Together with

Good Morning,

Almost 10,000 domestic flights were disrupted yesterday, Janet Yellen agreed to stay on as Treasury Secretary, US and allies are preparing new Russian oil sanctions, Bed Beth & Beyond rallied 69%, Twitter may sell usernames to boost revenue, Credit Suisse may halve its 2022 bonus pool, and BlackRock is cutting 500 jobs.

Tired of spending countless hours getting your expenses in order for tax szn? Streamline the process with today's sponsor, Divvy.

Let's dive in.

Before The Bell

MarketsIf you want to learn more about crypto trading strategies and the world of DeFi, check out our Foot Guns newsletter.

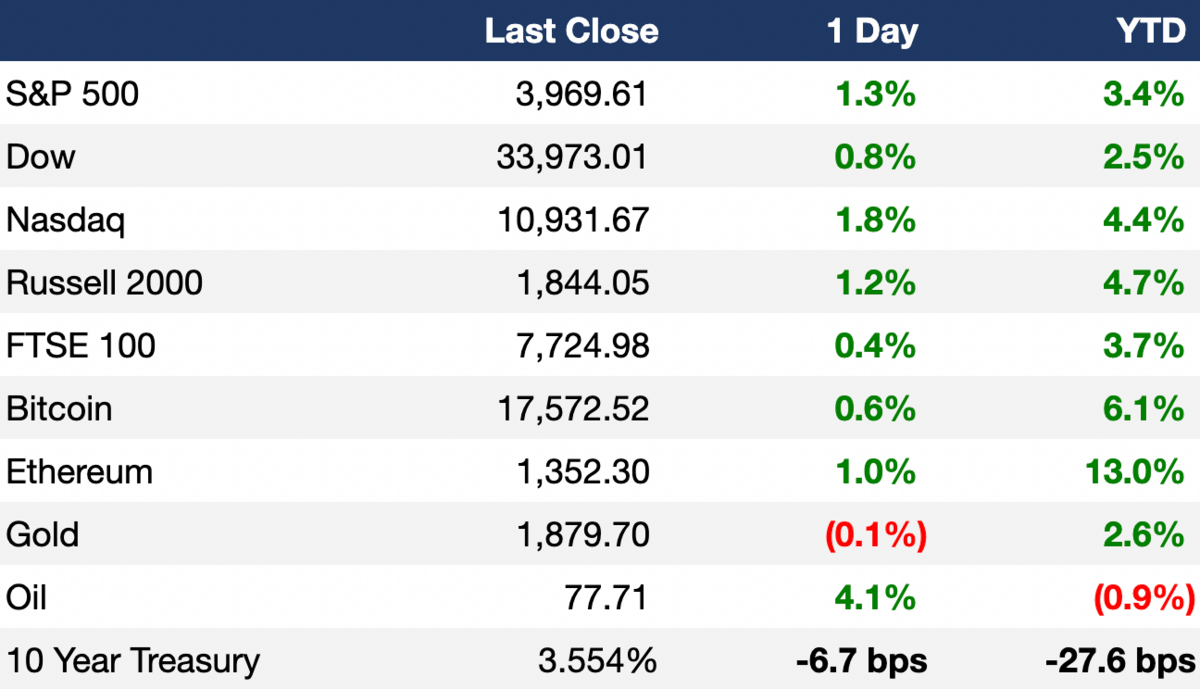

All three major US indexes closed higher on optimism over today's inflation report

The US Dollar Index was flat on the day as investors await today’s CPI print

Earnings

What we're watching this week:

Today: TSMC

Friday: JPMorgan, BofA, Citi, Wells Fargo, BlackRock

Full calendar here

Headline Roundup

Janet Yellen agreed to stay on as Treasury Secretary (AX)

Over 9.4k US domestic flights were disrupted yesterday due to FAA outage (RT)

BlackRock's iShares ETFs gained more net flows than Vanguard's ETFs last year (RT)

US and allies are preparing fresh sanctions on Russia's oil industry (WSJ)

