Together with

Good Morning,

OpenAI raised $300M, bitcoin is on a hot streak, 80% of S&P 500 firms have outperformed earnings estimates, SVB considered selling $20B of bonds in the months before the bank run, Lyft wants its employees back in the office, Hollywood is bracing for a writers’ strike, and JPMorgan acquired First Republic Bank.

Interested in making vacation rentals part of your portfolio before this summer? Check out today’s sponsor, Wander.

Let’s dive in.

Before The Bell

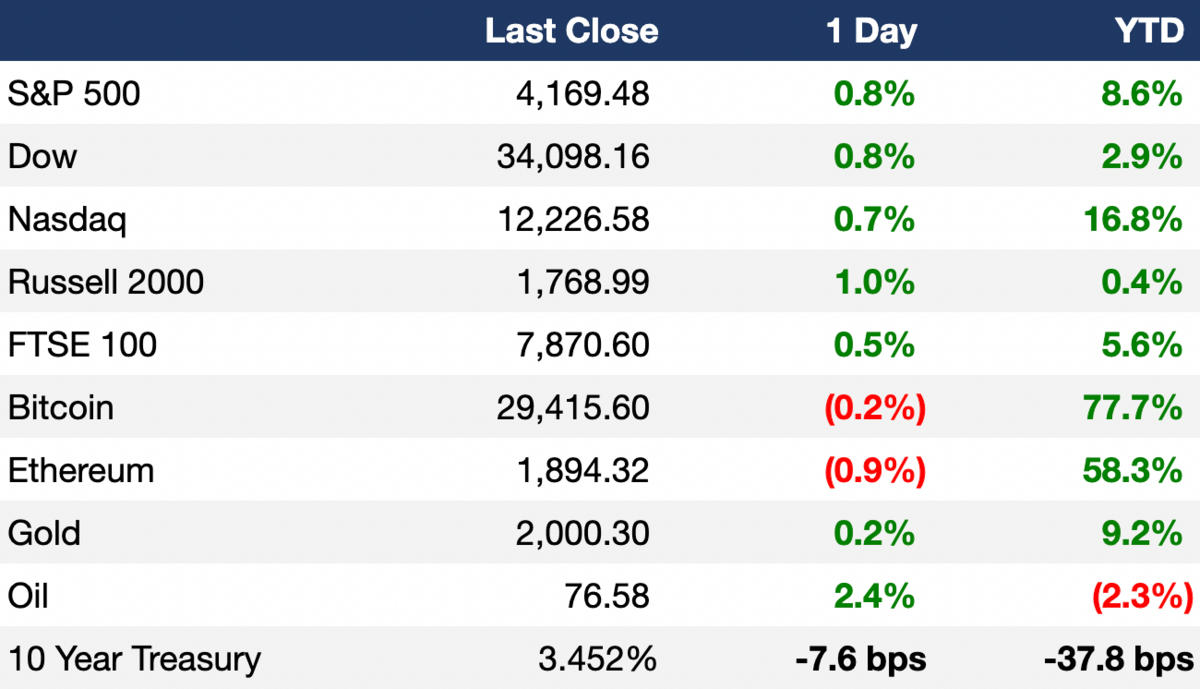

As of 4/28/2023 market close.

Markets

All three major US indexes finished Friday in the green as strong corporate earnings helped reverse a selloff earlier in the week

The Dow notched its best month since January while the S&P logged a 1.5% gain in its second-straight winning month

Futures traders are pricing the Fed fund rate target to peak at 4.75%-5%, with a 90% chance of a final 25 bps rate hike this week

Bitcoin is on course for its longest streak of monthly gains since 2021

On Wednesday, we'll receive the Fed's latest rate policy decision along with crucial jobs data this week

Earnings

Exxon topped Q1 estimates on top and bottom lines as rising oil and gas output overcame a pullback in energy prices; the firm posted record profit that was more than double from a year ago (CNBC)

Chevron beat Q1 estimates with net profits up 5% YoY thanks to earnings from refining compensating for the slide in energy prices (CNBC)

Lazard reported a surprise Q1 loss as dealmaking slumped and warned of an uncertain outlook for the FY while announcing a 10% workforce cut (RT)

What we're watching this week:

Tuesday: BP, Uber, AMD, Ford, Starbucks, Pfizer

Wednesday: CVS Health, Qualcomm, Zillow

Thursday: Apple, DoorDash, Shopify, Block, Kraft Heinz, Coinbase, Lyft, Bumble

Friday: AMC, Warner Bros Discovery

Full calendar here

Headline Roundup

Eurozone GDP grew 0.1% in Q1 (FT)

US housing market is in stalemate (NYT)

80% of S&P 500 firms have beaten Q1 earning estimates with over half reporting (CNBC)

Bond markets are still reeling after experiencing their biggest swings in decades (RT)

Five of China's largest lenders posted shrinking Q1 margins (RT)

US-listed shares of Chinese small-caps soared in a meme-like rally (RT)

SVB discussed selling up to $20B in bonds months before bank run (FT)

