4% (RT)

Fundraising

CIBC Innovation Banking announced $1.5B in growth capital commitments intended for investing in later-stage companies (TC)

Crypto Corner

Canada-based investment firm Cypherpunk Holdings sold all of its bitcoin and ether holdings to ride out current market risks (CD)

Axie Infinity’s Ronin Ethereum bridge, which allows funds to flow between Ethereum and the Ronin blockchain, has been restarted three months after $625M in crypto was stolen from the protocol (CD)

A storm in Montana knocked 75% of Marathon's active crypto mining fleet offline (TB)

Crypto lender Babel Finance has lost multiple top employees amidst an ongoing suspension of client withdrawals (TB)

Crypto exchange CoinFlex says 'Bitcoin Jesus' Roger Ver owes $47M (TV)

Exec's Picks

The crypto bear market continues to be volatile as many investors wonder if and when the markets will turn around. Tom Loverro, a general partner at IVP and former Coinbase board member, gave a detailed timeline of how he expects the market to play out over the next few years here.

Tonight at 7:00pm EST, Peter Tuchman and David Greene are hosting a free risk and pain management webinar to teach traders how to navigate this volatile market. If you're a trader, you don't want to miss a chance to learn from two greats! Plus, it's free. Click here to sign up for the webinar

The Hiring Block 💼

If you're looking to break into finance, lateral, or move out, check out our job board on Pallet, where we curate highly relevant roles for you. We aim to curate jobs across IB, S&T, VC, tech, private equity, DeFi, crypto, CorpDev and more. We'll sift through all the noise on LinkedIn, Indeed, Monster, etc. so you don't have to.

If you're a company looking to hire candidates and want to list a job opening on our board and feature on Exec Sum, click the button below:

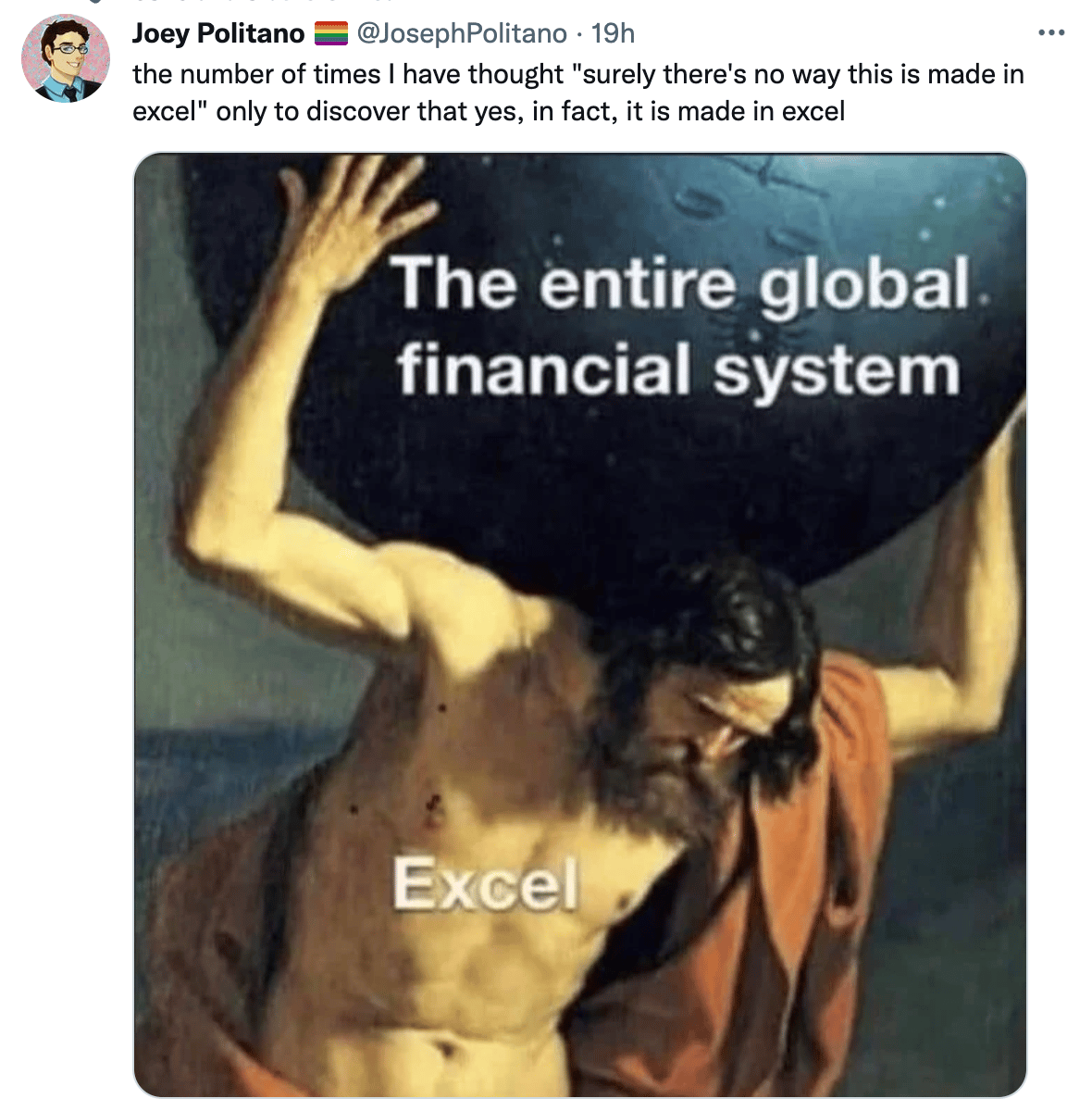

Meme Cleanser

What'd you think of today's Exec Sum?

1. Diversification does not guarantee a profit or protect against a loss in a declining market. It is a method used to help manage investment risk.

Private placements are high risk and illiquid investments. As with other investments, you can lose some or all of your investment. Nothing here should be interpreted to state or imply that past results are an indication of future performance nor should it be interpreted that FINRA, the SEC or any other securities regulator approves of any of these securities. Additionally, there are no warranties expressed or implied as to accuracy, completeness, or results obtained from any information provided here. Investing in private securities transactions bears risk, in part due to the following factors: there is no secondary market for the securities; there is credit risk; where there is collateral as security for the investment, its value may be impaired if it is sold. Please see the Private Placement Memorandum (PPM) for a more detailed explanation of expenses and risks.

Interests are being offered only to persons who qualify as Accredited Investors under the Securities Act, and a Qualified Purchaser as defined in Section 2(a)(51)(A) under the Company Act or an eligible employee of the management company. This presentation does not constitute an offer to sell or a solicitation of an offer to buy Interests in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction. There will not be any public market for the Interests.