Citigroup will launch a search for a new wealth management CEO (WSJ)

Twitter is considering selling user names to boost revenue (NYT)

Stripe has cut its internal valuation by 11%, implying a $63B valuation (TI)

One-third of Goldman Sachs' layoffs are from IBD and global markets (RT)

Citrix-parent Cloud Software Group laid off 15% of its staff (TC)

BlackRock will cut up to 500 jobs (FT)

DirecTV laid off ~10% from its upper ranks (CNBC)

Bed Bath & Beyond shares notch record jump of 69% (FT)

Alphabet-unit Verily Life Sciences will lay off over 200 employees (WSJ)

Credit Suisse may halve its 2022 bonus pool (RT)

Disney named Nike's executive chairman Mark Parker as its new chairman of the board as it prepares for a proxy battle with Nelson Peltz (CNBC)

Babies "R" Us will reopen its first store in NJ this summer, ~5 years after Toys "R" Us closed shop (RT)

BP will sell power to Meta from a solar farm in Ohio (BBG)

A Message From Divvy

If you are like us and most of the working world right now, you're getting your tax documents in order and frankly, it's a nightmare. The worst part has to be resolving expenses. Luckily, you can start the new year off right, with Divvy.

Divvy can eliminate tedious, manual expense reports and help you close your books in record time. Not to mention letting you view and control spend as it happens. No more looking at an expense from March 3rd 2022 trying to guess what that $39 was for and if you can write it off.

Even better, if you take a demo of Divvy's free expense management software we'll give you a $100 lululemon gift card. So you can start closing your books faster and get new activewear for the gym (or the couch, we won't judge).

Deal Flow

M&A / Investments

Sandwich chain Subway has retained advisers to explore a sale that could value it at more than $10B (WSJ)

Standard Chartered is considering a sale of its aircraft leasing unit which is worth ~$3.7B (RT)

Japanese IT firm Fujitsu is looking to sell its ~$1.1B stake in its AC manufacturing unit Fujitsu General (BBG)

Investment manager Harris Associates reduced its stake in Credit Suisse from 10% to 5% (RT)

Bain Capital is in talks to buy a minority stake in biomass company EcoCores for a 'few hundred million dollars' (BBG)

Belgian oil tanker and storage group Euronav disputes oil transportation company Frontline’s right to end a merger agreement between the two and is considering legal action (RT)

VC

B2B autonomous vehicle platform Oxbotica raised a $140M Series C from Aioi Nissay Dowa Insurance, ENEOS Innovation Partners, and more (TC)

DeepL, a startup providing ‘instant translation as a service’, raised a $100M round at a $1.1B valuation led by IVP (TC)

Hack the Box, a gamified cybersecurity training platform, raised $55M in funding led by Carlyle (TC)

Peppy, a B2B2C healthcare services platform, raised a $45M Series B led by AlbionVC (TC)

Inbenta, a provider of AI-powered chatbots, raised a $40M round led by Tritium Partners (TC)

VERO Biotech, a healthcare business focused on neonatal intensive care and the acute care hospital community, raised $30M in financing from Petrichor (PRN)

Inflow, a startup developing a platform for managing ADHD using cognitive behavioral therapy, raised an $11M Series A led by Octopus Ventures (TC)

Data observability platform Metaplane raised an $8.4M seed round led by Khosla Ventures (BW)

ReelData, a startup providing data and automation for land-based aquaculture farmers, raised an $8M Series A led by Buoyant Ventures (PRN)

Seek, an automation platform for data analytics tasks, raised $7.5M across pre-seed and seed rounds with participation from Conviction Partners, Battery Ventures, and former Snowflake CEO Bob Muglia (TC)

Open Forest Protocol, a startup allowing forest projects to measure, report and verify their forestation data, raised a $4.1M pre-seed round led by Shima Capital, Übermorgen Ventures, Not Boring Capital, and more (PRN)

zavvie, a startup providing real estate brokerages customized marketplaces for buying and selling solutions, raised a $3.65M round led by existing investors (PRN)