US will allow the auction of shares in oil refiner Citgo Petroleum amid creditor Venezuela-related protections (RT)

Companies are colluding to cheat H-1B Visa Lottery (WSJ)

Signature Bank had liquidity problems years before collapse (AX)

US money market funds see largest fund inflow in four weeks (RT)

Lyft asked employees back to office more regularly (RT)

Epstein’s private calendar reveals prominent names, including CIA chief and Goldman’s legal chief (WSJ)

Firms including JPMorgan and H&M will invest a total $100M in carbon removal credits (FT)

Hollywood is bracing for a potential writers’ strike (WSJ)

A Message From Wander

Invest in these vacation rentals in a few clicks ☝

With Wander.com, you can unlock access to vacation rental investing without the hassle and headache of doing it yourself.

Wander REIT is the first and only institutional-grade vacation rental investment product. That means investors get all the tax-advantaged benefits of a REIT in a new asset category: vacation home rentals. Instead of the traditional apartment or office-building REITs, Wander REIT invests in the best of the best of vacation rentals.

Enjoy targeted 8% dividends and a 14% targeted total return with appreciation from hand-picked, stunning vacation homes – starting with a $2,500 minimum – without having to buy a property, change light bulbs or deal with guests. And for a limited time, new REIT investors may get an opportunity to invest in Wander’s next round of funding.

Deal Flow

M&A / Investments

JPMorgan will acquire most of First Republic Bank following a third bank failure this year (FT)

Qatari group led by Sheikh Jassim submitted a final bid of $6.3B for Manchester United, while billionaire Jim Ratcliffe submitted an unknown bid as well (BBG)

Japan's Astellas Pharma agreed to buy US-based drugmaker IVERIC Bio for ~$5.9B (RT)

Malaysian gambling giant Genting sold the largest undeveloped waterfront parcel in downtown Miami for $1.2B (BBG)

Singapore wealth fund GIC agreed to buy a portfolio of Japanese logistics assets from Blackstone for $800M+ (BBG)

Canadian convenience store operator Alimentation Couche-Tard acquired 112 gas stations in the Southeastern US from Mapco Express (BBG)

PE firm Bain Capital built a stake in German software company Software AG (BBG)

VC

OpenAI, the company behind ChatGPT, raised $300M+ from Tiger Global, Sequoia Capital, Andreessen Horowitz, Thrive, and K2 Global at a ~$28B valuation (TC)

Polymateria, a startup using biotransformation to safely return plastic items to nature, raised a $25.1M Series B led by ABC Impact and Indorama Ventures (FN)

TympaHealth, a provider of digitized assessments of ear and hearing health, raised a $23M Series A led by Octopus Ventures (FN)

Networking platform Levitate raised $14M in funding led by Bull City Venture Partners (FN)

Wayhome, a London-based startup providing a hybrid part-buy part-rent homeownership model, raised a $10.1M Series A led by Allianz X, Augmentum Fintech, Volution, and others (FN)

Posh, an event management and ticketing platform, raised a $5M seed round led by Companyon Ventures and EPIC Ventures (FN)

VyperCore, a fabless RISC-V processor startup, raised a $5M seed round from Octopus Ventures, Foresight WAE Technology, and more (FN)

Bits Technologies, a Stockholm-based business and customer identity startup, raised a $4.4M seed round led by Unusual Ventures (FN)

Equipme, a B2B marketplace and asset management platform, raised a $3.8M seed round led by La Famiglia VC (FN)

Centuro Global, a startup providing an AI-powered platform to help companies expand overseas, raised $3.6M in funding from Mercia (FN)

Identity verification company IDPartner raised a $3.1M seed round led by Abstract Ventures (FN)

WunderGraph, an open-source framework enabling developers to quickly build backends, raised a $3M seed round led by Aspenwood Ventures (FN)

Elmo, a short-term rental platform for electric/hybrid cars, raised $2.9M in funding from Highgoal Capital Management, FlyCap, Barolo Invest, and SAGGIS (FN)

Pricing decisions platform Luca Software raised a $2.5M seed round led by Menlo Ventures (FN)

Dori, a provider of a financial platform utilizing ML to simplify and streamline venture equity transactions, raised a $2M round from Counterpart Ventures, Correlation Ventures, and Service Provider Capital (FN)

Fast-growing music licensing platform Melodie raised a $700k round at a $9.9M valuation led by co-owners of The Drop Festival and Nick Menere, founder of Code Barrel (PRN)

IPO / Direct Listings / Issuances / Block Trades

Debt

Fundraising

Crypto Corner

Exec’s Picks

Derek Thompson wrote an interesting piece on the possibility of AI as humanity’s biggest time suck.

Execs from music companies like Spotify and UMG are working through threats and opportunities presented by generative AI.

Litney Partners - Financial Recruiting 💼💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

Meme Cleanser

Want to chat social media growth, newsletter strategy, angel investing, Wall Street careers, or something else? Book a call with Litquidity here.

Thinking of starting your own newsletter? Beehiiv is the best platform for creators, period. Click here to get started building your own audience.