Casual gaming startup Giga Fun Studios raised a $2.4M seed round led by Lumikai and Fireside Ventures (VB)

MPC Therapeutics, a Swiss biotech company focused on metabolism and rejuvenation, raised a $1.6M seed round led by Plutus Investment Group (BW)

Fundraising

Investment manager Blue Owl Capital raised $12.9B for its Dyal Capital Partners V fund (PRN)

PE firm TSG Consumer Partners raised $6B for its TSG9 fund (BW)

Ares Management Corp raised ~$5B for an infrastructure debt fund (RT)

Layer-1 blockchain Venom Foundation and investment manager Iceberg Capital launched a $1B fund to invest in pre-seed to Series A web3 / dApp startups (TC)

UK-based investment manager M&G raised $622M for its new M&G European Living Property fund to invest in student, private rented sector and retirement housing (IW)

Crypto Corner

Exec's Picks

John Fio and Patrick O'Shaughnessy had a great conversation about building and scaling consumer products.

After months of radio silence, DCG's Barry Silbert published a letter to shareholders explaining where the company now stands.

Litney Partners - Financial Recruiting

If you're currently a junior investment banker looking to break into the buy side or lateral to another investment bank, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (one of the oldest finance executive search firms). We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

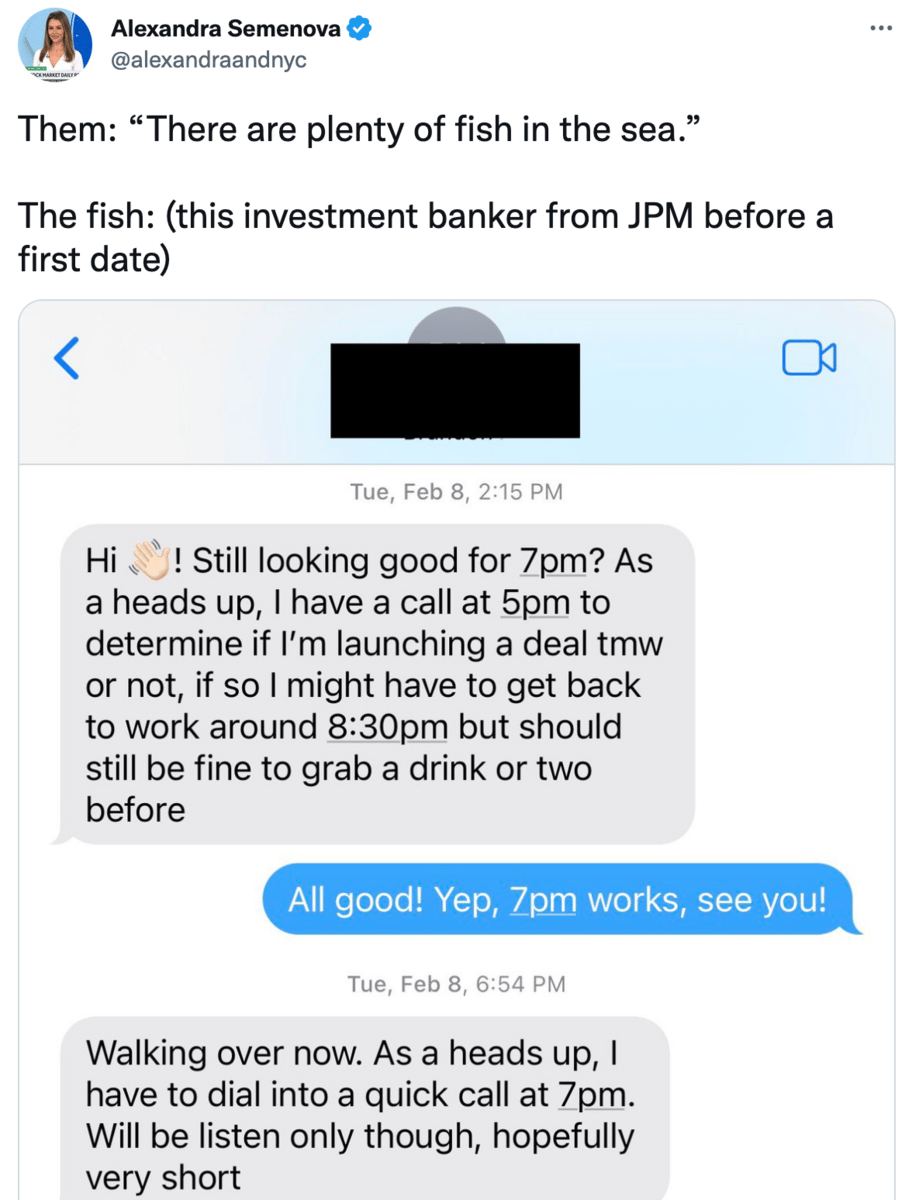

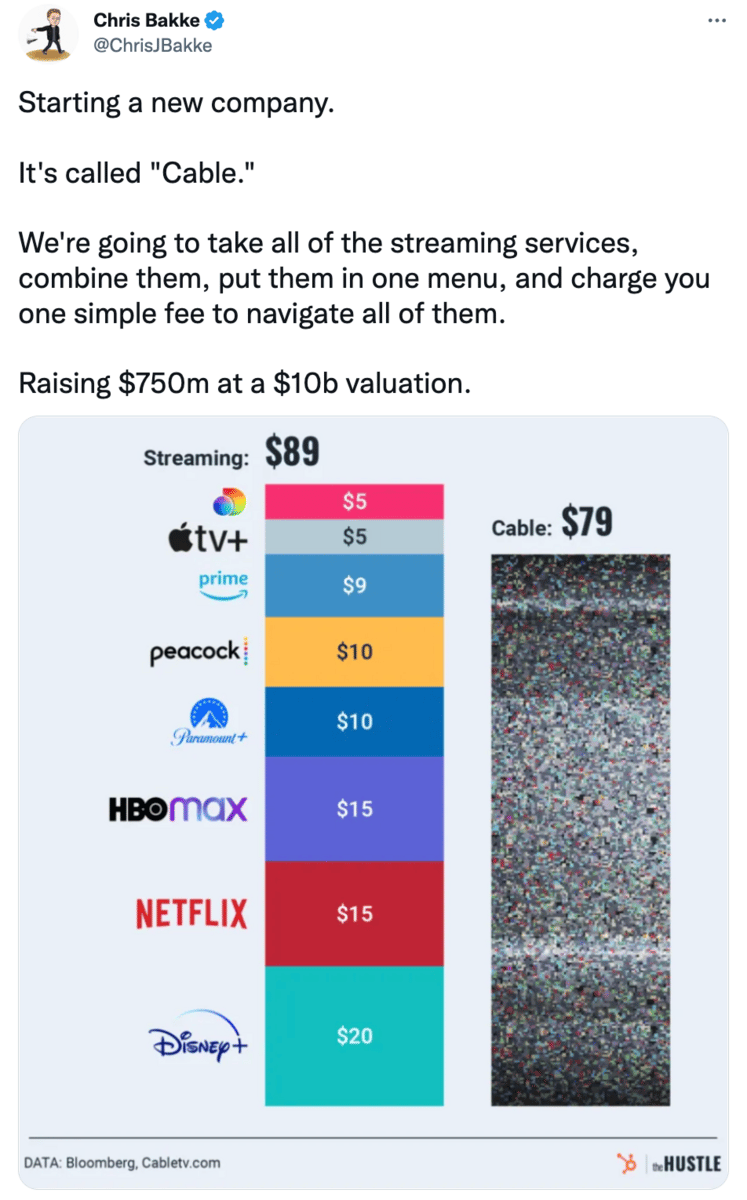

Meme Cleanser

Thinking of starting your own newsletter? Beehiiv is the best platform for creators, period. Click here to get started building your own audience.